Today SED provides its Interim Accounts. Quiet day to do it. Kitchen sinking?

I don’t think so. What’s the opposite of kitchen sinking. Kitchen rising?

The accounts were more or less as expected. But the key message in the accounts I want to immediately draw your attention to reader is this:

Whilst acknowledging the uncertainties described above, the Board have concluded, on the basis of all scenarios and related expected cashflows and available sources of finance, that the Group and Company will be able to continue as a Going Concern for at least twelve months from the date of signing these financial statements and therefore it remains appropriate to prepare the Group and Company's results on the basis of a going concern.

What that means reader is SED already have funding offers on the table. They must have in order to provide this “going concern basis” statement. What is the market’s reaction to this excellent news?

Wake up Mr Market!

I have set out the investment case in SED-ition parts one, two and three.

I don’t want to repeat the rationale in this article. Everything I’ve previously said still applies.

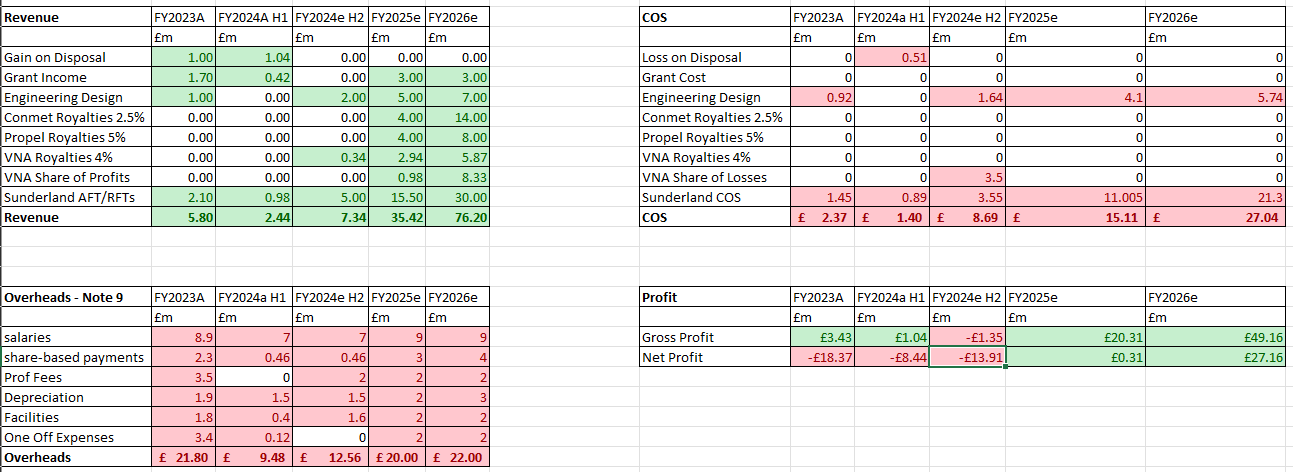

Except of course I will however take the opportunity today to revise my models. You’ll notice reader, I’ve split FY2024 (ending March 2024) into the two halves so added today’s actuals and revised FY2024e H2. All other assumptions stay the same. We are not told the overhead split so I’m assigning the £9.48m costs as reasonably as I can.

Feeding the cash related P&L variables into a cash model I arrive at near zero cash by end of March 2024. But this gets VNA funded, and cash burn is then slowing during FY2025 i.e. from April 2024 starts to become cash generative it is forecast (by SED) by November 2024.

Ayro

A key part of the above model is that Sunderland plays an important role in non-Indian production and sales. We know production began in Q2 (July - Sep ‘23) and we know today there was £1m of sales. Assuming these to be wholly Ayro (no AFTs for snow ploughs or other stuff) and assuming around £1400 that is around 700 AFTs produced and sold. 2,300 remain and we know automation is now driving down the COS from 9% to 29% in Q3-Q4. So there’s £3m of sales left in that order.

So a £2m shortfall in forecasts?

Well we know a £58m electrical pump order is forecast for FY2025 (forecast to conclude August 2024). We know too there’s a 2nd order.

But let’s return to the interim report and to the Outlook:

Read the words reader……Have secured… as in it’s already happened. “high volume… in the US” “set to utilise… Sunderland”. “The US”… that has to be Ayro. Well that’s really positive isn’t it reader?

What does Mr Market think?

Mr Market you’ve overlooked the 2nd key point in today’s interim, haven’t you?

There’s a reason this share is part of the Top 20 Oak Bloke for 2024. I agonised over whether it should be included. The key questions was a/ CASH b/ PRODUCTION RAMP UP. Today appears to answer both of those…. if you know where to look.

Now do you consider the already announced order for 3,000 AFTs is “high volume” and is that volume “set to utilise Sunderland”? I can’t see how you can say yes to either of those questions. Therefore further good news is coming.

