Dear reader

I’ve decided I’m calling time on Oak Bloke 25 for 25 idea: Water Intelligence (ticker WATR).

An imaginary £832.66 proceeds on a £1,000 investment including -£4 charge to sell and a £3.401 per share sell price at 8am this morning means this is a -16.7% loss so an overall -0.5% drag on overall performance. Boo. Another OB failure.

But it’s the right thing to do.

The house broker would disagree. Their bright and breezy EPS forecast today for 2025 guesses that earnings shall be 44.3c or 34.1p in 2025. That implies I’ve just dumped a stock at 10X earnings. A stocko super stock too - currently scoring 90 out of 100. Boo. Another OB failure.

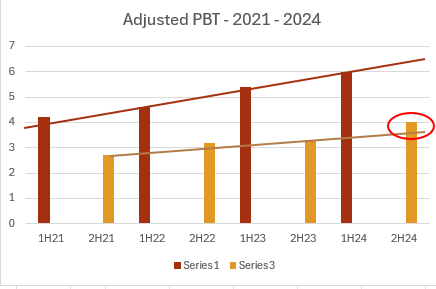

Yes, if it can earn that 34.1p EPS. So why don’t I think so? In my prior article “WATR-running-the-red-light” I spoke of the 1Q25 update being crucial. I needed to see a strong performance. The first half of the year is always the strong half of the year, the second half the weaker and 4Q24 was well below my expectations - and forecast. WATR was in its last chance saloon - it had 9 points on its licence.

Today is below expectations. Crucially we are also treated to an April YTD set of numbers. This was shared by WATR presumably with the intention to encourage and build a stronger business case. It had the opposite effect for me. The numbers are weak. Considering the expenditure on buying back Franchises a 2.5% increase in ALD revenue in the stronger half of the year (vs the 2024 average) is a disappointment. Product income down a sixth vs 2024 is a real disappointment, and while its international business at +21.6% is a bright spot that is only a +$0.5m increase in revenue and perhaps +$0.1m profit outcome, and only half of my own forecast number that I was expecting.

So why was my International forecast so aggressive? Well I extrapolated based on the 39.5% growth achieved in the International segment in 2024 vs 2023 as well as the highly-positive newslflow. But the outcome is it has slowed to 21.6% growth in 1Q25 vs 2024 and 4.3% vs 4Q24. Given the investment into Australia, Ireland, UK sewerage, and bidding for EU contracts so even 21.6% growth isn’t really that great. The 2024 Feakle acquisition accounts for over half of that growth too. Strip that out and the pro forma there’s hardly any growth in International at all.

April is described as “strong” and “significant”, but the truth as I see it is that it smells strongly and is a significant disappointment. Just because you use words like strong don’t just make it so.

If you strip out the 1Q25 result, yes, revenue is 10% higher compared with 1Q25 ($0.7m higher to the monthly average in 1Q25) but profit falls by over 50%. April delivers just a $0.27m PBT. I’m glad they shared the additional April data, even if they didn’t intend for it to sound the alarm.

If you translate the YTD profit into EPS then assuming a tax charge of 35% the EPS YTD to April is $0.081 leaving $0.362 EPS in 8 months to hit the broker’s guess for 2025…..

…That would need a 125% acceleration in profit during the rest of 2025.

Including in 2Q25 where the first month of that quarter (April) is actually only a third of that monthly EPS run rate $0.045 number ($0.015).

Beyond 2Q25 you have the second half traditionally the weaker and slower half of the year. If history repeats itself as it has for the past 4 years then I’ve sold a share that might hit 20X-25X earnings at the current £3.40 share price…. assuming it remains at that share price of course. I can see during Thursday it fell in price.

Other reasons to call time are where is the boost from the Texas acquisition? A $12m price tag for acquiring $6m of annual sales - so $1.5m per quarter. Yet ALD revenue between 1Q25 and 4Q24 is up only $1.1m. That implies zero growth on a pro-forma basis.

It gets worse. Comparing 1Q25 to 1Q24-3Q24 the result implies CONTRACTION on a pro-forma basis since 4Q24 itself was a poor result and not a fair comparison.

The frightening thought I then have is it is not just the Texas acquisition. In 2024 there’s Fresno ($2.9m) too. Plus in early 2025 there’s a Georgia acquistion ($3m) and a plumbing business in Connecticut ($1.2m).

So that’s nearly $20m of acquisitions in the past 9 months. In 1Q25 ALD is 2.5% ahead of the 2024 average so $1.4m of revenue ($5.6m per annum) and (generously) say a $1.4m net return. That’s a P/E of 14X - and that assumes zero organic growth from existing ALD operations. If you consider half of the growth is organic (I mean if it’s zero then that’s a huge worry too isn’t it?) then the return drops of 28X….. a poor result.

My base-case assumption was that an acquisition would be synergistic, that profits would grow but that simply doesn’t appear to be happening in practice. Or at least not in the 7 months under analysis (October 2024 - April 2025). Prior to this it was a different story - and those synergies did appear to arrive.

The lack of updates around progress with IP and product sales, as well as the poor performance in product revenue (at least from what the disclosures allow us to discern) is that the products are not proving to be successful. Where are the Sewer tunnel damage detection updates? Where are the DitchyMcDitchFace updates? (100% of readers voted and agreed in its renaming) Where are the Leak Detection product updates? What good is a trading update that does not update.

