Dear reader

Any train tannoys fans out there? ………….No?

Fellow Fun Runner Mr Head wrote about SEIT yesterday: “My impression … is that SEIT is more highly leveraged than some other trusts and has been struggling to realise value through asset disposals. The increase in RCF usage this year to support Onyx looks uncomfortable to me and is certainly not ideal.”

Contrast that with his recent comments on NESF:

The combination of small size and above-average gearing means I think the risks here are slightly higher than elsewhere. But with NESF trading 25% below book value and offering a covered 12% dividend yield, I think it could still be worth closer consideration for interested investors.

Of course only looking backwards ignores looking forwards. SEIT’s FY25 results did not include several significant expected EBITDA increases. SEIT tells us that here:

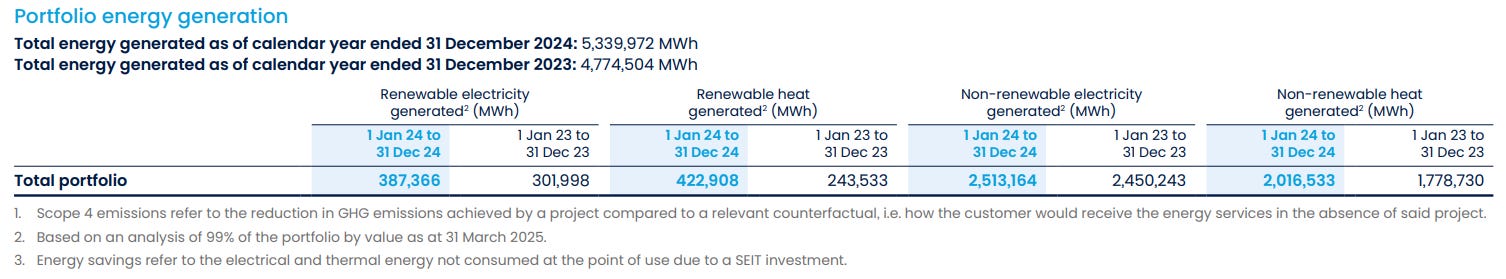

This SEIT ESG chart actually sums up an impressive performance from an energy point of view. SEIT’s 5.34 TWh of energy generation compares 6.5X to that of a much smaller 0.83 TWh produced by NESF. Not all energy is the same price? That’s true but 6.5X difference? Common sense should tell you something is fishy.

(Both companies have a similar Enterprise Value)

Now it’s true that SEIT’s gearing at the Interim Results (in September 2024) was £524m comprising £359m of portfolio debt and £165m of TopCo/HoldCo debt. It’s furthermore true that that SEIT’s debt grew by £102m to £626m by 31/3/25 and comprised of £392m portfolio debt and £234m TopCo/HoldCo. That’s a debt to Free Cash Flow ratio of 4.8X.

Where did the money go? Director’s pay? Wa-hay! Rob Peter to pay Paul? Nope.

SEIT added £102m of debt but that funded £171.5m of investment. That compares with just £14.6m of investment at NESF in FY25 (and at least some of that was sustaining capex). Common sense tells you that (wise) investment today leads to higher income tomorrow. Doesn’t it? More on that later.

Plus £5.5m of further investment post period too!

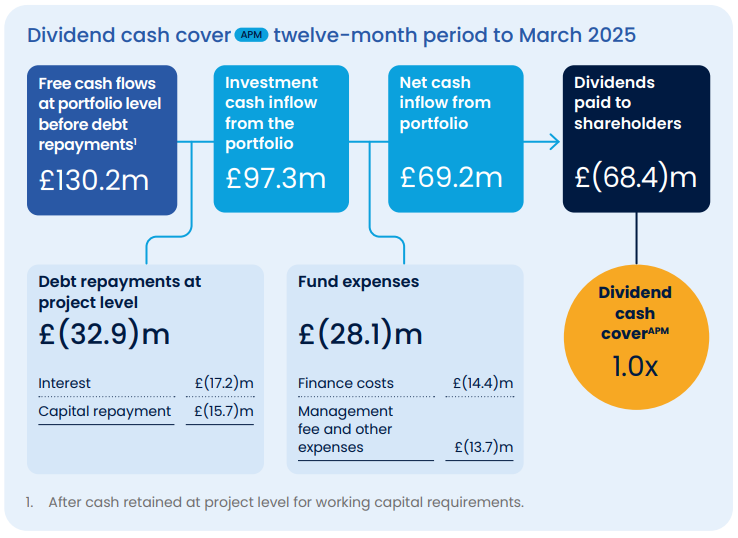

If you agree with the statement that long-term amortising debt “takes care of itself” (the creditor ensures your repayments of capital and interest match the life of your asset and its forecasted cash flows) then using the free cash net of amortising debt interest and repayments which is £97.3m at SEIT in FY25 then SEIT’s remaining debt of £234m RCF relative to that cash is only 2.4X.