Perhaps the place to look to answer these rhetorical questions is to ask what’s happening over at Ayro?

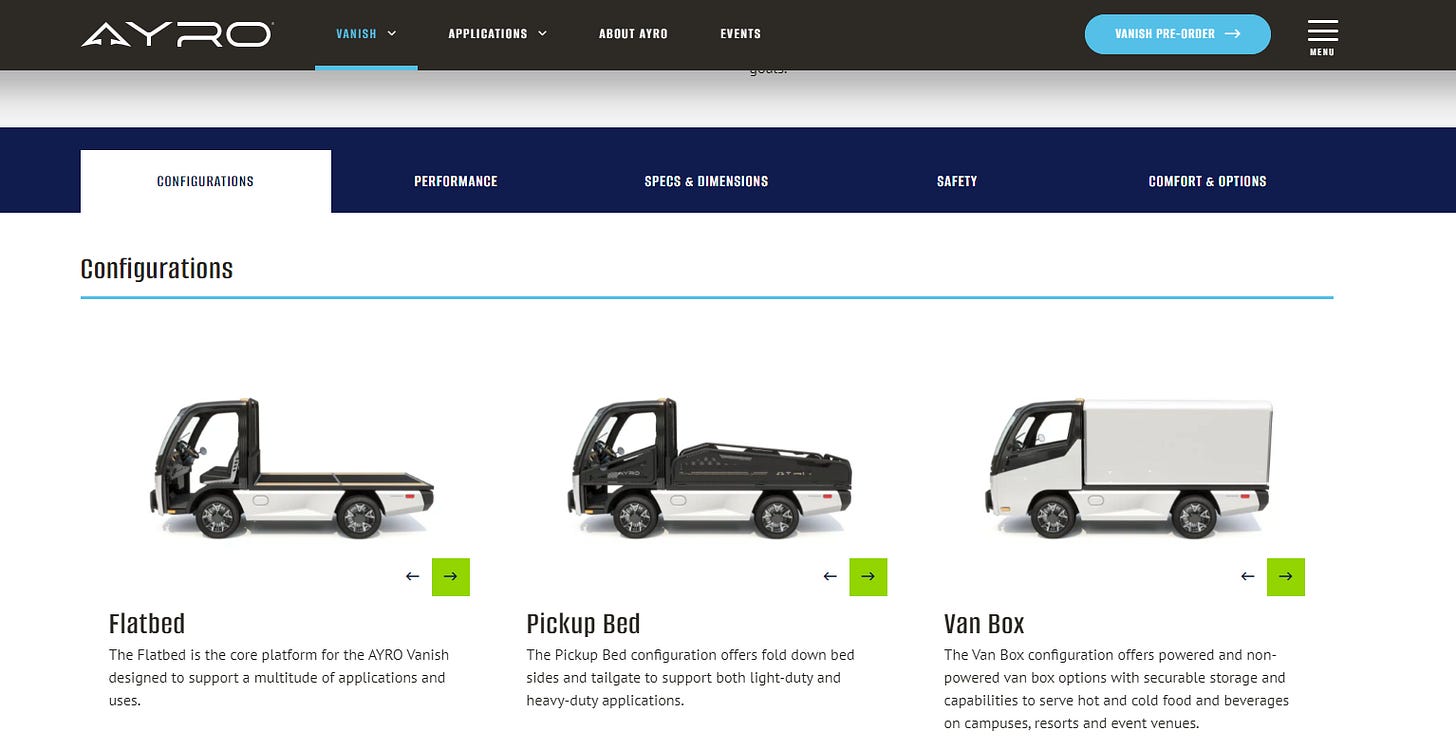

Ayro based in Texas, recently had in September 2023 a $26m Fundraise. It announced in September it’s moving from LRIP (low rate initial production) to full production in Q1 2024. Its price target on the Nasdaq in October has septupled (forecast to be a 7 bagger). Ayro got its fingers burned dealing with China, so 100% of its components for its new Ayro Vanish are US or European going forwards. Tick.

Ayro has a patented design that allows for all kinds of configurations within its subframe. Useful for lots of work-based activities (both commercial and governmental). It has government approval (homologation) in the US and Canada.

Ayro also has an initial order for 40 units from a Fortune 100 retailer - could be any of these:

STOP PRESS 03/01/2024 - Ayro also has an initial order from the US Government

Here’s where it gets VERY exciting!

If the Interim Report speaks to “high volume” and is “set to utilise Sunderland” means operating at capacity, well what is capacity at Sunderland?

Sunderland’s capacity according Cannacord Genuity is £50m worth of product per annum. If we change the P&L to full capacity (£50m at £1,400 a unit is 35,700 AFTs a year).

The effect on SED profits is dramatic.

This is not advice

Oak