PTAL - OB 2024 Ideas Review

15.5% yield, 41.4% discount to NAV ex Cash and forecast 2025 growth for Oil producer Petrotal

Dear reader

Drought has impacted PTAL in 2024. Drought as in a lack of oil? No they have over 100 million barrels of the black stuff - and growing (and I don’t mean Guinness). This oil producer lacks water - water in its nearby river - sometimes.

This aerial photo pictures the situation.

Oil is collected to a riverside depot and transported by barges to Brazil. When the river level drops past a certain level barges cannot navigate the river.

But let’s not forget that the river shipping route only began in 2018, and a new eastern route to Manaus, Brazil began in 2021, but also that PTAL has established and innovated two new routes in 2024 so there is optimism that it can continue to do this in 2025. To give you an idea, 2024 average production is forecast at around 17.5Kbbls/day. That’s grown from 9Kbbls/day in 2021, and PTAL are working towards a future 70Kbbls/day. More on that in a while.

As the above treasure map shows, pipelines and new river routes are planned to improve optionality.

Let’s recap PTAL’s 3Q24 Highlights:

· 3Q24 production averaged 15.16 Kbbls/day, a 39% YOY increase vs 3Q23. PTAL’s guidance was for 13Kbbls so this is a strong beat.

· 2024 annual production on track for an average 17.8Kbbls/day which will exceed the top end of prior 2024 guidance (16.5-17.5 Kbbls/day)

· Total cash of $133 million as of September 30, 2024, an 18% increase on Q3 2023

· The latest Well 20H achieved initial production rates over 5,300 bopd. Wells 21H, 22H, 23H are all planned for 1Q25.

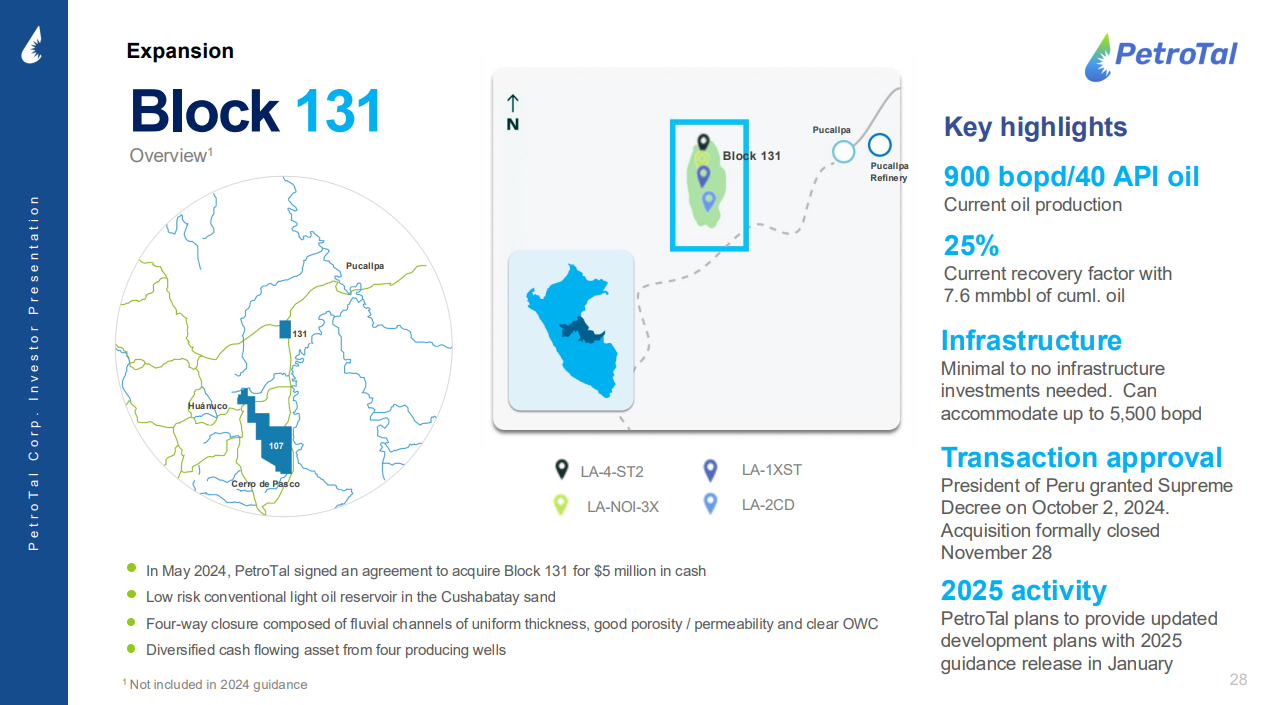

· The sale of Block 131 to PetroTal finalises.

Block 131 opens up access to lighter oil, and mixing this with the heavier Block 95 oil means barges sit higher in the water and are more able to transport oil even during dry periods.

