Tripling down on IDHC

OB picks portfolio movements

Dear reader

Egypt is revising its GDP growth forecasts up. Good news for OB pick IDHC.

Meanwhile the IDHC share price is down at $0.63 per share - the laggard in the picks for 26.

So I am making a OB picks for 26 change. Cash Proceeds from the Empiric merger with Unite (£432 of an imaginary £1000), combined with first dividends from RGL (£25) combined with the sale proceeds of the 2nd OB pick for 26 to be sold (£1365.30)** gives me imaginary follow on capital of £1822.30 to add to the £1000 invested in IDHC making this the 5th holding with a circa £3k imaginary weighting. (Alongside ECOB, ASAI, GCL and BSIF)

** - see later for who I’ve called time on!

Why Add to IDHC?

The IDHC share price is down nearly 25% vs recent highs following the 3Q25 news. This drop is price is not based on any news and in fact the macro newsflow remains positive. Very positive indeed.

EGP Devaluation

While the historical concern was devaluation and the effect this had on EGP earnings, the EGP:GBP has stabilised and the outlook is good.

Standard Chartered, Fitch, Hermes all speak of the EGP:USD rate strengthening by 2%-4% in 2026. So the headwind becomes the tailwind - as I anticipated it could. The UK and US are the larger basket cases with rising debt to GDP and aggressive spending, while Egypt is enjoying strong growth and taking a disciplined approach. Some of this discipline has been forced upon it by the IMF for example to allow the market to price the FX rate. Egypt has a mountain of debt so is being forced to make changes, reinforced by “brother” countries like the UAE who are lenders and who themselves run non-interventionist, free market economies, and will invest in Egypt based on assurances of change.

Egyptian foreign reserves are now $55bn and there is no longer any restriction in transferring money from EGP to GBP so comments about the “difficulty of getting cash out of the country” are outdated and inaccurate. Today it takes about 10 working days for IDHC to transfer money between Egypt and the UK.

But IDHC have a short cut. Expansion into Saudi Arabia has meant moving capital into a USD-pegged economy. The KSA has been pegged to USD since 1986! 3.75 SAR = 1 USD. Meanwhile Saudi Arabia’s Sarie system and Egypt’s Instant Payment Network (IPN) have begun a technical integration. Instant transfers are coming but for now the settlement time for business-to-business (B2B) transfers has dropped from weeks to 1–3 business days. Instant transfers are possible from the KSA to the UK.

Egypt Privatisation

The IMF are also pushing for reductions of the government’s role in the economy. This is called “The IPO programme” but it’s what Thatcher popularised as privatisation. $6bn has been raised from sales so far, and a further $10bn is targeted for 2026. Everything from fuel stations, to bottled water producers, to Wind Power like Gabal El-Zeit, the Egyptian military historically ran everything making private enterprise nearly impossible. That’s changing. Fast.

The Egypt Tiger

In fact HSBC Egypt speaks to an improving business climate and reduced red tape and a potential for Egypt to hit 8% annual growth and become a Tiger economy:

Last week the Central Bank of Egypt slashed key interest rates by another 100 bps to 19%, bringing borrowing costs to the lowest level since July 2023, amid slowing inflation and a strengthening currency.

Latest data showed annual urban inflation eased to a four-month low of 11.9% in January 2026 from 12.3% in the month earlier; while core inflation decelerated for the second month to a five-month low of 11.2%.

Egypt’s pound has appreciated around 2% so far this year and is currently trading at 46.8 per US dollar, its highest level since May 2024.

The discount rate was also cut to 19.5%. In addition, the CBE Board of Directors reduced the required reserve ratio (RRR) for commercial banks from 18% to 16%.

