UUUU-nicorn REE-known

Energy Fuels has the tools, the minerals and now has shock and awe GOP support too

Dear reader

It’s the Whitehouse guv, they’ve announced reform.

“U.S. policy will seek to facilitate the increased deployment of new nuclear reactor technologies and expand American nuclear energy capacity from around 100 GW today to 400 GW by 2050.”

OB25 for 25 idea UUUU shot up 20% on the news yesterday. But even after this jump UUUU is down -16% YTD, is this an attractive opportunity to buy? Fish and Barrel come to mind.

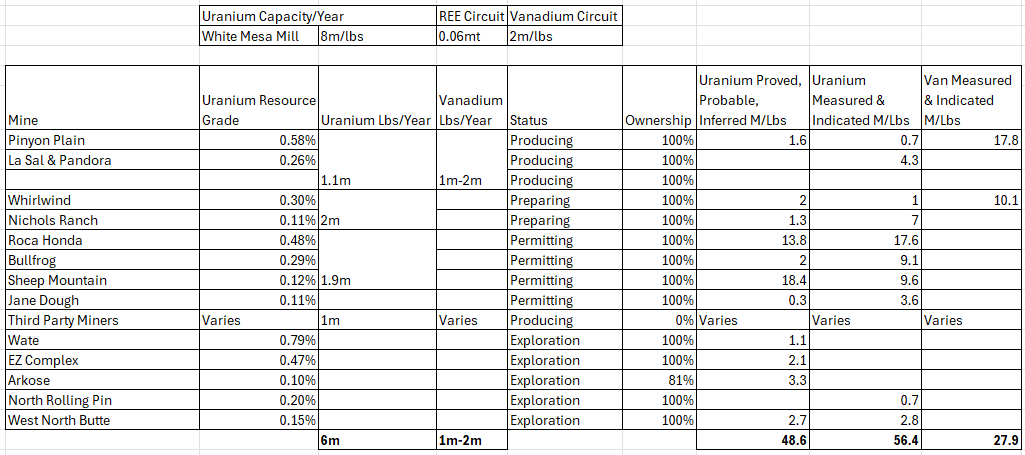

UUUU have three mines in operation Pinyon Plain, La Sal and Pandora, located in Arizona and Utah, and expects to mine 875,000 to 1,435,000 pounds of U3O8, depending on ore grades, mining rates, contract requirements and market conditions, which will be stockpiled pending processing at the Mill. It is also working with the Navajo Nation to receive cleanup material from abandoned mines dating back to the Cold War.

If called upon UUUU could grow its Uranium production 8X or more. Today, less than 5% of the Uranium consumed in the US (to power 100 GW generation) is produced in the US - so about 1% of the future 400 GW needed for generation.

This is UUUU’s uranium estate:

Finished uranium production is now expected to quadruple to 700,000 to 1,000,000 pounds of U3O8 for 2025. This is expected to be sufficient to complete all currently contracted uranium sales in 2025 and 2026 and a large portion of currently contracted uranium sales in 2027.

UUUU has further business segments beyond Uranium too. Its Heavy Mineral Sands (HMS) segment spans a JV in Australia called Donald, Bahia in Brazil and Toliara in Madagascar. HMS contains valuable minerals of Titanium and Zirconium but also Monazite which then contains Uranium and Rare Earths.

UUUU has a capability to produce rare earth oxides and is planning a second dedicated production line by 2028. Meanwhile in 2025 it has proven it can produce these but not concurrently with Uranium. They must be run as separate batches, but until the 2nd* line is built it can run REEs on its Uranium circuit.

*- the current commercial plan is a 2nd line. The White Mesa Mill could be extended to 10X production given funds. Y’know if the US government deemed it essential to national security under Section 232. More on that later.

UUUU also has the capability to produce Vanadium (which occurs in its Uranium Ore) and is exploring Medical Isotopes which is the use of radioactive elements as a medical technology to address cancer.

Coming back to rare earths not only have the White House engaged immediate measures to support domestic production. UUUU say they are in “active talks every week”.

The slightly funny thing is/was that back in March the market didn’t bat an eyelid at this positive development. No 20% share price rise.

The Secretary of Defense is tasked with faciliating the introduction of entities to ensure that commercially viable projects are supported to the MAXIMUM POSSIBLE extent.

