Quirks at The Works

Assessing WRKS - The Works - a new Oak Bloke idea

Dear reader,

I briefly covered the Works in my July Fun Run update. What’s that saying, that mantra? Always do your own research. How many times have you read that in people’s articles? Guess what? I missed something when I did my initial research.

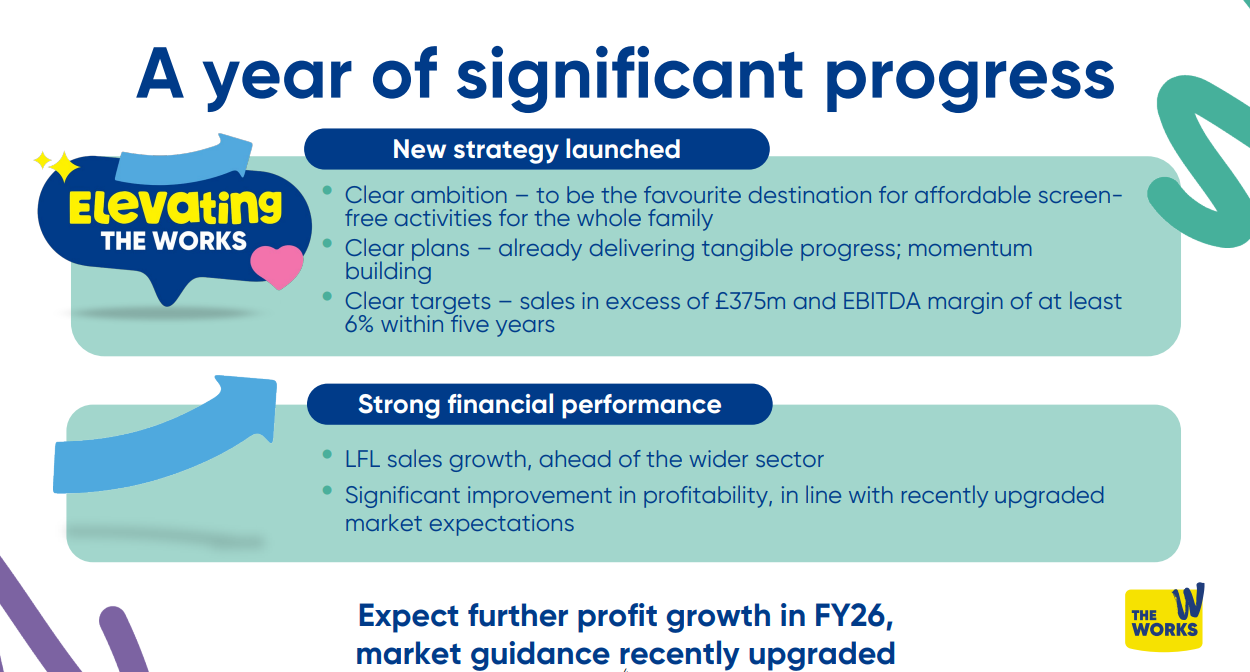

I read this:

I should have read this:

Within five years. Ahh. It seemed too good to be true. The good news reader is even if I thought the future was fairly near term you haven’t been inadvertently misled in my Fun Run article. After all I only spoke of “future potential”, not a specific time frame. Like that this would happen in FY26.

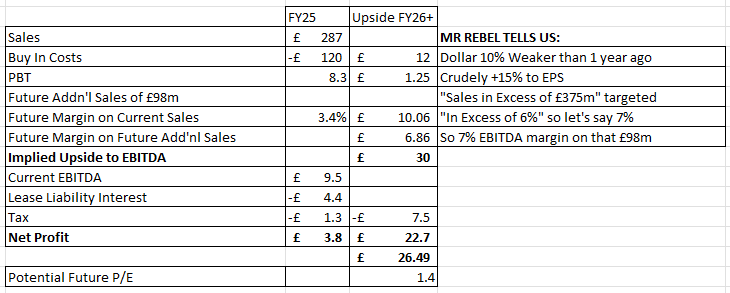

So this article is to do two things. First to look at what the next 12 months could be. A forecast of FY26. Second to be the second person to ever write about investing in WRKS the Works on substack. A further nod to Mr Rebel who was the first and drew my attention to this opportunity. The guidance is for £11m adj.EBITDA by the way.

