Will it, can it find safe HBR?

FTSE250 Harbour Energy considered

Dear reader,

I have now recorded a video covering this idea twice on my YouTube channel - there’s 51 videos uploaded there now) and have encountered repeated technical issues. So I am publishing this on Substack instead.

Harbour ticker HBR is the 2nd of two stocks recently cast adrift by fellow fun runner Mr Head in his April 1st update. Was this calling time just an April 1st comedy stunt to fool us? No, despite the unfortunately timing of the announcement his calling time is a fact. We are told the reason was because it failed Mr Head’s momentum rules and, 25% stop-loss rules and also because it is styled as a value trap by algorithms.

I was curious to see if offloading had been a good choice. I concluded it was a mistake.

Why do I consider HBR could be a great choice after its transformative 2024?

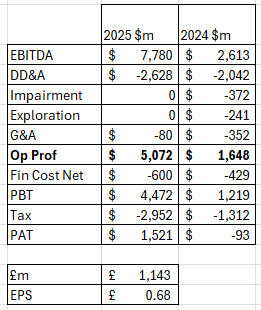

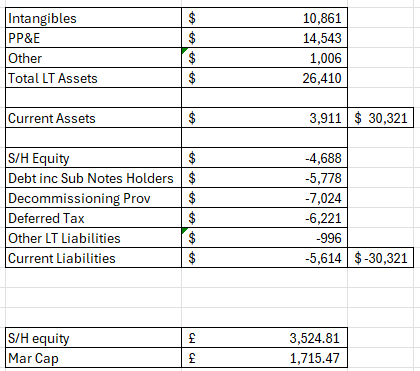

Stocko’s last review of HBR opens with “An operating loss appears to have spooked the market”. That’s not correct as there was no operating loss in 2024. Operating profits grew from £0.93bn to £1.648bn as shown below.

The problem and the loss was actually with the profit after tax. HBR made a PBT of £1.22bn and got a tax bill of -£1.31bn? Mega ouch. 108% tax.

But the underlying profit after tax was actually £0.17bn…. a quadrupling of profit from £0.045bn.

How so? With an -£0.26bn extraordinary tax charge due to decommissioning and impairments as explained in the accounts - see below.