Compare that with NESF which reported Debt of £490.6m and FCF of £64.3m so has a much higher 7.6X debt relative to cash flow….. In a period when disposals made up a substantial part of that “free” cash flow! NESF drops to 6.7X based on non-amortising vs net cash flows.

Finally, SEIT is substantially cheaper on a share price to Free Cash Flow basis too. NESF at 6.4X vs SEIT at just 4.2X.

Consider SEIT’s FCF grew substantially in FY25. £130.2m was up from £118m in FY24. The underlying FCF was much higher still. More on that later.

This was despite some noticeable shortfalls - noticeable to me anyway. I’ve highlighted them in red. But plenty of green too. I’ll discuss these below.

#1 Oliva

Oliva changed its electricity market agent, switching to a counterparty offering weekly settlement and access to ancillary services. This change is expected to support cash flow and open new revenue streams from CY3Q25.

Meanwhile a Spanish government decision to exclude “RoRi” distribution costs meant a one-off hit of £15m. This is connected with the EU Emission Trading, and while this is a one-off negative SEIT reported more frequent RoRi updates, creating a more stable market and providing more consistency with energy market pricing and more stable cash flows.

Importantly the underlying profit at Oliva was actually much higher in FY25 = £26.87m not £11.87m, and the 2H25 profit was 44% higher than 1H25

Doesn’t that make the outlook for FY26 rather exciting?

#2 Driva

£2.6m was invested in Driva, a Stockholm biogas distributor. Or at least historically that’s what it was. Imagine if you had a collection of assets across the world. Suddenly you realise why don’t these holdings sell each others products? It is Soooooo obvious. So just like the UK’s EVN Driva now sells various EaaS (Energy as a Service) ideas and reports it already has 5 contracts.

Driva has expanded their EV charging-as-a-service, solar-as-a-service (like Onyx) and heating-as-a-service (like Red Rochester) project offerings, creating additional company verticals to deliver customers services aligned to net zero. Those contracts have increased Driva’s valuation despite a higher discount rate.

Are you planning to get on a bus in Ostergotland reader? Driva will help you get you from A to B. Profits are up nearly 50% in 2H24 and Driva say they see “strong growth” in the Swedish market in FY26.

#3 Primary

Profits grew at primary but more modestly. This was despite production delays so the remaining assets actually outperformed.

Various initiatives will help drive higher EBITDA profits by around £1m in FY26.

Capacity Market revenues - tapping into the local grid to provide stabilisation

Variable Frequency Drives (VFD) is underway and will reduce parasitic load apparently. Basically several projects that will improve efficiency.

There remains a potential upside if an idled blast furnace gets put back into production (to support the supposed reshoring of manufacturing?)

#4 Onyx

I spoke of Onyx extensively in the article “Is it Crackin’” and “OnyxDaysWork” so I will just comment on the FY25 results.

The amortising debt facility secured by Onyx means the RCF is actually about 1/3rd lower post period so assuming £8.5m hit to net cash flow (on the £85m extension) then non-amortising debt vs net cash flows is less than 1.7X … nearly 4 times less than NESF!

A further £18m reduction is expected via new investment-level debt financing facilities at Zood imminently too. That would be £131m and a further drop in the ratio.

Uncertainty has clouded the sale of Onyx but SEIT are working on options, which include a possible partial sale of Onyx or bringing in a co-investor and further external financing options.

SEIT tell us that Onyx is expected to maintain strong momentum through 2025, with a large pipeline of projects progressing through the delivery cycle and aims to achieve higher targets than 2024.

SEIT’s focus will remain on supporting revenue conversion, managing supply chain exposure and identifying further opportunities for value creation through strategic capital deployment and partnership development.

114MW is operational so the FY26 target is for a near doubling of live assets, by three 100MW targets for live assets, pipeline ones, and in construction ones. I say a doubling but if you achieve the below it gets you to 314MW (with 214MW live and 100MW in construction) so is nearly a tripling, actually.

Target of 100MW of signed power purchase agreements, securing long-term offtake with high-quality counterparties.

Target of 100MW reaching notice to proceed, demonstrating continued progress through engineering, procurement and permitting.

Target of 100MW achieving mechanical completion, demonstrating robust construction management and translating pipeline growth into near-term operational assets.

