Dear reader,

Investing into the management of too little (and too much) can be smart business. Anyone who’s studied Marketing knows Abraham Maslow, and the hierarchy of needs. Physiological needs trumps all others. Apart from breathing, water comes 2nd.

IntelliDitch™ Versaliner™

The next lesson was to create a clear marketing proposition and brand. Somewhat bizarrely, what was until recently called Intelliditch is now rebranded Versaliner.

Was it intelli to ditch? Versus Versaliner? I’ll leave you to ponder.

Step one of a marketing plan is to define the problem or pain.

The Problem, the pain

Moving large volumes of water, such as from rivers to farmland, typically involves concrete or earthen channels. These types of channels lose water into the ground but are relatively easy to deploy. This is a trade-off which is acceptable when the price of water was cheap. However, today, climate change and water shortages have altered the equation by significantly raising the cost of water loss and the maintenance required as the earth shifts and concrete cracks from degradation over time. Customers now need a solution that both moves water efficiently and protects against water loss and reduces maintenance costs of aging infrastructure.

Water Intelligence’s Product

Versaliner is a new and patented product for 2024 which might look like a picturesque water slide but is actually, on closer inspection, a means to channel water without leaks, erosion or water loss. Versaliner is a HVPE ditch lining. It qualifies for the US National Resource Conservation Code 428 which basically means the Fed will match fund (50% off typically). Or means WATR make double the money and pocket the other half :)

Its corrugated high density polyethylene competes with concrete which as all ditch-ficionados will know can spall and crack, even after just a few years, whereas ALD’s ditch tech is good for 20 years or (much) more. This alone saves between $7k-$23k per annum on water costs in the US, let alone the crop yield losses due to a lack of water! Or penalty charges for over extracting water.

VersaLiner leverages a patented design and high-density polyethylene (HDPE) material to deliver water efficiently with close to zero losses due to leakage. VersaLiner also provides puncture and abrasion resistance, chemical resistance, and consistent top-level performance through repeated freeze and thaw cycles. A mechanical connection between liner sections also allows for a small degree of movement, giving the system outstanding performance with low maintenance. Finally, VersaLiner is easy to install with a small crew using only hand tools able to cover more than 500 linear feet per day.

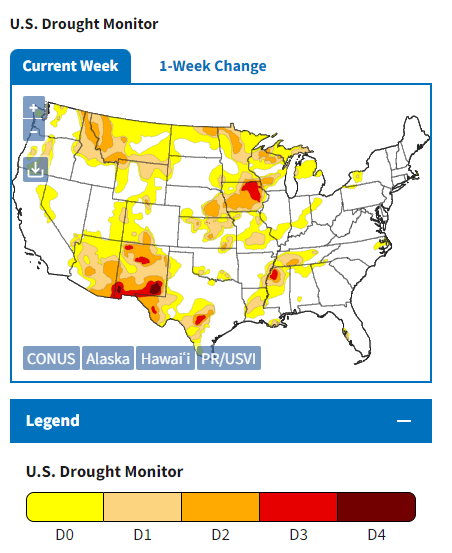

The US Drought-o-meter. 19.46% of the lower 48 are in drought status, and much of that is in farmland. There’s an almost unlimited need for Versaliner.

Successful first deployment - and Validation of Results

ALD personnel (N.B. ALD is part of Water Intelligence) worked with Ferguson LLC to deploy VersaLiner to rehabilitate the Nottingham-Puder ditch on the Eagle River. Prior to deployment, the ditch did not deliver a government allotted water right of 2 cubic feet per second (CFS) to an agribusiness location. The water sank into the ground.

Moreover, beyond the delivery to this agribusiness, more water is needed for the town further downstream. ALD's water management solution was deployed to solve the water rights allotment problem but also to test how much more water could be conveyed to the town without loss and how quickly.

Validated Results: On May 13, 2024, field tests showed outstanding performance of the ALD water management solution. After six months of deployment and through a full seasonal climate cycle, 6.78 CFS of water was diverted from the Eagle River into the Nottingham-Puder lined ditch, and 6.59 CFS of water was delivered to the town at the end of the ditch in less than half an hour, resulting in water retention of 97.1%.

VersaLiner solved the problem of inadequate water delivery and the amount of water that needed to be diverted to satisfy allocation obligations. At the same time, VersaLiner decreases future maintenance costs for the Nottingham-Puder Ditch. With its lower installation cost, VersaLiner paid for itself.

Laura Finch, Product Sales Specialist, Ferguson remarked: "We could not be prouder to have the opportunity to work with ALD to decrease water loss through value engineering.”

Who are Ferguson?