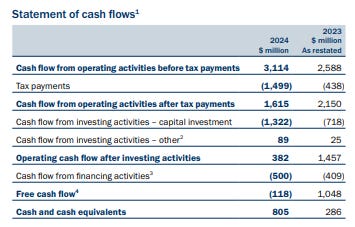

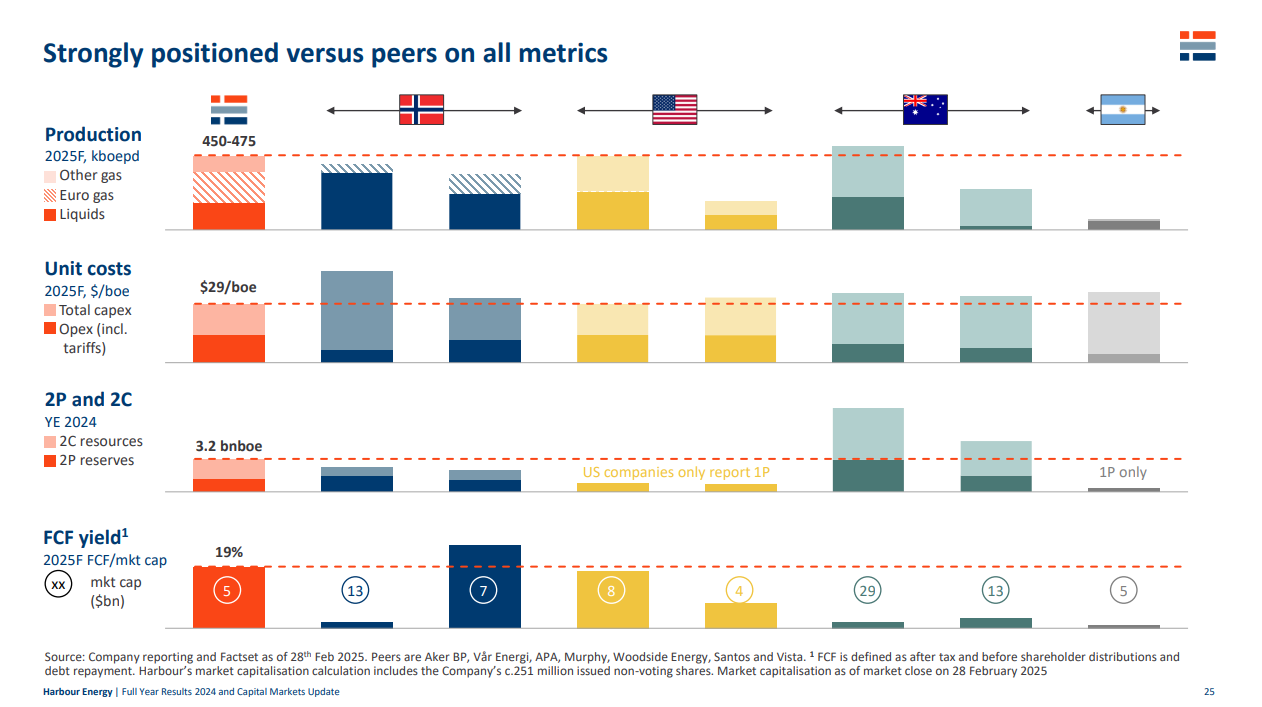

The assessment continues that debt increases and so does FCF by $1bn…. but only if Oil prices remain high. Stocko highlights that “impressive free cash flow is heavily dependent on the oil price”.

Oops, well Oil is down isn’t it? So is that a reason to worry? Is it “heavily dependent”?

Let’s consider today’s lower $66/bbl brent price what does that mean for existing or potential HBR-masters? But not ex-HBR-masters they have cashed up. Rules is rules.

Wait one. 26% of 2025’s Oil is hedged at $77, 48% of Nat gas hedged too at $84 BOE

Using conveniently provided sensitivities we can determine the cost of the unhedged on HBR.

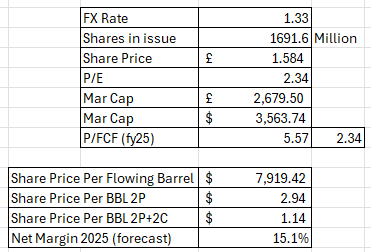

Oil at $66 is down 12% and Nat is up 20% to the assumptions of 80p/therm and $78 oil (in the FY24 report). So today’s $66/bbl is 1.2X -$91/bbl less 2X$36m (100p/therm gas average) = a $37.2m equity (fair value) loss according to the sensitivities. Fairly immaterial in other words. 1% of the market cap impact.

What about the P&L? What about FCF?:

Well we have to understand that 2025 will be very different to 2023 because of 2024. This slide sums up the delta of difference.