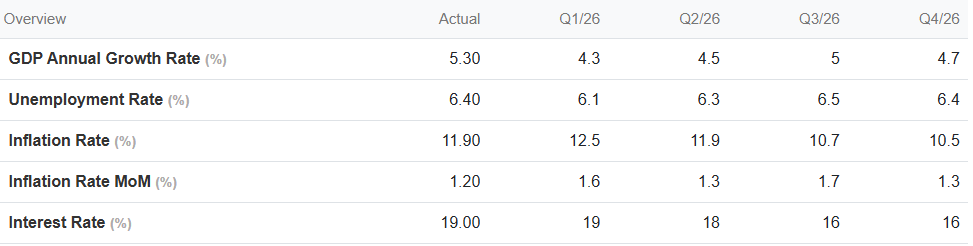

GDP growth is forecast at 4%-5% although latest numbers were stronger at 5.3% in 4Q25. Inflation is forecast to fall perhaps to single digits in 2026, and interest rates are due to fall further too. Debt to GDP is forecast to fall 3% from 81% to 78%.

Egypt Medical Tourism

Latest figures are that medical tourism tripled in 2024 to 12,000 people. Egypt is pursuing an aggressive medical tourism strategy for this invisible export.

Just like the eponymous Turkey teeth, the Egyptians are getting in to the medical tourism market. It’s well positioned to do so. Egyptian MRIs cost 70%-80% less than in the US or UK. Jordan is another medical tourism destination - albeit with fewer airline links than Egypt.

IDHC hold accreditations from the College of American Pathologists, ISO 15189 for Laboratory Processes, American College of Radiology and GAHAR (top-tier safety/hygiene) which are internationally accepted medical results.

A quick recap on IDHC itself.

I don’t want to repeat my most recent article “Do Tell S-idhc” but here are the top four aspects:

IDHC is growing its pathology customer base within Egypt but also growing rapidly into new countries such as the KSA. IDHC is also acquiring and expanding its radiology customer base in Egypt and in Nigeria.

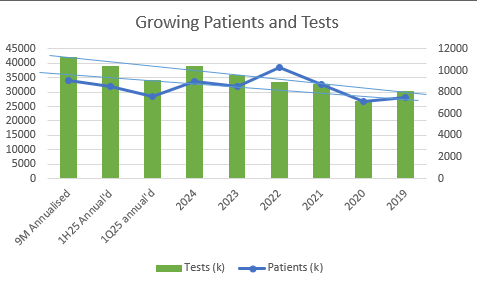

We see the the evidence to this in the period to period growing numbers of patients and tests.

Meanwhile in both EGP and in GBP terms we see growing revenue and net profit per test and per patient. Profits are about 35% higher per patient since 2022, bearing in mind point #1 that the patient numbers have grown too.

And it’s not just about the growing customers and revenues. Part of the IDHC story is its investment into its Hub and Spoke approach to capex and automation - and therefore its costs are far lower than its competitors.