Trump has also ordered a section 232 urgent review of REEs. Diversification of supply is one of its highest priorities. Therefore the world’s ONLY processor of Monazite rock from HMS, UUUU can offer the US government something no one can: Diversity of supply

UUUU can offer the US government something no one can: Diversity of supply

Trump has promised policies to incentivise production, processing and recycling…. and any additional measure that may be warranted.

UUUU meanwhile have “the Tshirt”, they’ve proven their capability to produce numerous (valuable) REEs at scale from Monazite. Monazite comes from different countries and sources than hard rock sources of rare earths.

Government needs REEs and HMS are the key to that kingdom

The US Govt don’t need Titanium and Zirconium per se. They do need REEs. They have proven willing to “do a deal” with Ukraine to get them.

How about Madagascar?

In April 2025, the United States, under President Donald Trump, imposed a sweeping 47% tariff on imports from Madagascar as part of a broader protectionist shift. For one of the world’s least developed nations, where exports to the U.S. are a critical economic lifeline, this move could not have come at a worse time.

Madagascar depends on U.S. exports, especially textiles, making the sudden tariff hike a serious threat to its economic infrastructure. Combined with climate vulnerability and unstable foreign aid, the tariffs deepen systemic risks, endangering both development and social stability.

Mega ouch. So what if the US gov’t offer to rescind those same tariffs if Madagascar fast track the Toliara project to further essential US interests?

Wishful thinking by the Oak Bloke? It’s not really that much of a stretch to think it could happen. The Madagascar government stand to earn vast amounts from the project anyway. $4.7bn over 40 years.

Meanwhile for UUUU shareholders for each $1 invested you also getting 2.2 tonnes of Toliara’s Heavy Mineral Sands with 6.1% valuable minerals including Titanium, Zirconium, Ilmenite and Monazite.

I nearly fell off my chair when I realised I did the maths of how much Uranium UUUU could get from Toliara…… 166% of their 2026 TARGETED Uranium production (of 6m Lbs). That’s based on 2% monazite, and 0.32% of that 2% monazite is Uranium. That’s 170,000 tonnes which over 35 years is 4857 tonnes a year which is 10m Lbs a year.

On the basis that only 24.5% of the REEs are valuable NdPr or Dy/Tb then 516 tonnes a year would equal around 5% of US consumption. To give you an idea an F-35 fighter jet contains roughly 427kg of rare earth materials, while a Virginia-class submarine needs nearly 4.2 tonnes.

Plus other HMS projects would deliver further resource. There is an as yet undefined Bahia resource. Plus 2.45 tonnes of HMS at Donald too with 3.2% minerals.

Toliara is a $2bn NPV.

My prior estimate was that Uranium expansion, HMS sales and REEs via Toliara would deliver a net $273m annual net profit. At 20X earnings this would support a $5.5bn target valuation vs today’s $1.1bn.

Conclusion

This slow burn idea was based on incredible value and economics, that is debt free and holds a decent slug of cash would slowly rise through its Uranium sales and then its growing REE sales affording it to fund Toliara via Debt or Offtake (or both) and would deliver a decent outcome.

The moves by the US government aren’t altogether unexpected but the speed and decisiveness by which it is progressing is impressive - appreciating there are many eggs being broken while it makes its omelettes.

I’ve been adding to UUUU during May, which is a strange experience for me since I am so used to dealing in UK-based holdings only and paying £10 trading charges and gritting my teeth paying a pricey FX rate on buys is a challenge. (Remember I received UUUU shares from the buy out of the UK’s Base Resources… the prior owner of Toliara)

I believe there could be serious upside here since it directly addresses several key priorities of the US industrial and military complex. If I were the UUUU CEO top of my list would be to say help me fast track Toliara. Second would be help me scale US REE production. I imagine the shadowy figure and let’s call him the smoking man would then say “and what else can we do to help UUUU, Mr Bloke?”

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

I was also a Base Resources holder that ended up with UUUU shares. I suggest you open an account with Interactive Brokers as they are the cheapest for all share trades and especially US and Canadian where the commission is usually $1 for each trade.

You also don't need to pay an FX charge because they lend you the money in USD and use your GBP as collateral, so you effectively only have your P&L taking on currency risk but not your original capital investment.

There are US brokers like First Trade who even charge nothing I believe but I've never tried them.

"UUUU is down -16% YTD". Au contraire, seems to be up 5% YTD and 25% in the last 5 days.