Dear reader

You might find this picture unsettling. Or you might not. After all, you are not the Prime Minister, are you? PM Starmer is welcome to read my blog.

This is not a political statement but instead a statement of principle. Would such an event as removing a portrait of a previous leader happen in the US? Did President Biden, take down Donald Trump’s picture from the White House? I don’t believe so. Heck, why not get the chisel out on Mount Rushmore too? Regardless of the politics, I believe the principle should be that our government should respect the institution. I don’t know why we have lost that in the UK. An update after a furore in the media is the “unsettled” PM has decided to move the unsettling picture to a different room. The attic perhaps?

Or perhaps it’s not just the UK where we have lost respect for institutions. This is a link setting out the deaths because of January 6th. Suicide was the main culprit. I think that that’s dreadfully sad. The thought that Law Enforcement officials took their own lives because they failed to hold back the mob.

Anyway, more musings and tid bits:

ANIC

I see we have a new quango to promote Cellular Agriculture: NAPIC.

While not a fan of quangos I nevertheless believe this will be a positive for Agronomics (ticker ANIC). NAPIC is spearheaded by the University of Leeds, with a total investment of £38 million to explore innovations in plant-based, cultivated, and fermentation-derived foods.

“A phased transition towards low-emission alternative proteins which have a reduced reliance on animal agriculture is imperative to deliver sustainability and protein equity for one and all. “NAPIC will provide a robust and sustainable platform for open innovation and responsible data exchange and collaboration with partners from industry, regulators, academic partners and policymakers that mitigates the risks associated with this emerging sector, and also addresses the short- and longer-term concerns of consumers and producers.”

With UK approval for Meatly (coming to a Pets At Home for your cat or dog) is this the first of many regulatory approvals?

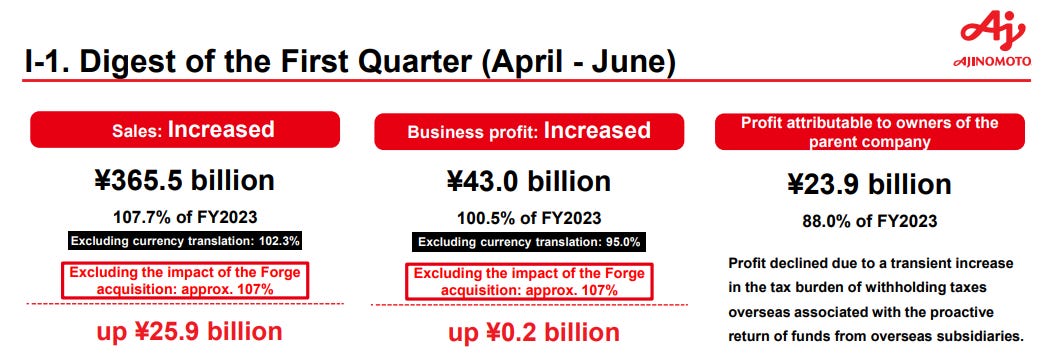

Across in Finland Solar Food’s Solein is a bespoke protein made from electricity and carbon dioxide, and replaces dairy with no cows involved in its making. Solar Foods will be listed on the Helsinki Stock Exchange giving ANIC its first public listing. Ajinomoto began selling two food products last month in Singapore: A flowering mooncake and an icecream sandwich. It has applied for US federal approval.

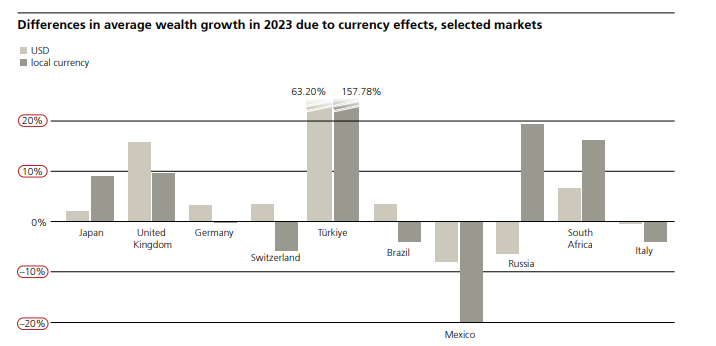

Ajinomoto is an £8bn t/o and £1bn net profit Japanese food products firm. Ajinomoto gives Solein has some strong backing through its partnership. Solar Foods next stage is to build Factory #2 which will be 40X the size of factory #1.

The Company’s growth over the next few years is primarily based on two factory projects:

Demonstration plant. Factory 01, has been commissioned in 2024, is approximately 160 tons per year for Solein. The factory’s production will be sold to customers’ test marketing campaigns and to pilot new products (like Mooncakes and Ice cream). The Company assessed that the implementation of these steps is a prerequisite for obtaining sales contracts for Factory 02. The actual investment of the plant was over EUR 40 million.

