Dear reader

Last year my forecasts on Venture Life Group were closer to reality than those of the broker (see my article - are you all ears). But we both fell short of forecasting the revenue and profitability progress VLG would make.

I believe this year may be a repeat of the same. Let me explain why.

In 2023 VLG achieved 6.1% of its revenue from the introduction of 28 new lines. That was £3.1m revenue. It also achieved 5.4% LFL revenue growth.

Today we learn 2 crucial facts:

First that 31 new lines have been introduced in just 5 months - more lines than were introduced in all 12 months last year.

In 2023 rapid growth could be observed in new lines.

Lift (Diabetes support) up +20% YoY

Gelclair (Oncology support) +52% YoY

Digital Channel Sales +40% YoY

Second that today’s AGM revealed an “inline” result to management expectations.

One of the crucial questions therefore, is to ask what are management expectations?

Is a repeat performance of like-for-like growth a reasonable assumption? If so, then applying a 5.4% LFL growth to 2024 uplifts the numbers a little. In the chart below I do this using a 45%/55% revenue split for H1/H2 (as in previous years). I also forecast a £4.5m contribution from new lines. That’s £1.5m in H1 and £3m in H2, and that’s £1.4m more than last year. Last year the majority of new lines were introduced in H2. So in 2024 we see the full effect and also the natural growth of those. But 28 new lines in addition. And of course it depends on what the lines are.

Given the pace of new product development but also private labels which was introduced with Boots (the Chemist) in late 2023 and the annual report tells us that relationship is expanding in 2024 but private labels are also being introduced to other customers too - to the extent that future reporting will split this out into its own category. That suggests to me the growth in private labels is significant. If that’s true, significant growth leveraging the brand of Boots is significant.

If that’s true, significant growth leveraging the brand of Boots is significant.

To be “in line” with expectations - I believe that 31 new lines being introduced in 5 months in 2024 that management expectations would be above the £3.1m from last year.

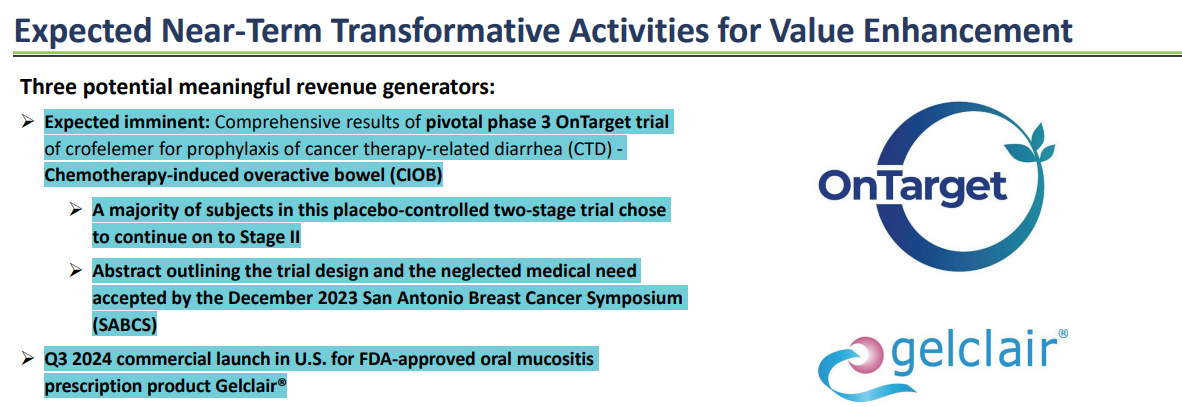

We also know one of these new listings was significant enough to release an RNS on the 19th April. This was a distribution agreement for Gelclair for the USA. I was on holiday when that RNS was released but re-reading it today on a proper screen, I notice VLG’s distributor, Jaguar call this a “near-term transformative activity”.

Before today, I wasn’t clear on what exactly Gelclair was, but think of Bonjela for people with Cancer undergoing treatment and one of the side effects are lesions in your mouth. Mega ouch. :(

In the USA according to the American Cancer Society around 50,000 people a year undergo radiotherapy. Around 400,000 undergo chemo. So based on 30-75% of chemo plus radiotherapy something like 250,000 Americans suffer oral mucositis each year. All require treatment over a few months. Looking at Amazon, Gelclair is something like $2 a day so that adds to $150 per person RRP over 2 months or so. Assuming a 20% market share and minus costs and margins to Jaguar, and even assuming a much reduced 15% margin (rather than the usual 22.5% EBITDA), that nets to well over £1m to VLG. That’s after applying some conservative assumptions.

It’s also the case that the Annual Report tell us that management were focused on improving margins, and delivering gross and EBITDA margin increments. That’s the Management expectation.

In my numbers I include a mere 2% margin uplift in 2024 compared to 2023. That increase is less than the average margin over the previous 3 years. So again conservative.

