Market Price $2.80/share (ask), Market Cap $84.9m.

NAV/share (30/06/23) $6.32/share. NAV total $198.7m

Discount to NAV 55.7%

Debt zero, Cash $7.8m

TMT is an early stage VC fund with a diversified investment portfolio of over 55

companies, focused primarily on Big Data/Cloud, SaaS (software-as-a-service), Mobility, and FinTech. 2022 and 2023 saw a dramatic change in the venture

capital and technology company environment, with most investors “returning to basics” by supporting ultimately profitable business models at sensible valuations.

“Growth at any cost” approach has been replaced with a focus on “fundamentally profitable growth at the right valuation”.

I’ve been a great fan of TMT for years. I’ve traded in and out a number of times but right now I’m in with both feet and feeling excited for its future prospects. TMT has achieved a 16.3% IRR over its 12 years. And notably in H2 2022 and H1 2023 its NAV has held up far more strongly than one might expect. In fact for 2023 YTD it’s actually grown its NAV (more on that in a moment).

It’s one of Simon Thompson of the Investor Chronicle’s picks for 2023.

I’m going to call out its top 6 holdings and not only why they don’t deserve to be at a discount (historically TMT has at a premium to its NAV because it was growing fast), but also the hidden value that’s worth at least equivalent to today’s market cap.

If I’m correct in my hidden value thesis, this is actually at over 70% discount to NAV so would need to 4X bag to return to its former 20% premium to NAV.

TMT’s Top 6:

A quick bit of maths tells you that the NAV of the top 6 alone represent 1.5X the market cap. ($126.23m). There are 49 other companies which make up the remaining $72.47m.

Let’s look at the top 6:

#1 BOLT - TMT’s largest holding is the privately held Bolt.eu. This video shows the incredible value on offer through Bolt.

Now you might be a bit cynical about a firm which as part of its offering has Scooter Rental? You’ve heard the horror stories - assets chucked in the river, and terrible disasters. Well Bolt seems to have made a lot of progress. Their Scooters have a 90KM range, any and all parts can be swapped out, and come equipped with IoT sensors that monitor “bad behaviour”. It’s more advanced than any other firms I’ve seen in the UK.

https://bolt.eu/en/blog/introducing-bolt-6-scooter/

Bolt are more than Scooters. They also offer e-Bikes, Taxi Cab Services, Care Hire, Food Delivery too. It is more accurate to describe them as a Digital Marketplace - where drivers, fleet owners (including fleets of Scooters and e-bikes) can participate. Of course they are leading the charge in quite a number of areas so the marketplace is how it sees its future rather than the whole reality of the present.

Bolt are active in over 550 cities globally (up from over 500 cities as of 31 December 2022) and are achiving double-digit annualised revenue growth and are forecast to achieve profitability in 2024 and potentially float in 2025.

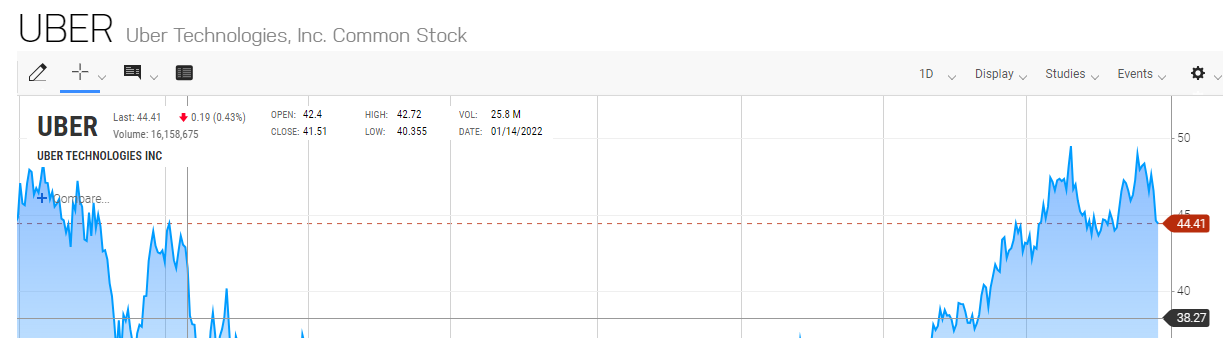

TMT invested $0.32m way back when and owns 1.3% of the company. Their holding is worth $71.3m - a 222x bagger so far!!!Bolt was valued at €7.4bn when it raised €628 million in its January 2022 funding round - so TMT have downgraded its holding by 26% relative to this. Yet comparing Bolt to Uber, Uber is up 10% over the same time period - not 26% down.