Previously I wrote:

#5 Red Rochester

It’s fair that risks exist. Delay to the partially constructed Li-Cycle site (now in bankruptcy) could result in a -£1m to -£10m loss, on top of a one-off -£17m hit taken in 2H25. Full replacement of the demand with other tenants would increase fair value by £17m to £27m. They say they are focused on getting new tenants.

Meanwhile other initiatives are increasing profits…..

Meanwhile CoGen and a Retrofit will translate into around £4m of EBITDA growth in FY26.

Plus a £16m NAV increase:

#6 Huntsman Energy Centre - 1% of portfolio

Valued at £13m in the report and following the commencement of operations in June 2023, this provides steam services to Huntsman Polyurethanes. However, there have been continued technical and contractual challenges with the operations and maintenance of the water treatment plant, part of the energy centre.

SEIT remain focused on performance optimisation, resolution of some equipment defects and achieving steady state operations. Remedial work on the water treatment plant is ongoing, with completion expected during Q3 2025 (calendar year).

In parallel, rectifications and further enhancements are being implemented on the steam compressors to improve reliability and availability.

#7 EV Network 5% of portfolio

£5m of follow on capital was invested in EVN bringing the valuation of EVN to near to £60m. The current difficult environment has led to SEIT seeking an equity investor for EVN as well as potentially debt financing. It still has a strong pipeline but also an opportunity to refinance its existing portfolio.

Or EVN might swallow up another SEIT holding and a customer of it. A holding called Zood. Zood is valued at £43m as at 31/3/25 and has 127 ultra-fast EV chargers across 29 sites. This would enable EVN to to be an operator and earn a higher level of income as a Charge Point Operator.

#8 FES 2% of portfolio

This £42m holding is growing via its LES LaaS lighting-as-a-service model. FES switched to larger opportunities in 2023 and 2024 with multi-site enterprise clients that have higher potential but slower sales cycles. This is paying off with 40% growth in the FY25 year adding to its long-term recurring income through its operational service contracts. It secured $12m finance in the year to support growth and now is seeking further growth capital.

Using their savings calculator an imaginary warehouse with 100 light fixtures at 60W running 24 hours a day would save $12k and FES take 25% so earns $3k per year.

#9 Discount Rate

The growth in the discount rate from 9.4% to 9.6% explains a drop of -£27.4m NAV - according to the sensitivity analysis.

Conclusion

I think SEIT has been massively misunderstood. The investments going in are achieving enhanced returns. Energy is expensive!

There’s at least £30m of one-off costs that won’t (shouldn’t) repeat in FY26. There’s a growth pipeline that will add around £10m in FY26 or more. So that’s a potential £40m+ boost to EBITDA profit.

WAIT ONE. Did you say a £40m increase?

But FY25 EBITDA was £86m. So that could be nearly a 50% increasae. Minus any mishaps and misfortunes that might befall our SEIT in FY26.

No wonder they say the dividend cover will be 1.1X - 1.2X in FY26.

SEIT is generating 5X more energy per £1 of enterprise value and per £1 of market cap than others like NESF. Logic and numbers tell you that SEIT is a clear winner. But then you have to also consider the growth of SEIT too. That there are numerous value adds coming down the line.

Yes there are risks too. SEIT absorbed numerous risks or set backs in FY25 and absorbed them in prior years too. It’s no doubt face them in FY26.

Yes it would be nice to reduce the RCF debt asap. Paying circa 6%-7% isn’t all that horrific but there are cheaper forms of debt such as amortising. It would be good but there’s no desperate need to pay off the RCF. SEIT are not a forced seller. The RCF has a 5 year life (extendable). A reader recently harrumphed about EcoFin US Renewables where as an investor they’d lost a load of money and because of that surely all US Solar must be terrible and tarred with the same brush. Err, no.

Onyx is “behind the meter” not utility power, and while there is an element of IRA tax credits solar does stand on its own two feet (like today’s picture).

SEIT has its eggs across many baskets too. Meanwhile a brucey bonus is a slightly higher 6.36p per share dividend in FY26 too. I remain of the view that these “boring assets” are completely mispriced with a 9.6% discount rate applied to boot, and that when you factor in the 21% that it is in construction or in development, with improvements going on at the other 77% which is the operational portfolio it underpins that growing dividend.

This OB25 for 25 idea will continue to rerate during the rest of 2025, I believe. And beyond. For me this isn’t a trading opportunity, this is a buy and hold for the long term. In my opinion, but you of course make your own investment decisions.

I notice there is growing interest again from IIs like Blackrock that have taken a growing stake in SEIT. The Smart Money sold out giving us PIs a window of opportunity at silly prices.

I hope you saw it, swooped and now are sorted.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings, even FTSE250 companies like SEIT, might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Best title yet. Bravo.

Great article! I did see it and I did swoop at the time.