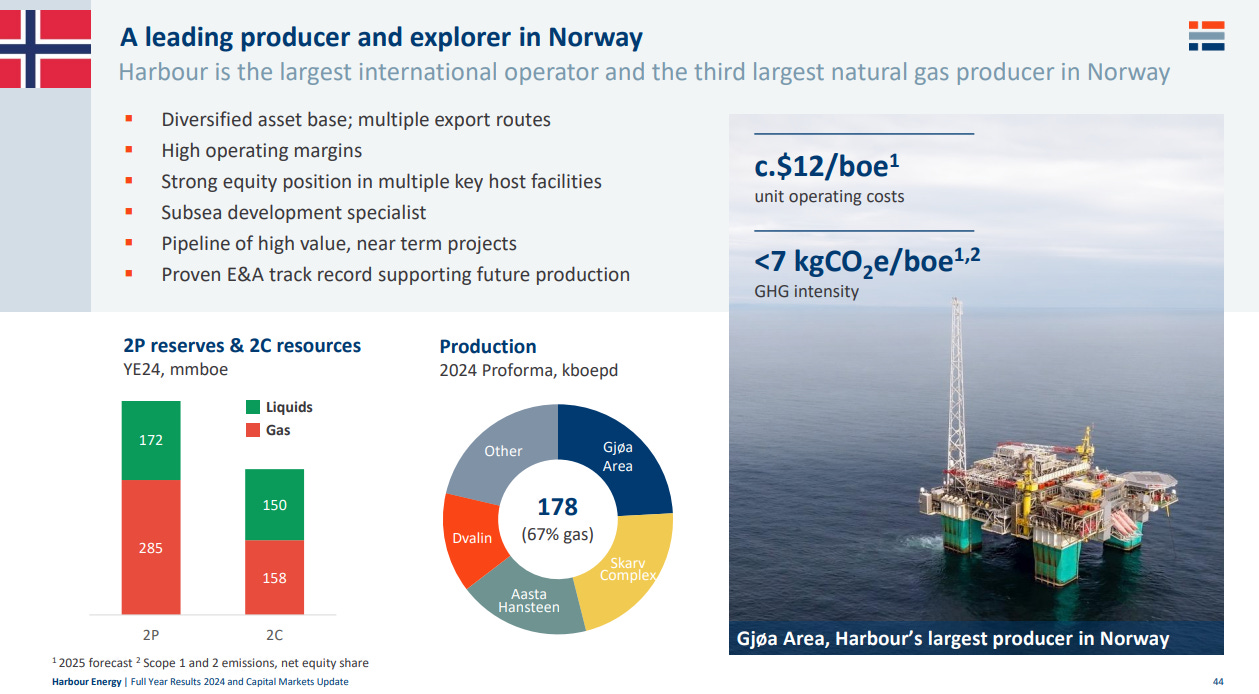

The acquisition of Wintershall Dea is the main reason for the step up in most metrics.

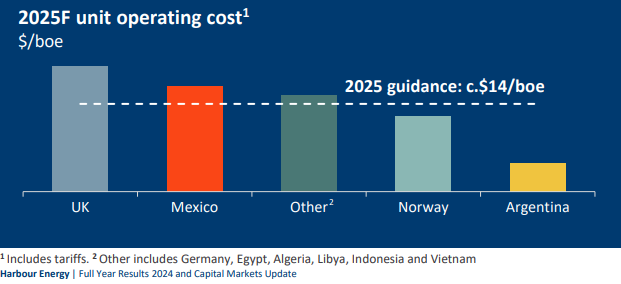

To construct the operating income I’ve used $66 Brent which is well below the 1Q25 average of $76/bbl. I’ve used 450KBOE, the lower end of 450-475, and I’ve used $14/boe op cost.

READER SAFETY WARNING: GRIP YOUR SEAT.

PLEASE DO NOT FALL OFF YOUR CHAIR

I’ve assumed $24/BOE “other” gas which is the value in 2024 and $62 Euro Gas which is 77p therm which is the current price and a YTD low where the average is 117p YTD.

Now Zeus reckon $9bn revenue in 2025 although they don’t say how and both their production and per BBL numbers are higher than mine - so I find that a bit bizarre. Am I wrong to assume >$10bn revenue? I don’t think so. HBR tell us if Wintershall Dea has occurred Jan 1st (2024) that revenue would have been $10.5bn.

WAIT ONE.

Before we get carried away let’s remember $7.78bn gross profit isn’t the final profit. For DD&A I’ve actually gone with Zeus’ number and also used their percentage tax (66%). They don’t explain how they arrive at those numbers but 66% feels more than adequate. Obviously eyewatering 78% tax applies in the UK but that is only about 33% of production.

I’ve gone with their -$600m finance cost.

