Dear reader,

This week there was plenty to please from Pease. From builder Watkins Jones’ CEO Alex Pease, of course. No banana(rama) slips; no cruel, cruel summer.

Congratulations to readers who followed this idea from the OB25 for 25 as those readers enjoyed ascension at some level of g-force.

So this article focuses those results, as well as on “what next”. Also is 29.2p too expensive now?

CASH

There was a £24.8 “disposal” which was a covert sale so £55m net cash flow puts this at 1.36X Price to Cash Flow. That 21.4p cashflow per 29.2p share. Think about that.

Then think about how between cash and debt WJG has 55.75p of cash headroom per 29.2p share.

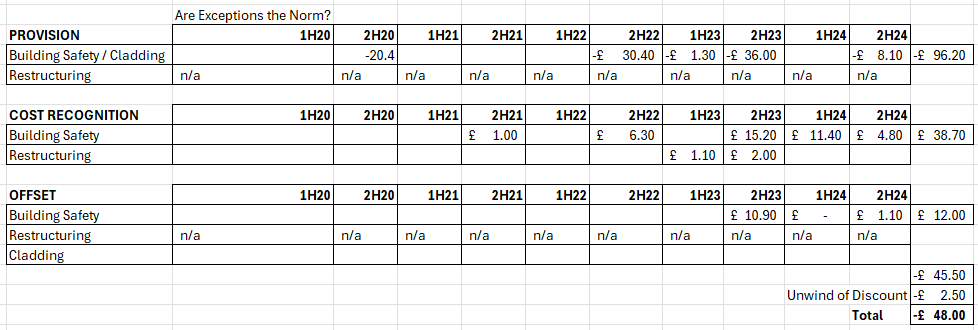

Cladding

Other commentators spoke of “watching out” because of “important exceptional charges” painting quite a negative picture. The true picture of £4.8m crystallising the P&L cost in 2H24 only reveals itself when you consider that cost recognition in 2H24 was much reduced vs prior periods. It’s true that £8.1m of additional provisions were expensed to the P&L (£7m net of customer contribution), but the £2.5m offset is also a reduction from the £3m unwind in the interim.

So underlying operational profit (excluding the above) therefore was £44.9m (net £40.1m). So each 29.2p share generated 17.5p in FY24 operating profits excluding exceptions.

Forward picture of cost recognition is a 10% acceleration to a net -£5.3m each period in FY25, dropping to a net -£3.75m per period from FY26-FY30 (plus inflation). So it’s a modest medium term drag but a very manageable one. What about the Donald Rumsfeld? i.e. Should readers “watch out” due to unknown unknowns?

Not if they are known unknowns, dontcha think? It’s a bit annoying investors couldn’t have been told this far sooner but we now know that 8 properties could potentially be added to the provision. I mean this isn’t like illegitimate children coming forward to claim an inheritance, WJG know precisely how many tall buildings they built. Anyway, we are also given a -£0.9m per property estimate. So a MAXIMUM -£7.2m could be added to the £48m, less any offset, plus any cost inflation of course. So -£3.75m might worst case become…. -£5.3m FY26-FY30. I fear the FUD brigade face an uncertain future harrumphing about WJG, doubtlessly.

In fact turning a challenge to an opportunity is the sign of brilliant management - we know there’s a fair bit of remediation work going on don’t we? So let’s help others too. Let’s also profit from our loss.

Revenue of £10.9m in the 6 month period to September and £1.5m GP is an additional £22m / £3m annualised gross profit going forwards. Think about the fact there’s 1.2p per 29.2p share of gross profit which didn’t exist a year ago.

Incredible as it may seem to readers, today’s students demand ultra fast broadband, fitness areas, saunas, smart building technology, cinema rooms, private dining, concierge services and cultural experiences. Where there’s elevated expectations there’s profit. Remember there is a profit motive for Universities seeking to pile students high so PBSA really matters.

The other “macro” this leans into is the funding environment. If Universities can’t splurge on new PBSA then at least they can tart up what they got. So that’s where “Refresh” is also growing. 240 schemes and a 538k beds market size is over 100X the current pipeline of 4,856.

Also good to see a Joint Venture approach where WJG (flush with cash) has gone in on on a 25% share investing £7.95m, where hopefully that translates into double profits, not just on the build but on also then selling 25% of the 397 beds.

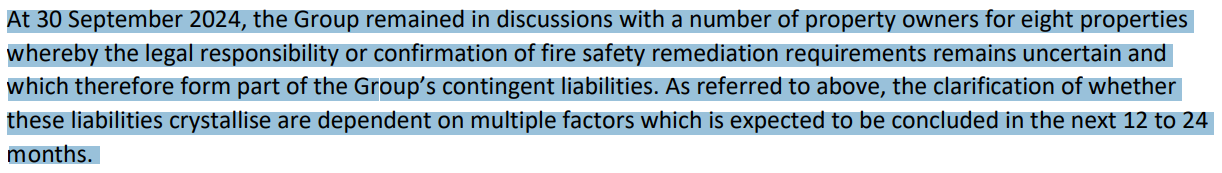

Bare bare minimum prices for Stratford are £200k per bed to buy or £295 per week to rent, so that would mean sales totalling £19.8m (less selling costs). Would it be cheeky to assume a £11.8m gross profit on top? Or a £1.5m gross rental income? Or £21.7m, gross profit given the gross development value is £120m?

