Dear reader,

Strong stomachs today. As stock market lurch downwards. At what point do you deploy the dry powder?

It’s a good question. Do you jump on a cyclical idea? Or a defensive one? Defensive will be dropping less than the cyclicals that’s for sure. Two cyclicals I spoke of recently Oxford Nanopore and Agronomics down double digits into bargain territory.

Tempting. Very tempting.

But “down to earth” OB25 for 25 idea SEIT was my choice today to average down and lock in a stunning and growing yield.

This was my rationale:

1.Who’s selling?

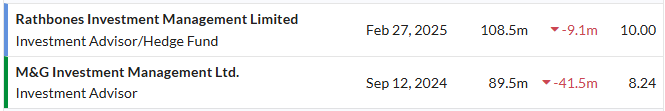

Disclosures show that Rathbones suffered £0.4bn in 4Q24 and consequently updated the market last week that they had reduced their SEIT holding by 9.1m shares. M&G have been major sellers too during 2024.

Rathbones Investment Management Limited

2.What do Tariffs do to energy?

Tariffs disadvantage the imports of products. The US is a major producer of energy (except Uranium - see OB25 for 25 idea UUUU) so tariffs are unlikely to affect SEIT energy inputs but possibly will affect imports of equipment e.g from China. The positive however is the USA is in expansion with manufacturing PMI at 52.7, and orders rising at the fastest since 2022.

Through reshoring, AI, Robotics, Tech and Climate Extreme Weather US Homes and US firms are hungry for energy and demand is strong. This is evidenced for example by the gas price at (recent) record $4.46/mmbtu.

What better picks and shovels on AI than to power it?

In a nod to other energy stocks in the natural gas space the 5 year storage average is now touching the 5 year minimum, in a shocking reversal of supply and demand dynamics.

3.SEIT is largely Operational and Cash generative

We know that cashflows are growing and that they grew to £48m in 1H25 (to September 2024). That £48m was net of £9.4m of project debt amortisation (repayments) and netted to £40.8m after interest on the RCF and £35.8m after fees/xps.

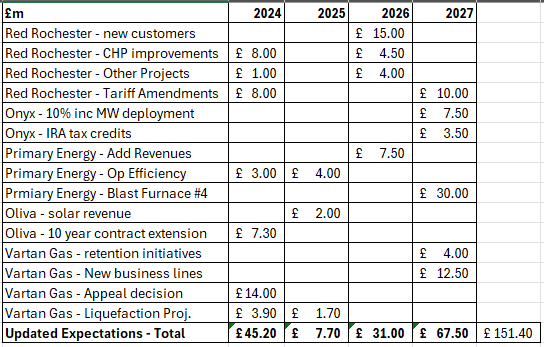

We know that it’s likely that cash will increase but what if it doesn’t? The current NAV including HoldCo and Project Level Assets and Debt looks like this. If we assume static cash flow but a 2% increase in the portfolio from the investments into EVN and Onyx moving into operational, Red Rochester’s CHP. That would be £30m.

Onyx is selling into a rapidly growing US solar market. 64TWh of capacity was added in 2024 overall (not just by Onyx!)

Static cash reduces debt by another -£9.4m and we see £1.7m of net cash flow.

So we see as at the end of March 2025 a 3.7p gain and a 48% discount of ignoring discount rate “noise” a discount of 61%. More on that later.

Let consider instead no net gains/losses for FY25 and instead consider a rise in cash flows. After all new initiatives are coming on line with 12% in construction (CHP at Red Rochester, EVN and Onyx which had new investment of nearly £100m in 2024). £10m of additional cash flow doesn’t seem unreasonable in 2H25 as a return on well over £100m additional invested in 2024.

This added to £48m generated in 1H25 gives us £106m for the year net of costs and interest. If we then deduct dividends (1.58p per quarter) and there’s £19m generated.

That would equate to 2p per share added (to 92.5p).

There are other initiatives SEIT have spoken of in the FY23 and FY24 annual reports. The CHP at Red Rochester “could” generate £8m alone. There are accretive projects which would generate increasing returns SEIT tell us.

4.The Macro is Good

Readers will know I’ve spoken about the Inflation Reduction Act numerous times. We know that the wall of money going in to energy is colossal and will continue to grow. The IRA gives subsidy to production and generation but 20% is directed at conservation, where SEEIT are one of the largest players ($1.5bn of $4bn). Oil & Gas majors have urged Trump not to touch the IRA. The only expressed desire I’ve seen from Trump is to prevent the Chinese benefiting from EV subsidies…. seems tariffs adequately does that job?

5.The Discount Rate

The WADR (weighted average discount rate) is 9.4% currently. Declining interest rates post period should reflect in a lower risk free rate in time.

6.Realisations

There have been no announcements but a plan is to achieve some realisations to reduce debt and to commence buy backs. With a substantial discount buy backs would be very accretive.

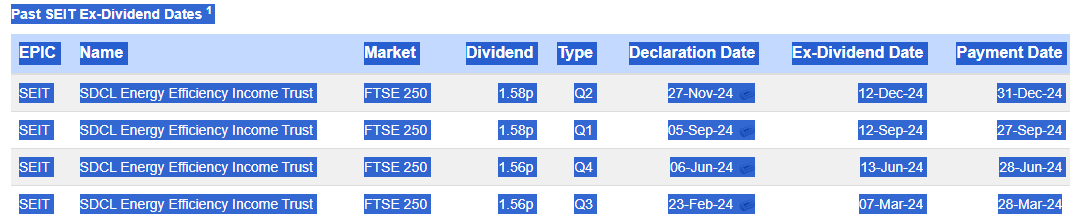

7. Dividend

All of the above and how it could grow net of dividends is one thing, but the dividend itself is another. 1.58p per quarter is 6.32p. Nothing is guaranteed but it seems the dividend is covered (it was as at September 2024 by 1.1X) and will potentially grow in time. At a 47.6p ask the dividend is a stonking 13.3% yield, goes ex-dividend in a few days and 1st dividend is just over 3 weeks away.

Conclusion

As I write I can see a strong bounce back up in the US market. I don’t know if the rollercoaster loops back up tomorrow, and what volatile times are ahead. The market are navigating the implication of Tariffs, deciding whether they are net positive or net negative.

Meanwhile SEIT is defensive, boring and insulated against tariffs to some extent, but a beneficiary of the IRA. The share price fall therefore seems like a good opportunity to lock in an exceptional yield where there’s a tilt to the US but also a range of geographies, technologies, counter parties and opportunities for growth.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings, even those held by a FTSE250 company like SEIT, might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Super write up- thanks for bringing this one to my attention.

"goes ex-dividend in a few days"

Yes, dividendmax - https://www.dividendmax.com/united-kingdom/london-stock-exchange/energy/sdcl-energy-efficiency-income-trust-plc/dividends - says it goes ex-div tomorrow.

FT - https://markets.ft.com/data/investment-trust/tearsheet/summary?s=SEIT:LSE - only mentions Dec 12 2024 in terms of dividend date.

I already hold this but topped up today.