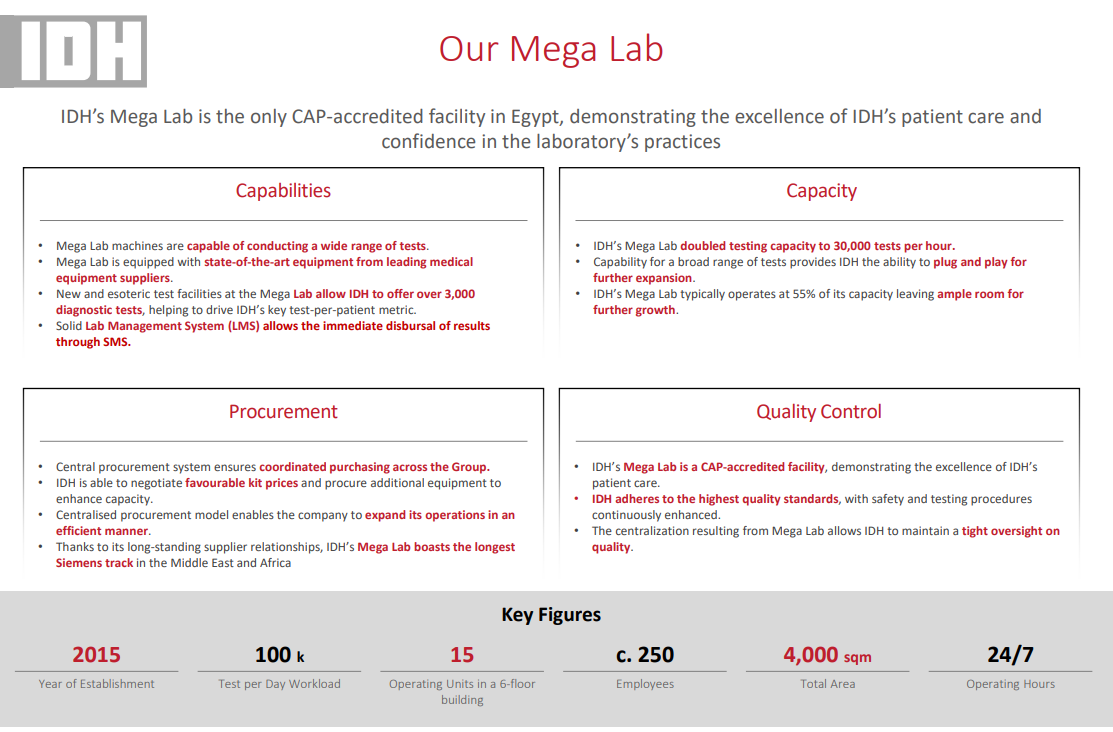

IDHC is the only total automation CAP-accredited facility in Africa. It’s one of 4 in the Middle East. On a global scale it’s about half the world’s leading facility in the US, but #5 in the world and #1 for Africa AND for the Middle East.

IDHC’s testing capability is unrivaled for its speed, accuracy and cost of sale per test in all its markets.

Branches feed into spokes and spokes feed into the hub. This diagram explains the asset-light model.

The IDHC mega lab operates at 55% of capacity meaning it has ample room for growth - at low marginal cost.

When controlling for the impact of FX gains booked in both years, IDH’s normalised net profit reached EGP 1,005 million, more than doubling year-on-year from EGP 458 million in 9M 2024. The corresponding net margin stood at 17%, up from 11% a year earlier, reflecting the combination of strong operational performance, improved cost efficiency, and lower relative financing costs.

Calling time on Gran Tierra Energy

Sorry Gran, it’s been a brief time to achieve a gain of 36.7%, but you are the victim of your own success. GTE could move higher but I’m happy to take profits here. I keep Oil & Gas ideas ENI, Ithaca, and Oil Services Ideas Hunting and Gulf Marine Services, so 4 of the OB 26 ideas are focused on the recovering oil price and the myth of an oil surplus. But I’m happy to take 36.7% while still keeping good exposure to the thesis of bustin’ the myth.

Bloomberg’s recent interview of Jeff Currie and his shocked mirroring of Francine Lacqua’s “It’s a shock” “it’s a shock”, is a current advert being run non-stop on Bloomberg. Seems everyone is starting to talk about the oil surplus myth being a myth.

Conclusion

Egypt was once the bread basket of the Roman empire. Today it’s not the basket case some commentators imagine it is. Businesses operating in that environment offer exciting prospects of growth. Egypt has had to take tough medicine as part of reforms and support from the IMF and fellow Arab Countries. The medicine is clearly working and the economy is growing fast.

IDHC is a beneficiary to this Egyptian growth (5%) but also a beneficiary to similar growth seen in the KSA (4.5%), Jordan (2.8%) and Nigeria (4%). Crucially, health spending will increase disproportionately as GDP rises.

IDHC has invested into its hub-and-spoke model, into growing its capabilities to be of a world-class standard, to the point where health tourism even attracts overseas clients.

IDHC provides a 40%-50% payout policy and its current foward yield is 2.7%.

Regards

The Oak Bloke

Disclaimers:

This is not advice. Make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as “blue chip”

Any update on Avation? What's your view?

What do you think about the Chrysalis (CHRY) share price decline? Time to chry or buy?