Dear reader,

One of the ironies of a highly successful (in terms of NAV) investment trust that trades on a large discount is that they can’t raise new equity for follow on investment. But also the logic of buybacks compete with the logic of follow on investment to back your winners.

Last week SEIT announced an Interim Update Statement for the period from 1 April 2024 to 30 September 2024.

CEO Jonathan Maxwell explained:

"The operational assets in SEEIT's portfolio are performing in line with expectations. The portfolio is also well positioned for growth.

GROWTH

Oxyx is a provider of distributed clean energy solutions to commercial and industrial customers in the US, while EVN is one of the most successful electric vehicle charging platforms in the UK. Both are growing fast and ahead of budget.

Both require further capital. SEIT is exploring financing co-investment and disposal opportunities to obtain capital to support their growth where surplus capital raised will be used to pay down the £155m Revolving Credit Facility (RCF).

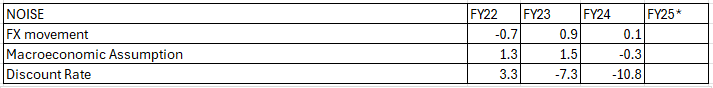

Discount Rate “Noise”

Interest rate cuts in the US and UK are likely to have a positive impact on the value of SEIT's portfolio on a discounted cash flow basis. SEIT (strangely) in my opinion are being prudent and absorbing decreases in risk free rates by increasing the risk premiums due to ongoing economic and geopolitical uncertainty.

Do they mean the budget on October 31st? Because there’s not really any other economic uncertainty, is there? Geopolitical? Presumably that refers to the Middle East (the Ukraine is not a new uncertainty), but again the rationale here is odd. If SEIT imported Iranian Oil or Israeli Houmous then I could understand it.

Anyway means the 90.5p per share NAV remains artificially depressed. If we strip out all what I’ve termed “Noise” adjustments then the underlying NAV is 12p per higher.

This means the trust is trading at a 32% discount with noise and 45% discount without noise. Take your pick.

But consider how many FTSE250 holdings can you buy at a 45% discount which generate income sufficient to pay a 10.3% yield dividend and still grow?

how many FTSE250 holdings can you buy at a 45% discount that pay a 10.3% yield?

Consider similar holdings not listed in the UK. XLUS is a close peer covering Electrical Utility players in the US. It’s up nearly 50% in 2024.

SEIT’s Board and Fund Manager say they remain highly focused on SEIT's discount to NAV, as well as keeping its gearing levels well within limits, and continues to prioritise taking actions described below in line with the six-point plan set out in the March 2024 Annual Report."

Let’s consider how they address the six points in the update:

1. Disposals and co-investment

SEIT is actively exploring co-investment opportunities in selected assets to meet the demand for additional capital.

Advisers have now been appointed with the aim of selling significant stakes, or inviting co-investment, in Onyx and EVN.

These and other opportunities could see the introduction of capital funding partners. Investments could be sold in their entirety, if the Manager believes this is in the best interests of its shareholders, as was the case with the Company's sale of UU Solar. The Company expects to make announcements on these initiatives by the end of the Company's financial year.

2/ Company level RCF and outlook

SEIT has commenced discussions on increasing and extending its RCF beyond the current maturity date of 2026, with the process expected to conclude this quarter. The Company intends to utilise the refinanced RCF to continue to provide capital to protect shareholder value at Onyx and EVN until completion of the co-investment/disposal processes and/or the project level financing. The proceeds of which will then be used to pay down the RCF whose balance was c.£165 million as at the end of the September Period. The RCF is above the previously expected target for 30 September 2024 by c.£35 million, due to accelerated deployment in Onyx that requires construction funding on a short-term basis. This is ahead of Onyx generating project level cash flows and sourcing funding and financing, that are expected to reduce the RCF.

3/ Capital Allocations

The test for all follow on investments should compare favourably to either buy backs or reducing debt. Considering that cost of debt is capped at 7%, we know the IRR is >7%. But considering the discount to NAV is 32%…. the IRRs must be incredibly attractive to be making follow-on investments.

The dividend is 1.1X fully covered from operational income, and the Company is on track to deliver its target dividend of 6.32p per share for the financial year to 31 March 2025, covered by net operational cash received from investments. At 61.5p that’s a 10.3% yield.

4/ Correlation with Inflation (not mentioned in the update)

5/ Engage with Shareholders (not mentioned in the update)

6/ Position for Growth

6a. Onyx

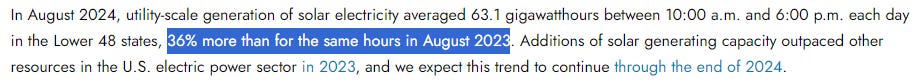

Onyx is now the largest SEIT portfolio investment. It provides on-site generated solar power and BESS to commercial and industrial sectors across 14 US states, continues to create and convert significant pipeline through its development activity. Onyx has already hit its 70 MW Notice to Proceed (NTP) target for the year and is on track to meet or exceed its annual Power Purchase Agreement (PPA) target. It is also on track to meet its Commercial Operation Date (COD) target for this year. COD is the point at which these new projects begin generating revenue.

The IRA provides to businesses for a 30% credit for qualifying solar, plus a 2.75c per KWh tax credit, plus potentially a further 10% in some circumstances. For tax exempt entities it provides direct payments.

6b.EVN

EVN, the electric vehicle (EV) charging infrastructure development company, continues to see strong demand for ultra-fast EV charging stations across the UK and has successfully brought a further 3 sites operational, bringing the total to 26.

