Dear reader

Riverstone is an interesting beast. Historically it was an investor in dirty oil and gas (‘the brown’). Back in 2019 its portfolio was 100% O&G (Oil and Gas). RSE had an epiphany and pivoted in 2020 towards decarbonisation holdings (‘the green’). Describing clean and dirty fuels as Brown and Green is not original to the Oak Bloke. I have to give Jeff Currie of Carlyle his due. In fact Riverstone is potentially an archetypal UK holding to Energy Transition. A few years ago you could’ve bought Shell and BP and both were offloading the brown and embracing the green, but are now more recently pivoting back to the brown.

Jeff Currie is a regular speaker on Bloomberg and elsewhere - well worth a watch:

RSE, meanwhile, it’s fair to say, has had mixed success in its decarbonisation strategy. However its oil & gas holdings have been successful in the past few years and generated very strong returns - and continue to do so today.

It’s also the case that buy backs and tenders (including a whopping $200m offer at a 14% premium) have reduced the near 80m shares in 2019 to just 27.5m shares today. The 2019 NAV of $776m equated to $9.71 per share while today’s $458m equates to $16.65 per share. The share price hasn’t increased by quite so much.

£5.18 to today’s £8.00 share price is a 54% increase while the NAV increased by 71.5% in the same time period.

And aggressive buybacks continue.

So why am I excited about its future prospects? Read on reader, read on!

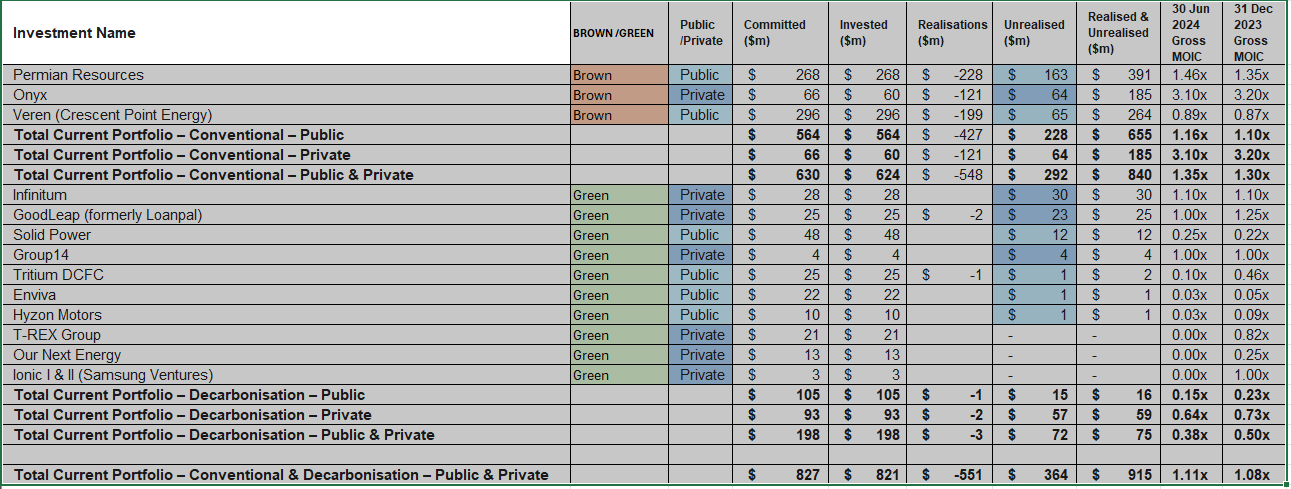

The RSE portfolio:

RSE’s $458m (£363m) NAV equates to a per share NAV of £13.37 vs £8.00. This puts the share on a 42% discount to NAV.

Its Market Capitalisation is $264m (£203.8m) and deducting its cash (which it is doing through buy backs aggressively remembe) plus publicly listed holdings deducts $337m (£266m) to arrive at minus $73m (£62.2m).