So if you considered it reasonable that Bolt should be valued on a “mark to market” basis to Uber, that equates to a valuation of TMT’s holding of $105.8m. That’s a $35m gain for TMT or a £0.88/share uplift of hidden value from its current valuation.

#2 Backblaze (BLZE):

Market Price $5.97/share. Holding 3.72m shares worth $16.2m (+$2.27m partial cash exit) = $18.47m at last NAV.

Back at 30/06/23 BLZE was $4.33/share. As of 22/09/23 it’s up 38% since last valuation at $5.97/share. That’s a $7m unrealised gain to TMT.

Cavendish aka Cenkos put Backblaze on a target price of over $10. Of course Cenkos is not alone in positive feelings towards Backblaze. The lowest upside forecast is +60% and the highest is +125%.

BLZE is 9.3% of TMT’s portfolio by historic value. So in the future if $10/share is achieved (and on the Q2 update they are on track) that would equate to a $42.7m gain…. and that would equate to a 21.5% gain to TMT’s NAV….. £1.09/share of hidden value.

Backblaze is on the cusp of being cash generative and EBITDA profitable and is about a 1/4 of the cost of AWS and Azure, while not compromising on features. It recently increased its prices slightly but remains far cheaper than the “Magnificent 7” competition. This is an example review. Make up your own mind:

#3 - The 3S Money Club

The 3rd largest is is a FinTech global payments provider - nothing to do S Club 7.

It’s all to do with real time FX and international money transfers which are 5x cheaper and 10x faster than traditional banks. It removes the need to maintain bank accounts throughout the world in each location where you buy and sell. Corporate clients can send, receive and exchange high-value payments in 190+ countries and access 65+ currencies, and providing them with local EU, UK and US account details.

In 2022, 3S Money processed over US$3 billion in client payments worldwide and has grown from a single co-working desk at launch to a team of 150+ people in 6 offices.

Its EBITDA profitable in the UK and its value to TMT is $14.9m and has generated a 2.5X return (MOIC) for TMT so far. So in other words, the current discount to NAV effectively snakes and ladders this investment back down 2.5X times. Doesn’t make sense to me.

#4 PandaDoc

Today, over 50,000 businesses use Pandadoc for digital quote building, proposal building and contract sign off. That number of busineses in 2023 has grown 25% from 2022. It integrates with all the main CRMs (Salesforce, Hubspot, Zoho etc), storage and payment platforms as well as with Integration Middlewares so you can interweave it in to your business. It’s main package is $49/user/month.

It is privately held and was valued at $1bn in its Series C funding round in 2021. TMT owns 1.17% so $11.7m, yet its holding is valued at $10.8m in the latest accounts.

When you look at how it can help sales people build quotes and proposals more quickly, but also provide oversight and sign off to the sales process it is impressive.

Features like its Smart Content make me think even those paying for a CRM system would pay for the benefits of this platform - especially those in Professional Services. Its full features are here:

https://www.pandadoc.com/features/

#5 Scentbird

TMT have seen a 5.7X return so far and this is a perfume and beauty subscription service in the US. Like a “LoveFilm” for perfume. With double digit growth and EBITDA positive, it appears to be doing the right things. This sort of business isn’t really my thing but I would point out their “Clean” range was unique and interesting - I guess other perfumeries do this too - but this is the 1st time I’ve seen this concept and can see that meeting the needs of people who worry about all the stuff they put in products - see https://www.scentbird.com/clean/perfumes

This reviewer gives his good, bad and ugly - my own investigation found a 50/50 like dislike on the web. He talks about decanting out the fragrance - do people actually do that?!

#6 Collectly

Collectly is a patient billing platform for medical organisations (www.collectly.co), completed a new equity funding round during 2023. The transaction represented a revaluation uplift of US$4.4 million (or 213%) in the fair value of TMT’s investment, compared to the previous reported amount as of 31 December 2022.

This is another investor (Sapphire) who recently interviewed the Collectly CEO

To conclude, there’s a lot going on at TMT - quietly and below the radar. We are about 3 months away from a trading update, and the finals are 6 months away. So this might sit quietly for a while.

But its current share price seems to represent a great buying opportunity, with the prospect of up to a 4X return.

As with all my posts, this is not investment advice. It is written for my benefit, and to set out my investment rationale. I state facts and source them where possible. I also use words like “infer” and “think” which means it’s a reasoned opinion based on facts I’ve found. Investment requires filling in the gaps with inferences and thinking about the facts to form forecasts. I hope you enjoy what I write and find it useful in forming your own investment rationale.