Standing Avation?

Should we be popping corks, or corking this idea looking at AVAP's 1H25 results?

Dear reader,

Callsign Alpha Victor Alpha Pappa cleared for approach. Descending to runway 1 visual, ground stop. Those (including the OB) expecting ascension instead faced a sinking share price.

This OB25 for 25 idea is in the doldrums down -13.4% since I included it in my 2025 ideas. Or is it doldrums? Are buyers actually celebrating their exceptional future good fortune?

Let’s unpack what’s going on.

A headline $0.9m profit, an operating profit of $18.8m, a loss before taxation of -$9.8m you could practically pick your own bull or bear narrative profit figure. Not the easiest set of accounts to digest with derivatives and fair value losses with less than clear reasons. The headlines were reasonably positive.

Growing revenue, with 100% utilisation, was through higher levels of maintenance reserves revenue. While it might appear “revenue is going up” the answer is arguably not yet, since maintenance income covers the dilapidation or depreciation of aircraft - think of it like the x pence a mile above 10,000 miles on a PCP agreement car. Maintenance reserves are a form of depreciation and sit on the balance sheet under liabilities. Go and check it out for yourself. There is is: -$131.6m. So the true aircraft net assets is not $773.6m but $641m, net of maintenance reserves.

However we also know that “10p a mile” is over and above what it actually should cost in the fullness of time - and that $163.4m is the projected gain. On the basis that the average lease is 4.2 years that works out to be $39m or $19.5m per half year.

We also see a large -$15.4m loss on purchase rights. But this is “noise” and offsets the $44.7m gain from the prior period. Similarly a -$5.6m impairment is partly reversed this period by $1.4m.

A helpful way to understand the underlying performance is to strip out the noise. When we do so we can see Operating Revenue is FIXED - and will increase once lease renewals occur assuming they get renegotiated higher, more on that later.

Depreciation is fixed as a function of the number of aircraft. Overheads are more or less fixed although vary according to legal costs and so on.

So up until “Operation Margin” you get a fairly fixed business over the past 18 months. But Finance Cost is where we start to see benefit. As the business generates cash and deleverages, and particularly pays off expensive covid-era debt we see finance cost falling from -$31.4m to -$28m. We see other income is fairly fixed and finance income too. To properly understand the performance we need to apply an average to the maintenance gain over lifetime (average $39m per year) and the purchase rights (average $10m per year).

The result is we see a business that over its lifetime on average is generating $45m of value (£35.7m) per annum and which is valued at £91m. Which of course is 2.55X earnings. Which under any definition is very cheap indeed.

But what I’ve described above is a fairly FIXED business with fixed income, right?

What if it’s not Fixed?

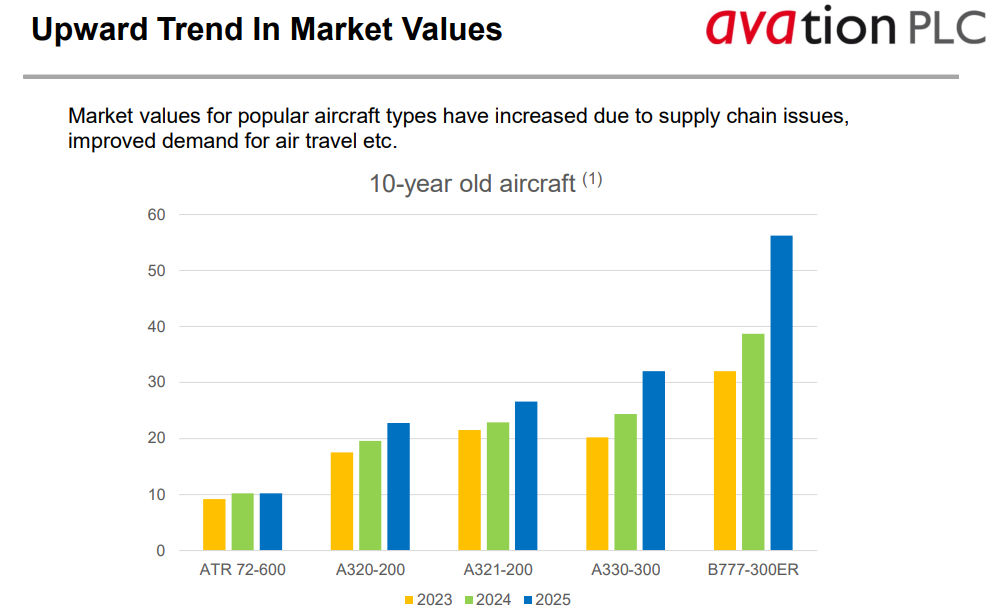

What if it is FIXED in the short term but not in the medium term? What’s the stream of future income going to be worth? Here is what AVAP say are the increase in market values. You may or may not consider it reasonable to increase the lease rates in line with values…. but I do. A PCP for today’s cars averaging say £40k is higher than a PCP 5 years ago when car’s were about £25k, right? (I’m not going to say pre Brexit, am I?)

