Dear reader

The original Mag 7 rode out with high hopes against the Bandit Calvera. But they were betrayed and the Village Elder tells them in the end gunslingers are "like the wind, blowing over the land and passing on." They returned home downhearted.

The new Mag 7 today appear to dominate the world; dominate the burgeoning opportunity of cloud. But it seems competitors are snapping at their heels.

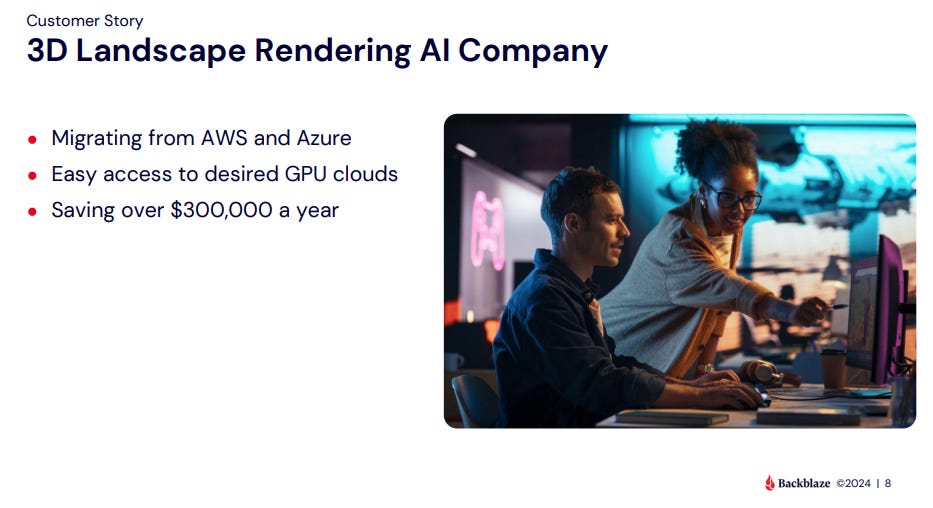

Competitors like TMT’s holding Backblaze. Migrating customers from AWS and Azure saving them $300k. Happy Landscapers and unhappy Mag 7s.

A happy NFL team as Backblaze replace not only AWS, and their extensive range of services, but storage provider all into a single platform.

With revenue up 27% in 2Q and ARR an impressive $126.3m, and adj.EBITDA margin growing from 9% to 11% in Q3 along with ARR growth to $129.6m-$131.2m

Assuming GM % stays at 55%, revenue needs to grow to an ARR of $200m to break even at net profit level. At current rates of growth that is 12-18 months away.

Current assets stands at $33.7m and cash at $9.3m, with the business now operating cash generative.

TMT devalued it to $6.16 per share based on the June 28th price.

Since then BLZE is up 9% at $6.72/share which is a $1.7m post period gain. Its average price target is $12.91/share, and that would imply a 92% upside and for TMT would be a further $19m gain. That would be about 0.8+9.1% = 9.9% added to the NAV and 1.8% + 20.8% = 22.6% to the market cap.

Backblaze isn’t the only late stage portfolio member with upside.

Today I’ll just cover Bolt, 3S Money and PandaDoc - its four largest holdings.

Bolt.eu

Bolt which I’ve covered in my article “Bolt upright” is serving a rapidly growing market.

Now we know Bolt.eu’s 2023 revenue and profit numbers, we can see the substantial growth story at Bolt.eu. But also at Uber which announced bumper results in its 2Q24 update last week.

Comparatively Bolt remains substantially undervalued relative to Uber, in my opinion. While comparisons are difficult and it’s true that Uber is better established, the implied valuation of Bolt (based on its 2022 funding round) of $8.1bn vs $151bn valuation (18.5X higher) is rich. Bolt anticipate to turn cash generative in 2024 and at least EBITDA profitable. An IPO is planned for 2025.

While revenue is clearly vastly different between the two (21.9X) the comparative is 2023 vs 2Q2024. Assuming the same growth trajectory for Bolt by 2Q24 revenue is close to $2bn. A 18.6X differential - or almost precisely the same differential as the two company valuations.

But assuming profits move also. Let’s assume that Bolt can deliver a further improvement to the P&L as in 2023 - an $188m improvement. That puts Bolt on an $85m profit (but arguably this isn’t physically the case as at 2Q24) but that is a 11.7X differential. If we look at 10 quarters of Uber profitability, $1bn profits is a new phenomenon. Bolt today is arguably is in the same trajectory where Uber were in late 2022.

Well if that is true we should consider Uber’s market cap from 2022 shouldn’t we? Uber started 2022 at $43/share and fell to $24.90/share by end of 2022. Even taking the $24.90 low point the market cap was $52bn.

