Dear reader,

Feb 2025 update - interesting to see the buyer of Saietta is up 50% on the year.

Back to the article from Feb 2024:

It’s nearly 2 months since Saietta closed its doors. And I wrote about risk in SED#7 facing risk. At that time I said it was the last time I’d write about Saietta unless and until the IP was sold.

It’s been sold.

Saietta at 17p was one of the Oak Bloke ideas for 2024 where I said:

Saietta is my final growth play (and final sucker stock). World class technology as Renault’s Papa and Nicole would attest, with commercials in place, cash (partly) in place, and a partnership in the USA and a JV in India which will propel SED to greatness. It’s true that SED lost its way in 2023, and new management had to make some tough choices to cull overcommitments to different programmes….. It has an order pipeline of $366m contracts pipeline which is nowhere in the price.

So let’s consider the assets:

Existing customer base in the USA, Finland and India.

Proven AFT Technology including software and invertor including patents

Proven RFT Technology including software and invertor

A developed marine engine to be commercialised

Ability to re-enter the Heavy vehicles market

A Conmet Licence Agreement

A 49% ownership of Saietta VNA

A Sunderland factory with 4 lines. The equipment from one of those 4 lines was announced as sold for £0.6m shortly before the suspension. 2 of the 4 lines were sold for £3m to VNA.

A Silverstone engineering facility

49 people who on LinkedIn (as at 29th April 2024) still list “Saietta Electric Drive” as their current employment (including many key people).

Possible £3m debt owed by Saietta VNA to Saietta Electric Drive

On to the news:

(Big shout out to my reader, Mayday Maverick for spotting this)

EXEDY a Japanese automotive OEM has last Friday acquired the assets and intellectual property rights of Saietta Group PLC. By effectively utilising Saietta’s assets, EXEDY aims to accelerate the development of electric products within the EXEDY Group and contribute to the realisation of a sustainable society.

For those who’ve followed Saietta’s fortunes and misfortune this is taken from the Exedy web site. Is this a match made in heaven for Exedy?

What price did they get?

We don’t yet know.

But we do know that:

A Conmet Bid

There will probably have been a competitive tender for the Conmet assets:

Why? The royalty is 2.5% of sales capped at €20 million

So logically, it would save Conmet money to buy the royalty from the Insolvency Practitioner for any price up to €20 million (£18m). Conmet as of 29/04/24 are actively marketing their emobility products of an in-wheel motor and in-wheel generator, making trucks hybrid vehicles, and here’s some current testimonials on their web site:

A Padmini Bid

There will have been interest from Padmini who own 51% of Saietta VNA. Interest to buy out the 49% of the Indian business (with its £366m pipeline), as well as the royalty agreement (worth about 4% of sales).

How much? The contribution to the start up costs were around £5m; but this is just book value of the assets. The going concern of the business is worth at least that much and probably more. The royalty of 4% based on £366m of current pipeline might be worth as much as £10m to buy out.

So £15m total at a guess.

So £33m for the pair competitively plus whatever value you place on the strategic value of the IP, the core 49 people, the factory, the engineering capability, the Indian contracts, the marine contracts.

Plus £3.6m of debtors, probably.

Minus Insolvency costs which will be several million. Minus whatever cashflow issue which drove the insolvency (probably monthly wages due - where there was a £1m a month shortfall in my estimates)

I included SED in the OB20 at a marcap of £24.6m. Could the proceeds of the sale cover that? Possibly. To know the answer to that we need to understand who are Exedy and how and why would they outbid Conmet and Padmini?

Who are Exedy?

When they are not recording Nicole et Pappa lookalike videos, Exedy are actually a fairly big business.

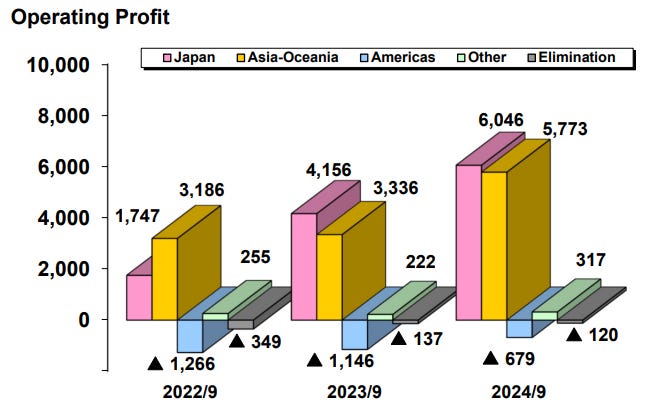

Turnover £1.57bn in the year to 31st March 2024; net profit of £50m in the prior year with a small loss this year.

Sitting on Cash of £376m as at 31st March 2024.

Well established in the automotive sector with quality awards from Isuzu, Yamaha and Suzuki. An established motorcycle OEM.

In their FY2023 results (to 31/3/24) they tell us their biggest problem - companies like Saietta have disrupted their business model:

The profitability of the AT segment production facilities is expected to decline due to a significant change in the business environment, namely a decrease in demand resulting from the shift to EVs, and we have identified indication of impairment and tested for impairment on the subject assets. As a result, the book value of the subject assets was reduced to the recoverable value, and we recognized an impairment loss of ¥ 32.2 billion as “Other expenses”

The impairment is £164m.

In other words the underlying profit grew from £50m to £163m but a £164 impairment led to the ¥158m loss you see in the above accounts.

The question I leave you with reader is this. If you imagine a company turning over £1.5bn, that has growing underlying profitability, but a problem with its Automatic Transmission division and that has £376m of cash available, let alone any credit facility. That has competitive bids for part of a fallen competitor (which they presumably admire) possibly of around £30m. They want the lot. How much is solving that problem worth?

Seems to me, even £50m is good value from Exedy’s perspective.

Time will tell.

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

21st May 2024 - THE FINAL CHAPTER ON SAIETTA

The story ends with the Administrator’s Statement report from Ernst & Young (big thank you to Dave R for sharing this)

https://assets.ey.com/content/dam/ey-sites/ey-com/en_uk/generic/saietta-group-plc-and-saietta-sunderland-plant-limited/ey_sg_deemed_consent.pdf

To summarise:

Exedy have bought all IP and virtually all assets for £2.46m.

Creditors total £10m. Cash and the £2.46 will cover 20% of creditors. Shareholders will get zero.

The exedy deal excludes Saietta VNA. But realising any value from the 49% ownership of Saietta VNA may or may not be pursued (EY are uncertain whether it is economic). It is likely that Exedy will form a new and separate commercial licencing agreement with Padmini who own the other 51% of VNA.