Dear reader

Will Ixico (ticker LON:IXI) play music for you?

Ay, ay, ay, ay

Ay, ay mi amor

Ay, mi morena

De mi corazón

Me gusta tocar guitarra

Me gusta cantar el son

Mariachi me acompaña

Cuando canto mi canción

Come on you Mariachis be off with you, and get your hearing checked. Those ear mufflers they insist on wearing create all sorts of misunderstandings. Mis amigos detienen la música por favor.

This is a pick from fellow Fun Runner the stockmarket supremo Mr Hill. Unfortunately down -37.3% YTD for 2025.

Is this an almighty bargain or one to avoid? Let’s try to find out.

I’ve considered each point of the rationale given for this idea:

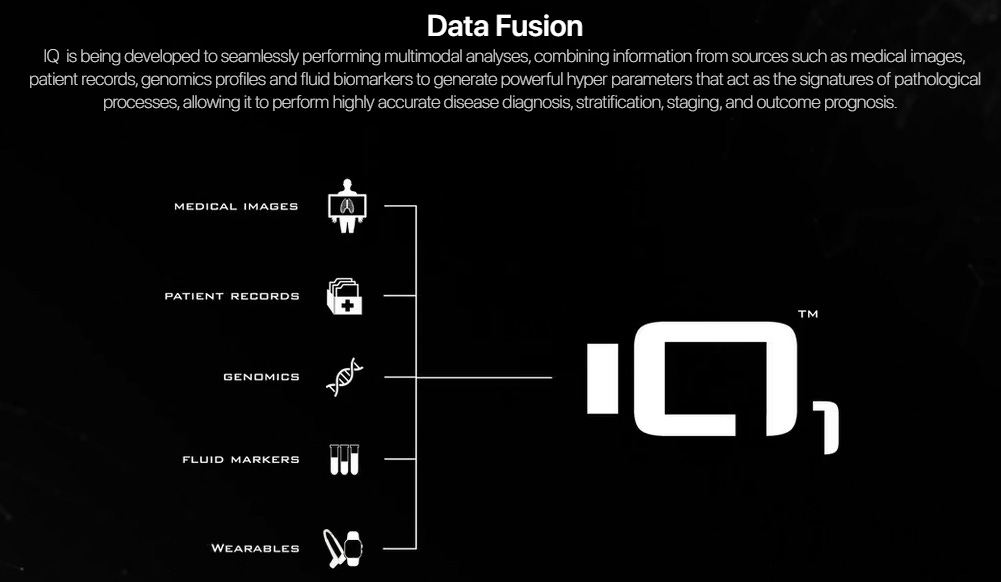

It’s a leader in assessment of digital/MRI brain scans and helps BigPharma develop/test new neurodegenerative disease drugs (re Alzheimer's, Parkinson’s, Huntington’s). It has cutting-edge science, industry experts, a revamped Trialtracker platform & AI algorithms can interpret >150 unique brain structures & digital biomarkers in microscopic detail.

“It’s true. Ixico appears to have been an expert for 20 years. This is good and bad isn’t it? It has a £7.3m market cap today and that includes a £4m raise while it peaked at a £35.3m market cap in the past so a net £3.3m implies a 95% drop in share price”

£6m FY25 revs

“This £6m revenue is forecast it’s true but due to -£8m of annual costs means it is forecast to lose -£2m in FY25 same as it did in FY24. So £6m revs isn’t a rationale to buy”

It’s currently running 26 trials for 18 customers with a £15.3m orderbook up from £12.7m as at 03/24

“The order book was £14.8m in 2023 and grew by £8.9m but shrank by -£2.7m due to trial descopes. So the order book is pipeline, not a true order book. Customers are not committed to proceed. That scares me.”

Surge of new candidates (eg Roche, BMS) entering late stage trials

“I struggled to find any evidence of a surge. Revenues shrinking less in 2024 vs 2023 was the best I could find. Post period a £0.2m/year and a £0.5m Huntingdon contract win are announced. The 2nd win speaks to “combined value” which makes me wonder that it is not £0.2m + £0.5m but £0.5m combined. £0.5m of wins (or even £0.7m of wins) over 7 months since September 2024 appears well below the replacement rate of pipeline. That does not appear to be a surge. A scourge perhaps”

Highly contextualised database, incorporating 250k images. Goldmine of brain scan data acts as major competitive moat

“Gold is worth $3,200 an ounce. If this were 250koz of gold it would be easier to quantify. It’s unclear what the value of this mine is. As for the major competitive moat, I don’t know how I discern which database is the better one but Ixico’s UK competitor Ainostics appears to have something similar and boasts a wide range of NHS Trusts, Universities and Pharma Majors among its collaborators.”

Aiming to double sales (£10m+) over 3-4 years vs Est FY24 £5.5m & breakeven revs £8m. Post marketing surveillance (Biogen & Lilly)

“This implies they can enter a new area called Post Marketing Surveillance and expand their commercial footprint in the US without incurring further cost beyond their current -£8m annual costs, although I have my doubts about that. Surely this expansion will cause costs to rise? Addressing the US market requires further investment surely? So even if they do achieve £10m of sales surely the breakeven will be higher than £8m?”

Oversubscribed £4m placing at 9.5p (Octopus 18%).

“This is probably the first genuinely positive aspect, in that Octopus, Gresham, BGF, Amati and Canaccord have all added 50m shares (of 92.7m total). And at a premium to the market price. Very generous of them. Obviously high profile names but should you go into an idea because some IIs have? Also I start to wonder is a £4m raise enough?”

Cavendish 24p price target. High risk, high reward.

“It is impossible to forecast any kind of reward from what I can see. Even if you have order book, the customer can cancel that (and have). Even if you have contracted with them they can still cancel (and have). They did so in 2020 and 2021. Ixico is dealing with monoponistic customers - they have the power. Furthermore, consider the various predictions given in the past by Ixico brokers. All prior forecasts were wrong. What’s changed now? And if something has changed when will it change back? No way of knowing.”

“Tangible Traction May 24 - TP 24p - Actual 7.8p”

“Sharpened Focus Dec 23 - TP 35p - Actual 13p”

“Successful execution May 23 - TP unknown; Actual 19.8p”

“Well Placed, May 22 - TP unknown; Actual 41.4p”

“Upgraded trading update, reinstate our Buy Rating Oct 21 - Actual 84.5p”

“Resilient Performance Apr 21 - TP u/r “suggests upside” Actual 83p”

Gross margins 40% -> 60%+

“Recent margins have been closer to 40%-50% and should sales and marketing really be below the line costs? I see them as a cost of sale. If we include them gross margin is 25% on that basis. As you look back to 2020 and older 60% margins were achieved, again reflecting monoponistic power of the buyer.”

Conclusion

Even though it has fallen in price I don’t see this as an opportunity. Or at least it’s not one for me. Perhaps I’ve got it wrong, and perhaps I need my head read.

Wouldn’t that be ironic?

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"