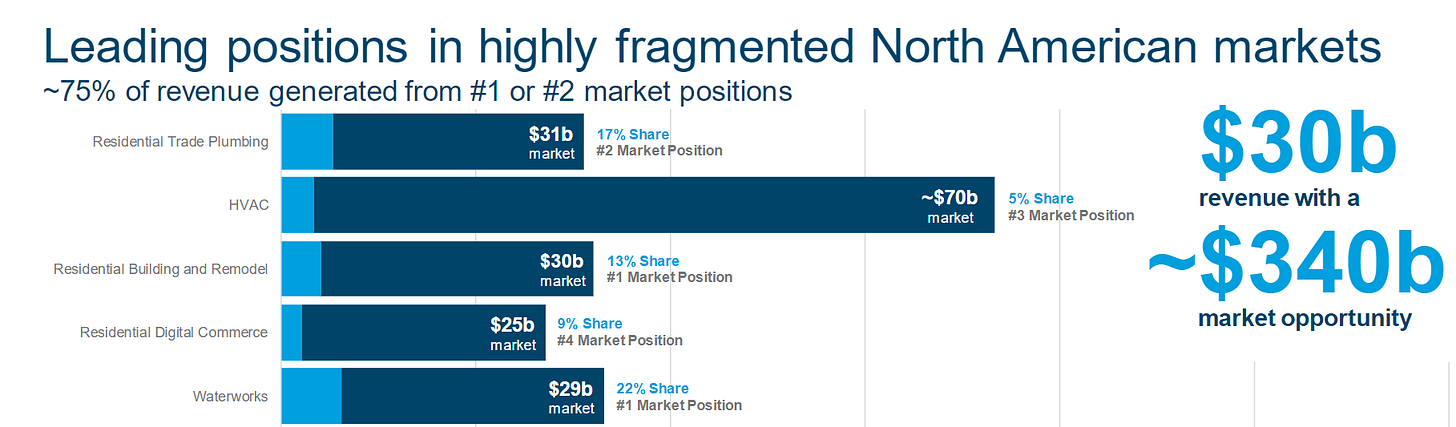

The US Waterworks market is worth $29bn per annum, and Ferguson have a #1 position in that market and a 22% market share.

SIGNIFICANCE

Versaliner is a ***patented product.***

Did the market realise the value of this proof of Versaliner’s effectiveness when they announced the outcome of the trial?

Did it ‘eck!

The fact that Water Intelligence is planning to sell its products via distributors like Ferguson is highly significant too. This is the first time such a partnership has been announced. Until now its products have been sold as part of its direct leak detection work, and via its franchisees but not via distributors. In the recent article watr-is-a-goin-on-aheh I spoke of the significance of the reacquisition of the Fresno California operation and its connection with agribusiness, but also the new franchise in upstate New York, and its access to wine growing. It’s clear they are thinking in terms of selling product, not just expanding service.

Versaliner isn’t WATR’s only patented product either.

Eagle-eyed readers know about Pulse:

Pulse

Pulse is another new product for 2024 and uses an acoustic excitation fired through a pipe to work out either blockages or damage in a pipe’s interior. Compared to CCTV on a little robot trying to see damage where the surfaces are smeared with detritus it’s a much faster and more thorough way to detect damage. Prevention is better than cure, so tackling damage before it becomes a blockage is a major usp. The device has been designed to minimise the cost of skilled labour for infrastructure surveys and is already used at three different UK water utilities.

Did you spot that Ferguson has a 17% market share in the US Residential Trade plumbing market? (a $31bn market).

CreatorSuite 2.0:

Starting in 2024 CreatorSuite is an AI video ecommerce tool that enables the Group to make video moments of its products and services with “end-cards” that more efficiently convert leads into purchases. The product has been tested in various business-to-business channels with significant improvement in lead conversion. Water Intelligence has an exclusive licence to the tool for the field of water and wastewater.

LeakVue™

The LeakVue™ system uses a laser sensor to detect changes in a water’s surface of a swimming pool. It sends its findings to a screen that displays a graph of rises and falls and determines whether changes in the water come from a leak or natural environmental factors.

NAV backs up 100% of the market price

Balance sheet - the trading update doesn’t give us a full balance sheet but the market cap at £64m, prior year at £56m it wouldn’t surprise me to see net assets at £64m in 2023. So on a net assets basis you are paying £3.75 a share for £3.75 of assets which are profit making. Included in that the value of the patents will purely be the capitalised intangibles.

Having written about ZTF (Zotefoams) a few days ago, where the assets backed up about 40% of the market price, and 60% was the potential of a foamy milk carton, WATR seems very cheap in comparison.

Hidden Value

It is also of note that there is investment hidden in these numbers in a number of aspects:

a. The value of efficient systems

$3m investment in Salesforce. I attended the Salesforce conference in London last week, and was deeply impressed by the capability of its Einstein AI, the integration with Slack (including AI) and process flows and automation which can transform a business. Watch this Aston Martin proof of concept - and think how WATR are doing something similar.

**STRONGLY RECOMMEND YOU WATCH THIS VIDEO**

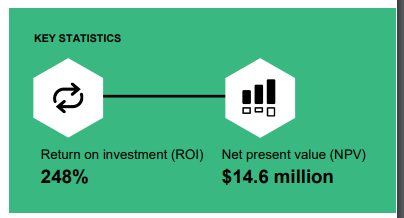

The Capex vs Opex of this I’m assuming at 50%/50% which means profits are $1.5m lower due to the one-off implementation cost (PBT grows 40% if underlying profit was therefore $7.7m). Typically for a CRM/ERP project the payback on this in terms of efficiency is usually positive. More capital means more productive, efficient and therefore less units of labour. So arguably the +$1.3m cost (franchisees contribute $0.2m) should be offset by reduced labour and administrative costs. This is a link to Salesforce's Total Economic Impact study.

