Dear reader,

If you’ve not heard the Transport Police mantra enough times while onboard a UK train or tube I decided to use it for today’s article. Today’s picture imagines a police response to someone saying it on a train and the police have come-a-runnin’.

Meanwhile SDCL Energy Efficiency is doing a bit of sorting also.

I covered this FTSE250 Investment Trust previously in my article “SEIT to believe it”

I said in my article “in the FY24 results in June maybe we’ll see an unwind of the discount rate noise. The investment manager alludes to this too….. the numbers shine through, there’s no other way to describe it.”

I also said:

Relative to the electricity sector, a 60% upside back to £1/share placing seems fair, putting this on a 6% yield, with classic GARP (growth at a reasonable price) from there. A relatively low risk way to lock in a high yield and benefit from electricification, energy security and transition too.

Do I still think that?

In July SEIT announced one of its holdings (Primary Energy) had restructured debt at a 0.75% lower rate that also provided a better yield for SEIT. It further announced another holding Oxyx had upsized its RCF to $100m to fund expansion of its solar project pipeline across the US.

After my article in early June SEIT announced its FY24 results in late June. Not sure why I didn’t cover this at the time.

Compared to the interim (as at 30/09/23) result the NAV falls 0.1p from 90.6p to 90.5p. Just as was forecast the discount rate unwinds from -11.9p to -10.8p (i.e. +1.1p in 2H24). We also know there is a profit on disposal post period from the sale of UU Solar worth 0.4p a share (plus it was sold at a premium to NAV while NAV is currently a -32.6% discount)

This is the FY24 actual:

So the salmon coloured entries above show a strong portfolio performance (stronger than 2023) offset by a large discount rate reduction.

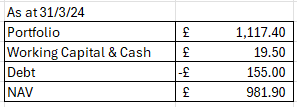

The NAV of £981.9m is comprised of a portfolio valued at £1,117.4m with w/c of £19.5 and debt of -£155m

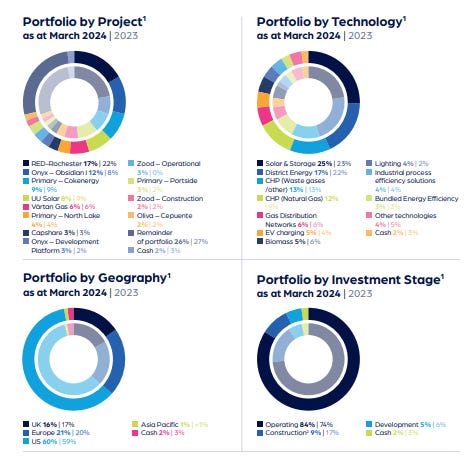

I found the portfolio analysis interesting particularly the “updated expectation” entries (16 of) which gives a range of estimated of upside (of up to £145m or the equivalent of 13.3p per SEIT share) over the next few years. I’ve used the midway point of each estimate which sums to £106.2m or the equivalent of 9.7p a share. This would equate to a more than doubling of FY24 income returns.

In the below grid I take the results of the past 4 years and show both the “portfolio view” which is one of growing income (NB this is not portfolio valuation uplifts, but instead net income performance from the portfolio minus their finance costs. Plus the “Top Co” which is the SEIT fund. I add FY25 estimates using the $7.70m of updated expectations for FY25.

Top Co reports dividends from its portfolio, as well as gains and losses. But these “fair value” adjustments contain a lot of “noise” which masks the portfolio’s performance, where gains and losses at portfolio level which don’t correlate directly with the fund’s performance.

This is due to the FX, Macro Assumptions and Discount Rates.

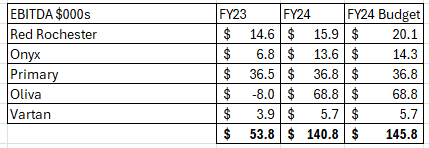

I also noticed several instances of “below budget” so calculated what “on budget” would have looked like. The answer was another $5m EBITDA at least on the 5 holdings where SEIT shared EBITDA info. $140.8m EBITDA is not the entire EBITDA of the portfolio.

Using the net income of £92.5m for FY24 adding back interest at 6% on portfolio debt of £485m is £29.1m. Adding back an assumed 20% tax rate is £22m and depreciation of 3% on an Enterprise Value of £1,616m (gearing is 30% of EV and gearing is £485m hence 485/0.3) is £48m means EBITDA is £191.6m or $253m expressed in USD.

Conclusion

It was interesting to note Kepler state the current portfolio according to SEIT management generates a 9.4% return based on paying down debt or if debt were rolled over a 11% return is achievable. With a closing of discount, and also an unwinding of discount rates, more favourable FX and macro assumptions a higher return is possible. Perhaps upwards of 15%+ per annum.

Meanwhile there are potential upsides at portfolio holdings which could add the equivalent of a 22% upside over time too.

The fact that a large asset was sold at a 4.5% premium to NAV should have helped prove the NAV but the market still isn’t convinced, or isn’t “getting it” with the share price remaining in the doldrums. Of course the “noise” of the FY24 discount rate leading to an apparent loss in FY24 doesn’t help. Also it’s devilishly difficult to understand all of the mechanics of the calculations of the fund and these ITs don’t help themselves in my opinion.

Having HoldCo’s galore can make sense for risk minimisation and optimisation of holdings but it makes an investors job terribly complicated and there’s little or no reconciliation of the numbers to make sense of quite how a loss or a gain is arrived at.

But if you look at this from a portfolio holdings perspective rather than TopCo an estimated £191.6m EBITDA result and £92.5m net result on an estimated £1,616m EV illustrates how a corresponding -4.7% loss at TopCo is confusing.

But a tasty dividend of ~10%+ which is growing and generally backed by contractual and inflation-linked returns for an essential service (energy) makes this an interesting way to earn a chunky return with earnings upside, capital upside and discount upside and a relatively limited risk.

SEIT, play it, sorted.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

I found your writing through a DEC article and have stayed ever since for the witty and insightful articles. Thank you, your wonderful work is greatly appreciated.