Dear reader

New tax year and a good time to revisit assumptions and consider the (tax) year ahead.

Happy new tax year reader!

Because do you agree this new tax year will be happier? The US employers report offered an intriguing possibility that the 3.5% productivity increase, the BLS reported in 4Q23 is feeding into a stronger neutral rate for interest rates - I believe. But what is driving a 3.5% increase? I am convinced that automation, robotics and AI is behind much of this. Speaking personally, in my own professional life I am at the very least 3.5% more productive due to changes like using ChatGPT and CoPilot but also even smaller items like using Calendly. Going back and forth by email saying can you meet next Thursday or Friday before 10am or after 2pm, simply goes away. That alone is 20-30 minutes of my working week given back to me. My customer, supplier or colleague can simply pick a day/time and a Teams/Zoom appointment gets generated. In a classic power of the network if a group of people all use Calendly it will give the dates/times which would work for everyone in that group.

303k jobs were created in the US in March. Some of this is immigration. Numbers vary but we know 875k citizens were created in 2023. 200k work visas were issued. It’s thought 3m illegal immigrants in 2023. Possibly 4 million new souls, so the idea of a “tight” labour market must be considered relative to immigration (I don’t see that commentators really consider this). Unemployment at 3.8% is a fantastic achievement. We all know the saying “when the US catches a cold…” - but what happens when the US is in rude health? What does that mean for investors?

The slightly rhetorical answer is that we are seeing “Goldilocks” conditions state-side. Any holdings with US exposure should do well. A shocking tidbit yesterday on Bloomberg was if the UK were a US State then we would be the poorest state in the USA. $1000 per capita below Mississippi (the current poorest). You could see the visible shock on the anchor’s faces - think it was Scarlett Fu, Alix Steel and Romaine Bostick. I think Americans would be shocked how dour and negative the UK business climate feels. How negative the UK stock market remains. I am neither dour nor negative, but I am a perma-bull who believes something is always going to be going up - it’s a question of working out the probabilities of what.

Productivity: I was very interested to see UK productivity is actually no worse than the EU as a whole….. but Europe is far worse than the US.

Goldilocks for the UK? While it’s possible the Fed will delay rate cuts (and the obsession of speaking about rate cuts will continue) could we see the BoE break with the central bank crowd and begin to reduce rates?

UK Exports to the US are £193bn and grew 16.7% in latest stats and exports grew 4.6% overall. Inward direct investment from the US to the UK was £675bn. Meanwhile GDP growth for the UK is forecast at 0.8% by the OBR, with inflation falling. But are we far, far too bearish about the UK? 0.8% growth is seen as a negative, and yes it is the slowest among its peers, but it’s also noticeable that Goldman Sachs (for example) see potential for UK 1.4% growth in 2024, while the world is growing around us at 2.6%. If you are investing in export focused and commodity stocks that’s a huge positive surely?

I’ve hyperlinked the below picture to the ONS web site which shows our imports/export patterns and growth. I found this export data by country fascinating. I’d commend that you click on it and explore the UK’s exports country by country.

For example the US imports and exports with the UK are as below:

The UK all share remains less expensive on a 10 year CAPE (Cyclically adjusted Price Earnings)

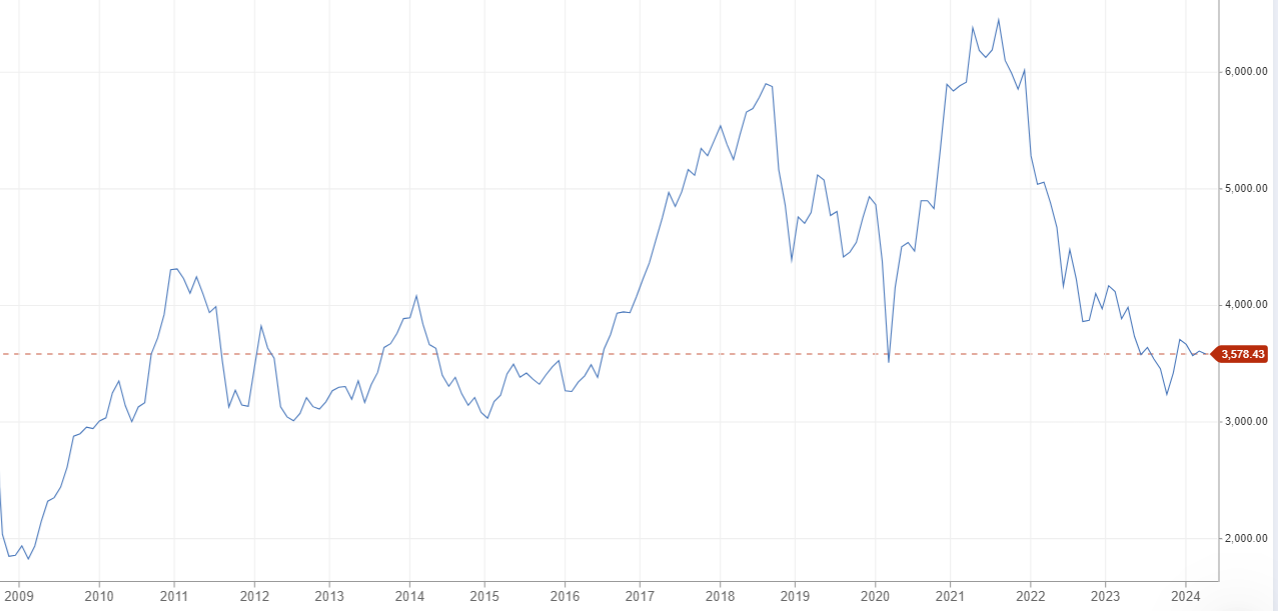

Of course the green includes the FTSE100 and 250 so what about stripping those out? Is that possible? Well it isn’t possible to find any metric which tracks small cap earnings over time, so there is no comparable CAPE ratio, but we do know in price terms the AIM market is at the same price as its 2009 Great Financial Crisis lows adjusted for inflation. This is shown below.

I meant to write to speak about stocks and shares but I’ve meandered into speaking about the UK economy instead.

Oh well. At least I can sign off without writing a disclaimer. Silver linings and all that.

Speaking of silver, at $27.48 an ounce and no signs of slowing I read (at the Silver Institute):

The silver market is forecast to remain in a deficit (total supply less demand) in 2024, marking the fourth consecutive year of a structural market deficit. Although this year's deficit is expected to ease by 9 percent to 176 Moz (194 Moz in 2023), it will still be exceptionally high by historical standards.

My relative heavy positioning into commodities (mainly through doubling down into that sector) is paying dividends (in some cases literally!). Combing the triple discount of:

a/ UK

b/ Small Cap

c/ Commodity

I see the upside from here as very exciting. I am beginning to profile what revised commodity prices mean to the portfolio. I see this as an area of hidden value (which is unhiding itself). In forecasts I’ve set out what I saw as fairly conservative and realistic assumptions to price. I used Copper at $8k, Gold at $2.1k, Oil at $70, Vanadium at $30. But based on my reading of decling grades of copper, mine closures, growing demand I felt it were strange that prices remained stubbornly at $8k. Quite suddenly they aren’t. Patience brings a reward and “animal spirits” appear to be returning to commodities. And Statue-eqsue stocks grow legs and appear to be on the cusp of having a Night at the Museum.

Oh dear I’ve spoken about stocks after all. Disclaimer to follow…

Regards,

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".