It is astonishing that what cost £361m to buy just 2 months ago today can be bought for £278.4m, that’s £82.6m cheaper or 25% off - despite zero negative news.

That bargain basement price places PTAL on a 30.5% discount or a 41.4% discount to NAV after you exclude the $133m of cash as at 30/09/24, a cash level which will probably be higher as at 31/12/24.

A share which yields 15.5% plus buy backs have added a further 0.3% return in 2H24 (alone). A share which also offered a special dividend in 2023 (and might again in 2024?)

So what’s the catch?

Other than river levels, PTAL suffered indigenous unrest in its past but a 2.5% per annum (of revenue) social fund which is payable if there is no unrest appears to have succeeded in quelling said unrest.

Repairs to buttress the riverside is partly 33% a capex cost, and 67% an opex cost so there is a 2025 hit of $50m to opex. The upgrade project provides five breakwaters and future proofs the site.

Peru’s country risk has been called out also, and a tension between the left and right wing peoples exists where today’s leader, Boluarte, can be accused of human rights issues and her right wing government deals with unrest with beatings and bullets. Leaving the politics aside, the economic outlook is a reasonable 3%+ growth in 2025 and 2026 and PTAL has operated in country successfully over a number of years.

PTAL had reserves of nearly 200 million barrels of oil as at 31/12/23 and the replacement level has been well above 100% in the past. 4.2m bbls have been added via Block 131 plus the active drilling should return a higher level of 1P + 2P + 3P reserves. PTAL also has the as yet undeveloped block 107 as a further upside for reserves.

Notably drilling into a new depth of ground, is likely to boost reserves.

Reading PTAL’s balance sheet, $433.6m of petroleum interests values its assets at $2.17 per barrel or at $5.16 per barrel if you nuance the reserves at proved 100%, probable 50% and possible at 10%.

The proved and probable has an NPV of $1.6bn alone.

It is notable that reserve replacement each year is well above 100% (i.e. growing reserves) with its 1P 2 year replacement averaging 165% & 2P 2 year averaging 292%.

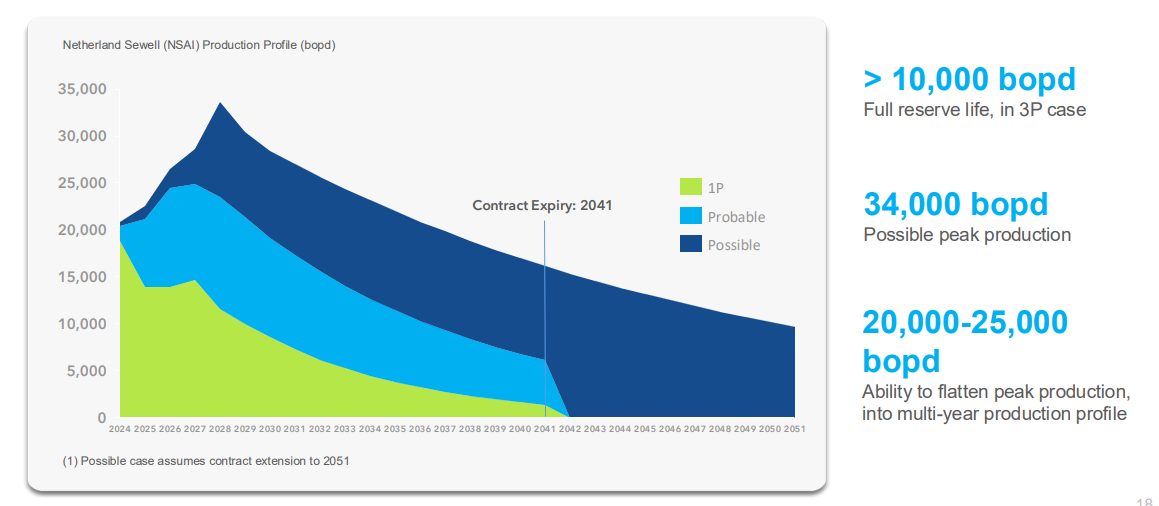

Its reserve replacement is part of a capex programme towards a 25,000 - 34,000 bopd production by 2028. There is then a 13 year programme to manage and harvest production potentially flattening declines beyond 2041.

The larger numbers are more recent wells hence the smaller circles below but as PTAL have learned and understood the field more recent wells are at a much higher flow rate. All wells except one have paid out for more than their capex cost and most have generated over a three times payout.

Cash and Liquidity Update

PTAL maintained a strong liquidity position as at 3Q24, exiting the quarter with a total cash position of approximately $133 million, of which of $121 million was unrestricted. PTAL entered into a hedge agreement for ~5,750/bbls per day until August 2025 with a costless collar floor price of $65.00/bbl and a ceiling of $84.25/bbl, with a cap of $104.25/bbl.

