*** 50 readers have now helped give a HAND UP to the ex-homeless via this Emmaus Charity Fundraise. Thank you!

Dear reader,

WJG for less than 19p. Less than a tin of baked beans from those past student days!

I’m digging the student digs and digging the build to rents, digging those high-margin student accommodation management fees and digging the affordable homes. All sectors receiving a wall of Labour’s largesse in 2025. Thank you very much Sir Starmer.

And not just the government tier, a second tier of investment exists too. Knight Frank’s November 2024 survey captures the views of investors who see PBSA and multifamily housing as most attractive and plan to increase their investment allocation by between 40%-100% in 2025.

Watkin Jones (ticker WJG) is a leading developer and manager of housing and accommodation. It has four segments. First residential “for rent homes” in urban areas of the UK targeting young professional and families. Second Student accommodation in key university cities across the UK, including London, Manchester, Birmingham, and Edinburgh. Critically it sells developments to Institutions who then deal with Joe Public - it does not sell direct. So a customer would be the likes of RESI which I’ve written about before, and which is currently winding down. Thirdly it develops Affordable Homes and this has historically been a small segment but is now growing. Fourthly it manages buildings and runs the services like concierge, maintenance and gardening. This is a highly profitable but small segment.

WJG say:

“We operate in attractive markets with long‑term growth opportunity. With growing demands for housing and a changing rental landscape, our developments are answering a critical national need.”

In that case WJG should be a slam dunk. So why the near vertical decline in August 2024? Let’s find out.

An August 21st profit warning is the culprit.

On one hand the “Refresh” is gaining good traction and two further completions are expected (now delivered) in this year.

We are further told ratre cuts will help with liquidity. Today we learn rates remain at 4.75%.

The actual problem is a lower number of transactions. WJG’s customers typically use Debt to part finance purchases and of course debt has been more pricey of late. So while rents are rising and demand is high, WJG doesn’t sell to Joe Public and doesn’t directly benefit. But consider this. Rents are up 8.7% in the past 12 months.

As UK rents rise the economics of engaging WJG to build improves and improves, despite the cost of capital. At the end of the day it is simple economics.

Read on reader, because there are revelations later on that those simple economics are driving activity.

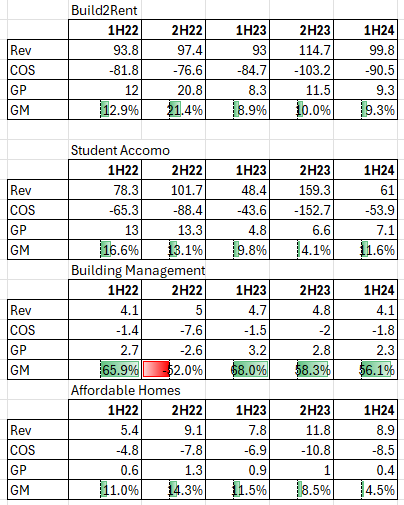

The 1H24 gross profit of £18.4m is around 10% and 10% is in keeping with margins over the past 18 months, and is about half the prior margin average of around 20%.

Overheads have grown a little but what caught my eye was 2H22.

A £2.4m negative cost made me go Huh? But the answer lay in section “3.3 Business Combinations”. A divestment created this so there’s £17m extraordinary income hidden in that line of cost. Strange way to deal with income, never seen that before.

Moving down the list even mole-eyed readers will notice exceptional exceptional costs. One word: Grenfell. Named Cladding then Building Safety this refers to legislation introduced since Grenfell to sort out flammable cladding in high rise buildings. This has cost WJG £80m so far. Of that -£34m has been recognised and the rest provisioned. You’ll actually see a -£57m provision for future liability however +£11m of that has been negotiated as the liability of the customer, so the liability is £46m net.

Now, this extraordinary cost is not WJG’s fault. It is an unfortunate tragedy created by the building materials firms, but WJG is caught up in the cost of the clean up along with its customers. It is furthermore unfortunate that the government changed its mind in 2022 as to what sort of buildings needed sorting out. It began with >18m buildings and shrank to those above >11m high. The net in England was widened too from 12 year old buildings to up to 30 years old building. The Welsh and Scots are lagging (unfortunate word) behind but there is no additional liability expected. There is recent talk that Labour will accelerate the remediation timeline which is currently 5 years. Another Grenfell would be politically catastrophic after all, let alone the terrible human cost.