In other words the easily realisable cash value exceeds the market price. But that’s not all. There is then a private portfolio worth $121m (£93m) in the price for free too.

Or put another way in pence per share for each £8 share then over £10 cash/listed holdings and a free £3.63 worth of private holdings on top.

Or put another way a discount of 42% rises to 56% discount ex Cash and 160% discount once you strip out listed holdings too.

Now if everything was only worth their NAV value £5.81 or 60% upside is ok but not exceptional. So why am I a bit excited?

Considering the green.

Enviva went into Chapter 11 during 2024 so its 3p a share valuation could be actually zero and 2 other small holdings have been similarly reduced to $1m (3p) token valuations too. It’s fair to say many green investments have been horrendous since 2022. But there are grounds for optimism going into 2025 - at least for some. Valuations have stabilised and some winners have emerged.

1. Infinitum 90p a share

The humble AC motor reimagined - using lighter weight materials, a PCB stator improves efficiency by 10% and reduces noise and torque ripple, with built in IoT performance monitoring makes this easy to install, maintain and is fully recyclable at end of life (most of its components have a 100+ year life so can be reused). IoT monitoring can alert you on the voltage, temperature and efficiency meaning the motor tells you when there’s a problem (handy for mission critical stuff)

Infinitum is cash generative with a strong pipeline and continued focus on both ramping production and converting purchase orders into revenue. The company’s new facility in Saltillo, Mexico doubles production capacity by year-end.

A key growth market is Data Centres, including AI data centres. In 2024 it has received several awards such as the IT/Electrical category WINNER for its ability to improve the efficiency and sustainability of AI data centres. As AI increases demand for data centres, and their accompanying power consumption and emissions, the need for energy conservation is more critical than ever. By 2030, data centers could consume 9% of U.S. electricity generation, which is more than double today’s usage, according to the Electric Power Research Institute.

Founder and CEO Ben Schuler was likewise named among Bloomberg BusinessWeek’s Green Ones to Watch, of the climate leaders of tomorrow. As of 30 June 2024, RSE’s interest in Infinitum was valued at 1.10x Gross MOIC or $30.2 million. Post Period a $35m Series E funding round has likely increased its valuation and an IPO in 2025 is a distinct possibility.

Sounds like the 90p could be heading upwards.

Good Leap 69p a share

I’ve written about the US inflation Reduction Act a number of times and domestic solar and storage is something of a growth area. Not least that the American psyche is deeply rooted in “independence” including of course energy independence.

Goodleap are a broker for loans on energy generation home improvements and RSE has $25m invested. Homeowners meanwhile can invested zero up front for something which according to the DoE increases the value of their home by about $15k. Goodleap have originated over $27bn of loans with over 1m homeowners.

Meanwhile the IRA 30% tax credit reduces the cost of solar and BESS by 30%, with $1200 for HVAC, $1200 for Weatherisation (e.g. windows and doors), $2000 for heat pumps (to replace A/C), $1000 for EV home charging. This handy tool where I typed in an imaginary California address earning $100k 4 people in the home told me 18 ways I could save upwards of $25000.

As well as marketing to homeowners, Goodleap also actively engages with contractors through its Warriors of Light programme, bringing together the supply to the homeowner demand and the financing + government IRA funding.

RSE has invested $25 million to GoodLeap. It is a technology-enabled sustainable home improvement loan originator, providing a point-of-sale lending platform used by key residential contractors. GoodLeap does not take funding risk and just originated loans which are funded by large asset managers.

This attractive model and asset-light business model has enabled rapid growth and the ability to scale faster than its competitors, while generating free cash flow by capitalising on upfront net cash payments on the flow of loan originations and avoiding tying up lots of capex.

The valuation multiple for GoodLeap was lowered to 1.00x Gross MOIC for 2Q24 as the macroeconomic environment headwinds did not decrease as much as originally expected, but the industry outlook is positive.