Perhaps the numbers will improve in time. I’m not waiting further to find out - I said I’d wait until 1Q25 and decide. There’s several reasons to think the numbers won’t improve, and without successful products can the “service side” of this business deliver sufficient profit? I don’t think so. Even its new Leak Monitoring product I questioned in the prior article, and it is unclear what margin exists (if any - this is a Chubb-owned product) nor whether a plumber-installed product WATR sells vs a clip on DIY- installed product could succeed. A reader shared with me Ondo InsurTech (ticker ONDO) that does the same thing at a lower cost and without needing professional installation. An easy DIY install with no pipe cutting required. My commonsense tells me which one will do better. ONDO own the IP and product rights too.

So I take the 16.7% hit and exit. Road Closed. This is also a 2025 pick for fellow fun runner Mr Hill who wrote a highly-positive article today praising its “impressive growth” and “best-in-class solutions”. Thoughts and comments are welcome.

I’ll continue to monitor this during 2025 to see who is right. I’ll do best in future reporting neither to mention uphill battles nor that WATR is going downhill. I wouldn’t want anyone to get the hump.

Regards

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

From Simon T in the IC (i have no view on this stock - in the too hard pile!)

Water Intelligence (WATR:338p) is a multinational provider of precision, minimally invasive water leak detection and remediation solutions. Around 90 per cent of revenue is generated in the US, a country where 15 per cent of all water is lost due to leakage.

Water Intelligence is targeting this captive market through its American Leak Detection (ALD) business that has revolutionised the water infrastructure services industry. Specifically, ALD has pioneered the use of acoustic and infrared-based technology to pinpoint water leaks as opposed to traditional methods of visual inspection that require breaking walls or digging up surfaces until the origins of the leak could be found.

ALD’s focus has been on small-diameter pipe: homes, swimming pools, and commercial premises. For these types of hard-to-find leaks, customers such as homeowners, property management and insurance companies value the quality of service and the fact that ALD’s proprietary technology minimises destruction to walls, floors, and roofs.

Investment in technology is a key differentiator of Water Intelligence’s product and service offering and has helped grow ALD into a national business that operates in 150 locations across 46 US states. The business continues to capture market share by establishing national channels with insurance companies, property management and municipalities.

Sensibly, Water Intelligence is using strategic partnerships to drive organic growth. For instance, ALD has recently entered a partnership with StreamLabs, a Chubb Insurance company and a leading provider of patented, state-of-the art water usage monitoring, leak detection and water shut-off solutions for commercial and residential properties. ALD expects to generate organic revenue and profit growth through:

• The resale of StreamLabs products at favourable wholesale prices.

• Service installations of devices by ALD from StreamLabs.

• ALD “aftercare” programmes for water management sought by residential and commercial customers.

• Leveraging ALD’s other proprietary products.

Much like how insurance companies have transformed healthcare, insurance companies are working with homeowners to promote preventive maintenance solutions for water infrastructure ranging from water monitoring to alerts to minimally invasive leak detection and repair. As the leader in the US in providing end-to-end solutions to more than 200,000 residential customers each year, ALD is the only company in a fragmented services industry that can offer insurers national coverage for leak detection and the highest level of data security through its cloud-based Salesforce application.

Having signed multiple national insurance contracts last year, ALD now works through national contracts with 20 of the largest US insurance companies, providing both insurance companies and their loss adjusters with a trusted solutions partner and operational coverage across the country.

A market leader in its field delivering growth

ALD’s 44 directly owned US corporate operated locations account for two-thirds of group revenue and adjusted pre-tax profit (pre-central overheads), but the franchise operation is also an important income generator. That’s because ALD sells franchises and receives royalty income from the franchisees based on a percentage of gross sales to third parties. It then uses debt funding to buy in mature franchises at favourable prices which provides an exit for the franchise owner. It’s a business model that works for both parties.

The fact that the share price declined 6 per cent after the trading update (22 May 2025) is a reaction to the company reporting flat pre-tax profit of $2.5mn on 4 per cent higher revenue of $21.3mn in the first quarter of 2025, albeit the 10 per cent growth in underlying cash profit to $4.1mn is a far better metric to focus on. Moreover, management reported a strong April, booking $1.1mn of cash profit on $7.8mn of revenue during the month.

It adds credibility to Dowgate Capital’s maintained expectation that underlying operating profit, pre-tax profit and earnings per share (EPS) can rise by more than a fifth to $12.7mn, $11.2mn and 44.3c, respectively, on 16 per cent higher revenue of $97mn. Furthermore, the board has almost $20mn of funding available to make earnings accretive acquisitions to broaden the geographic footprint and increase the scale of directly owned businesses. Debt ratios are improving too as current total net debt (including deferred consideration on the reacquisition of franchises) to cash profit ratio of 1.5 times should fall to 1.2 times by the year-end.

So, although the shares are below my 377.5p entry level (Alpha Research: ‘Tap into a small-cap company that’s a market leader’, 6 March 2025), there is no doubt in my mind that Water Intelligence is making strong underlying progress. Trading on an enterprise valuation of 5.7 times cash profit estimates and on a prospective price/earnings (PE) ratio of 10, the share price should bounce back. A US listing is also being explored and can only help improve investor sentiment for this underrated company. Buy.

I agree that this is a disappointing update and have also sold my shares. I agree with your comment other than that you used statutory PBT and compared it to adjusted PBT provided by the broker. If you use adjusted PBT for both the required EPS acceleration in YTG becomes something like 40%, but the point remains the same.