Dear reader

Revenue down -21%, net profit down -27.7%, and this idea’s share price is down -6.7% since I included it in the OB25 for 25.

In my prior article “Reeves-A-tax the North Sea” I said bad luck comes in fours at Serica. I was wrong. Turns out it comes in fives. Storm Eowyn being the ill fortune disrupting the Triton FPSO. Its outage continues until June.

Do I regret picking SQZ?

Nah.

Of course there’s lots to potentially dislike at Serica (SQZ). So why do I maintain this 6X choice was a good one?

Net profit is down -27.7% while EBITDA is unchanged - what does that mean? Depreciation, Interest and Cost of Sales is basically driven by the extensive capital programme - which tripled in 2024.

Cash fell as capex grew.

2023 and 2024 delivered triple the production of 2022. The trouble was the price. Gas prices in 2022 were glorious (for consumers not so much). Glorious for SQZ and for the HMRC too. The Oil price has been a steadier performance but flat to downwards too. The 2024 results were always going to be a bit disappointing but they are looking backwards and the exciting part is what’s possible looking forwards.

So far in 2025 UK gas prices have been about 25% higher than 2024 and it was a cold winter for the UK.

What caught my eye was this.

“Over 25000” doesn’t really mean much until you line it up against 2023 and 2024 average performance. Given there is further optimisation work at Bruce and assuming “Other” can deliver 90% of its 2024 volume then you get to 50,000 BOEPD.

Then you fall off your chair when you realise that was just 2 of the 5 wells in the campaign. Then the chair falls on top of you when you then realise that at least 2 further wells (out of 3) have “positive” results.

SQZ guide to a 33-37kboepd average production implying that in 2H25 we will see 17k-25kboepd via Triton. So double or 2.5X its 2024 average.

CEO Chris Cox clarifies this to be 30kboepd via the Triton FPSO (which is not operated by Serica) once it’s resolved:

The highly positive results of the drilling campaign at Triton are not yet being reflected in our production and cashflow due to ongoing issues at the Triton FPSO. Our frustration is exacerbated by the fact that the Triton area alone could be delivering up to 30,000 boepd net to Serica with the addition of the wells already drilled.

Observe the smaller Sky Blue sections denoting Triton disruption in May, July, August, October, November and December last year. Then consider the 23rd January performance in the final column.

A positive is that the previously scheduled summer maintenance will also be carried out during the repair period, so no further outages are scheduled for the remainder of 2025. Guidance fell from an initial 46kboepd to 40kbeopd and now to 33-37kboepd.

These are the key metrics for 2024. Notice CFFO less tax rose substantially in 2024.

So what might appear a deteriorating cash position is also artificially depressed due to timing issues. For example nearly $140m of difference is due to overpayment of tax (which will reverse and mean greater cash generation and cash profits in 2025). A further surprise is to learn that the $1bn tax loss pool remains at $1bn due to investment and capital allowances. A further $0.25bn will be added once the Parkmead acquisition finalises due to carried forward tax losses.

Dividend & shareholder returns: the total spent on dividends and buybacks last year was broadly unchanged, at $114m. Serica has cut its final dividend to provide more flexibility to allocate capital to M&A, development programmes or buybacks, as suitable opportunities arise.

Final dividend: 10p (2023 down from 14p)

Total dividend: 19p (down from 24p)

Assuming a 19p payout for 2025, the shares offer a potential 15.7% yield at current levels. Potentially higher if buy backs are also carried out. At £456.7m market cap SQZ is at a 26.6% discount to its Net Assets.