Today’s article picture is just my wild imagination, if I were fitting out a Works store. I’d install a HUGE W outside. I’m sure the H&S folks would be ok with that. Didn’t Woolworths do that once? I miss Woolworths. I might go to Australia some time just to go in one again.

Work History

Let’s start there. My own history with the Works (for the little that it matters) is/was that I’d always be tempted to pop in to the Works if/when I was in town. Always buy a bucket load of stuff. Always as an impulse buy. The Works was filled full of esoteric books on a wide range of subjects and I read a lot. I’d buy my diary in there in mid January at a silly price, sniggering at those who’d paid double the price to have theirs a few weeks earlier. Yes it kind of had kids stuff too. I remember buying the complete works of Game of Thrones at less than the price of Amazon for example.

It was yesterday’s middle of Lidl before Lidl came along and invented the middle of Lidl (who then jacked up their prices). Middle of Lidl? Aisle have none of it.

Competition and Marketing

Today it no longer is that esoteric place. It’s full of kids and stuff for kids. It is now “specialist”. Specialist for “non-screen” stuff.

Stand outside a physical shop and before long you’ll hear a whining noise coming from the throat a passing child…. mmmmmmoooommmmm/daaaaaadddddd can we go in the Works please? It still does books, stationery but today it’s far more mainstream targeting parents and going for impulse purchases.

Crafts, puzzles, games and seasonal goods I guess are its focus. Linking in with kids favourites like Paw Patrol (rich patrol, rich patrol, meet me at the triple as I often sing to the annoyance of a family member who has perfected the rolling of her eyes). Peppa Pig, Bluey, Night Garden - they are all there. Kids love those characters. Campaigns and in-store events seems to me a genius move. No one else is doing that.

Social Media appears to mainly consist of winning stuff which draws in around 1k people with regularity and very limited sharing. Online reviews are 50% positive although the other 50% harrumph about broken one-day delivery promises of online purchases. Today’s web site is very clear: we do not do one-day delivery.

307k Facebook followers is a very reasonable number (4x that of WHSmith, more than ToysRUs and only a bit less than HobbyCraft, but only 1/3rd of Smyth Toys) and suggests people like following the news from The Works. WRKS say they have a #TimeWellSpent media strategy for FY26 but 4 months in I’m seeing very little evidence of its success. Just some posts from various “Shopping Centre” accounts that are presumably just Social Media accounts belonging to WRKS.

