The complicated value story of Hansa, Ocean Wilson & Wilson Sons

HAN, OCN, PORT3

I do like to pick ‘em.

So I’ve been a Hansa holder for many years. It never seems to do anything. I bought it because it was on a big discount to NAV. Seemed like a good idea. It pays a 2%-ish dividend and seems to drift on by. 10 year return of 55% according to Edison. Plod, plod, plod.

Their own marketing contained in their latest Annual Report is to “Dare to be different” and their latest quarterly speaks to the uncertainty of outcomes in the months and years ahead.

All laudable. But it’s fallen by 10% or so in recent years but less than the wider UK market - and that’s due to its range of funds and hedge funds. Its a lesser known wealth preservation vehicle. The Salomon family are major holders.

I always read about investments before taking the plunge (as I’m sure you do) and whilst I don’t particularly remember this article from Edison I reference it here as it must have helped me decide to invest here.

Recently, the investment manager has announced a capital markets presentation of HAN. First one I’ve ever seen. Thoroughly recommend the Mayfair Hotel if you can go!

Date: Wednesday 27 September 2023 13:00 BST

Location: Private Room 8 - The May Fair Hotel, Stratton St, London W1J 8LT

Attendance: To attend in-person, please register here

I’ve no idea how HAN intend to present their investment trust on the 27th or whether we will see any great new strategy announcement (it would be a good time to do so?) but assuming it’s more of the same from HAN here’s my attempt to convey the value. I’m drawing a very deep breath to try to explain it. In fact I’ll draw you a picture of the per share value. MP is market price, NAV is Net Assets, stuff in brackets is the “look through” i.e. if you roll up the NAVs from children to parents (except Wilson Sons where instead it is a potential buy out value I’m rolling up).

£5.33/share look through vs £1.87 is a 65% discount so what’s going on?

**** - £5.33 look through estimate of NAV assumes the NAV of each subsidiary rolling up to HAN rather than OCN’s market price determining the NAV price for HAN. £5.33 is a 65% discount to NAV for a wealth preservation vehicle when the normal discount is around 0%!

As you can see HAN owns OCN or Ocean Wilsons plus invests in various funds. These are a mix of Private Equity, Hedge Funds, Long Funds, Short Funds, ETFs and 1 or 2 Investment Trusts too.

OCN then invests in various funds too (HAN manages this portfolio) plus owns 57% of Wilson Sons. Wilson Sons is listed in Brazil and owns 2 ports, and operates tugs (“towage”) and vessels for O&G.

What will make HAN (and OCN) rerate massively?

Suggestion from ExTrader on LSE that MSC may be buying Wilsons Sons. Either entirely or perhaps looking only at OCN's 57% stake

Reported here: https://www.infomoney.com.br/mercados/wilson-sons-port3-controlador-confirma-que-avalia-venda-de-investimentos-na-companhia-desempenho-acoes/

Googletranslate :

"According to a report by Bradesco BBI *, MSC is reportedly negotiating the purchase of 57% of Wilson Sons in a transaction of approximately R$ 5 billion or R$ 8.8 billion for 100%.

Bradesco BBI commented that assuming the amount of R$ 8.8 billion-R$ 11.3 billion as equity and company shares to establish the price range, this change of control may result in a tag-along price of R$ 19.90 to R$ 25.60 per share of Wilson Sons, resulting in a possible increase of 90%** to 144% over the closing price of last Friday.."

* Bradesco BBI is the investment banking arm of Bradesco Group , 3rd largest bank in Lat Am, for context, in market cap. a little below Barclays.** I’ve assumed just 90% in my diagram. But 144% would be another £9.75 (103% of MP) to OCN or an extra 80p (45% of MP) to HAN.

If that happens, you can only imagine the memes as OCN says, I’m sorrrrrrrrry Wilson, as it waves its English-sounding Brasilian subsidiary goodbye or “adeus”.

Wilson Sons by the way is a great asset. It is on an exciting trajectory:

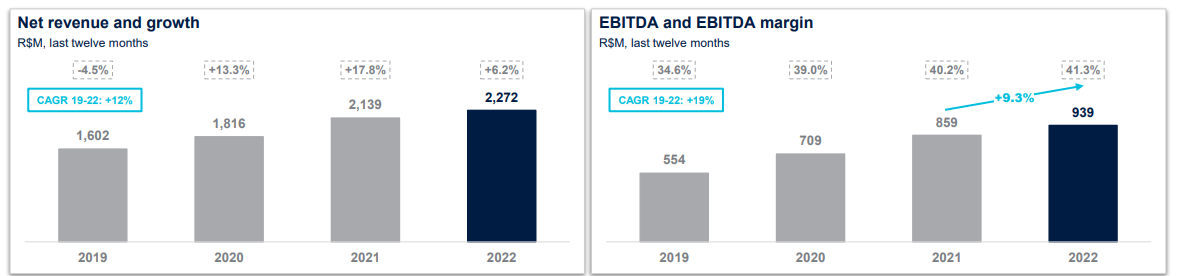

What if the sale of Wilson all goes Pete Tong? What if the sale doesn't go through? Digging into WilsonSons web site what is impressive is the growth story, the profitability and the future opportunity. Revenue CAGR 12%; EBITDA CAGR 19%.

