Dear reader

Strategic Financing and Proposed Formation of Uranium-Focused Joint Venture

A £2m loan note, 5 year terms (assuming JV proceeds), 10% interest.

13.33m warrants (non-diluting) at 15p if/when actioned would bring in £2m equity to POW. Dilution of 0.6% to shareholders.

A prospective JV on a 70%/30% Ucam/Power Metals valuing the assets at between £14.3m-£20m. £14.3m if the £4m earn in isn’t achieved but £20m if in the future it is.

£10m/0.7 = £14.3m or £14m/0.7 = £20m

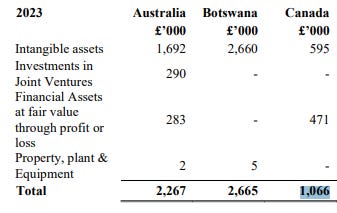

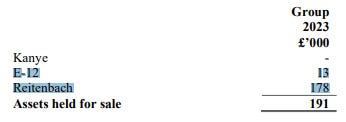

The book value of these assets meanwhile is just £1.606m!

It would be a uranium-focused joint venture involving Power Metal's entire portfolio of uranium licences. UCAM will make an initial equity investment of £10 million into Power Metal Resources Canada Inc ("PMC"), for a majority interest in PMC of 70%.

The gain to POW’s NAV will be £2.2m (30% of £14.3m less the £1.6m current book and £0.5m now obsolete IPO prep costs), with a £4m upside for “value realisation”.

POW will potentially receive an additional cash payment of up to £4 million, conditional upon a sale transaction completing, or other value realisation by the Investor, subject to the Investor achieving a minimum return threshold on its investment.

The proposed Joint Venture is expected to provide Power Metal shareholders with exposure to at least five significant, high impact drilling programmes with an experienced financial partner, with significant advancement on several more. UCAM have investments in mining and exploration projects globally including the Gardaq joint venture with TSX and AIM listed Amaroq Minerals in Greenland.

Sean Wade, Chief Executive Officer of Power Metal Resources, commented:

"We announced on 25th March 2024 that we were looking at various options to maximise value from our uranium portfolio and whilst these discussions are still taking place, I am pleased to announce that we are making progress to finalise a transaction that we are confident will crystallise significant value for our shareholders.

Whilst there can be no guarantee that the Joint Venture will complete, we are confident that we will achieve a successful outcome and will update shareholders once the legally binding documentation is finalised.

UCAM have already made a significant commitment to the Company pursuant to the Subscription and we look forward to working with them to successfully conclude the proposed Joint Venture."

Conclusion

Cash of between £2m - £4m to POW. £2m of debt and potential £2m of diluting equity where the dilution is less than 1%.

A £6.2m potential gain to POW, £2.2m in terms of uplift of NAV and a £4m future earning, but crucially 5 drilling programs in the prospective Athabasca basin so this accelerates the value recognition of the assets.

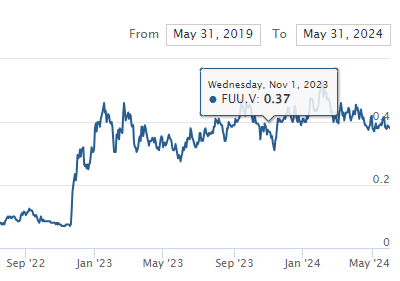

A uranium JORC resource will propel the JV to multiples of its current £14.3m valuation. Fellow Athabasca miner F3 Uranium (FVE:TSE) 4x bagged as pictured below when their drilling programme 18 months ago intercepted 7%-9% uranium. Of course back then Uranium was $50/Lb whereas today it’s $88.6/Lb. So 4x Bag is pretty conservative.

If I’m right, and if a successful drill discovery is made, it would probably bring a FURTHER £17m-£21m uplift to POW (i.e. its £4.3m holding x 4 plus would the £4m earn in kick in at that point?) if POW’s share price reacted similarly to F3’s.

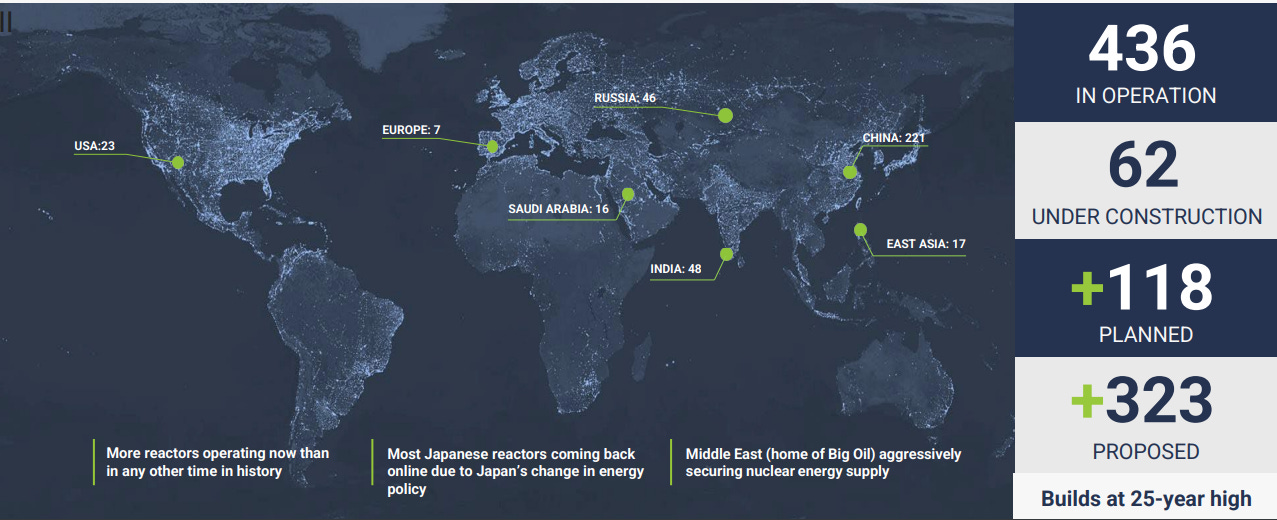

This slide from F3’s presentation gives a view of the number of planned Nuclear power plants - so driving Uranium’s current and future demand.

Will the share price POW-er today on the news? I wouldn’t be surprised!!!

(Given my observations around GMET’s meteoric rise last week and the price disparity of the value of POW’s holding of GMET there’s more than one reason for POW to outperform too)

Regards,

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".