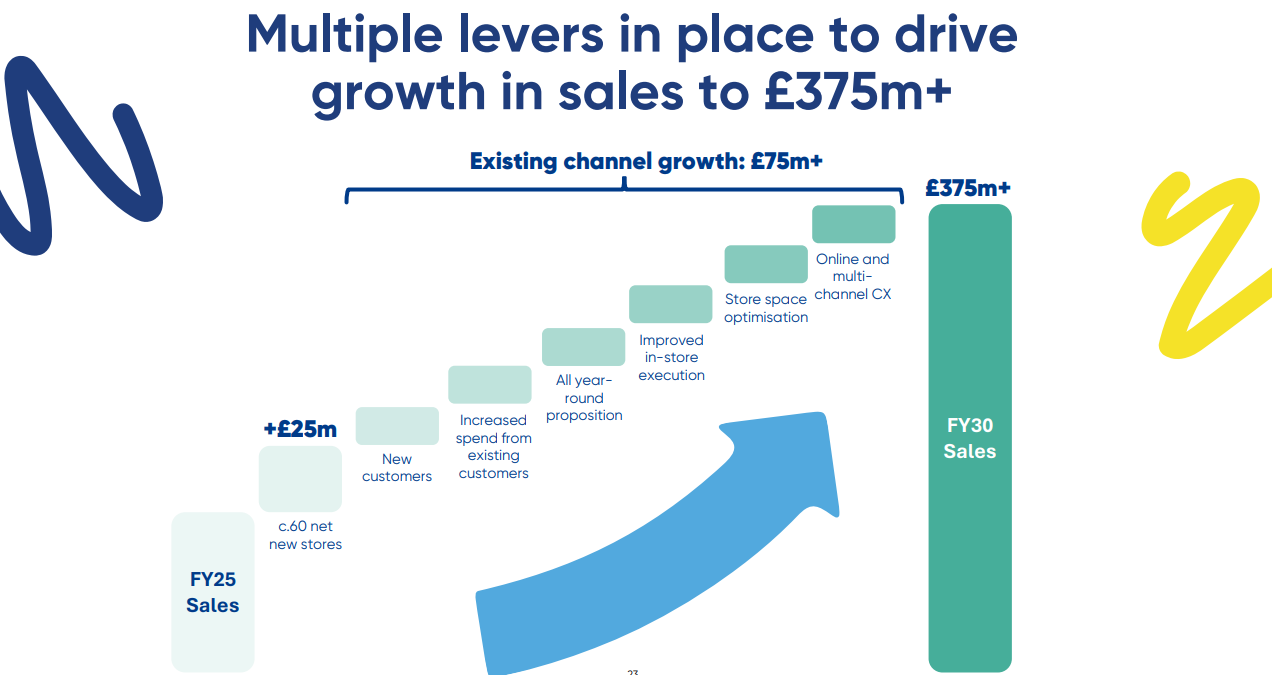

The Five Year Plan

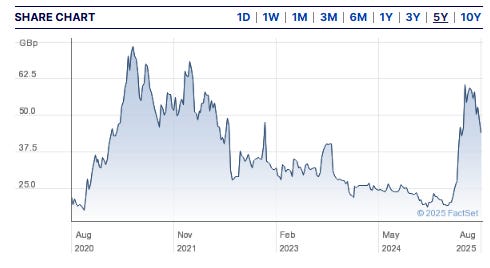

At today’s lower share price a future potential P/E of 1X today’s share price is possible (it was 1.4X a month back). EBITDA was £9.5m so £39.5m would translate to around £27m (today’s market cap).

An FY26 EBITDA of £11m could mean £5m net profit so a P/E of 5X today.

Elevating the Works is how they will get there.

WRKS made good progress on lifting profit margins in FY25 by 2.1% or 1.7% on a constant currency basis. The weakening of the USD should be highly supportive in FY26 too.

WRKS plans to drive further improvement too through a series of actions around margin, sales, price rises, operating costs and further store changes.

So far so good and WRKS have made a strong start with LFLs +5% in first 11wks to mid July.

I’ll return to forecasts but first I would like to understand and extrapolate the past.