I’ll leave you to ponder the size of the rectangles reader, but clearly when WJG’s customers forward buy projects they are doing so because in the future it will be profitable, and we know there is an acute structural shortage in LB of Newham.

A further positive is to consider the (logical) synergy being a PBSA constructor that you’re likely to win the property management afterwards - which we see at Stratford.

Tossing ammo to the FUD brigade

WJG didn’t have it all their way in 2H24.

Mole-eyed superficial analysis missed the concealed losses at Affordable Housing and Fresh. But eagle-eyed readers would have spotted that the number of beds and apartments under management dropped from 23,064 in FY23 to just 18,656 and so the 2H24 performance was substantially worse.

Understanding the turnaround in Affordable Homes

We see build costs caused the operating loss in 2H24.

To tackle this improving the mix of units seems sensible.

Understanding the turnaround in Fresh

Reduced units, delays and inflation all hit Fresh - aka the so called cost of living crisis. The investor call explains the loss of a key client (who strategically decided to inhouse their halls of residence)

It sounds like accommodation management has suddenly become a miserable place to operate - with competitors exiting. Perhaps the strong margins and the downturn in commercial property led other companies to jump into PBSA building management. Will they remain? Fresh has 11% market share and is 3rd largest provider.

The white label offering sounds sensible, and WJG are doubling down to grow Fresh, recruiting and investing into a BMS (Building Management System) called…. Yardi.

Yardi - manage all the buildings and tenants in your ‘hood with a cloud-based portal; which helps meet the expectations of those sophisticated fine dining students, but delivers efficiency in case management, revenue recognition, lease accounting, doc mgt, maintenance mgt, scheduling and the endless red-tape management.

Pipeline

Compared to 1H24 we see a £170m increased PBSA pipeline, £140m BTR pipeline, plus a new Partnership pipeline of £240m….. that’s £550m MORE pipeline than reported 6 months ago.

Another way to look at that number is to consider that FY24 revenue was £362m so the pipeline grew in 6 months by 18 months worth of revenue.

the pipeline grew in 6 months by 18 months worth of revenue.

It’s true that the secured BTR/PBSA development pipeline of £1.3bn is lower than 1H24 of £1.4bn and £1.5bn at 2H23. That was based on 2 sites exchanged in FY24 while here we are in FY25 with 4 sites under offer.

BTR/PBSA revenue was £329m in FY24 so £1.3bn still represents 4 years of order book at FY24 levels of activity - and Fresh has £450m which is over 41 years of order book at FY24 levels of activity. I’m joking about 41 years - on the basis the run rate grows to £100m (i.e. it’s a 4 year order book too) then that’s half of the pipeline yoy “loss” is gained through the new activity anyway. Right now there’s £55m in 1-2-1 negotiation.

Interest and Gilt rates will determine the improvement of forward performance WJG tell us, and how many is uncertain, meanwhile the Fresh refurbs and the JV partnerships offer other paths to market.

Markets expert Cockney Rebel reported “(WJG) have recently done a development with Haworth Group, HWG, with no upfront cost (to WJG) using Howarth Group’s land, meaning the contract was cash generative from day one. The new CFO seems to be demonstrating smarter thinking than the previous CFO. They seem to be targeting a lot more capital light projects.”

Based on the WJG web site I constructed this view, but note this pipeline doesn’t include any Refresh or Fresh pipeline.

Conclusion

WJG fell precipitously due to cladding and cost of capital.

The risk from cladding now appears to be…..contained. Yes, there is a cost for the next 5 years but this appears better contained, and crucially we now have a number of buildings that could still be added - 8 at £0.9m each. Housebuilding is a cornerstone government policy which makes further legislative liability seem quite inconceivable. There are also other avenues of insurance and sharing of the liability which appear to offer upside too.

The second challenge of pipeline and forward selling also appears to be contained. Yes, there is a drop in secured pipeline from £1.5bn to £1.3bn (4 years of order book), but a strongly growing pipeline, including one which is “capital lighter” involving its new Refresh division. This is a colossal possible 538,000 beds PBSA opportunity for students expecting, nay demanding their curated living experiences.

But more than this, WJG is also taking a stake and sharing in the upside in Joint Ventures, because WJG is fortunate to be able to use some of its £143.2m cash pile and borrowing facilities as well as having strong £55m annual cash generation to invest into its pipeline too.

So am I selling WJG at 29.2p? Not when I can see, love in the first degree.

Talking of first degrees…. I talk through the idea here:

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Enjoyed this write up. I see where the company said they are in discussions with 8 property owners regarding cladding remediation works but when and where did they indicate that this was the maximum number of properties requiring remediation? Also where does the £0.9M per property estimate come from?

Great analysis!