Good morning readers

Regional reported their Q3 trading update today.

In that update (which is a financial semi-snapshot) they revealed several important details.

£2.1m of disposals in period. Post period disposal of £6.25m at a 26% PREMIUM to valuation. So when Inglis speaks of the Valuations being wrong we now have evidence to that.

We know quite a bit of work has gone in to refurbishment and the jump in ESG is impressive - and makes the assets more attractive (for sale or for rent)

We know, too, the portfolio increased in value - despite the (small) disposals - so the refurb work wasn’t all dead money it improved the valuations a little (£0.7m).

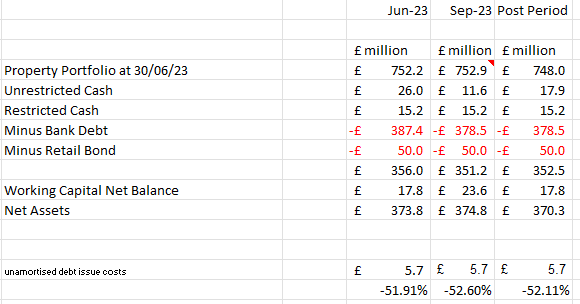

My calculations are these:

I’ve arrived at these numbers by adding what we know and then extrapolating what we don’t know. i.e. we know the gross portfolio value, the debt position, the bond, and the LTV percentage. One can then calculate the unrestricted cash based on these provided numbers (with the balance moving to working capital and outside the LTV calcualtion). Cash is down by quite a bit - due to refurbishments.

Crucially post period the LTV near stabilises to a 0.2% fall since June (Covenant is LTV <60% - target is 40%) - at that speed it would take 10 years to breach the covenant with the same level of decline observed 30/06 to 09/11 - further assuming:

1. ZERO realisations for the next 10 years (at 0% discount let alone at 26% premium) despite evidence to the contrary.

2. With ZERO rent reviews and uplifts (despite a +6.2% uplift observed)

3. No further voids are filled (or don’t increase)

4. That the £50m bond cannot be refinanced at a value greater than £50m (the bond is not part of the LTV covenant)

5. That no equity raise is possible even at terms detrimental and dilutive to us shareholders.

6. That no predator buys RGL - despite mergers and activity occuring in the market. .

Other observations:

Dividend is maintained. Would it be sane for the dividend to be maintained if we were heading for a LTV disaster?

Rents are up too - would rent renewals be up in a market where office rentals are doomed and asset prices will fall further and further? The numbers tell another story.

Downsizing. EPRA occupancy is down another 1.8% to 80.7%. So thats more voids and fewer pass through costs coming out of free cash. Virgin Media (largest tenant) is retained but with less than half the space. Shell Energy (2nd largest tenant) is also retained but at a substantially reduced rent was 1.4m now 0.9m and all thats bought them is two years

Rent Roll is down 2.6% in Q3 but even taking this into account and assuming this feeds immediately into income (which is pessimistic) also assuming costs don’t reduce then income is hit. Assuming the same 2.6% drop countered by the letting announcements today, we see Q4 rental income rises. £6.14m + £8.61m = £14.75m so £2.15m ABOVE the numbers for H1.

Have a good morning and it seems we’ll keep doom for another day.

This is not advice.

Umm read between the lines that sale is good they then go on to say overall sales are at 2% better than valuations that tells me todays RNS is potentially an outlier. Onto the trading update its reasonable they've retained 73% although the asterisk note indicates it might not be as good as that. Anyhow its a decent level but lets move to vacancy level its down another 1.8% to 80.7%. So thats more void cost coming out of free cash but significantly NRI down another 1.8m over the qtr. They have at least retained Virgin Media, which was the biggest tenant, but at less than half the space they had. Also they've retained Shell Energy 2nd biggest tenant but at a substantially reduced rent was 1.4m now 0.9m and all thats bought them is two years.

The lower divi is still covered but the margin is falling and if they dont stabilise NRI, which seems unlikely given they are making disposals and the evidence that rents are falling, then even that divi is under threat. Of course thats more than in sp currently but until they have dealt with the bond refi cant see sp reacting favourably.