Big thank you to the 33 readers who’ve “paid” for their “2025 OB subscription” clicking the above link……. But I have nearly 2,000 subscribers.

Dear reader,

I have to thank an eagle-eyed OB reader called Hans who wrote back in August and said:

First of all thank you very much for sharing your articles, I find them incredibly helpful. Wondered whether you might wish to look at Puretech (ticker prtc) at some point. Currently trading not much above cash due to a botched buyback tender, Invesco sales (early stage investor) and obviously current market turmoil. Inflection points coming up are approval of Karuna (pretty much baked in - will release very substantial sales royalties), Stage 2 results for its drug LYT-100 later this calendar year (possible multi billion pound blockbuster - modified version of existing drug so imo better chances of success). Also very substantial stake in Vedanta (stage 3 study ongoing and likely to float at some point) as well as a number of promising but earlier stage drugs.

As an aside, I learned this week that Mary Poppin’s umbrella is one of her dearest friends, enabling Mary to fly but also sings and interacts adding a touch of magic every day. Not many others can claim such an affinity with their umbrella.

Will we see a magical performance in 2025? When I wrote an article out of Hans’ idea back in August I said I was pondering the Oak Bloke Top 25 for 2025. And here we are. And here it is.

Puretech Health is giving life to new classes of medicine. Not just theoretically - in practice. It’s already got the T-Shirt. Several in fact. The sale of Karuna for $14bn is one heck of a T-Shirt. More on that in a little while.

PRTC has risen by 3 in Stocko-scoring since August now “boasting” a 21, based on it having a low “Value” score of 2 (based on P/B, P/E, P/FCF, Yield).

The question you have to think about is what if a business expenses what others capitalise? This came up recently at Thor Explorations so let me explain this accounting concept. Imagine you sold….. Christmas cards. Imagine if you were accumulating Christmas cards in your warehouse ready to sell but expensed every one to your profit and loss. Your profits would be terrible. At least in the short term. But when you came to sell those cards they might be pure profit. Because you’ve accounted for their cost already in a previous year. Now, “best practice” is that you should “match” costs and revenues. If I have 10m cards at 10p each, my stock is worth £1m. If in 2025 I sell 1m cards at £1 each then my revenue is £1m my cost of sale is £0.9m and I still have 9m cards worth £0.9m, right? Puretech expense all their R&D.

So their “Christmas Cards” are nowhere to be seen in the accounts but imagine a warehouse piling up full on cards that are “not on the books”.

PRTC’s P&L is just “L” - for now.

No assets with the exception of $29m of its subsidiaries. Notice the $317.8m in the prior year included its subsidiary Karuna - now sold.

So that’s how you can have a strong clinical track record of success “outperforming the biopharma industry by 6X” and have such a low score.

So profits are lumpy. Blockbusters take time. PRTC made a net profit in 2019 nearly equal to today’s market cap and made losses since. The question you must ask is will 2025 deliver a Blockbuster? Or several? Plus what’s the value of the prior Blockbuster (Karuna).

The Dec 2023 Annual Report contains 716 pages so no shortage of detail.

The June 2024 Interim at 38 pages was much briefer!

P/B - Price to Book. The latest 2024 interim accounts show net assets of £306m and this is currently a market cap of £402m. Not sure how this can be scored as poor value. Paying 1.1X for Pharmaceuticals would typically be incredibly cheap. Hikma is 2.51X and GSK is 4.52X by comparison.

Of course P/FCF is negative, and earnings too in the last four years, and such is the nature of drug development. Speculate to accumulate. Keep buying cards because Christmas is coming.

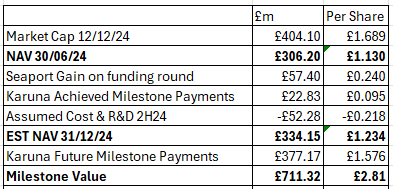

Puretech had net assets of £306m (as at 30/06/24) across 239,318,580 shares as at 30/06/24 is a NAV of £1.13/share.

Of which Cash and cash equivalent is £242.9m (as at 30/06/24). So stripping out cash you are paying a net £161.1m for what exactly?

A historical 80% clinical trial success rate (80% is extremely high)

In 2024 the $14bn acquisition of Karuna by Bristol Myers Squibb completed. 2.3% owned by Puretech and powered by PRTC’s technology. This was worth $292.6m upfront cash (£230.4m) to PRTC and was held on the books at $280.7m so made an immediate gain of $11.9m (£9.4m)

A tender offer bought back 31,540,670 shares during 2024 at a cost of $100m (£78.7m) to reward shareholders.