Goodleap is implementing strategic changes to better navigate market dynamics such as expanding product partnerships, introducing new products such as new areas of home efficiency and tightening contractor payment guidelines.

This share is an asset light way to play the inflation reduction act, and climate change as well as ENERGY INDEPENDENCE is core to many Americans keen to improve their homes.

Solid Power 36p a share

Moving to a less successful holding - for now. Nasdaq listed SLDP won a $50m DoE contract for sulfide-based solid state batteries last month. The US government is awarding contracts to “strategic” firms - and Solid Power is keen as strategic vs China.

As at 30/06/24 Solid held $358m cash eq. and a market cap giving it at least a 4 year runway. (and valuing its current market price at a 40% discount to NAV incredibly!) - which is a +24p a share look through for RSE, technically.

It has three industry partners in BMW, Ford and SK. It has 50 patent families covering the production of Solid-State Batteries which can take a car 600+ miles.

Both Ford and BMW are publicly bullish about Solid Power’s battery.

The technology sounds like it needs ironing out but given the above statements I believe this is further along than the market gives it credit.

Even if I’m wrong Solid Power equates to 4% of RSE’s market price and this share could come to naught - but if successful then it would be many multiples of today’s share price.

As well as Ford and BMW the South Koreans are also actively involved in supporting and backing and partnering with Solid Power too.

Group 14 - 12p a share.

This is another battery materials technology company and has agreements with 5 EV and consumer electronic manufacturers.

It has received, post period, $200m from the DoE under the Bipartisan Infrastructure Law. The largest global source of silane (a type of silicon) today is China. The $200m funds a US factory to source this critical raw material domestically, with a 7,200 tonne capacity.

Its other two factories BAM-1 has been operational since 2021 delivering 10GWh worth of battery materials per year. BAM-2 opens this quarter and extends capacity another 20GWh.

The post period funding from the DoE strongly suggests an increased valuation in the next update from RSE.

Now let’s consider the Brown - and this gets even more exciting!

Permian £4.88 a share

Permian probably exemplifies the “Drill Baby Drill” mantra more than most.

A repurchase programme of $1bn announced last month is about 1/12 of its market cap. Dividends were boosted too. This is a 17 “strong buy” and 2 “hold” with analysts and over 5 years its share price has risen from $3.33 a share to $14.22 today.

That’s thanks to relentless cost control and $7.45/BOE costs is certainly impressive!

Bolt on acquisitions at ~$10k/acre totalling $4.5bn have delivered >$225m per year synergies but debt is only about 1X EBITDAX.

Onyx at £1.92 a share

Onyx is a highly efficient coal and gas generation power provider (four power plants), but also is building a blue hydrogen plant, too, incorporating carbon capture alongside gas power. It is highly cash generative.

It is transitioning its coal plants to biomass and other initiatives to improve its environmental credentials.

RSE has tripled its money on Onyx and received 2X its investment back already giving this £1.92 a share a “free ride”.