Wilson Sons latest EBITDA was R$939m which is £150m EBITDA or £2.43 per year per OCN and net profit 68.5p/OCN share. If it keeps on that trajectory it will be worth triple that in 5 years.

How could it triple? Well, for example, for Brazil to draw level with a peer like Chile then it's TEU would need to grow by 300%. That's a lot of growthv ahead for WilsonSons. Plus the opportunity to capitalise on growth in Uruguay and Argentina's trade due to the River Plate's shallowness - and Wilson’s Port which accepts deep ships.

See their presentation deck here

Also their latest (August) port movements shows Wilson Son are up 12.1% year on year.

Even if the offer doesn't go through, this 57% holding of Wilson is valuable to OCN and if nothing else the news of the rumour will draw new interest to the clear value on offer here.

What if HAN launches a takeover bid for OCN? Or OCN for HAN? What I come back to is the grandparent HAN and father OCN both hold the same portfolio of investments. Why? There’s a lot of locked away value. More than 66% upside if you agree my calculations (£5.53/HAN share instead of £3.16). Merging the 2 together seems to have huge sense to my simple mind. There’s about £4.5m of overheads saved, but millions of unlocked value.

What about buybacks? The stated reason HAN have not done this is that this would increase the relative proportion of OCN in its holdings (above the current 24%).

Here’s an intriguing thought. What if HAN merged/took over OCN, the proportion drops by about a third. Buy backs could continue until we reached the God forbidden 24% level again (I’ll pretend you’re not thinking why is 24% a limit in a high growing and successful company anyway?). Buying back that amount of HAN would be about £40m which would equate to an increase in NAV of over 38p a share.

But here’s an even more intriguing thought. What if HAN merged/took over both OCN *and* Wilson Sons? Remained listed in London (via Bermuda) and added a Brazilian listing? Many of the Fund holdings are publicly traded, some aren’t. By my reckoning and on the basis that 75% can be liquidated that gives a war chest of some £300m (between HAN and OCN combined). To buy the remaining 43% of Wilsons Sons at NAV would cost £55m or if the above article of a bid at 144% upside to NAV (R$25.60 per Wilson Sons share) is what it will take then that requires about £135m. In other words selling about 40% of combined investments would buy Wilsons, and that assumes no Salomon family involvement, but also assumes no form of share swap offer for Wilsons which might work too? Also if MSCI is sitting in the shadows a bid would prompt a bidding war for the asset. What better way to smoke them out? Such an event would be a win/win no matter whether MSCI, HAN or another bidder win Wilson Sons. There are a number of JVs that Wilson Sons are invoved in too, and these could give grounds for further expansion on top of its core business. Perhaps the conclusion of the strategic review is that holding investments is the past and Wilson Sons is the future? Very exciting if so - a sunny Brazilian future.

So to conclude, HAN is currently a fairly boring holding paying 1.7% yield. It holds OCN which is also a fairly boring holding paying a 6% yield. Yet the discount to NAV excites me. The Wilson Sons story definitely excites me. The synergy and potential for the strategic review to lead to something extremely exciting, extremely excites me.

Do I know this will happen? - of course not - but what other conclusion will the review conclude? Apart from continuing to drift along, some form of re-invention appears to be required. Isn’t amalgamation and expansion of the most exciting bit of the portfolio the most obvious thing to do? What will the Salomon family want? Boring drift or growth?

But reader, if boring is still the future it doesn’t stop the underlying value being arguably worth £5.33/share which is a look through 65% discount to NAV. A 65% discount for a wealth preservation vehicle is very high. Its peers Ruffer and PNL are currently on a discount of 1-5%!

My posts are written for my own benefit, without warranty, to set out my own investment rationale. I state facts and source them where possible. I also use words like “infer” and “think” which means it’s a (reasoned) opinion based on a fact. Investment requires filling in the gaps with inferences and thinking about the facts to form forecasts. I hope you enjoy what I write and find it useful in forming your own rationale in your own investment decisions.

"What if HAN launches a takeover bid for OCN?" Well, that's what is about to happen!

https://www.londonstockexchange.com/news-article/HAN/possible-combination/17088912