Karuna has a Schizophrenia drug called KarXT now called Cobenfy which was approved by the FDA in September. While Puretech has sold its shares in Karuna, it retains its Royalty agreement. To slightly complicate this it has sold this agreement to Royalty Pharma in exchange for $100m upfront and remaining stage payments of up to $371m based on commercial milestones ($29m was realised in 2H24 post period).

In additional PRTC receive 2% royalties if KarXT sales exceed $2bn in a year. The schizonphrenia drugs market was $4.8bn in 2023 and is forecast to grow to $9.5bn by 2030, so on $5bn sales for example this would be worth $60m a year. (£47.2m)

Subsidiary equity holdings (“Founder Entities”) in Akili, Vor, Sonde, Vedanta, Seaport and Gallop worth £29.2m as at 31/12/23 + £25.2m invested in Seaport post period.

Net Assets adjusting for the above are now an estimated £290.7m. Over 239,318,580 shares that’s £1.21/share (or if we factor in the $400m royalty then £2.53/share).

But this also doesn’t include a wholly-owned pipeline of four products:

Hidden Value - Wot no capitalisation?

The costs of developing PureTech’s products are being and have been in the past 100% expensed to the P&L and explains what a superficial analysis of P/E and P/FCF doesn’t show - that there is hidden value.

The value is hidden in the sense that there is no “asset” recorded in the balance sheet and therefore in the NAV but arguably much of the P&L should actually be capitalised and then expensed if the the pharmaceutical fails to meet its goals. Unfortunately IAS38 prevents this. 2021-1H24 $398m of R&D has been expensed (£313.4m). While it’s not fair to think 100% of that expense is an asset, if it were, then PureTech achieved profits of $64m a year, for each full year since 2021, on average. (£50m)

Or put another way that’s a P/E of 8 based on an average profit over three years, and at today’s market cap, it’s cheaper than GSK and Hikma which are at a 9.3 and 11.7 P/E respectively.

LYT Me Up - the wholly owned portfolio

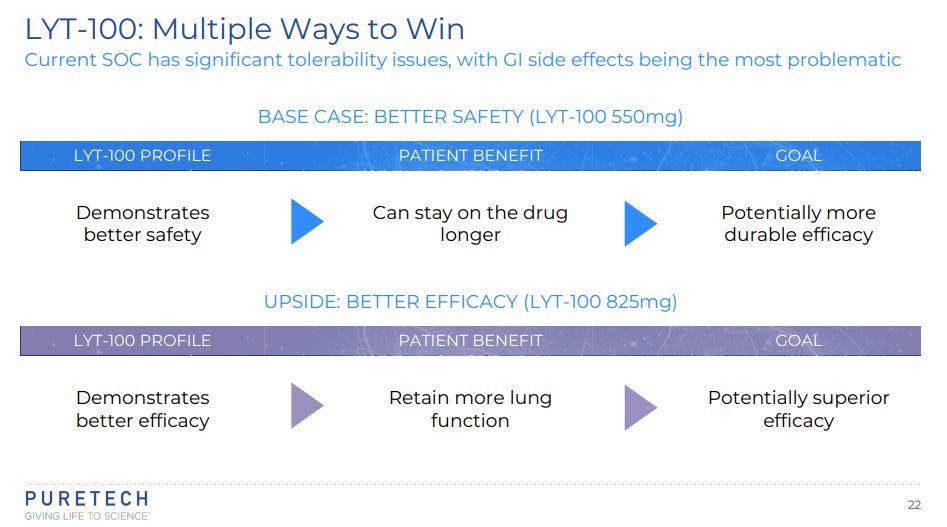

LYT-100 (deupirfenidone) is in development for the potential treatment of conditions involving inflammation and fibrosis, including idiopathic fibrosis (IPF), for which current standards of care are associated with significant tolerability issues, resulting in approximately three out of four patients in the U.S. foregoing treatment with these otherwise efficacious medicines.[2] LYT-100 is a deuterated form of one of the two standard of care treatments, pirfenidone, which has proven efficacy and has been shown to improve survival in these patients by approximately three years, but its side effects cause patients to discontinue or dose reduce, thereby limiting its effectiveness.[3]

LYT-100 has shown a 50% reduction in gastrointestinal tolerability issues in a head-to-head study versus pirfenidone, and it can be dosed at a higher exposure level, but with a lower Cmax, than the FDA-approved dosage of pirfenidone, potentially enabling improved efficacy.

