Dear reader

SEIT’s aim is (was) “to provide an attractive total return for shareholders of 7%-8% per annum – with a stable dividend income, capital preservation and the opportunity for capital growth”

If you contrast the movement of the electricity sector vs SEIT as well as its NAV vs its share price, neither easily explains the halving of the share price.

Capital preservation, my foot. So where did it all go horribly wrong?

On the face of it SEEIT is the electricity sector. Solar, storage, district energy, CHP, gas, biomass, EV charging, lighting, energy efficiency. SEIT has fingers across many pies with a £1.1bn portfolio, and is diversified by geography (56% US), by counter party and about 79% is operational, with 11% underway.

The reduction in NAV appears to be mainly caused by two factors. The risk-free rate driving a higher discount, and operational issues at Red Rochester.

Let’s talk the discount first:

The Interim accounts (as at 30/09/23) tells us a 1% (100bps) increase in the weighted average unlevered discount rate to 8.7% “largely drove” a 10.9p reduction (106.1p to 90.6p). This means that the value of SEIT’s “risky” assets are reduced because risk free assets pay higher levels (“the risk free rate”) so comparably risky assets are worth less. For the half y/e 30/09/23 that discount meant a loss of £129m, following a net loss of £18.6m y/e 31/03/23. Ouch.

However this is a theoretical loss and ultimately what assets can earn what cash flows they can provide (and when) and what you can sell those assets for in the real world is what matters. Rates rise and rates fall. That’s just noise. Do you think interest rates will fall going forwards reader? If so, that will cause SEIT’s NAV to rise as the reduction unwinds.

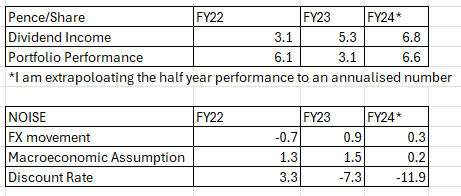

There are five factors influencing the NAV (and two more factors I’ll talk about later). Let’s split them out so we can see them more clearly.

I’ve taken the data from the FY22 and FY23 (y/e March) accounts and also the interim FY24 data. I’ve DOUBLED the FY24 data to provide an indicative comparison. I think that is a fair (even conservative) assumption because in the H2 trading update 19/03/24 they say:

Anyway I’m splitting out the pence per share by factor. There are two factors which are “true value generation”, and three which are “noise”. I do appreciate that a loss is a loss but FX movements, economic assumptions and discount rates wax and wane. An FX loss this year is a gain the next year, probably.

Well anyway you make your own judgment on the wisdom of that approach but I felt it was useful to see underlying performance. I was gobsmacked how different SEIT looks once you do this.

The underlying performance is that the IT is achieving over 10% underlying growth (10.3p per share NAV per year) excluding noise. Minus dividends that’s growth of about 4% per year.

Let me show the pence per share gains/losses by year graphically and it becomes much clearer.

Dividend income.

It is impressive how income from its portfolio is growing period to period. That is partly through more assets becoming operational but also the inflation-proofed income streams typical of the electricity sector. 6.8p a share covers the dividend 1.1X before any portfolio performance or other factors.

Portfolio Performance

What is particularly impressive is that the net £42m positive portfolio performance in 1H24 (which is 3.3p a share and I’ve doubled to 6.6p for comparison) includes some pretty large negative reductions (in H1).

Red Rochester is SEIT’s largest holding (22% of NAV) and covers the supply of nat.gas, heat and other energy services to over 100 corporates in Eastman Park (including to Eastman Kodak). Warm/mild weather reduced demand leading to reduced EBITDA and a £43m reduction. Steps are being made to drive value through new measures like CHP cogeneration which SEIT say will improve margins and cash flow generation. It’s likely the 2023/2024 winter will be a headwind in the 2H24 results.

Positives though included Vartan (6% of NAV) and Oliva Cogeneration (2% of NAV) where governments made regulatory updates on incentive schemes or revisions to regulated calculations which reduced uncertainty and improved performance of some £44m. So the rest of the portfolio (70%) delivered a £41m gain in 6 months. The performance of that 70% is the equivalent of an 11% gain (or 23% annualised).

The performance of Oliva and Vartan are even more impressive. A 52% gain in a six-month period (£44m gain on a NAV of £85.3m). But these are examples of governments being supportive of Energy Transition and Energy Security. Will there be more or less of that kind of support in the future do you think reader? My money is on more.