The best view of its success is that the order book it has is for further 100 sites.

Consider that despite the negative press both BEV and PHEVs use fast chargers (when they are away from home) and there will be an estimated 40,000 new BEV/PHEV vehicles up to July 2024. So perhaps 70k new vehicles in 2024?

Will Labour do something in the budget? Seems a strong possibility.

What about businesses seeking to hit their Net Zero goals? Fleet managers up and down the country are working with EVN to plan and deploy their plans. It won’t just be Amazon EVing around the place soon.

On a $265k-$285k capex at 35p per KWh, with 15% utilisation, you’ll lose money without subsidy.

According to McKinsey a well-utilised site charging 40p per KW price can deliver a EBIT P/E of 8. Most UK rapid chargers are 74p+ so an EBIT of 4?

6c.Oliva

Oliva is currently performing ahead of budget, and SEIT expect this will continue due to the successful management of the cost of gas by their in-house procurement team, maximising operating margins.

6d.RED

RED, one of North America's largest district energy systems, has multiple workstreams underway, including:

· Current negotiations of tariff amendments are expected to significantly improve EBITDA performance, correcting current underperformance in part resulting from lower demand from one of its key customers. The Manager forecasts that RED will miss 2024 budget EBITDA by c.17% but considering the upcoming tariff amendments, it sees the underperformance as predominantly a short-term timing matter.

· As previously reported, Li-Cycle, an existing customer, is significantly expanding its facilities with the construction of a new hub processing centre that will increase their demand for services from RED. The additional funding Li-Cycle needs to restart construction continues to be expected before the end of 2024, as previously announced.

· Meanwhile, RED's cogeneration project is progressing as planned and remains on schedule to come online by Q1 2025.

As announced on 25 July 2024, the Manager has successfully renegotiated the loan facility for Primary Energy, a portfolio of on-site energy recycling, cogeneration and process efficiency projects, servicing blast furnaces, including the largest steel blast furnace in North America. This includes an improved margin of 350bps over Secured Overnight Financing Rate (SOFR), down from c.425bps and restructuring the debt to improve yields for SEEIT.

Investment activity

When SEIT acquired Onyx and EVN, their investment cases focused on ambitious growth targets to add significant value for shareholders in the long run. The hard work undertaken by the Manager and the management teams have set them up to deliver the targeted growth.

In the 2024 annual results, the Company provided guidance of £75-125 million of organic investments for the 2024-25 financial year. During the Period, the Company has invested c.£74 million into Onyx and c.£4 million into EVN. While this accounts for a significant portion of the guidance, the Manager still expects the total for the year to sit within that range.

At a time where equity fundraising is not a viable option given the discount to NAV at which SEIT's shares trade, the Company's RCF has been used in the short-term to meet capital requirements. However, the Manager sees three options available to meet those requirements in the medium to long-term and is pursuing each of these in parallel.

· Extend financing facilities at the project level that amortises from free cash flows.

· Re-cycle capital through disposals and re-investment.

· Introduce co-investment in some of the assets.

Project level financing

Project level gearing remains around 21% of the 31 March 2024 EV and, due to the amortisation profile of this debt, there is significant headroom beneath total gearing limits.

As part of its business operations, Onyx has short- and longer-term financing options available to it. Onyx operates its own revolving credit facility that is being refinanced to extend and increase it. There is also scope to further utilise longer-term debt secured against operating portfolios.

Conclusion

The news of strong growth in the interim update is of course positive and indications of further newsflow to follow in the current quarter is welcome.

Its holding Onyx doubled its EBITDA in 2023 from $6.8m to $13.6m. That doubling of EBITDA was despite over 50% of its 2023 projects being still in project (therefore earning zero). Once live, EBITDA would more than double again. But add in the $100m of fresh capital injected in 2024 and Onyx’s holding value has grown in 2024 from $255m to $355m (before portfolio gains) and EBITDA potentially above $45m.

On a FY24 (y/e 31/3/24) EBITDA of $253m that’s more than a 10% gain from Onyx alone. Adding in the other 2024 gains like EVN, Red Rochester and Oliva alluded to in prior articles then we arrive to an estimated EBITDA well north of $300m. A 20% gain in EBITDA profitability which isn’t reflected in a flat market price, nor in the stubborn discount.

SEIT’s holding UUUU solar was sold earlier this year at a 4% premium to NAV and it appears work is going on to drive a further proof point and a further sale. That will have the effect to recycle funds to support further growth.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings, even those held by a FTSE250 company like SEIT, might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

That UUUU sale was for about £90m. But I note an RNS in 2022 where they bought it from United Utilities for £100m, so although they sold it at a premium to the current book value, didn't they take a loss on the original purchase price?

It is an interesting one.

General Atlantic have come storming in with c.16% of SEIT and 25% of the manager. They could take coinvestment stakes to substantiate the NAV and see an immediate ROI on the discount narrowing.

The manager notes the companies need capital for growth. A lot of them are at the stage where additional debt financing will become possible, so debt could be moved from the trust to the asset level, freeing up RCF facility for any other investments not at that stage. I mean they say capital raises are not possible but actually it could be a good and proper thing to do, even if not conventional given the discount - a normal holdco would happily do a rights issue if it meant they could use capital more effectively. So really the talk of co-investment is really about providing a mark for the asset valuations, which is fine. You're basically doing a rights issue that someone else is paying for, its a bit dilutative but if it substantiates the NAV then fine.