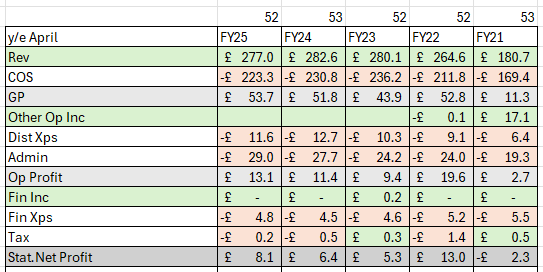

Analysing the History

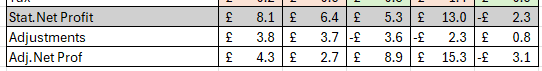

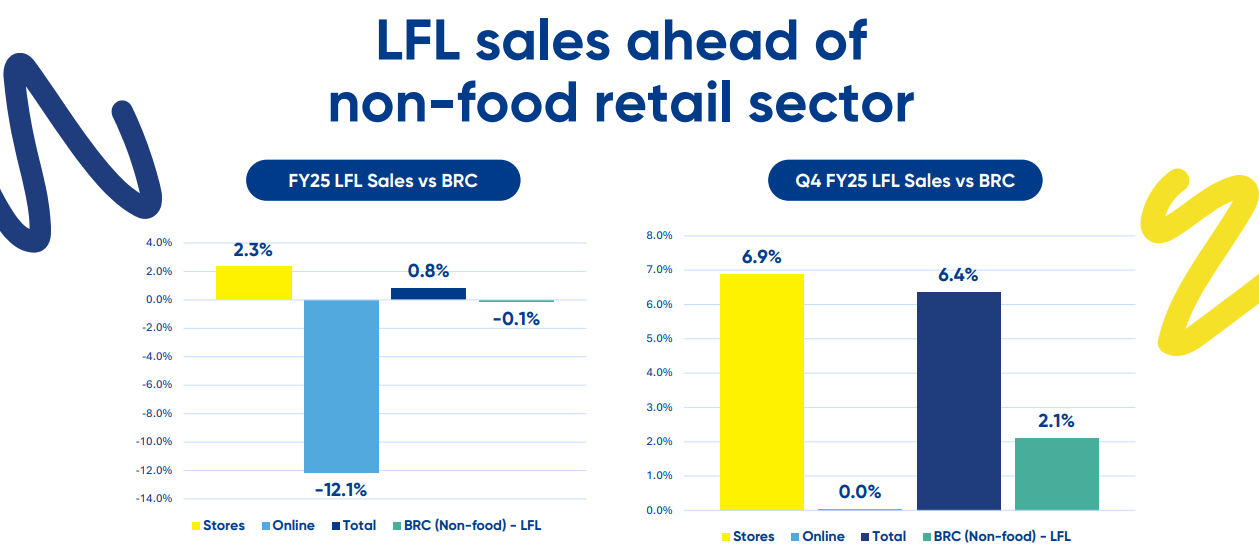

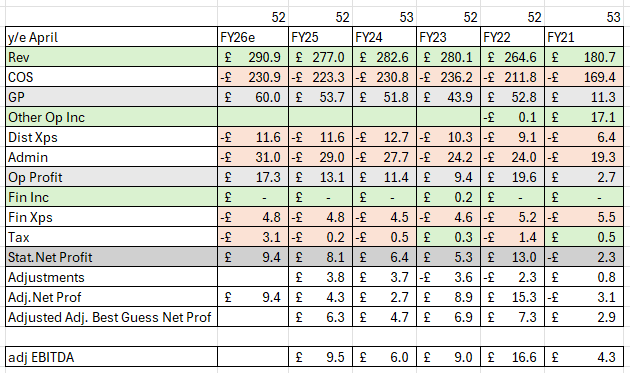

Eagle-eyed readers might have spotted my £5m net profit estimate and harrumphed that’s a CUT to net profit. A cut from £8.1m in FY25.

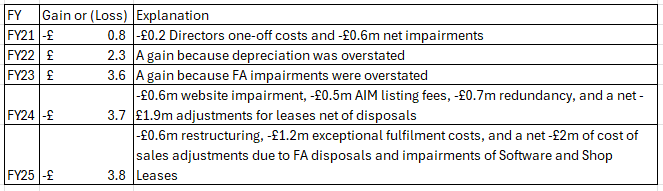

But wait. There are a lot of extraordinary adjustments to consider. They appear to happen every year so are they extraordinary?

Yes although the Shop Leases and Stock Valuations appear a dark art of adjustments where even the so-called “final” Annual Accounts are adjusted a year later. Don’t go and look at the FY23 annual report for those. Look at FY24’s annual report instead, because the FY23 numbers will inevitably be very different and restated.

The problem is that many of these adjustments actually belong to previous years I believe. The Cost of Sale in FY22 and FY23 were very likely overstated by around £2m judging by the reversals in FY24 and FY25.

Then you’ve got the whole lockdown and delayed gratification thing in FY21/FY22 and there’s about £6m below/above in my opinion.

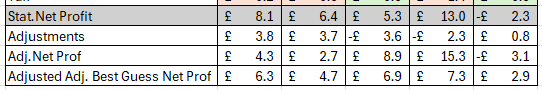

My own best guess is that the underlying performance is more like this. So we see a business where FY24 showed a dip in profit and a recovery in FY25 to April 2025. A business on 4.2X underlying earnings.

Because the adjustments are mainly to the cost of sales the underlying performance is more visible here. We see profits are actually growing year to year.

If we consider WRKS have achieved LFL sales growth with its stores since FY22 then the drop in share price during 2024 doesn’t really make any sense. Yes the environment has been “Challenging” which actually means those modestly growing adj.profits are an outperformance.

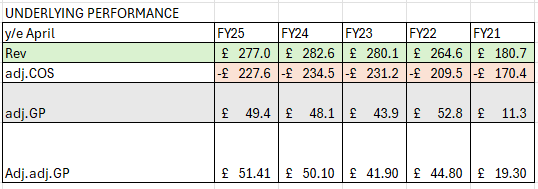

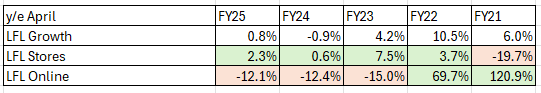

Here’s a further proof of outperformance. WRKS stores are the yellow +2.3% LFL sales growth vs the British Retail Consortium average which showed UK retailers sales fell -0.1% in FY25. Feb 2025 to the start of May was a dour time for Brits as they braced for Rachel’s taxes and the BRC average increase of 2.1% compares with outperformance by WRKS stores of 6.9%. Triple the performance.

The online sales have been the disappointment dropping post covid, post lockdown, since FY22. Although you don’t know to what extent the web site serves as a shop front for browsing but where people actually end up buying in the shop - although “click and collect” is now part of WRKS web site. Challenges with ecommerce delivery speed and the increase of minimum free P&P above £30 have all caused a reduction in online browsing and sales.