ZEUS ASSUMPTIONS QUESTIONED

TAX

In fact 66% tax might be a bit high. Note 8 in the accounts tells us the EPL rate is 38%, and the RFCT remains at 30%. The combined tax rate for ring fence profits subject to both taxes is:

Effective Tax Rate= 30% + (38% × (1−30%)) = 30% + 26.6% = 56.6%

However, not all profits are subject to EPL, as ring fence tax losses and decommissioning deductions are only subject to RFCT (30%). We do not know what proportion of profits subject to EPL versus RFCT alone, but for oil and gas production profits (the core of Harbour Energy’s UK operations), the 56.6% rate applies. Other territories like Milei’s Argentina now has tax breaks to ENCOURAGE growth. Do tell Mili that Milei is bringing home the bacon with his policies.

The Argie is going largey.

Finance Cost

If I add up those interest rates I get to $133.5m. I’ve assumed no finance income (even though there was $173m in 2024). Look at those costs! 0.8% interest going up to 5.5%.

Imagine borrowing a billion and paying just $8m interest per year.

Wow.

I’m using the same $600m finance cost. While the Bond interest is only $133m there’s several costs like Leaseholds which would be valid costs, but quite a bit that were extraordinary costs and wouldn’t repeat. My estimate is $400m is actually recurring so that’s a tiday $200m up yer sleeve ;)

Ex-UK Production

This was 2024 production by country:

And this is 2025 forecast production: 35% UK, 35% Norway, 30% others.

Where I get to is a $1.523bn PAT or £1,143m. This translates to £0.68 EPS.

(this has been revised due to post period share issues and non-voting shares - thank you to reader Mill for spotting!)

Need Safe HBR? More like Michael Fish predicted the storm.

Nothing to see here.

FREE CASH FLOW

“impressive free cash flow is heavily dependent on the oil price”.

I don’t think I’ve yet assessed this so let’s look at that next.

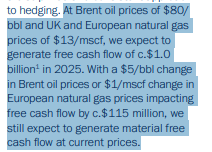

“At Brent oil prices of $80/ bbl and UK and European natural gas prices of $13/mscf, we expect to generate free cash flow of c.$1.0 billion in 2025. With a $5/bbl change in Brent oil prices or $1/mscf change in European natural gas prices impacting free cash flow by c.$115 million, we still expect to generate material free cash flow at current prices.”

If you agree with my $66 bbl oil and $62 BOE gas, which is pretty conservative for all the reasons I’ve previously stated (I’m using the YTD low etc), then once you factor in the hedged components you get to $68.86 Oil and $72.56 BOE gas.

That translates to a forecast $640m FCF. But I think that could be potentially higher.

I put Capex at -$3,509 as the agreeing number to get to a $640m FCF outcome. But then I read this guidance. Opex + Capex < $30/boe. So that means Capex must be $16/BOE which equates to -$2,628m in FY2025.

I’ve already modelled for $14/BOE opex so if I also model $16/BOE sustaining capex then FCF rises to $1,521m. So $640m might be a bit conservative?

In any case those forecast earnings puts HBR at a P/FCF of just 2.34. In plain English HBR-masters get 42.7p of cash generation per £1 of shares. That 42.7p can pay down debt (you then own more of HBR and the lenders own less) or pay you dividends.

HBR give guidance of $2.4bn-$2.6bn capex guidance (falling in 2026 - 2030 to below $2bn). That capex maintains 450Kboepd to 2030 HBR tell us.

It’s simply incredible that a business can generate so much cash and profit despite facing horrendous taxes, the burden of debt interest, and have lost 70% of its share price since May 2022. Has the world gone mad?

Consider the price of European Gas (6X that of US Gas). Then consider it is producing it at $12/boe vs $10.10 for DEC. More pricey? Nah. Shipping LNG costs around $26/BOE so it’s nearly $24/BOE more profitable to be producing in Norway than the US!

