Dear reader

With money creeping back into nano caps, after they spent numerous years in outer space and with Silver and PGM prices rising spectacularly in 2025 Alien Metals ticker UFO would appear to be worth an evaluation.

Space travel comes with risk and there’s certainly ups and downs to space travel - and nano caps. UFO went up 40X and down 40X (97.5% loss) over 10 years. Even that 97.5% fall understates the fall given the fundraises, consolidations and so on from its prior days as a Mexican prospector called Arian Silver.

In fact, yep if go to a 25 year view of UFO and a £6.19 per share high makes the 2p high in 2021 compared to £0.001 today like travelling from Alpha Centauri falling to the earth, flying to the moon and falling back to earch a 2nd time.

So why should you consider UFO?

Assuming you are still reading and the 99.99% fall is not off putting (!), then let’s consider whether space travel is in Alien’s future.

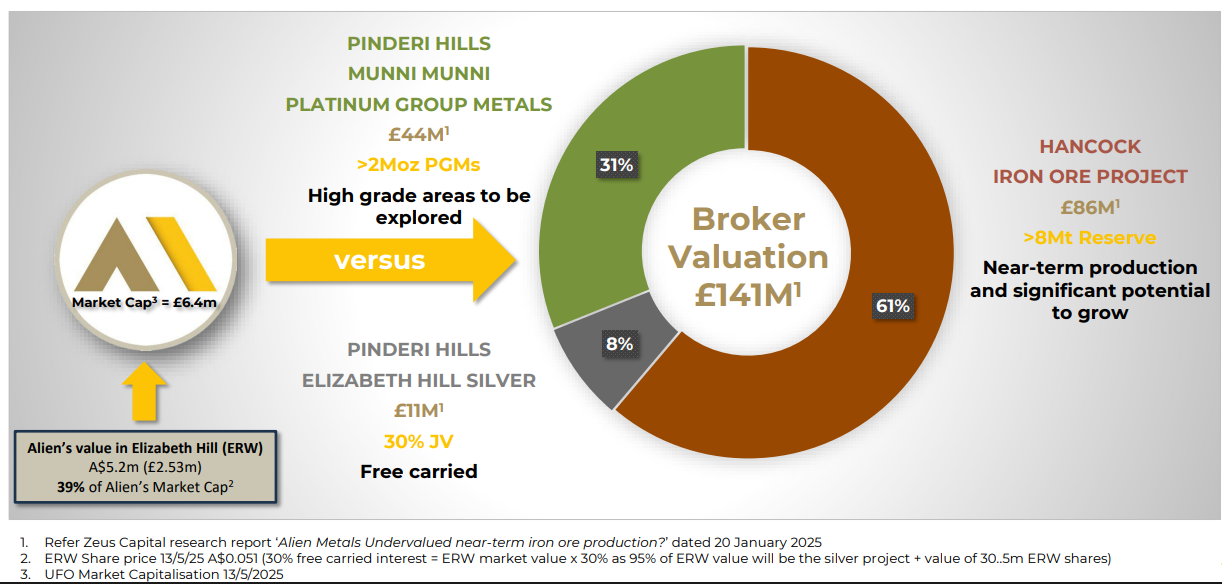

The broker thinks so. There is a broker guess of a £141m target valuation that might tempt you (vs a market cap. today £8.8m). If that’s true that would be 15X not 40X as in 2021 but more on that later.

There’s also strong insider skin in the game and ongoing remuneration is 25% in shares. Dilution pain (if that happens) is therefore felt by all. Today’s management were not involved back in the 2010s so don’t get too overly influenced by its history.

You also might also like to listen to Mr Archer’s recent interview with Sr Maiolo, of UFO. Some great questions asked - and answered. But questions remain too. More on that later too.

Incidentally, and speaking of Maiolo if there’s a worthy addition to your bucket list it is to taste bread from Maiolo. A place so proud of its bread making that it even has a bread museum.

Let’s consider the assets:

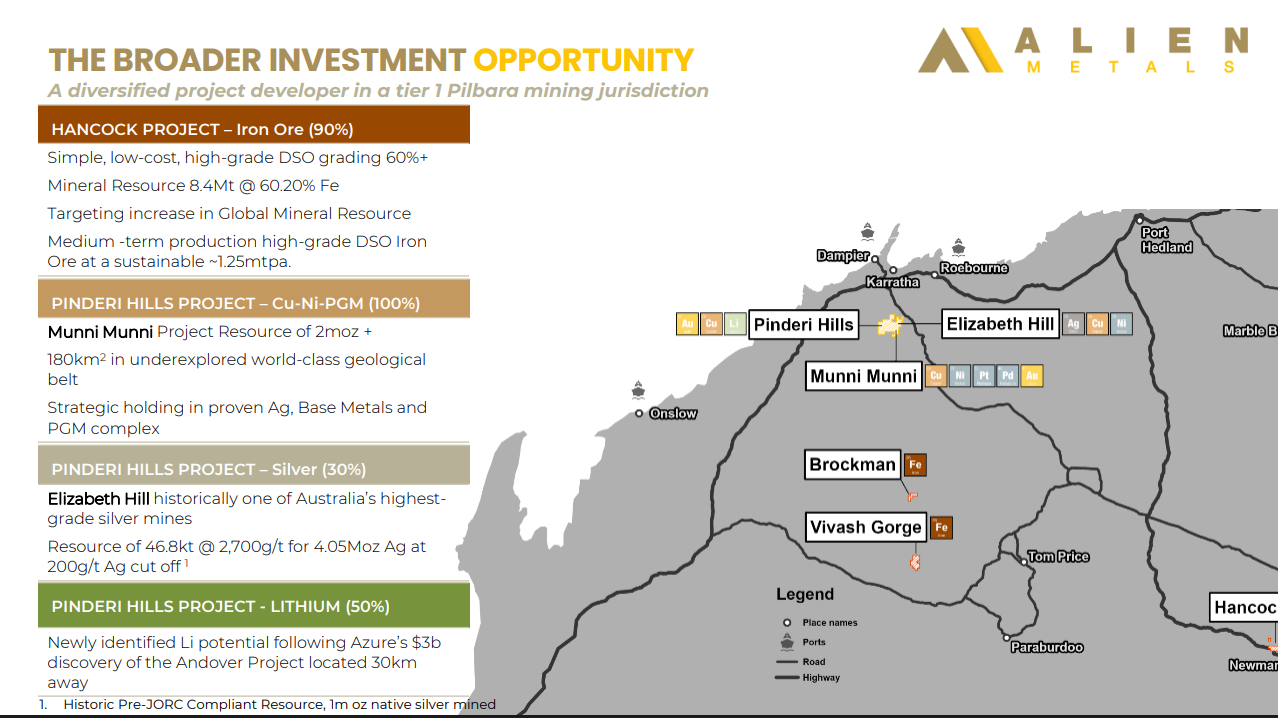

#1 Hancock

This is described as a simple, low-cost, high-grade DSO grading 60%+ Mineral Resource 8.4Mt at 60.20% Fe Targeting increase in Global Mineral Resource Medium -term production high-grade DSO Iron Ore at a sustainable ~1.25mtpa.

Nothing is ever simple and permitting has taken a while. It’s taken about 5 years. The good news is that those years have come and gone. To finalise this, Maiolo describes this as “months not years” to complete a deal.

Recent news is that Hancock has been extended to some further adjacent tenements and there is rock chip sampling going on to extend and further prove out the resource and expand the resource.

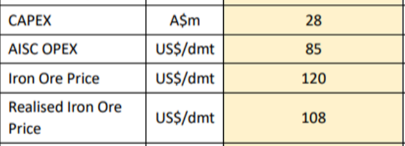

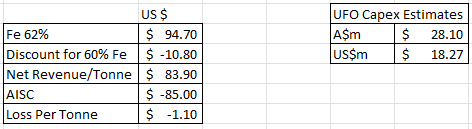

UFO’s study dates back to Feb 2024 and reveals “excellent returns”. Excellent is defined as a NPV10 DCF of US$93m over an 8-year mine life, producing 1.25Mt 60% iron ore per year of DSO on a mining inventory of only 8.4Mt and with an initial capex set at only A$28m (US$18.2m), based on an iron ore price of US$120/t.

That’s where the wheels fall off. Iron ore today is $94.70 a tone with an 11.1% discount for 60% iron (Rio’s May 2025 percentage) so this project can be as capital light as it likes - spending $18m to lose -$1.10 per tonne won’t fly.

The outlook for iron prices is that prices will drift downwards reaching $79/t by 2032 (according to BMI). Loss per tonne would grow to -$15 if that happens.

So the obvious question here is why are UFO progressing an uneconomic asset? Do they expect costs to fall, and if so how? Do they expect (hope for) prices to recover? Could they be planning to ship 62% Iron Ore (which would remove the discount) in stead of 60%?

That would be the question here. I am assigning a zero value since can an operation that can’t even make a gross profit be viable? I mean you might make a few bucks renting the land to a Kangaroo farmer but Iron Ore is uneconomic to mine - based on Alien’s own numbers.

#2 Elizabeth Hill

Asset number 2 is valued the least and I personally like it the most. The broker guess is $11m - while the evidence shows the recent deal with WCE put the holding at a £3.40m valuation.

UFO has a JV agreement with West Coast Silver (ASX:WCE) comprising:

A free carry - so WCE pay for all the exploration (£1.45m) up to a Final Investment Decision (to mine).

UFO retain 30% ownership of the 180Km2 area worth £1.33m*.

30.5m shares in WCE (A$0.082) (worth £1.2m)

A$880k cash (worth £0.42m)

*Based on WCE paying £3.07m for the above for 70% then that implies Lizzie Hill is worth £4.4m. So 30% of that is £1.33m. Add the 30% of exploration cost carried, the cash and the WCEshares and 30% ownership and you get to £3.4m.