PureTech is currently evaluating two doses of LYT-100, one with comparable exposure to the approved dose of pirfenidone and one with a higher level of exposure, in a global, randomized double blind, placebo-controlled trial in patients with IPF, which is expected to serve as the first of two registration enabling trials. As previously noted, the Company has taken measures to accelerate enrollment. Phase 2B results are now expected imminently (in 4Q24).

Liberum see a successful outcome adding £320m / £1.25 per share to the target price (TP).

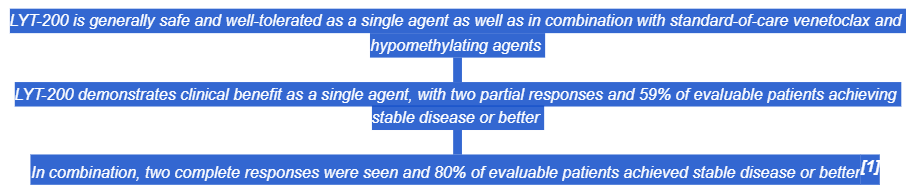

LYT-200 (anti-galectin-9 mAb) is in development for the potential treatment of metastatic solid tumors that have poor survival rates as well as hematological malignancies, such as acute myeloid leukemia (AML), where more than 50% of patients either don't respond to initial treatment or experience relapse after responding to initial treatment.[4].

PRTC announced positive results from its Phase 1b trials “generally safe” “well-tolerated” with “59% of evaluable patients achieving stable disease of better”, or in combination “80% or better". Wow! But it is early evidence, with just 18 patients. Next steps is to discuss a pivotal trial design with the FDA - the Phase 2.

LYT-300 (oral allopregnanolone) is in development for the potential treatment of anxiety disorders and postpartum depression (PPD) where there is a need for safer and more effective treatments that work quickly, have more favorable tolerability and can be administered orally. A Phase 2a trial completed last year and achieved its primary endpoint. PureTech will be conducting additional studies into 2025.

LYT-310 (oral cannabidiol [CBD]) is in development to expand the therapeutic application of CBD across a range of epilepsies and neurological disorders. LYT-310 is designed to enable oral administration of CBD in a capsule; expand the use of CBD into a broad range of therapeutic areas and patient populations (such as adolescents and adults) where higher doses are required to achieve a therapeutic effect; potentially improve safety and reduce gastrointestinal (GI) tract side effects that are associated with the currently approved CBD-based treatment by reducing GI and liver exposure; and allow for a readily scalable, consistent product in a cost-effective manner.

Founded Entities

Puretech’s approach is also to take stakes in either listed or unlisted entities. Liberum describes a series of “valuations” but I believe they meant to say “target price”

Vor 3.9% holding - TP at $9m - targeted cancer therapies. Newsflow VBP101 and VCAR33 Phase 1/2a clinical updates in 2H24

Sonde 35.2% holding - valued at $3.1m but TP of $26m - voice-driven AI platform for health monitoring.

Vedanta 36.1% holding - TP at $162m - modulate the microbiome - Phase 3 study for C.Difficile with drug VE303 ongoing in 2024 and has received fast track designation from the FDA.

Entrega 73.8% holding - TP at $3m - hydrogels for improving capsule absorption.

Seaport 36.7% holding - which used to be valued at $32m (based on a 2024 investment) is therapeutics, and early stage.

Seaport - repeating the formula

Post period (2 months ago) its ownership of Seaport was 61.5% but as reported in my article “Round at Seaport” PRTC booked a $72.9m gain on a $325m valuation in October leaving it with 36.7% on a diluted basis but a valuation that increased from $32m to $119.3m

The programs in Seaport's pipeline use the Glyph platform, which is designed to enable and enhance oral bioavailability, avoid first-pass metabolism and reduce liver enzyme elevations or hepatotoxicity and other side effects to advance clinically active drugs that were previously hindered by those limitations.

The most advanced therapeutic candidate in the pipeline is SPT-300, an oral prodrug of allopregnanolone that is being advanced into a Phase 2b study for major depressive disorder with or without anxious distress that has the potential to be registration-enabling. Allopregnanolone is an endogenous neurosteroid with clinically validated rapid anti-depressant and anxiolytic activity, and SPT-300 retains this activity in an oral form.