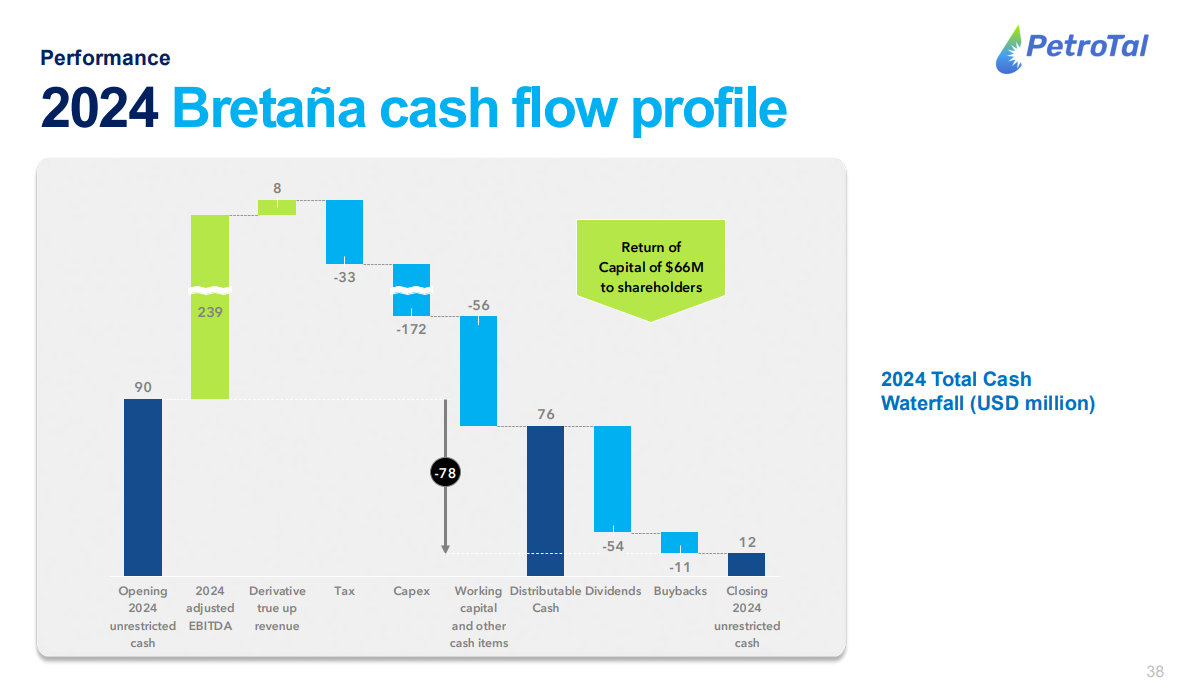

PTAL is forecast to remain cash positive despite investing $172m into capex spend, $56m into working capital and $66m of returns to shareholders. $216m of operating cashflow post tax equates to an astonishing 62p return per £1 invested into PTAL - in one year!

Block 131 Acquisition

Block 131 acquisition was finalised post period. It contains 2 million bbls of proved and 2.2 million probable at a purchase cost of $5m, but also 4 producing wells at 900 bbls/day. So just $1.61/bbl on 100% of proved and 50% of probable. But also just $5,555 per flowing barrel of oil. PTAL intend to increase those reserves through deeper drilling.

With production forecast to growth to 18,500 bopd in 4Q24, Block 131’s 900 bopd takes PTAL to around 19,500 bopd exit rate.

Forecasting an average 21,500 production/sales for FY25 growing to 23,000 in FY26 we see the 2/3rds of erosion control posted to Opex (and the remainder to Capex) so a $50m hit to income in FY25. Despite this earnings are actually forecast to grow next year.

With erosion control out of the way and assuming just a 1,500 barrels growth in 2026 we see earnings grow to 16p per share.

Even assuming just 4X forward earnings you get to £1.20 per share.

I notice the future transportation capacity is noted as 70,000 barrels per day. If - and I do say if - production could grow to this level PTAL would be worth many times more than today. My estimate of earnings on an assumed $100 per barrel oil would be over 91p per share per year. Leaving aside that possibility the near term growth augers well where EPS rises to over 16p a share in just over a year from now.

And that’s based on $75 a barrel brent oil in 2025 and 2026 - hardly a stretch.

Regards

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

In depth analysis and evaluation, thank you, great find, not an easy terrority to explore and have a route to market.

Excellent summary. The near-term prospects of the company are so enticing that it is understandable that you didn't emphasize the potential upside. But there are some large prospects beyond Bretana on Block 95 and Block 107 has over 500 million unrisked barrels. Government permitting, Petrotal will be producing from these blocks for a very, very long time.