What is the effect of the above increase (at lease renewal)? Well AVAP show us when, through its lease expiry profile and lease commitments.

These are its lease commitments as per the Interim Accounts.

Have you ever played “Mastermind” reader? Guess the approximate values to win a prize. In this case we know there’s $350.15m of lease commitments and the lease renewals stretch out over the next 7 years so I arrived at these annual lease prices per aircraft (for the current 32 aircraft). These are best estimates but where the rates per aircraft per year multiplied by the number of years left on the lease add up to the $350.15m future commitments.

Multiplying a lease rate x the number of aircraft x the number of years I got it to $350.15m

I then considered the percentage increases by aircraft (based on 10 year old aircraft). ATRs just 6% increase, through to the B777 being a 72% increase. That’s based on the above graph showing increases to value. The results are we see what I interpret as a one third increase to income over time where from 2027 we see some tangible gains of about one third to future lease revenue.

Or from an income perspective that the current 32 aircraft deliver a 7% annual gain after the current year. The estimated future growth of the current 32 aircraft looks like this. This excludes maintenance revenue remember.

But then we need to consider new aircraft in the pipeline too. A 33rd aircraft, an A320 assumedly at an estimated $3.66m (based on my above analysis) joins next month (March 2025).

Then 11 more (ATR72) aircraft join until Q2 2028 adding $253m of new aircraft at new lease rates of let’s say $1.38m per year (remember the above $1.02m is for a 10 year old ATR72 aircraft worth around $13m, new ones are $23m so I’m using a 6% lease rate which is $1.38m per year). The new ones have the snazzy new low maintenance engines and lower running costs remember. Paying $360k extra per year is well worth it Mr Airline Customer ;)

Well now the numbers get pretty exciting. Operating Profits BEFORE PURCHASE RIGHTS gains and maintenance gains (of $49m per year) are increasing well over 10% per year.

If I take an FY28 valuation of $128.5m less depreciation of -$50m less overheads of -$12m (so -$62m up from today’s -$48m) that’s a net $66.5m + $49m gains less finance costs of an estimated -$60m (higher amount and a lower rate reflecting the refinance) that gives us a net $55m vs $45m over the past 12 months. (Obviously Finance costs fixed at -$60m is a further form of growing profits, but let’s ignore that)

In other words earlier on when I said I see a business today generating $45m of value (£35.7m) per annum which is valued at £91m. Which of course is 2.55X earnings. Which under any definition is very cheap indeed.

I’m actually saying the perceivable near-term generation based on rising lease rates and new aircraft lease rates is (at least) $55m which is £44m which is slightly over 2X earnings. Which under any definition is very, very, very cheap indeed.

That grows as finance costs decrease potentially too.

The problem is going back to what I said at the beginning, the accounts are reasonably complicated and it’s quite hard to discern the current and future performance for amateurs. Let’s hope they read the Oak Bloke, but remember this is not advice and it is just my subjective interpretation but where I’m seeking to make sense of the current and perceived future numbers.

The key phrase why this interpretation is different to other people who read is I’m basing the value on “A business over its lifetime on average”

Other Bullish Factors:

I’ve modelled the increase to lease rate renewals but the increases would also apply to disposals - were those to be made. I’m working on the basis that AVAP is a GROWTH stock using leverage to support its returns and not an asset-stripping and deleveraging idea. In my prior article I spoke of even a 5% increase being worth $40m and therefore £0.48 per share. The AVAP slide on resale value increases shows the increase is FAR MORE than 5% (up to 72%!)

Finance Costs (generously assumed at -$60m in the above) can be reduced both in volume and in rate through refinance, although the unsecured 8.25%/9% bonds making up 50% of that finance cannot be refinanced before October 2025 without penalty. Strong cash flow can aggressively amortise debt.

There is a growing mix of countries, airlines so customers, so a broader spreading of risk

The increase in aircraft prices is how the land lies in 2025, could further increases occur? I’m not assuming so, although the backdrop appears positive.

Could AVAP be taken over? Yes absolutely, it appears to be a screaming buy at a X percentage uplift.

My assumptions are based on 11 aircraft (firm orders) until 2028, but AVAP have a further 24 aircraft until 2034 available to them at a discount too.

Green theme and use of 100% SAF (sustainable aviation fuel), use of hybrid engines (20% less maintenance and 20% less operational cost) all reasons this is well positioned for the future.