Commercial scale production facility. Factory 02’s production capacity for Solein is estimated to be over 50-100 times higher than Factory 01, which the Company estimates would generate net sales of EUR 80-200 million. The Company estimates that the production cost of Solein on the Factory 02 scale excluding depreciation and financing costs is currently around EUR 4.3–5.2 per kilogram and estimates that it will fall further in the future thanks to technological developments. The investment cost of Factory 02 is estimated to be EUR 150-420 million depending on the production capacity and the country of investment. Investment costs will be specified as planning progresses. The Company expects that investment decisions will be made by 2026 at the latest.

We get a peek into the economics of this new protein.

Using the RRP of Whey Protein as a proxy then 23 Euros/Kg is reasonable and assuming just 7 Euros/Kg wholesale price and 5.5 Euros/Kg production cost Factory #2 is profitable and would increase in profitability as debt fell and as production cost moved towards 4.3 Euros/Kg.

ANIC hold 5.8% of Solar Foods who produce Solein valued at £17m. That’s an implied valuation of £293m. A business who can produce a protein whose characteristics mirror that of dairy but is dairy free and has a vastly superior nutritional profile to dairy. For example Whey only has a high level of protein because it is processed. Milk has 6% protein. Solein has 60% protein but is unprocessed (so probably has higher bioavailability)

Solein is cruelty free (no female cows constantly impregnated to keep the milk flowing; after all milk does not appear by magic reader, just like the birds and the bees). Solar Foods is a business which could generate £100m and probably up to £200m from its first main factory. That’s likely to be worth at least 10X and probably 20X-25X, given its monopoly status, and capability to licence the technology world wide.

By the way, it would only be a £293m valuation is if you paid the NAV value. But ANIC is trading at a 65.3% discount to NAV so you would be paying the equivalent of £101.5m for ANIC holdings like Solar Foods. Even applying some fairly harsh methodology to the numbers, at that discount it can generate earnings equivalent to a P/E of 1X. And 0.5X or 0.3X in time.

And of course Solar Foods is one of a number of highly credible companies. Liberation Labs is another close to commercialisation building fermentation production capacity for Alt Proteins. The CEO who has worked in food production for 35 years including at Monsanto is a great watch:

KZG

Director buys at 0.7p and 1.1p tell you something about the value at Kazera. The NNR inspection is now complate and sales of HMS begin. The Market Cap is now £10.3m and with estimated cash flows of $0.5m a month flowing in, and £1m a year admin costs KZG is priced on a P/E of 3. But this assumes the Hebei debt (£7.7m) is not collectible. What does legal action require reader? Cash. What will KZG now have to pursue its debt and the costs of recovery? Cash.

Hebei are well aware that KZG’s position has now changed, they are very close to completion on their Namibian plant with the Arcadians (3-4 months). I expect we will see the debt being settled in the coming months. This means the market cap is actually only £2.6m net of that debtor’s cash owed (and accruing at 8%), and therefore a £3.5m net income from WMS is actually a P/E of 0.8.

Plus diamonds. Plus the NSR of 2.5% from Aftan that Hebei will also be liable to pay on proceeds mined from the Aftan site.

I top sliced KZG but still hold a large wodge almost at a free carry and the outlook here is extremely favourable - even at 1.1p a share.

CGEO

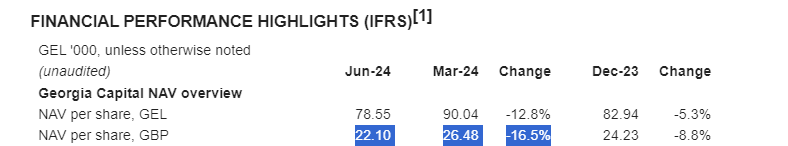

Capital Georgia released their 1H24 results on the 13th August. I think its appearance the same time as DEC and a few other holdings meant I haven’t looked at it properly until last week. I was gob smacked when I did. Since the results on the 13th August the share is flat.

Meanwhile BGEO is up over 10% since the 30th June result, but when looking at their handy NAV tool I noticed that factoring in Bank of Georgia’s current share price (CGEO own 20% of BGEO) I get to a 56.5% discount at Capital Georgia. If I put in BGEO’s target price 26% above today CGEO rises to £26 a share and that’s a 62% discount to today’s £10.22 share price.

But then as I worked through the 1H24 report, a superficial read is that CGEO’s NAV fell 16.5%. OUCH!

But the telling factor was the Operating Performance and the Multiple change. A (smaller) loss at hospitals and a worse result at insurance but a strong operating performance. But how strong? I was curious. I also saw the valuation multiple and FX were the reason for a poor performance in 1H24.

Comparing the operating performances of 2023 to 2024 (NB: I’m doubling the 1H24 performance to produce a comparable “full year” with 2023) we see an overall MORE THAN DOUBLING of Operating Performance in GEL terms which is defined as the change in the fair value attributable to the change in actual or expected earnings of the business, as well as the change in net debt.

This is despite the riots and unrest and issues within Georgia which purportedly according to some detractors would cause the economy to tail spin to disaster. I was sceptical and that business would take it in its stride and things would settle down. And so they did, and the numbers show my instinct was right. Whilst the valuation multiple is down the business performance is not. Quite the opposite actually.

A more than doubling of operating performance.

So when the CEO says “Exceptionally Strong” he’s not exaggerating.