So the primary danger is the £46m gets recognised sooner. Also if further buildings are identified then a further ~£2m per building could be required. However the £46m provision includes contingency costs.

With Cash and receivables of over £94m such an acceleration appears to present no issue to WJG. In fact, I find it incredible that Current Assets less ALL liabilities (including that £46m provision) is £1.3m. In other words if you asset stripped WJG tomorrow you’d have £1.3m left over before you touched any of its plant and equipment and other assets. In other words you pay 26.7p to get 36.1p of cash/debtors and 45.6p of property where you owe -44.8p this year and -36.4p in the future so have net 0.5p a share for your 26.7p. But then you also get 11.5p of fixed assets (diggers, cranes, cement mixers, building materials and so on but also leased properties) and 39p of other assets - contract assets, intangibles, reimbursement debtors for the cladding and deferred tax credits.

Peers

Valuation #1 - let’s assume WJG Continues:

WJG has generated a £197.7m on average revenue each half year at an 16% GM rate. This is a £62.7m average annualised gross profit, less a -£25.3m overhead

£19.5m average annualised operating profit and at a -£14.4m Admin Cost delivers roughly £37.4m operating profit over a full year - ignoring exceptional costs. Finance costs of about -£6m a year and Tax -£8m a year gets you to an underlying £23.4m net profit per annum even during a period of four years that could be described as “depressed levels”.

WJG’s peer Grainger has a 5 year average P/E of 15. A P/E of 15 based on a £9m run rate underlying basis puts WJG on a £135m valuation so 2.6X today’s share price and today’s market cap of £48.8m and forecast p/e of 5.6X.

But it appears £200m is too high for 2H24. What if the number is £150m instead? At the same margin that’s a £16.5m gross profit and £2.1m operating profit and £0.4m net profit to September 2024 maybe.

With Inflation moderating, with 300k new homes a year required, vast net immigration (1.1m net people last year), an order book of £1.4bn, improving sentiment, further rate cuts and growth in its high-margin Refresh business there’s reasons to feel that FY25 is turning a corner. WJG says it is targeting a 12% GM %.

Demand and Supply suggests property builder can look forward to higher margins, growth and success.

If we break down the segments we notice Student Accomo is delivering good returns while Affordable Homes are proving nearly unaffordable.

The King’s speech has knee capped Nimby’s and sped up the release of land. WJG said availability and cost of land was a major reason for BTR margins being low so that’s positive for WJG.

Over half of the £1.4bn pipeline is “subject to planning” so speeding that up as Labour have announced would speed up the Forward Sold also.

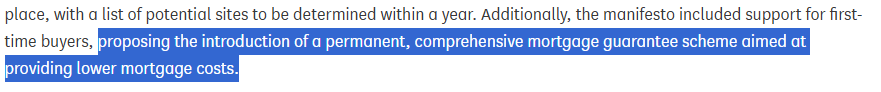

We have seen £5bn support in the Budget to encourage home builders today. 12,500 new homes were started in 2023 vs a 60,000 requirement means something needs to give. Housing is a key election promise and the King’s Speech contained proposals for a mortgage guarantee scheme.

Probably as with other parts of the market uncertainty over taxes and Labour’s budget is holding back investment decisions - until now.

Knight Frank show in their 3Q24 update that PBSA is rebounding in 2024 (investment in 3 quarters nearly equals 2023 full year) and a return to the annual average could be hoped for. But if not in this quarter the prospects for 2025 appear brighter based on the numbers and forecasts for GDP growth, rate cuts and inflation.

A final point of note is the restructuring and new(ish) leadership. CEO Alex Pease took on the role permanently in November 2022 and appears to be a positive impact on the business.

Newsflow

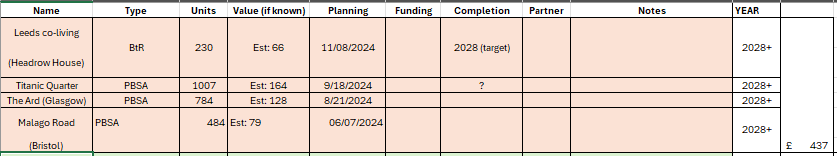

Judging by the newsflow and putting some estimates against projects we can profile the potential 2H24 numbers and the forward order book.