Lizzie Hill was once Australia’s highest-grade Silver Mine and a non-JORC resource suggests that over 4Moz of silver remain (worth US$145.6m at today’s prices).

Check out the world record Silver Nugget of 3,500 ounces from Lizzie Hill!

WCE raised A$3m to advance exploration. They’ve done the geophysics, geochem and next step is assess the resource to JORC standards, to extend known mineralisation and also commence the search for more Lizzie Hill type deposits.

Once WCE get to a “Decision to Mine” UFO will have two choices:

• Convert to 2% Net Smelter Royalty (NSR) i.e. and lose the 30% share.

• Fund 30% share of expenditure (or face dilution) and keep the 30% share.

UFO funding 30% expenditure seems unlikely for UFO so a 2% NSR appears the way to go. But 4Moz Silver at US$36/ounce assuming 100% recoverability at a 2% NSR is worth only US$2.88m (£2.1m)

At a 100:1 conversion of silver to gold 4Moz of silver sounds a lot but it is only 0.04Moz equivalent. Takes the shine off a bit then.

Obviously if the resources were extended - let’s say by 10X then this would be more interesting. But there’s no certainty or evidence that that could be the case - yet.

#3 The vast expanse of Munni Munni

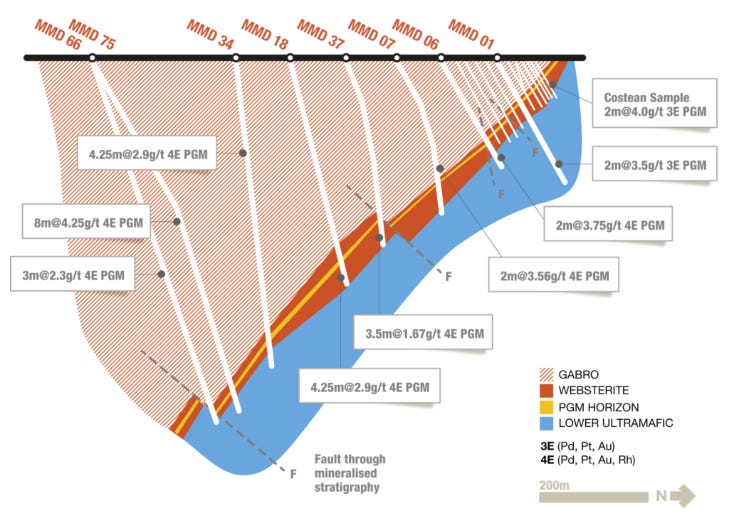

Based on several drill holes (see below), a non-JORC resource of 24Mt resource for MunniMunni grading 2.9g/t PGM’s - containing palladium 1.14Moz, platinum 0.83Moz, rhodium 75koz, and gold 152koz – is reported for Munni-Munni.

I would be minded to value it similarly to that of Jubilee’s Tjate Project. $0.63 per PGM ounce on a roughly 2.8Moz PGM basket (where Rhodium is counted on a 5:1 PGM eq’t and Gold is 3:1 eq’t basis). That’s a US$1.75m valuation. (£1.3m)

The broker compares it to a selection of companies such as a Russian PGM meme stock (Eurasia Mining) - the assumption that today it is worth £43.8m valuation risked at just 50% (so £21.9m) is simply fanciful.

£7.82 per PGM ounce equivalent vs 63p I know which asset I’d prefer to hold. And at what price.

Besides how will UFO fund the work to develop the asset? This is not clear either. Comparing it with JLP they are cash generative. Perhaps a further JV is possible but wouldn’t that end in a 2% NSR also - one day - possibly.

It’s a vast area of prospective ground. To get a perspective of how large 180 square kilometres is let’s put it this way. If you walked from Ealing to London City Airport and then walked back along the North Circular you’d have covered about 180 square kilometres. That’s the ground UFO has - which is great - but the ground that needs studying and investigating by UFO for non-Lithium resources.

But with what money?!

Strangely there’s a 50:50 JV over Lithium with WCE (who invested A$0.5m in UFO at 0.2p per share) but not any other resource. There’s a further commitment by WCE to spend A$3.5m on exploration.

Again I’m struggling to assign much value. Even if they find Lithium will it be economic? Lithium prices are at record lows. Hard to get excited by someone spending millions for a barely economic mineral in the hope of future higher prices.

Conclusion

£141m valuation?

I’m struggling to see even the market cap in value. Yes there’s a possibility that further resources could be uncovered, and justify today £7m market cap, but this isn’t one for me. Better opportunities elsewhere.

The danger here is you see what whacking great nugget of silver and the daily rises in the price of Silver, a broker report valuing UFO at £141m and then you can’t unsee it. Great wealth beckons, it might seem. Star struck, get your ticket to the stars.

But if you look instead at the numbers and breathe you realise that UFO - just like the vastness of space - is AVOID.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"