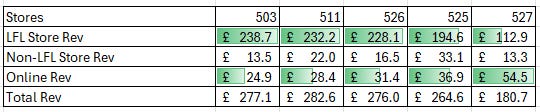

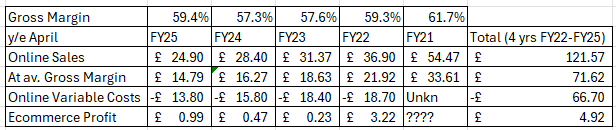

Here’s the breakdown over 5 years:

This next chart took quite a while to construct since the split is expressed in “sales” not in revenue. The former includes VAT and the latter does not. So I’ve made the assumption to split the VAT pro rata. Remember some products like books are non-VATable, so sales are not just 20% higher. About 65% are VATable, which implies books make up about a third of WRKS sales and all other products, toys/crafts etc make up the balance.

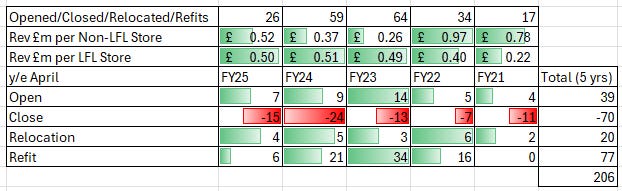

We see strong LFL (like for like) growth. Notice that LFL sales have grown about 20% despite about 5% fewer stores too, so a 25% outperformance compared to when the share price was about the same as today.

I was interested to analyse the revenue per store also. To do this I took the total stores and deducted the “Non-LFL” stores. To work out how many of those there were I considered all that were “opened”, “closed”, “refurbed” and “relocated” over the past 5 years. 30% of all stores we are told although reviewing the 5 annual reports I calculate the changes to exceed 206 so 40% of all stores have altered.

The picture that emerges is stores in FY25 are selling about 25% more per store than they did back in 2021. 2020 was a lockdown year so I’m just ignoring that. Obviously the “non-LFL” stores rev per store is much higher in 2020 and 2021 back when closures were low relative to openings, relocations and refits. The “non-LFL” stores in FY23 - FY25 are much much lower reflecting the larger number of closures.

Ecommerce Turnaround

It is noticeable that sales are falling and web site visits are too. 41m visits consistently in FY22-FY24 and dropping to 31m in FY25. It is also the case that the entire ecommerce operation has been impaired. A new distribution centre mezzanine increases storage space helping deal with peak volumes more efficiently. A new ecommerce fulfilment provider has been appointed. The new fulfilment facility is expected to be operational prior to the FY26 peak period. It is expected to deliver cost savings in FY26 and beyond and, most importantly, to provide a higher standard of service to our customers.

WRKS is driving a focus on its web analytics, and improved customer experience in focus as well as mimicing that middle aisle with a “when it’s gone it’s gone” proposition.

Mr Rebel has a view that WRKS should close down its ecommerce operation. I think that’s a mistake and the numbers appear to explain why. If you assume that online gross margin is the same as the stores on average and if we use those percentages to work out a cost of sale, in the last 4 years of accounts we know the “Online Variable Costs” as a line in the accounts so we therefore know the ecommerce operating profit.

While, yes, profits peaked in FY22 that was due to lockdown and people wanting to get stuff. But remember my point about ~£6m of underlying profit that was “delayed” catch up sales due to lockdown. The true online profit in FY22 is probably lower.

The point is, while modest, the op profit has quadrupled between FY23 to FY25. Relying on a “yearly percentage growth” number as to the success of online masks that simple yet profound fact. You’d reduce profits by around 20% by shutting down online. With a new fulfilment provider reducing costs, a new click and collect proposition and a more realistic free delivery order level, I think ecommerce might be a surprise in FY26 and beyond. I road tested the new web site and it is clear, crisp, and uncluttered. It has that “honest to goodness” feel about it so seems to pitch right for its target audience of busy parents catering for their kids.

Amazon feels very “busy” and its messaging doesn’t come close by comparison.

Efficiencies

A new EPOS system was introduced in FY25 and cost efficiencies will more than offset the rise in 7.3% average increases due to living and minimum wage increases. 15% Employer’s NI too. Everyone else got a 2% rise - right up to the Board.

The Coleshill distribution centre has been restructured and new ways of working introduced.