We can see WJG appear to have enjoyed a robust 2H24. An estimated £259m of completions £94m above a minimum run rate cost of sales assumed of £330m per year.

The challenge is looking forwards in 2026 and beyond. You see in 2025 we see a £278m targeted pipeline for 2025 (plus Fresh Mgt). At an 11% margin for that £259m and 50% margin for Building Management with £9m revenue in 2025 we arrive to a £10.5m net profit.

But the sensitivity here is whether cost of sales can truly be flexed. Here I’m assuming it can (i.e. subbies, plant hire, materials are not a fixed cost).

A further sensitivity is that I’m further assuming a static 11% margin. Now the historic margins range from 7%-23%. At a reduced 7% margin (excluding Building Mgt) 2025-2027 would be break even years or a very slight loss.

But I’m also assuming zero growth in the Building Mgt business, only a 50% margin, I’m assuming no more wins and crucially I’m ignoring the £437m unfunded pipeline announced, where we don’t yet know the funding is secured.

As can be seen from the final “run rate” column if contracts roll in nicely and assuming a blended 12% margin and debt is paid off then you can get to a £30m net profit run rate.

Valuation Approach #2 - let’s asset strip this holding!

An alternative approach to arrive to a valuation would be to asset strip Watkins Jones.

Here’s the Watkins Jones balance sheet (I used the one from the last annual result 2H23, rather than the interim 1H24 but they are largely the same - in fact there’s £2m additional equity I’ve diddled myself out of). But I don’t care.

The numbers are strong enough to not need it.

I worked through each asset and considered a worst case and a likely case. As you can see I tried to sell the highly profitable Fresh Business. This is an accommodation management service run for 20,000 student on behalf of Universities. It makes strong 56%-66% margins. Worst case? I can’t sell it. Bang. Gone. But reader. Let me tempt you, probably. Let’s assume you look at my accounts and see £2.5m of profits over several years. What’s that worth? Do I see 3.3X earnings from a bidder in the room? I think £8m for a business like that is achievable all day long.

On a good day 10X earnings because you know this is a growing segment where 294,000 more students demand accommodation compared to 10 years ago. But if I start achieving profits on disposal I’m going to be “too bullish”, so let’s shake on a bargain 3.3X.

Next my sale and leaseback are properties valued at fair value (IFRS15). They will earn an income stream over the next 15-17 years. Worst case? I’m going with a 40% haircut. But the likely outcome is they are in the balance sheet at book and housing has been going up so I reckon realising £24.2m is quite easy. I’m avoiding another gain on disposal.

Next right of use. Worst case - those leases don’t get used. Worth zero. Probably, yes take a hair cut and can sublet them at a 1/3 off.

Diggers and stuff next. 95% discount worst enough for you reader? A 1/3rd off is more likely. There are equipment auctions and dealers I can use I reckon. I can shift the equipment. It’s in demand. 300,000 more homes need to be built per year in the UK after all.

Money in the bank from customers. Is cash. Worst case is I lose none of it - it’s cash.

Deferred tax assets - worst case I can’t use those so they’re worth zero. But in the real world when I make profits I can use them. So 0% off and I just use them in a “probably” scenario.

Selling a trust? 40% off for a quick sale, but it’s valued at fair value. So probably I can get its fair value.

Land, buildings next of all - well again book value isn’t market value as you know. But let’s say 20% off for a quick sale on a land grab. Realistically book value is more likely. Profit on disposal possible here too.

WIP Assets next. These are properties, possibly half built. Worst case I down tools and sell it to another developer at 40% off. But realistically I’d complete them and turn them into debtors and get paid. So 0% off probably.

Finally we’ve got more customer cash, and more tax credits and finally cash. Lots of cash.

The outcome of the rather unrealistic scenario of never again turning a profit and selling everything would net somewhere between £25m and £124m. That’s a £100m continuum of possibilities.

Even if we end up more than a quarter way along that we are at breakeven to today’s share price. Halfway and there’s 40% upside to buying WJG at 20.95p today.