NAV gain from 285p to 294p despite the fall in purchase rights. Without this the NAV would have been £3.12 which is 1p more than my own forecast of £3.11

Bearish Factors:

Could another Covid lockdown smash travel once again? Always a risk. People harrumph and declare that they would “never be locked down again”. Really? Wait till we get a future virus that kills a much higher percentage and we’ll see the truth of that. We forget just how lucky we were compared to 100 years before and Spanish Flu. Each holiday count your blessings. I do.

Could the demand and supply dynamic change? Aircraft are conservative affairs it won’t be easy for a new entrant to upset the Airbus/Boeing duopoly e.g. from China. Seems there’s far more aspiring travellers than seats for those bums to sit on but we should always consider the worst.

What if the finance can’t be refinanced? More on that below.

Weighing up the value:

I took full advantage of a sub 140p share price yesterday. This share is deeply mispriced there’s no other way to describe it. At least that’s my opinion.

Others are less enthusiastic. Another commentator said it was amber/green since:

“While the discount to NAV seems compelling, the other value metrics are not as good. Their broker, Zeus, is forecasting 9.1c of EPS for FY25, putting them on a P/E of 21.9” and

“unless they can pay down or refinance their expensive PIK notes then their earnings will not reflect the market value of the assets. Hence, I retain the AMBER/GREEN”

For a start that comment is not accurate - Zeus are actually forecasting far less. 1.1c EPS. That’s a P/E of 181 by that logic. So how can the OB reach a 2.5X or 2X valuation when others arrive at 181X earnings. That’s a puzzle isn’t it?

I don’t disagree with the statutory numbers. I foresee EPS at 4c but that assumes no adverse adjustments which might tip the FY25 numbers to a statutory loss.

But remember my 2X valuation is based on “A business over its lifetime on average”

So what the statutory numbers miss is the underlying maintenance revenue in excess of what it will cost. Think again of the PCP analogy. They miss the purchase rights. The “Finance Contribution”.

Those FY25 statutory numbers include a -$15.6m loss on purchase rights for crying out loud! A Supplementary Charge if you take PCP so to speak. Longer term we know purchase rights are an income because it’s like PCP “contribution to finance” that the car manufacturer often provides (alongside expensive finance!). In AVAP’s case that’s a future $100.46m contribution.

So -$15.6m is NOT AVERAGE!

They miss too the increase to future lease rates, you won’t find that in the FY25 statutory results. That’s because leases are agreed for a period of years.

They miss the lower future finance costs. Hasn’t happened yet, can’t happen yet due to penalties so you won’t find that in the FY25 statutory results.

Of course, yes, I am assuming in my numbers AVAP can refinance… after all they successfully secured $85m of finance just 12 days ago so it is a stretch to think they can’t agree a refinance when it is advantageous to do so post October 2025. Let’s not forget this is a tangible asset rich company with 5 unencumbered aircraft - although it’s true the question remains on what kind of terms - it’s difficult to think the terms would be more onerous than the current terms! After all, their new facility of $85m is “substantially lower”.

So I disagree with an amber/green assessment, and I think that assessment is wrong, but you need to make your own mind up.

Conclusion

Callsign Alpha Victor Alpha Pappa is cleared for take off. Please ensure your seatbelts are fastened, all carry-on items are secured, and your seats and tables are in the upright position for takeoff. Cross check.

Enjoy the journey. Ignore the bumpy statutory results - sunnier conditions and tailwinds ahead.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Hi - good summary OB

I agree with your thesis on AVAP - I hear a lot of commentators highlighting that the ATR options are not “hidden value” on the balance sheet as if they are pointing out something profound. But what they miss is precisely what you’ve pointed out; that there is “hidden value” - it’s in the maintenance reserves!! But this latter item generally gets overlooked as the same commentators focus on the option value and then move on, satisfied they’ve dismissed the notion.

I would add that from a top down level plane lease rates are basically 12% - so yes, if the planes value has gone up lease renewals will likewise. Leasing is generally all about the cost of borrowing but when you have an environment where asset values are increasing then you get a rising NAV and increased forward lease rates. I find it hard to imagine AVAP will pay anything much over 6% when they refinance the bonds in Oct. So that will knock c. 2.5% off the cost of debt on average, so maybe $6-7m of financing costs.

From the top down then operating profit can quite happily get to your $55m+ (looking at it a simpler way take a net margin of 6% on gross assets of $1.1bn less central overheads) and you come to broadly the same figure.

That said aircraft lessors tend to trade at NAV so they will be capped at £3 until the increased NAV comes through.

Great article as usual. What do you think is the catalyst or are we waiting for this to be acquired?

There were acquisition rumours back in Oct, as you pointed out previously.

Would be good if it paid a reasonable divi to make waiting for a catalyst easier.