TEK-ked off

Calling time on TEK

Dear reader,

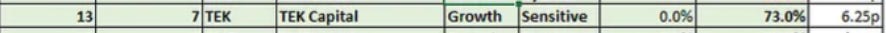

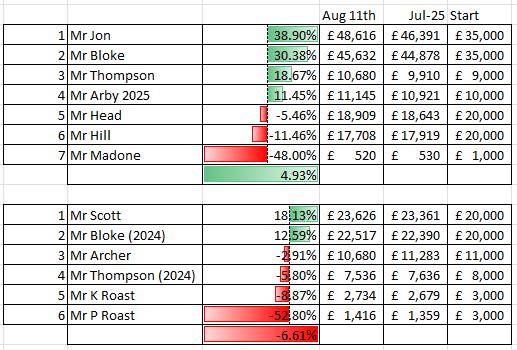

I’ve decided to call time on TEK and sold today at 7.225p at a gain of 0.975p to when I included it in the Oak Bloke ideas 2024, 20 months ago at 6.25p.

A 16% return is 11% per annum. I also consider it a lucky escape.

Here’s why I sold:

BELL - suspended and announced today a follow on investor had reneged on the funding. They are now discussing the sale of IP to a competitor. The death bell tolls.

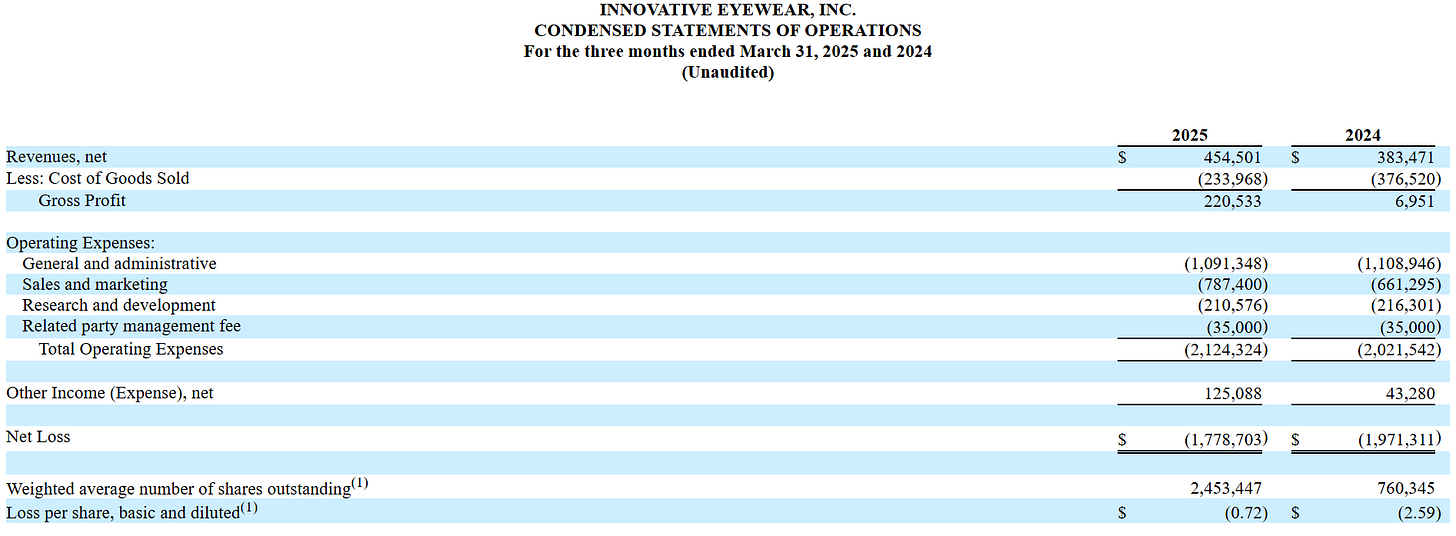

LUCY - no traction in sales, the glasses are great the financials have disappointed. Can it turn around with Reebok, Armor, Eddie Bauer brands added? Not enough sign of it. Where are the sales? $70k or 25% more in 1Q25 c.f. with 1Q24? It’s just not enough.

Guident - no traction in the technology; an IPO is planned. Can that transform things? Not clear it can. Where are the sales?

SALT - down from recnt 80p levels to 51p. An unfair related party transaction was the final nail in the coffin for me today. I like and believe in the technology but where are the sales?

Note to people: This isn’t just “ground down salt” nor is this “low sodium salt”. You’ve not understood the technology. But regardless have they made it pay yet? No. Is there a chance that the unfair transactions provoke some key people to leave Microsalt. I would hope not but the risk is there.

GEN IP - no traction in sales, even if the idea is a good one. Yep. Where are the sales?

So after asking myself where are the sales five times the cockrel crowed and I realised it was time to sell.

I wrote many articles extolling the virtues of TEK and its holdings. Those views were honestly held. So what’s changed? I want to put cash to work into cash-generative activity. This idea has had plenty of time to mature into what it should have been but didn’t become. When you analyse your own decisions and performance that real-world expectation of LOOK AFRESH if you were buying this today is extremely valuable. You make your own investment decisions but one such decision is whether to grimly hang on to losses hoping for a turnaround or put your money to work productively.

If you wouldn’t buy it today then why are you still holding it? I don’t want to crystallise my loss is the usual reply. Yes but could you put your money to work in a better idea?

For the record there were six spikes to 10p-16p and six dips to 6-7p where I top sliced and topped up so this has been a reasonably profitable holding for me. But do I wish to include it in the OB24 ideas still? No, it’s time to TEK my leave.

The remainder of my ideas from 2024 are performing well up 12.6% since 01/01/24, delivering 12.59% even net of losses from Belluscura, Saietta and others.

My 2025 ideas are doing even better!

Regards

The Oak Bloke

Disclaimers:

This is not advice, you make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

I see Guident today announce they have only just achieved ISO27001 certification.

If I were producing a technology like Guident has been developing for many years, I'd have achieved that certification years ago. Surely info security is almost the first thing a potential customer would ask for? And expect.

It is a serious oversight to only be achieving this in August 2025.

https://www.research-tree.com/newsfeed/article/tekcapital-plc-portfolio-company-update-guident-corp-2975093

Bell looks like it was a net loser to Tek and I think Lucy is at a loss after all the funding rounds and probably in a forced sale they would have lost on their Salt holding- so 3 losses out of 4 but is the news this week on Guident and their potential float actually going to give some value to Tek.....nobody knows as we have no info yet but so far TEK business model has not produced the goods as they never get money back to the shareholders.