Even if WJG only perform as badly as the last 4 years (i.e. more exceptional costs) then the £48.8m market cap - £25m net “worst case” net assets, that’s a £28m net cost so 4.6X earnings based on those £6m worst case earnings.

Or less than 2X the underlying earnings.

Conclusion

Current assets net of all liabilities being 0.5p a share was a surprise.

How many businesses can you buy where the cash, debtors and stock of property would cover all liabilities? A business where a long term run rate of £500m turnover and 12% average margin appears not unrealistic an expectation, which delivers a £30m a year net profit at 15x would be a £450m valuation, over 9 times today’s market cap!

The strong demand and the restricted supply make for likely higher future profits. Growth in the high-margin refresh segment seems the obvious way to boost profits and to de-risk the cyclical building business is by running Accommo for Universities. Nowhere is that in the price either.

My interpretation of The Building Safety Act and the future secondary legislation is yes it could drive up costs - and prices - but its effect could likely create an important moat for WJG (and others) dissuading new entrants from entering, thus creating lucrative markets. My reading of the provisions is that nothing is absolute and further provisions might be required but this appears to be fairly limited at circa £2m per extra building, and the notes imply a maximum of a few so a possible £6m further provision if the current contingency doesn’t cover it, and nor does a customer in full or in part. The main concern actually appears to be a potential acceleration of the remediation work. Which isn’t a problem for cash-rich WJG.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Will WJG double in price before the end of January? It's now up 77% since I included it in the OB 25 for 25. Congratulations to readers who agreed this was mispriced.

Interesting write-up - hadn't heard of this name before. Almost unbelievably cheap, looking at what they used to earn.

A couple notes/questions:

1. The £46m cladding liability has already been expensed. If they've added a liability onto the balance sheet (without adding a corresponding asset), that IS them recognising the cost. As they actually pay it, the liability will be written down, at the same time as cash/inventory is spent doing the re-cladding. Because they're writing down an asset and a liability at the same time, no cost need be reported (remember earnings (less payouts to shareholders) equals change in equity, equals change in assets minus change in liabilities) - although it's at that time that you'll see it run through the cash flow statement. Let me know if you need any more explanation on this.

2. You marked the goodwill of the fresh business acquired down slightly, but kept it at £8m because the business could easily be sold for £8m - but I think what you've forgotten is the assets of that business are now consolidated onto WJ's balance sheet, so if you assume a sale of the fresh business, you're double counting if you don't subtract its assets from the balance sheet (assuming it has net assets associated with it). Generally when we're doing liquidation valuations we would liquidate all parts of the business, rather than sorta a mix of liquidation and SOTP like this - but to be fair it's your life. Just make sure you're able to sub out the fresh business's net assets in that case.

3. In a liquidation analysis we also tend to mark down non-cash assets to be conservative. Common numbers are 80% for receivables, 50% for PPE, somewhere in-between for inventory - and we would usually wipe off tax assets entirely. That's to account for the fire-sale prices that we would expect to see in a liquidation. You can be a bit more sophisticated with some of those if you like, and try to estimate how much they'd actually go for - but they're intended to show the business is undervalued under a worst-case scenario - so for that reason you might as well be conservative if you do do one. Then again, I think if you don't expect the business to be liquidated, why do a liquidation analysis?

4. The market valuation here is... weird. If I took a glance at those financials and tried to pluck an estimate out of thin air for the value I would probably say something on the order of £300m. So you have to ask yourself what the market is thinking here. There's quite definitely not any risk of bankruptcy looking at the current balance sheet (as long as management don't find some magical way to cock it all up). So the market must be looking at the last 2 years of operating earnings - which have been about zilch - and thinking that's gonna continue for the foreseeable. The question then is, why won't it? What changed in 2023/24 versus prior years, and why will the future look like prior years, not the recent past?

5. A last note - I found the financials being given on a half-yearly basis quite confusing, as an investor I'm very used to everything being presented on a 12-mo basis unless clearly specified - especially since housebuilding is a fairly seasonal business. I'd suggest trying to stick more to annual financials in the future :)

Given the insane valuation, I'm gonna start looking into this one immediately. I'll let you know my thoughts when I have some. Thanks for shining the spotlight on this!