Meanwhile debt is being paid down and strong levels of cash is generated. “At least” $48m is a P/FCF of 11.5. Buybacks increased the NAV by 2.1% in 1H24.

Being able to top up last week at £10.20-ish price is a gift in my opinion.

CHAR

Following my ENOG-gin article I realised the weight of purpose behind ENOG and how they need for Morocco to work, and how Chariot stands to benefit from that heavyweight’s expertise and cash.

20th August was the start of drilling at Anchois and it is a 2 month programme.

12th August was the completion of CHAR’s $9m fundraise.

I realised the price had slipped below 6.5p (6.44p) last week so added here.

Assuming a reasonable degree of success at its onshore (Loukos), offshore (Anchois), its Royalty, the Dividend (and this assumes ENOG buy a further 10% interest in Lixos/Rissana), plus other revenue generators leads to a $89m (£68m) net profit for CHAR, whose market cap is just £76m.

I pondered the shall I/shan’t I in my prior article, well the toe has slipped forward to become a foot in CHAR. Will I get my toes burned? Or should I sit back and enjoy the char with some bikkies? Time will tell.

Fun Run Update

1st place - Paul Scott is still blasting out ahead at +32.5%. The news that Beeks had the Nasdaq as a client is a real coup, and came out of the blue. Well done Mr Scott!

2nd place - Arby is at a respectable +4% since April 1st. Bitcoin is still a drag at -18.4% but interesting to see the 3 Vanguard ETFs are up 6.9% (US/S&P 500), 5% (non-US global tracker) and 2.1% bonds. Well done Mr Arby!

3rd place - overtaking Oak Bloke Charles is now at -5.3% with Guardian flagging a little (on no news) but still +282% YTD. Great pick at GMET Charles!

4th place - Oak Bloke is at -8.7% with Kazera delivering the top result at +67.3%, then Trident +49%. Frustratingly Power Metals is up 2.8% by comparison (1/100th of GMET’s rise, despite owning 45.36% of Guardian Metals). Kazera is a great example that deep value is for the patient. I remain optimistic that my portfolio will improve in the remaining 4 months of the year. Particularly that Petrotal (down -17.4% YTD despite cracking progress on drilling and a solid 1H24), DEC (down 17.7%, despite also delivering a strong 1H24 result and having made a series of acquisitions and a disposal which will deliver a net $500m or more additional profit), IPO with its rapid buy backs and maturing portfolio and cash realisations is nevertheless down 28.9% YTD, CGEO which I covered earlier is at 0% YTD despite a strong performance in 1H24.

5th - Simon T’s Bargain Shares is at -11.2%. BP Marsh is Simon’s top performer 22.8% YTD and TENT #2 at 13.5%, but EAAS at -28.9% and NXQ at -30.6% are dragging down the bargain shares.

6th - Sunday Roast Phil is at -11.5%. Incathera is 0% since 1st July while POW is down -11.2% even while GMET for Roast compadre Kevin is up 21.9% (go figure?). Despite a warm assessment last week, Jubilee is down -22.8% since 1st July at 5.4p. A surprise given the progress made commissioning the copper units as I’ve covered recently.

7th - Sunday Roast Kevin is at -20% where GMET 1st July to now has delivered 21.9% but EST and TM1 are both down around -40% since 1st July.

Repositioning for September

I said the article name was repositioning but I’ve only made some minor changes to my portfolio. My main purpose of the title was the moving of Lady Thatcher’s portrait.

I am near 100% invested based on what I see is conviction and analysis on mispriced assets. I continue to believe in the value in parts of the Japansese market, and am still exploring other options within this. I have a strong belief that Venture Capital and Private Equity are deeply mispriced and realisations and newsflow will expose their value. The market has begun to recognise this at holdings like GROW (up 100% from YTD lows) but not universally.

I continue to believe Oil and US Natural Gas are commodities which will do well, and have opened a position for a Uranium Miner (UUUU). This is a great interview with UUUU’s CEO out today:

But I also believe that various “green” holdings are mispriced and have greedily positioned into their high dividend yields but prospective re-ratings. I continue to hold a number of gold equities and various special situations too. I had a long think about returning to RGL and property (the new government’s promises to build lots of houses) but a visit to a major UK city recently and the sheer number of empty offices “to let” even yards from the City’s railway station made me think again. It is shocking but go and actually visit a city wander around before touching commercial real estate. As for house building, waiting until the budget seems sensible.

Today feels like the end of summer, and a new season begins. Kids go back to school, commerce and industry kicks up a gear, Q3 dividends flow through and the UK stock market is back on global investors radars. A likely US rate cut and more soft landing news, along with further cooling of inflation (with some stings in the tail) suggest that the final trimestre should be positive.

I spent a very productive 6 hours today in a garden. Not my garden, but I visited a garden in the National Garden Scheme. I thoroughly recommend this as a great way to disconnect from the world and contemplate life, shares and everything. Open days continue until the end of September. I wish you good fortune in the next four months.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Net profit looks a lot healthier now! How long before the foot becomes a leg?

On Char you have cut the $ netback significantly from your previous article. Any comments ?