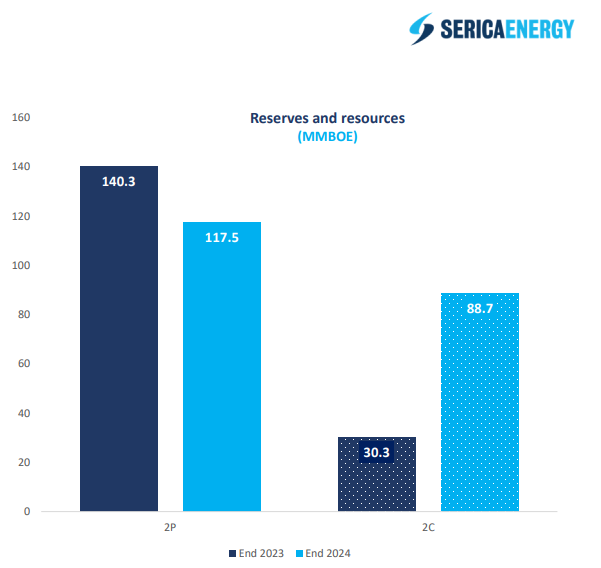

At 50kboepd (assuming that’s the run rate SQZ can achieve and get to and keep to) that’s 18.25MMBOE per year which equates to a little over 11 years of 2P&2C reserves or 6.4 years of 2P so better defining the potential reserves is a further objective. Or 9 years if the current 35kboepd can only be achieved.

Serica is currently discussing a merger (reverse takeover) with Enquest. More news will come on the 2nd May too which is the deadline to announce a firm intention. ENQ offers a number of synergies. Consider the picture below.

Magnus (ENQ) and Orlando (SQZ) NE of Shetland are closely proximate, and SQZ’s Ninian Pipeline uses ENQ’s Sullom Voe Terminal. Krazen (ENQ) is nearly at the centre of the Bruce Hub (SQZ), while Golden Eagle is adjacent Fynn Beauly and Scotty/Alba/Greater Kittiwake (ENQ) are all proximate to the Triton Hub (SQZ). My mind is full of the possibilities of tie backs and streamlining of hubs.

The reserves of ENQ are interesting too, adding 143% of 2P and 400% of 2C reserves to SQZ. Production would approximately double (or nearly double if you agree SQZ can get to 50kboepd in 2025). ENQ comes with a lot of debt but manageable. ENQ is also involved in Malaysia where it has a producing asset off the East Coast but also has involvement in various renewable energy, green hydrogen and CCUS opportunities too. It also boasts expertise in North Sea offshore decommissioning (a popular pursuit nowadays)

ENQ would add $2.1bn to the $1.25bn SQZ tax loss carry forward pool.

If the merger were on a 2:1 basis (based on the market cap) then this would be highly accretive for SQZ-ers.

2025 Estimate

I’ve modelled an estimated profit based on a 33,000 KBOEPD production profile of 50%/50% oil/gas (NGLs are fairly immaterial so I’m ignoring) where the Triton outage means a further year with an elevated cost of sale, and further assuming a tax bill of around 43% then you can easily get to below 5X earnings.

Conclusion

So to conclude, even with this 5th bad luck and months of down time for 40% of SQZ production thanks to the Winter Storm Eowyn, the forecast performance of SQZ in 2025 relative to its share price is about 4.5X price earnings.

That’s based on 33Kboepd. You get to <3X P/E when you model production at 50Kboepd levels.

SQZ yields 15.7% at the current £1.21 share price.

If it can merge with ENQ then it doubles profit, cash flow and more than double reserves. There is obvious synergy and some new avenues of growth for SQZ too.

My sense is the SQZ Management is fundamentally strong and they are also very factual about err the facts and have not sought to gloss over inconvenient facts. I respect that.

So let’s get that Triton sorted out, let’s get Triton production back underway, let’s try to do a deal with Enquest and let’s finalise the Parkmead Finn Beauly acquisition. Plenty to go after in 2025 and plenty of opportunity for this to end the year up and not down.

Regards

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Seems a shame!

Serica Energy Plc ('Serica') notes the announcement by EnQuest Plc ('EnQuest') confirming that EnQuest does not intend to make a firm offer for Serica. As a result of the announcement, EnQuest is bound by the restrictions contained in Rule 2.8 of the City Code on Takeovers and Mergers.

While there would have been strategic and financial benefits to the combination, in light of current market volatility an agreement on terms that would have been in the best interests of shareholders was not possible at this time.

The Board remains very confident in Serica's standalone ability to generate significant cash flow and deliver shareholder value and highly competitive shareholder returns from its balanced portfolio of oil and gas assets. Delivering sustainable operational improvement remains paramount. In parallel, the Company continues to pursue its clear growth strategy, as detailed in the 2024 full-year results, progressing numerous organic growth opportunities across the portfolio as well as actively screening a number of cash-generative and value accretive M&A opportunities in both the UK North Sea and other geographies.

The North Sea is currently offering an ocean of geopolitical stability between the Orange man baby and warlord Vlad. At least, I hope that’s how Europe sees it