That’s 5.9X higher than what TMT value Bolt at. TMT’s valuation of Bolt of $70m would become $413m and a $343m gain would equate to 3.76X today’s share price i.e. a $10.53 per TMT share gain.

Since the mark down to TMT’s Bolt holding at the end of 2022 was due to a reduction of Uber and Lyft I’ve tracked share prices since. Whilst some other analysts believe Uber is up 2.5X that’s not true. It’s up 66.27% since 31/12/22. Lyft is up 16.79%. Taking the average and applying the same methodology for the devaluation there is an implied $28.8m gain (and $26m overall considering Backblaze).

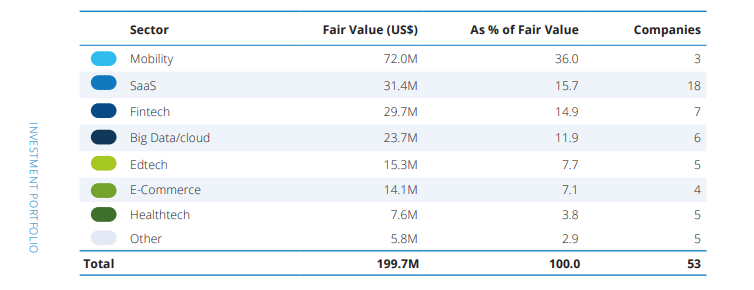

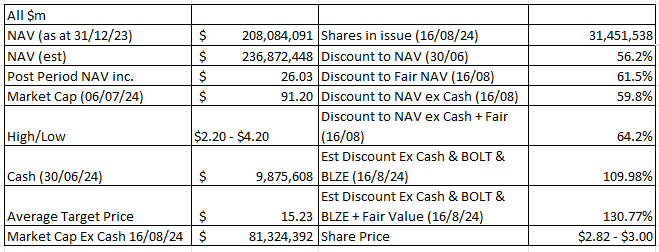

The 1H24 update leaves us with a discount to NAV of 56.2% (as at 16/08/24). But considering the above fair value the discount rises to 61.5%. If we strip out cash the discount is 59.8%. Strip both and you get to a 64.2% discount.

But if we sold Bolt even at today’s $70m valuation and BLZE at $6.72 a share on the Nasdaq and stripped out the resulting cash we get to a 110% discount. In other words you could buy the whole of TMT for $91.2m and sell BLZE and BOLT and have $100m cash (assuming you could find a buyer) and STILL hold 51 other companies worth $105.1m.

The question would then turn to well what are those “free” 51 companies actually worth? More than $105.1m I would argue. Let’s look at the two next largest

#3 - the 3S Money Club

3S Money Club. Their 2023 accounts show a growth in revenue from £10.6m to £17.4m and operating profit of £2.4m turn to a loss of -£0.8m. Much of this loss was funding expansion in Doha and Luxembourg, and an expansion of headcount from 88 to 157. Its (main) UK entity accounts for everything except £5k of revenue and generated a £1.66m profit in FY23.

In 2024 since then growth has continued. Headcount now exceeds 200 and their offices now number seven based in London, Dubai, Amsterdam, Luxembourg, Riga and Hong Kong.

So what does a money club do anyway? It offer near wholesale FX rates to businesses in exchange for a $100 or $300/month membership. For many businesses this is a no-brainer. That’s because competitors like Transferwise charge “from 0.33%” and Equals Money say “Varies”. (helpful).

TMT value their 12.2% holding (156055 of 1277696 shares) at £13.4m implying a £109.7m valuation of 3S. 3S’ turnover to 31/5/23 was £17.4m. Implied growth (in headcount, offices and past sales growth) puts FY24 turnover potentially at circa £27m-£30m with a £2-4m profit perhaps. £13.4m is therefore a 27X P/E possibly?

Equals Plc on a £212m marcap, £95.7m revenue, delivered a £7.75m net profit in 2023 (after years of losses). But is on a slower 37% revenue growth. In international payments Equals delivered zero growth 1Q23 to 1Q24 and 25% growth from 1Q22 to 1Q23. Its solutions business is Equals growth area, which appears to be its spend management services to Corporates.

Both 3s and Equals compare equally on Trustpilot.

The implication here is that 3S is at least comparative to a listed peer; and arguably is growing faster and potentially is therefore worth more than the implied £109.7m valuation.

Or put another way, it’s worth than zero implied in the TMT share price.

