PSH - Fannie Mae and Freddie Mac

Considering the upside for OB25 for 25 idea Pershing Square Holdings

Dear reader,

The Oak Bloke will be on annual leave until Sunday 9th February, so this is the last article until then.

Great to see Ackman’s missive on Fannie and Freddie last week. The decision ahead for Trump and the USA is whether to end conservatorship to what are today GSEs (Government Sponsored Enterprises).

The GSEs contribute over half of credit to the US mortgage market, and insure mortgage-backed securities “MBS” for a fee.

The fall of the GSEs

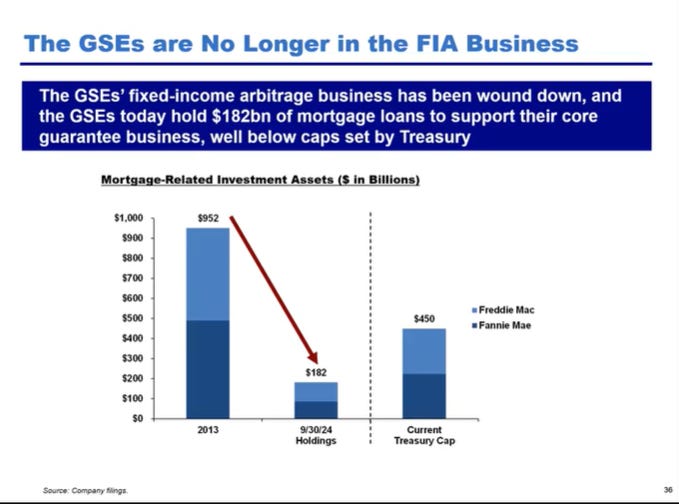

A decision to extend Fannie and Freddie to spice things up with Fixed-income arbitrage was a mistake. Its exposure had grown to $1.6tn Ackman tells us by the time of the GFC.

Meanwhile between a third and a half of losses during the GFC were for subprime loans which are no longer covered today (and never should have been back then)

Today subprime are not guaranteed and GSEs have exited the FIA business, and existing commitments have been wound down and even its MBS exposure reduced below its treasury cap.

Meanwhile the US government who have “swept” all earnings since 2012 have taken $301bn vs the $191bn disbursements given. Even after including a 10% interest charge the Fed has taken $25bn more than was agreed at the outset!

Ackman makes the valid point that none of the other bailout recipients were put into conservatorship, and some lost money for the government!

Mnuchin allowed the GSEs to recapitalise since 2016 and today they have $131bn of net worth. To support 2.5% equity capital would equate to ~$170bn so $39bn more, which in turn would support ~$6.7tn of guarantees, at a level 5.5X higher than historic levels.

Ackman argues a modest IPO next year to release FNMA with FMCC following in 2026, would fully cover the $8tn guarantees at a 2.5% equity level. He foresees a 11%-12% ROCE while allowing for growth in guarantees over time (i.e. a 2.5% cover level) and a low risk ~5% yield via dividends.

The above is a much redacted and reduced version of Ackman’s presentation found here and the slides here.

What does PSH get out of this?

This is just my assessment - nowhere does Ackman describe the implication for PSH.

The capitalisation of FNMA by 2026 would be $116bn where legacy shareholders own 18% so $20.9bn. Today the market cap is $6.65bn implying 3X upside.

The capitalisation of FMCC by 2027 would be $99bn where legacy shareholders own 16% so $15.8bn. Today, the market cap is $3.4bn implying a 4.6X upside.

This source claims PSH owns 10% of the GSEs. If that were true 10% of $36.7bn by 2027 is $3.67bn.

Which I’m sure you might find a bit hard to believe!

But consider SEC records show the following purchases:

FNMA 115,569,796 shares 31/12/24 $3.28 each → 24/01/25 $5.74 each = $379m → $663.4m is a gain of $284.4m

FMCC 63,575,565 shares 31/12/24 $3.26 each → 24/01/25 $5.23 each. = $207.3m → $332.5m is a gain of $125.2m

FNMA was $0.996 per share on 31/12/23 and FMCC was $0.81 per share on 31/12/24. These would sum to $166.6m which is slightly less than the $180.1m of “Financial Services” holdings at that date, but it sort of fits.

So the GSEs appeared to have moved from a ~$400m loss for PSH as at 31/12/23 to a ~$400m gain as at 28/1/25.

Based on the number of shares and the market price of each share it would appear PSH hold $663.4m + $332.5m = $995.9m so worth nearly ~$1bn!

So a 3.67X uplift is in keeping with the above statement of 10% of $36.7bn is $3.67bn. The numbers do fit perfectly…..

This paywalled article from Barrons suggest a $1bn gain also.

On a ~$13bn portfolio (as at 31/12/24) a $3.67bn gain would be a 28.2% increase to NAV.

Ackman closes by quoting Trump. Nowhere in his presentation does he directly explain the benefits to PSH shareholders. I’m not entirely certain that I’ve entirely understood the 103 slides missive combined with the scattered clues relating to the implications but it feels “along the right lines”.

Moreover I do know as much as Ackman (like Musk) is a keen advocate for Making America Great Again I also know that Deals are the art form of more people than just President Trump. Ackman is a shrewd deal maker too, and building 103 slides and a vast public policy presentation while yes, is a wonderful poetry, but I suspect is a big deal for PSH shareholders too.

The Oak Bloke will be on annual leave until Sunday 9th February, so this is the last article until then.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

The Howard Hughes news seems to be quite significant to this trust. Any chance you can take a closer look at its effect please? https://citywire.com/wealth-manager/news/pershing-square-invests-900m-in-howard-hughes-as-ackman-chases-berkshire-dream/a2465133

Thanks for this I bought FNMC after Ackman's New Year tweet but hadn't appreciated how much exposure PSH has to both stocks, also worth noting one of PSH's largest holdings, UMG had a great day yesterday up over 5% on Spotify deal