VSL-state

Discount analysis on VPC Speciality

Dear reader

VPC is in a period of wind down. Its dividend on a “headline” basis is one of the strongest on offer at 16.84% per annum but is that good value for money? Is it “real” and sustainable? And should existing shareholders hold on, average down, or exit?

VPC’s monthly reports Jan and Feb 2024 as well as the 2023 annual report give little scattered clues but each are partial pictures to the mechanics driving the share.

The NAV 31/12/23 was £225.1m since then we know as at 29/02 there’s a 1% YTD reduction in the NAV, we know a dividend has been paid, plus a £11.9m capital return has occurred. Net of those items (but not including income titled “revenue return” which is about 1.16% per month so about 5.2% YTD) we arrive at £205.4m

NAV of £205.4m or 73.82 pence is a 36% discount to NAV compared to today’s share price (46.7p bid / 48p ask)

If we add forecast income extrapolated from 2023’s revenue return that’s 1.16% x 4.5 months we arrive to 77.67 pence and are at a 38.2% discount to NAV.

But eagle-eyed sceptic readers might say Ah hah, but what about the -18.34% capital return suffered in 2023. That NAV is not real. They won’t necessarily be able to explain why, just that it isn’t. Somehow. Well let’s examine the NAV a bit further.

The NAV is made up of four components. Current assets cover debtors, cash and prepayments.

Current assets money is more or less “in the bag” so discounting that would be strange.

We then have £161.2m of Loans and those are largely what drives the revenue returns (about 90% of returns). Equity drives 10% of revenue returns i.e. via dividends and these comprise £77.5m of assets. There is then a debt component that is creditors (zero interest) and a Credit Facility and this is being paid down - nearly £60m was paid down in 2023 so will be completely paid down during 2024 (albeit 0.18x gearing in Feb 2024’s newsletter shows debt has increased - and it will get used temporarily as they use the RCF facility for working capital)

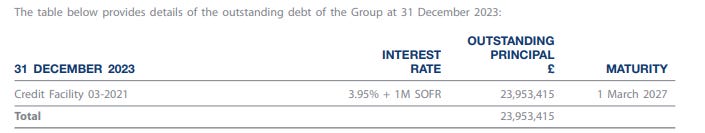

Debt at 3.95% + 1m SOFR = 8.5% interest and equates to a £2m saving once all debt is repaid. Higher interest rates obviously have been a slight drag on performance for VSL.

Equity

Turning to equity these are the top 10 positions comprising £55m and there’s £22m of other stuff. Negative capital returns in 2022 and 2023 were majority equity losses - which isn’t a surprise. Equity comes lower than debt in the pecking order in bankruptcy. There have been some bankruptcies which explained some losses and others where there is a mark down on a mark to market basis. But what remains arguably has the “bad news” now in the price. HeyDey is in Chapter 6 bankruptcy but there’s £1m left in valuation so is no longer material (but still may offer some upside if it can successfully trade out of chapter 6, or get acquired). In fact during Jan 2024 positive news of HeyDey’s peers forming a merger of Razor and Perch (creating a $1bn turnover Unicorn). Also VSL’s sale of Bakkt at a profit was well timed as post sale Bakkt fell by over 80% so nice one VSL!

The US macro story of a soft landing, strong jobs growth, a dovish Fed or at least the perception of this, and interest rates reducing later in 2024 (or at least the perception of this) all bode well for these equities. For example recently an ecommerce company like Klarna is mooted for a $20bn IPO which is 3X its current valuation so it is not inconceivable ecommerce and fintech assets have upside from here. In 2021 the capital returns were +25% not negative. Is there a recency bias built in to that discount to NAV?

For example Post Period L&F aka ZFox was acquired at a 45% premium. VSL has a £5.94m holding so that’s a £2.67m gain to be realised in the “next few months”. 50% uplift to that NAV component.

WeFox is in Trouble (updated 21st May 2024)

L&F isn’t the only one. There remains the possibility (probability) of VSL’s largest equity holding WeFox also moving to IPO in 2025. However, bad news struck yesterday just as I released this article when Sky News on the 16th May released a scoop that WeFox faced bankruptcy. Clearly that paniced markets and WeFox holders VSL and CHRY tanked as a result late yesterday PM.

As far as VSL is concerned, the WeFox holding (£20m) is 7.2p per share, or 5.3p per share considering the 36% discount to NAV (i.e. failure is already priced in to some extent). Reducing by 5.3p assumes the equity holding is worth zero - that bankruptcy if it happens leads to 100% loss. The Sky News article stated WeFox circulated a letter earlier this month to its investors, but CHRY report this morning that in fact they’ve been in talks with WeFox for much longer. The recent appointments of a new Chief Risk Officer and new CEO replacing the founder clearly are being driven by investors. CHRY go on to state “A plan has been put in place to simplify wefox's business model to drive the company towards profitability. Following these conversations, the Investment Adviser believes there is a route to ensuring a successful outcome for wefox and Chrysalis's investment.