Here are the resulting numbers vs 2023 and vs the broker.

Compared to the broker who covers VLG my numbers come out slightly higher (like in 2023). Let’s drill into a comparison.

Revenue - the broker thinks 7% growth. Given price rises (at least in line with past inflation) as well as growth of new lines, as well as LFL growth this would be well below expectations because price rises would need to be at least 7% to cover inflation. My numbers come out as 14% but based on LFL growth plus NPD growth plus price increase growth. 14% is quite conservative. 7% feels too low.

EBITDA - my assumptions are based on a 1% lower margin. If the broker is correct on margin then that adds £0.4m EBITDA to my forecast.

D&A - I struggle to see why the broker believes depreciation & amortisation will grow by 32.5% from 2023. My forecast of a 21% growth of D&A costs might be too much.

EBIT to PBT bridge - I was interested to see that the broker believes interest will fall from £1.5m in H2 2023 to £1.6m for the whole of 2024. That’s a very rapid pay down of £24m of debt to avoid interest costs - which I believe will be £0.7m higher.

Despite all of my more conservative assumptions I arrive at a £0.4m higher profit than the broker and a sharp 270% rise in PBT from £1.3m in 2023.

But if my assumptions on interest and margin are incorrect, and the broker is right, then I arrive at £4.6m PBT which is 350% higher than 2023.

That would put this on a PE of just 13 - far lower than its (albeit larger) peers like Convatec (P/E TTM of 32) and Unilever (a P/E TTM of 19).

Arguably VLG sits on some high growth categories too.

Areas like ear wax are high growth where the NHS have withdrawn their services (except in emergencies) and self care is the only course of treatment. VLG’s acquisition of Earol has been a tremendous success, in the 2.5 years since December 2022. VLG intend to become the category leader and they believe they can achieve that.

Some products are in a less competitive space, and therefore have strong pricing power. For example I’d be very surprised if a single one of my readers knows the competitive prices (and even brand names) for Proctology products - if you need it you don’t care about the price, I would imagine.

For people with various skin complaints, it’s much the same. Rosacea, fungus fingers, you want a fix - asap. For these products you are probably a repeat buyer too.

You’ll recall I assumed a like for like growth of 5.4% (which excluding new product lines would be £54.68m (almost what the broker assumes as total revenue for 2024). But this chart from the VLG 2023 annual report is interesting. This shows by product area the growth by area.

If we apply those same 2023 growth rates in 2024 we arrive at £57.1m. If we then assume the same £4m of sales through new product development that’s £61.1m - £6.1m higher than the broker.

That puts VLG on a 4X PBT compared to 2023 and the P/E falls to 11.

Sweat the assets - spread the costs

Looking at their gross assets, 2 factories and current assets back up 80% of the £52m market cap, but net tangible assets are only ~£2m. However, those factories are at about less 50% capacity so any growth requires minimal capex, and helps spread fixed costs over a broader base - meaning margin expansion.

Intangible assets are just under £75m (goodwill and product development) and those assets take this to 1.5X the market cap. So the question is the extent to which you value the products, the distribution partnerships and the brand equity. The fact that VLG products regularly achieve shelf space in retailers is an intangible too - not easy to get that space if you don’t have it.

In fact 28 partnerships with 47,277 outlets (plus online) selling 850 SKUs. VLGs market presence is quite impressive and one that generated nearly £11m of op. cash flow (up ~50% on 2022). Margin expansion, rising sales and falling debt should deliver at least a £4m improvement to cash flow in 2024, I estimate, so around £15m. So <4X P/FCF.

Conclusion

At a forecast P/E of 10-12 and forecast <4X P/FCF comparing it to peers on a 20X P/E basis it’s easy to see how VLG can get to 75p+.

Comparing VLG to peers like Unilever or Haleon both on a 16X P/FCF basis, VLG is really cheap. 75p, if not more.

Of course you could sneer and say comparing VLG to Unilever or Haleon is no comparison. VLG’s Earol or Dentyl are mere minnows lost to the colossus Unilever with its 30 power brands pictured below.

That’s true, I’d reply - but unlike Unilever or Haleon - VLG is an easy to swallow £52m mar cap - and is ripe for a takeover in my opinion. Could the giants get taken out at a 50% premium? Could they ‘eck!

Apart from speculating on a take over, the reason you’d pick VLG is it offers investors a niche healthcare company, that’s mainly in defensive and growing sub segments, with attractive fundamentals and is a completely different dynamic to the hyper competitive mainstream where giants have those 30 power brands and spend vast sums on marketing to battle for survival.

Regards,

The Oak Bloke.

Disclaimers:

This is not advice

In general, Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Good company with good prospects for organic growth and eventual add ons.Not sure to which degree it might become a takeover target for really big players as the business is too small to move the needle for them. Also they would end up with a bunch of non globalniche products which they often try to unload.But hat makes VLG attractive... I am long!