Of course not all new planned assets are so cheap. Cuvette and Dvalin in Norway are about double at $24/BOE-$28/BOE - but still below the $30/BOE hurdle. Similarly Maria Phase 2 in Norway is forecast to be producing oil at $35/BOE opex.

Then look at the yellow. APE and Vaca Muerta (dead cow) are Argentinian shale projects and will enjoy a $10/BOE opex cost! Argentina has vast shale reserves.

Mexico is also another area of focus and growth for HBR. I will write more on both Argentina and Mexico in a future article.

Why is the price so low?

Lumpy profits and apparent losses, a fear of north sea tax, low dividends a few years back, fear of debt - or for Mr Head it broke his rules - there are various reasons you can ascribe to the low share price.

I can’t help but think SQZ-ers, HBR-masters, DEC-hands are all in the same, err, boat. FTSE250 O&G producers. All of them are despised by the market. All highly cash generative, all with large decommissioning future bills, large debts and all aiming for growth - and being punished for it. You can point to a negative story line for each of them and enough people believe that.

HBR is 3.5X the size of SQZ and 1.5X DEC. In terms of EBITDA per share DEC wins ($12.26 vs $7.18) and of course the “T” (tax) is not pretty for HBR for now. Even so I do like the idea of energy exposure in Argentina, Germany, Norway, Mexico, Egypt, Algeria, Libya, Indonesia and Vietnam

(Vietnam has since been disposed post period to Enquest).

Particularly Argentina. Look at the economic miracle Milei is instigating when he yells AFUERA to the left…. to those mad caps, imagine what he might say to our bacon chomp energy secretary. Milei is instituting a DOGE-style AFUERA (get out) to waste and nonsense.

Argentina will thrive. If you know your history then you’ll know how wealthy Argentina once was.

I really like that the operating costs are low and one third of the 2P/2C reserves are Argentina. That’s why I’m more than happy to NOT play top trumps of HBR vs DEC and to want this in my portfolio.

Based on the balance sheet HBR is at a 50% discount to its NAV. That discount does include a large “intangible” number but it’s not as though the above 3.12 billion barrels of probable and contingent oil are on the balance sheet as such. Other than via the intangibles.

In fact if you consider based on 450kboe you are only paying £3,812 per BOE per day. Also you’re paying £1.42 for each probable barrel of oil. 55p average for probable and contingent (2P and 2C). If you sell barrels of oil equivalent for $66/bbl that translates to an up to 15% net margin.

That £3,812 cost per flowing BOE is best understood if we model the 2025 forecast costs for that flowing barrel. As below it generates £1,706 *PER ANNUM* on a £3,812 investment. Put that way that’s a pretty tasty investment. Of course you are taking a risk etc and these are forecast numbers based on a $66 basket.

If I’m right on PAT of $1,250m then the above is a translation of that at a 1.33 $:£ conversion.

I hope I’ve done this share justice since HBR-masters waited a long time for me to write this article. I’m glad I did; it looks a great share from what I can see.

Regards

The Oak Bloke

Disclaimers:

This is not advice. Make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Interesting that Harbour mention competitors, one of which was Woodside Energy Group (ASX:WDS). It used to have a secondary LSE listing but they dropped it (lack of trades). I hold. Market cap AUD 38b or £18b so 9 x bigger than HBR. Its dividend is now 9.25% so not to be sniffed at. It has just decided to go ahead with Louisiana LNG which, by the 2030s, should mean it operates over 5% of global LNG supply. Could turn out to be a less volatile investment than HBR and SQZ etc while still paying a high dividend.

Great analysis, agree it's undervalued, doesn't help being at the sharp end of UK net zero madness. I am concerned that it's carbon capture will be valued destroying, the technology is largely unproven and a serial waste of time and resources in my opinion. Being an ex oil person I into oil, have been an investor in the past time for another punt. It certainly has potential for proven reserves to increase, the Wintershall acq was very positive and it's difficult to lose money on shale oil