The other impact is better ability to manage recurring revenues (contracts) and to handle renewals, cancellations, additions and reductions. To auto calculate revenue recognition. To apply AI into aspects like coding of transactions, scheduling and providing a seamless back office/front office comms link between the people on the coal face and the people co-ordinating them.

The corollory of this is the time it takes to train Leak Engineers. 18 months. That’s a substantial cost and making these “expensive” people more productive is usually where software systems help. If they spend more time mining coal and less time standing in mine shafts you get a sharp economic benefit. Sharp meaning 10%-20% productivity potentially more. It’s also the case that upsells are easier once you’ve established trust, and given the US Water Industry is worth $20bn alone, there’s plenty of coal out there to be mined!

b. Insurance and playing the Claim game

Rather than just marketing to home owners, and coming at this from the perspective of the individual, gaining agreeents with two insurers are enormous wins. These wins have been supported by national coverage, but also better systems and processes, security and “Professionalism” delivered via Salesforce which will better meet levels of service while providing data security and customer analytics to support customer claims. Huge value adds for the insurer and a huge value add for WATR.

I read both WHI’s and Dowgate’s analysis and there is zero consideration given to the increase to sales this will bring. Past network sales growth were 3% so that’s the target given by the Brokers for 2024 more or less.

The significance of the news of the two contracts with national insurance companies, also could mean further product sales too. For example customers buying leak detection services, get a discount on their home insurance. It’s pretty much a win-win-win for home owner, insurer and WATR to offer something like this.

The value of these contracts is not disclosed and perhaps they are a schedule of rates rather than any of fixed volume but water-related claims was one of the largest sources of home insurance claims, with average claims in 2023 being $11,605 and restoration costing between $1,322 - $5,954 and that 1 in 60 home owners made a claim for water or freezing damage.

Thinking WATR will only achieve 3% revenue growth in 2024 seems far too low.

c. The UK Water Pollution Cover Up

I imagine more people than just the Oak Bloke wrote to their MP following an episode of Panorama and this Dispatches doc. I was fuming to learn that a discharge of 2m gallons of raw sewage could be classified as no impact.

If you didn’t bother to complain shame on you, but you will nevertheless, be pleased to hear the government reacted to the Panorama programme and are ratcheting up pressure on Water Utilities and that’s good news for WATR. £60bn investments are planned by UK water companies. Will WATR get a slice of that action with products like Pulse, Intelliditch and LeakVue? Will they provide services like sewage flood monitoring? I think the answer is fairly obvious. 3% growth? Give me a break.

Similar problems and challenges exist throughout the world. The UK isn’t alone in being challenged by sewage.

d. Penultimate Thought: Franchises and the strategy of buying them up.

There is a fixed and various cost and therefore margin trade-off between franchise royalty growth and corporate-operated growth. The margin on services is 29% and therefore higher than the 6.75% royalty margin. The other difference is the extent of additional fixed management costs and reduction of contribution to shared costs (e.g. Salesforce) for franchisees.

In the trading update acquisition of the Pittsburgh franchise is announced at a cost of $0.5 million, based on pro forma sales of $0.5 million and net income of $0.12 million which WATR believe they can grow. Royalty of $33,750 would grow to $120,000 which puts the buy on a “P/E” of 6 ($86k/$500k) but a PE of 3 (so profits double) if sales increase by just 60% (60% of $500k at 29% margin is a further $86k). In other franchises a 3% improvement is noted.

So a WATR guide to swallowing up your Franchisees would look like this:

What marginal management fixed cost? -A

What current sales? 22.25% of B

What upside service performance? 29% of C

What upside product performance? D

Cost of acquisition: -E

Cost of Debt, if relevant: F = 8% of E

B+C+D-A-E-F

To me especially as they can pick between dozens of franchises generating $94m of sales to choose which franchises to reacquire it provides a growth engine both to widen the network and buy up growth at a low PE. Compared to establishing a brand new office taking on a going concern with a bank of customers and who already are loyal to your brand is a dream. Remember you’ve got 100% visibility over every metric via Salesforce to see exactly how well each franchisee is performing. When they say Pittsburgh offers upside they know exactly how and why.

Conclusion

Having heard from analysts and pundits saying this was a steady eddie stock that won’t shoot out the lights I think there are reasons to think it will do much better than forecast, has dry powder to pursue growth opportunities in 2024, so is an interesting stock especially when you consider it’s defensive, has growth tailwinds yet trades at around its net assets.

The patented Versaliner proof of concept results are fantastic.

Plus the news that it is distributing via Ferguson a $30bn turnover giant and the #1 market leader of US plumbing and waterworks.

This is not advice.

Oak