Strategic frameworks are being introduced to improve buying and merchandising. A “what good looks like” guidelines and area managers are focused on driving through that consistency to each of their branches.

Leases have been renegotiated downwards and closures have been driven by demanding landlords cut rates. Lease for less or the business WRKS away… it seems the closures have convinced landlords that this is no bluff and there has been success in renegotiations.

A more scientific approach to store space trials is being introduced to actually calculate and manage “sales densities” - rather than leaving the make up of stores to a branch manager’s discretion. Pile it high becomes no pile it here and only here.

WRKS is focused on people development to invest in its staff to grow leadership from within but also is embracing apprenticeship programmes. It emphasises its flexible working approach and it has a very “Gen Z” oriented approach to its recruitment web site and job specs. Have you ever seen a job description made up of little emoticons. Go and apply for a job at WRKS and you’ll see.

We are told that five new stores will open in FY26

Show me the money

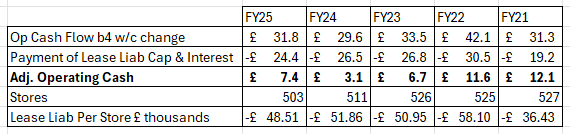

Impairments and Leases would impair your brain if you study them too hard. But a lesson I’ve learned from WRKS is beware of operating cash flow. The rules are that some operating costs are treated as “financing activities”. So no, WRKS a £27m market cap isn’t actually generating £32m a year operating cashflow.

Rather than use the NON CASH adjustments I’ve decided to use the cash movements instead to arrive at an adjusted operating cash flow.

£7.4m is nevertheless impressive leaving WRKS on a 3.66X P/adj.FCF. That means for every £1 that goes in the till 27p goes to pay for future capex, pay down debt and afford shareholder returns.

We see per store lease liability payments reduce to £48.5k per store average so we see evidence of reduced costs going forwards.

Leadership

Mr Rebel says for a recovery play (his speciality) to be genuine, you need a catalyst. The same old board doing the same things over and over again rarely proves to be the real deal. We see a recently invigorated leadership at WRKS:

2023 saw Rosie Fordham take over as CFO.

2024 saw Stephen Bellamy join as Chairman. He is a turnaround specialist.

Simon Hathway is an acclaimed retail specialist and joined as a non exec

Graeme Coulthard has taken a 7% position – a Retired Private Equity Partner / Private Investor

So while the same CEO, Gavin Peck remains at the helm, there has been a complete change of people around him according to Mr Rebel, with some corporate big guns with lots of experience surrounding him and with good advice and experience and people with huge skin in the game too.

Forecast

We saw 6.9% store growth in 4Q25, so I’m assuming in FY26 there’s a slow down to 5%. There is no meaningful contribution from the five new stores and cost of sales grows by a lower 3.4% through lease and supplier negotiations. Mr Rebel reckoned on a 10% cost saving due to the USD weakening so a 3.4% increase of costs might be zero or even a reduction. I’m assuming a hit to admin costs (via the 7% increase of costs from tax/wages/salaries) offset by some cost savings is a £2m increase of costs.

The net results is we see a sharp increase in net profit in FY26.

This places WRKS on a P/E of 2.2X.

Conclusion

Misreading the target was “by FY30” not this coming year could’ve cost me. But now I’ve deep dived into the FY21 → FY25 accounts I’m pretty happy. Very happy actually.

Will the back of the fag packet calculations all happen in FY26? I’m now assuming not (yet). But it doesn’t matter. £290m instead of £375m of sales, no -£12m reduction in cost of sales, no increase of margin to above 7% are in the above assumption of a jump in profit.

I’ve decided I’ll continue to buy into the falling price knowing that I’m buying a company that appears instrinsicly misvalued, in FY26 as well as beyond to FY30 (assuming you agree it can achieve its targets).

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Great write-up. In case you miss Woolworth - you are happily invited to Germany - here in Berlin we still have one :-)

Thanks for the credits TOB.

I spoke to Gavin Peck re the online side of the business. They have considered closing it. It wasn't making them money. I think they would close it but the issue for them is they can't quantify how much business in the retail stores originates from people going online. I think they are doing some work in this area to measure it. Gavin said they would just like to get it profitable and holding its own and they'd be happy, tho trying to get more. H2 looks like being far better though and as you say, the new website layout and theme is far better and coherent/targeted to stuff to do away from the screen. It's greatly improved in my opinion.

Cheers