-

Pandadoc

PandaDoc on the other hand, outstrips its competitor Docusign by a mile on Trustpilot by 4.3 vs 2.6. Lots of customer stories saving time and money. At its last funding round (in 2021) Pandadoc had a $1bn valuation. This was when Pandadoc had 30k customers compared to the 55k it has today. I strongly suspect this $1bn valuation is (highly) conservative. TMT holds 1.08% of Pandadoc after selling 11% of its stake for $2m in 2021. Implying that its remaining holding is 0.979% of PandaDoc. At a $1bn valuation TMT’s holding “should” be worth $10.8m not $8m suggesting that it is undervalued by at least $2.8m. Based on the 11% it sold for $2m, the remainder is worth $18m. ($2m/0.11)

In fact it was devalued by $2.8m in 2023 because someone made a silly offer to TMT! Never been revalued.

Pandadoc Customer Stories:

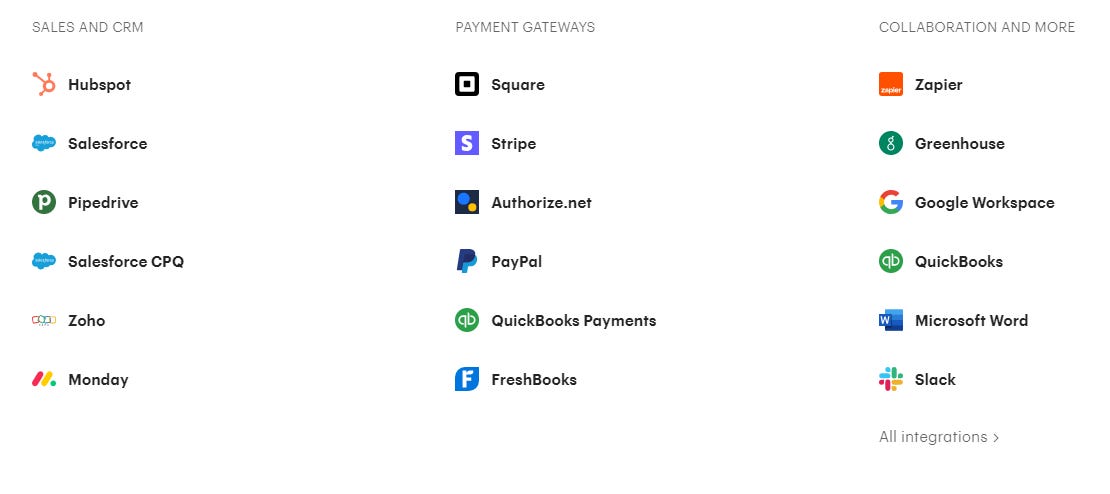

Pandadoc a wider set of integrations than docusign, including crucially (in my opinion) to all of the major CRMs rather than just Salesforce in Docusign’s case, and crucially with Salesforce CPQ which is where a complex proposal software would be most useful!

Users that rate software on G2.com also rates Panda the best

In the latest G2 Grid for proposal software, it’s the clear leader for both market presence and performance.

When you look at how it can help sales people build quotes and proposals more quickly, but also provide oversight and sign off to the sales process it is impressive.

Features like its Smart Content make me think even those paying for a CRM system would pay for the benefits of this platform - especially those in Professional Services. Its full features are here:

https://www.pandadoc.com/features/

PandaDoc in action:

Conclusion

I could keep going as to why I think the valuations of TMT’s NAV are highly conservative and why I believe the “fair” NAV is far higher from their conservative levels used by TMT to arrive at $6.62 a share.

Even that aside, the market price is at a 56.2% discount to the updated $6.62 per share NAV. A NAV which hasn’t increased in 1H24 but not decreased either.

Where long term for TMT $310.8m value has been created (through gains) and $34m has been lost (through write offs and write downs). Including a $2.8m write down at Pandadoc when someone made a silly offer for TMT’s holding!

EY tell us that IPO activity in Europe and the US is increasing relative to 2023 and rate cuts and the US election bodes well for 2H24 and 2025.

Growing IPOs, realisations and continuing growth in performance all bode well for TMT and its holdings. I am excited for news in the coming months.

Will the Mag 7 see off competition from start ups and upstarts like those backed by TMT? Seems to me TMT’s ragtag 53 are making inroads on their entrenched positions. Meanwhile, the Mag 7 are priced to perfection - while the ragtag 53 are priced on an assumed deep imperfection. Why does the market overlook an opportunity like TMT? I believe buying the index and ignorance of the implication might be why? I’ll end with a Mag 7 quote to ponder:

Vin: It's like a fellow I once knew in El Paso. One day, he just took all his clothes off and jumped in a mess of cactus. I asked him that same question, "Why?"

Calvera: And?

Vin: He said, "It seemed to be a good idea at the time."

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Just a small point with regards to Bolt is that it seems to be a law of nature that no European firm can ever survive a sustained challenge from an American firm, so I can see Uber reaching a size where it pushes Bolt out of every market, just like when eBay eliminated Ricardo and then bought Gumtree to corner the second hand goods market.