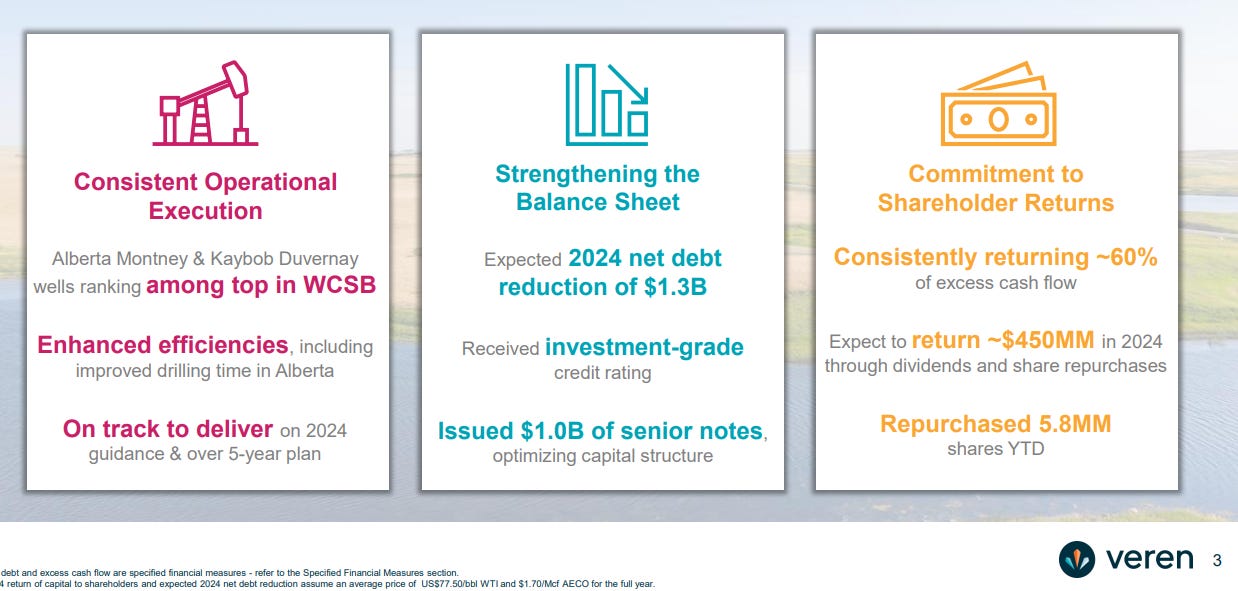

Veren £1.95 a share

Another that analysts like. There are 13 “Strong Buys” and 1 “Hold”. It is based in Canada and it’s fair to say that it has suffered from record low Canadian natural gas prices (Veren is 35% gas and 65% liquids) and its share price is down about 1/4 YTD. It is now priced at 0.84X its book value but is generating significant cash flow.

It is focused on growth and returning capital to shareholders in its 5 year plan.

Conclusion

I’ve not attempted to explain or justify the 9p a share for Enviva, Hyzon or T-Rex. Let’s assume that all three are toast. Zero.

But for the remainder of the green that’s £2.07 where uplifts appear likely on £1.71 of that.

The £0.36 Solid Power is more speculative but solid state batteries, if the challenges can be solved, would be worth many times its current bombed out value. The company is at a 40% discount to NAV after all! Is there a strategic value in helping it succeed in the EV arms race? I can’t help but feel there are reasons to think the optimism expressed by BMW and Ford (and the South Koreans) isn’t based on bravado, it’s based on fact.

Then we consider the brown. £6.83 per share represents 85% of the market cap where all three appear solid to me. All three could deliver capital increases in the coming year due to their growth and factors like increasing amounts of US and Canadian LNG export.

Plus adding £2.82 per share of cash held by RSE gets you to £9.65 or 20% above the share price. Plus you need to add the £2.07 per share of green (excluding the 9p). Plus potential (likely?) uplifts on those too.

I’ve one final surprise. Both Permian and Veren pay dividends. Without even factoring in the buy backs both speak to the $163m Permian Holding delivers $13.25m dividend or 40p a share, while Veren’s $65m holding delivers $3.36m or 10p a share. So 50p a year on top of £13.73

All in all I think this appears to be a compelling set of holdings where the share price is simply mispriced.

Regards

The Oak Bloke.

Disclaimer: This is not financial advice. Micro-cap and Nano-cap holdings may have higher risks and volatility compared to traditional "blue chip" companies.

I've made a tidy profit from RSE, but you don't really need to own it full-time. The share price won't move much until one of the public companies is taken over and the next RSE tender offer is announced.

Interesting news today about the wind down. The poison pill in RSE was always this "Relevant Termination Payment" of 20 times the quarterly management fee if the investment manager was fired. So now that the investment manager are themselves proposing the wind down, it seems pretty unfair that they still want to claim their Relevant Termination Payment. But I'm thinking that if they've at least reduced their fees to 1% from 1.5%, that's a saving for investors.