In recent weeks, wefox has raised approximately €20million from shareholders, to which (CHRY).. contributed €3million in support of the aforementioned strategy; the (CHRY) Investment Adviser continues to consider how best to support wefox achieve its ambitions and is confident of continued shareholder support for the company, if required.”

So CHRY reducing its holding by 1/3 suggests that there's a 1/3 chance of failure, or more likely that there’s going to be a 1/3 dilution. It would be prudent to assume VSL will suffer a similar mark down. Because if bankruptcy were certain CHRY would have written it down to zero. 7.2p reduced by one third is a reduction of 2.4p per VSL share. (which in fact is the amount the VSL share fell by yesterday).

The WeFox CEO Mark Hartigan says "The opportunity to rebuild through restructuring and any optionality for the future remains dependent upon reaching [a] sustainable position by balancing cashflows with the timing of our planned disposals," Two weeks ago it appears WeFox has already disposed of its Italian business according to the Coverager - so it's already making progress it seems.

But it everything as it seems? Is the CEO doing an “inside job” to panic the market? As revealed by Donald Pond on Pond Life - Mark Hartigan attempted to panic LV (London Victoria) into a sale back in 2021 to a PE house where he would personally benefit. The article reveals Hartigan allegedly stands to receive £20m if he can force a sale of WeFox in 2024.

So next month’s update on WeFox may contain some interesting commentary. In time it is also possible that CHRY may look to take VSL’s WeFox holding. They took Jupiter’s holding of Starling, so watch this space.

Why the equity discount is overdone?

To suffer a negative capital return equal to that in 2022 oand 2023 would essentially equate to about 66% of the remaining equity being worthless. The discount to NAV is so large that if 100% of the equity were worthless then the NAV net of equity is still 53.06p and there’s STILL a 9.5% discount on NAV.

Loans:

The top 10 loans and other loans sum to £161m. These generate around a 15% return.

These have a repayment schedule which is shown below.

In the next 12 months over 40% of the loans will settle. The chart below is net of debt (£24m) plus about £45m of paydowns up to Q2 25. Obviously the 16.84% dividend will reduce but it’s likely to continue for another 4 periods at 2p a quarter - so an 8p a share return. After that (Q3 2025) it probably drops to 1p a quarter for another year and after Q3 2026 perhaps drops to 0.5p a quarter until the end of 2028.

If that’s the case then that’s 16p of dividends over 4 years. In 12 months time alone deducting 8p from today’s 48p buy price is equivalent to buying at a discount to NAV of 45.8%

Remember too the 73.82p estimated NAV is net of a 2p per share dividend in Q1 as well as a 4.26p capital return of B shares in April 2024. In other words we are on an 80.08p NAV as at 31/12/23 less distributions in 2024. Less a 1% YTD loss.

Conclusion

Recency bias feels a good way to understand the discount here. It’s been bad for two years so 2024 must be bad too. Holdings in wind down must equate to a fire sale.

But there’s already been positive news in 2024 and there’s so much bad news already built in to the price - it would take a spectacular 1929 style crash to achieve what the market is assuming and ignoring that the US and UK are doing nicely thank you - on Bloomberg this morning “Maybe we are experiencing normal for longer” was an interesting comment. The nature of VSL’s assets are that they continue to generate strong returns over their contractual period of about four years, albeit returns fall as capital is returned.

Meanwhile because the liquidation of assets is reasonably near term that in the next 12 months it’s likely that there’ll be a 10p-15p capital return and 8p dividend. So potentially 50% of today’s share price.

A final thought is VSL is the sort of share which Simon Thompson of the Investor’s Chronicle likes to spot. VSL is like another Urban Exposure which was one of the ideas he advocated I believe in this article from 2021, or I believe he spoke of Amadeo earlier this week. VSL will reduce costs and probably delist at some point to save money, after which returns then get paid into your SIPP or ISA as cash - they did for me with Urban Exposure.

Regards

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings including those held in Investment Trusts might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

20th May update

VPC’s March 2024 update delivers good news. First that the NAV has increased in March by 0.64% so YTD now is just -0.36%. (where most of that “loss” is just FX movement)

Second that a follow on £0.4m has been invested in WeFox. VSL holds preference shares and convertible debt with WeFox so is ahead of other investors. Notably there is no reduction in the WeFox holding suggesting that CHRY’s 1/3 reduction may be cautionary and therefore we unwound in the coming months. CHRY is up 5.4% today suggesting that the WeFox “bankruptcy” was tabloid headline grabbing but not actually the case. VSL state they will provide a more detailed update on WeFox in 1 months time.

some really good analysis here. today's "news" on WeFox might even present a better entry point. also worth noting that VSL doesn't hold loans at amortised cost: it has taken ECL reserves of £6.4m at year end 2023 (vs 16m at end 2022). so if loans are repaid at par that's another 6m you need to add to the NAV

Hi Oak. I just had an idea - Bakkt is up over 29% today, it being carried up on the waves of the melt up in crypto. What percentage of NAV of VPC is their Bakkt holding? The underlying NAV may now be significantly higher.