While I’m assuming identical growth in H2 as H1 it’s also the case that SEIT report in their H2 trading update “notable developments” and “good progress” in EV charging (5% of portfolio). I recently wrote about growth of EVs and particularly PHEVs so charging infrastructure is a profitable place to be (in my opinion).

Further NAV growth factors - Sale of assets & Buy Backs

SEIT speak of two asset disposals before the end of June 2024.

The sale of UU Solar for £90m on 7th May 24, whose NAV at 30/09/23 was £86m, so a 4.5% premium will reduce the RCF debt. Clearly an example where the current 28.5% discount to NAV doesn’t reflect the actual value of assets. If we see a 2nd example with a gain on disposal this should provide further proof to the market (that the discount is unwarranted).

Someone buying SEIT at current market prices would effectively have bought that asset for £61.5m so made £28.5m on its sale, or £4m above the NAV.

Moreover the company intend to complete further buy backs and to invest into other holdings which offer “strong double-digit returns”.

So the 6th factor to consider is what gains SEIT can make from other realisations. There is one listed below and a second to follow shortly. SEIT are pursuing other realisations too.

A 7th factor is risk of rate rises. Company and portfolio gearing is 44% the company-level gearing drops to zero based on the asset sale. Meanwhile, 85% of portfolio debt is fixed and on 4 year terms. So the cost of debt is not really an issue here and in the event of catastrophic rate rises (if that occurred) could be managed.

An 8th factor is buy backs. Between 03/23 and 09/23 a £20m programme was completed. Unfortunately this was during a time of falling prices so the average buy back price was 86p and so the accretion compared to the 90.6p 30/09 NAV was 4.6p a share average. 23.3m shares bought back equated to a £1.1m gain or 0.1p per share gain. Barely visible in the chart below.

But a further £20m buy back assuming a 65.1p ask and a 91.6p NAV/share would be far more accretive. Over 7X more actually at £8.1m gain or 0.8p/share. Perhaps we’ll see a further £20m, or maybe even a larger than £20m buy back in FY25? A £100m buy back would boost the NAV by 4p/share plus however much those purchases closed the discount by. Not impossible to envisage.

Conclusion

I’ve only mentioned the shareholder dividend in passing, and of course the dividend detracts from the above NAV accretions and reductions - which I’ve not shown in the above chart. But the performance more than covers the 6.24p/share dividend. On a 65.1p ask that’s a VERY tasty 9.58% yield. Given the portfolio performance and increasing dividend income (from holdings) a 10%+ yield is foreseeable.

Potentially in the FY24 results in June we’ll see an unwind of the discount rate noise. The investment manager alludes to this too.

Having read various Broker notes which give you a “meh” impression of SEIT I didn’t expect to come down as excited about its prospects as I have.

But the numbers shine through, there’s no other way to describe it.

Relative to the electricity sector a 60% upside back to £1/share placing seems fair, putting this on a 6% yield, with classic GARP (growth at a reasonable price) from there. A relatively low risk way to lock in a high yield and benefit from electricification, energy security and transition too.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings, even those held by a FTSE250 company like SEIT, might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Well, thank you for this, which I hadn't noticed when I bought a half position yesterday for very similar reasons. Because I think their debt is under control, I see this as one of the handful of yieldcos that are on a yield which will look ridiculous in a year, when rates are dropping. They look comfortable with being able to maintain and slightly grow that 9.5%, while doing buybacks. Doing both simultaneously implies a fair degree of confidence in a company that is not a minnow in this space. (I also hold TENT, which IS winding up, because it is too small...)

Perhaps people don't believe in 2% inflation in the UK. I do actually, in spite of higher services pay, a China begins to export deflation again, and we begin to get on top of the energy equation. Forget growth: why would you be unhappy with 7.5% above inflation. I think these ITs are the bargain of a generation. And even if it only goes to 80p in two years, with divs that's 20% p.a. (I alwasys take a two-year view.)

more great work Mr Oak; i always look forward to your latest analysis.

i think the mkt is pricing this one a little like a Private Equity company with electricity holdings (albeit without the high PE fees), rather than a yieldco? i do wonder how much DD SEIT was capable of doing in all these various technologies in differing geographies? retail will of course get interested, but i suspect only when the yield>10%?