"The development of important new neuropsychiatric medicines is often halted due to poor drug-like properties or unacceptable tolerability, challenges that our Glyph platform can now uniquely address," said Steve Paul, M.D., Founder and Board Chair at Seaport Therapeutics. "For instance, xanomeline was an effective drug that faced tolerability challenges, but once resolved, led to the FDA approval of Cobenfy™ (formerly KarXT) for schizophrenia.

Glyph

A final area of hidden value is that PureTech have a proprietary platform called Glyph which bypasses the liver and uses the lympthatic system to absorb drugs. This can improve bioavailability therefore effectiveness. A number of its drug candidates use Glyph as its delivery method.

Low Case Valuation

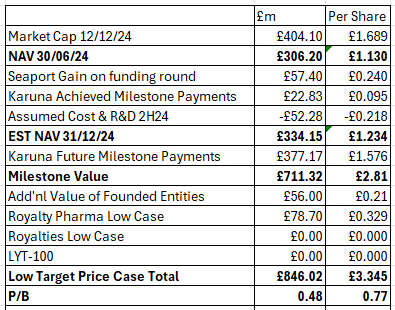

On the basis that the current book value for Founded Entities is all they are worth, if none of the $371m Royalty Pharma milestones are ever reached (Bristol Myers spent $14bn on a pup) and therefore the $129m cash up front is the only earning, if Cobenfy sales are sub $2bn forever no 2% royalty is earned, and if 100% of the wholly-owned portfolio are also worth zero, including the LYT-100 candidate, then the LOWEST valuation of PRTC is £1.23 per share (estimated).

That’s the minimum, and this would require PRTC moving from 80% historical success to 0% future success. Drug development is a risky business after all. That £1.23 per share would whittle away to zero over several years and you’d be left with nothing. Christmas never came - like in Narnia.

But if you believe the milestones of commercialisation of what the mental health community are heralding as ground breaking then you can factor in a £2.81 BOOK value. So you are buying today at 0.6X the BOOK value.

If you furthermore believe (as I do) that the target prices given by Liberum over the fair values of its stakes in founded entities like Vor are worth £56m not in the books, and that there’s a reasonable chance of 2% royalties since a blockbuster schizophrenia drug should do well in the USA where mental health is a scourge then £78.7 assumes modest success. Book is now less than 0.5X.

HIGH CASE VALUATION

If you believe the founding entities are worth more than their book values (Seaport was a great example of this as a proof point) then you might assign an upside of around 20p at this stage above their book value (the book deduction includes the Seaport Gain in case you’re wondering why that -£132.3m looks higher)

If you believe LYT-100 will succeed, that 2% royalties will be based on $2.5bn for 15 years (undiscounted) plus that Glyph is worth £100m then you look at the numbers - the Christmas Cards if you will - and you’re buying at 69% discount and a P/B of 0.4X.

I call this the “high case” but I am using Liberum’s target prices for the founded entities which they admit are moderated by chance of success (so isn’t really a “high” case, and more a weighted case. Equally I’m assigning a value to LYT-100 based on Liberum.

For example Vedanta’s VE303 for C-Dificile expects topline Phase 3 data in 2026 with a VE202 ulcerative colitus Phase 2 data in 2025. Either could be a blockbuster so £127.6m is a small chance of “something”.

I’m assuming the full $500m is realised from Royalty Pharma for Koruna and that sales average $2.5bn rising with inflation (making a zero discount rate ok)

As it is, I arrive to a £5.17 per share valuation. At today’s share price it is at a 69% discount to that future NAV.

In either the low or high valuation, gross cash of around £394m provides lots of optionality, with only -£110m of current liabilities (as at 30/06/24).

A further $100m tender, for example, at today’s share price would boost the high case valuation per share from £5.17 to £5.83.

Conclusion

I’m feeling Christmasy, and I hope you are growing excited reader in the 13 days until Christmas Day with family and loved ones. These days are days to treasure.

After Christmas we will turn to 2025 and the cards on the mantelpiece get taken down. But what is on the cards for PRTC in 2025? I’m excited to see, and will certainly be Poppin this in my 25 for 25. Ho ho ho.

Regards

The Oak Bloke

Disclaimers:

This is not advice - you make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"