X Trackers Robotics ETF

A Top 10 Update for this OB25 for 25 idea

Dear reader

MAGA. Make Automation Great Again.

My desire for a good way to invest in Robotics started with a comparison of three Robotics ETFs: RBTX, ARCI and BOTG. I felt BOTG to be the best of the bunch. The three month performance bears that out. Just about. Interestingly RBTX shadows BOTG closely, even though holdings aren’t that similar.

The Top 10 of BOTG has changed shape somewhat with some partial sales: 30% of NVDA sold, 33% of Intuitive Surgical sold, 20% of ABB sold, 5% of Fanuc sold, 6% of Daifuku sold, SMC 10% sold.

Meanwhile new entrants in the Top 10. Yaskawa 10% added, Keyence 10% added and new entrants like JBT Marel added to the top 10.

#1 NVDA

Despite a reduction NVDA remains the #1 holding.

NVDA remains a large position for BOTG and the thesis remains that while the numbers are mind boggling (a market cap larger than the UK annual GDP) the growth and profitability is rapidly justifying that valuation. A P/E of 41.4 today. Blackwell going from essentially zero to $11bn and “in full gear” with data center expansion at 93% where essentially that is a contract sale with renewal.

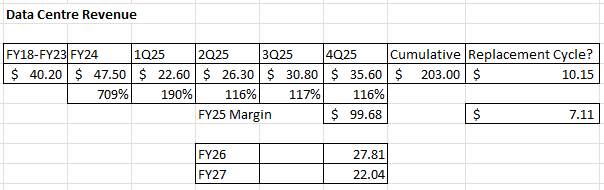

If you value NVDA as though you would a SAAS business and the mathematics are incredible. Let’s ignore gaming, Professional Visualisation and Automotive for a moment. Just Data Centers (90% of revenue). Consider that cumulative sales are $203bn. Consider the FY24 growth was 709% of average FY18-FY23. That FY25 delivered $115.3bn so well over double FY24.

Assuming 70% margin (it’s 73%-75% but with Blackwell it’s forecast to drop a little short term), and a replacement cycle of 5 years. If we further assume that in 7 years Data Centre customers have been through 4 cycles i.e. there are $50bn of chips in use “live” today then with a 5 year cycle we are looking at $10bn per year repeat business. Evidence shows the cycle is much shorter due to the intense power computes of AI and Video. Chips wear out faster. By including growth of new Data Centers with replacement cycles you can get to a P/E falling to 28 then to 22. Agree the cycle is shorter then the P/E drops to the teens. And of this without considering triple digit growth in Automotive (and vehicle autonomy), Gaming and the Metaverse plus the slower growth of Professional Visualisation. Then there is the robotics segment. All of that is on top of semiconductor chips for data processing in Data Centres.

If you consider that 1Q26 is forecast at $43bn revenue so at 90% revenue, and then assume slower growth of 9% Q-to-Q in FY26 the P/E is lower than 27.8 (drops to 24) and a P/E in the teens is a year away. Just Data Centres remember.

Growth stocks aren’t my natural hunting ground but the path to upside is there.

#2 Keyence

Previously this was on a P/E of 42 and now 37.7.

Keyence is a major player in optics and microscopes (it’s the 6th largest company in Japan) which is relevant to the growing area of Robotics vision, quality control systems and automation. Keyence generates 83% gross margins.

Am I happy 10% has been added? It’s a solid pick but with ZERO investor relations (even in Japanese let alone English) so it is difficult to assess.

#3 ABB

Things were looking good for ABB when I looked at their 3Q24 numbers but the full year confirms this with revenue and profits up and order book steady. $1bn of buy backs and a CHF90 dividend supported by $3.9bn of FCF in 2024 and record margins and ROCE (22.9%)

ABB forecast mid-single digit revenue growth and EBITA margin improvements in FY25.

#4 Fanuc

FY2024 9 months to 31/12/24 revealed 4.5% net income growth, although a small (-1.9%) drop in revenue.

2024 European sales weakness (especially automotive robots) is not a surprise (i.e. it’s been observed in other OB articles). But the stand out was growth in FA (Factory Automation) and Robomachines for China and Rest of Asia.

The forward order book is even more impressive! I’m a big Fan(uc)

#5 Intuitive Surgical

IS is another “SAAS business”-esque with Robot consumables building repeat revenues as footprints grow.

A 15% increase of Systems to 9902, supported a 25% revenue increase.

2025 Financial Outlook

IS expects the following results for the full year of 2025:

The Company expects worldwide da Vinci procedures to increase approximately 13% to 16% in 2025 as compared to 2024.

The Company expects non-GAAP* gross profit margin to be within a range of 67% and 68% of net revenue in 2025, compared to 69.1% in 2024. This range does not include any potential impact of new tariffs on our business, which could be material.

The Company expects non-GAAP* operating expense growth to be within a range of 10% to 15% in 2025, compared to 10% in 2024.

#6 SMC

SMC is heavily involved in industrial automation and the “nuts and bolts” behind robots. Underneath the shiny exteriors of robots lie actuators, switches, valves, vacuums and sensors.

A less hale quarterly result for SMC with net profits up Q-on-Q but this is due to FX gains and underlying profit is down in the period to 31/12/24

The order book looks much more positive however.

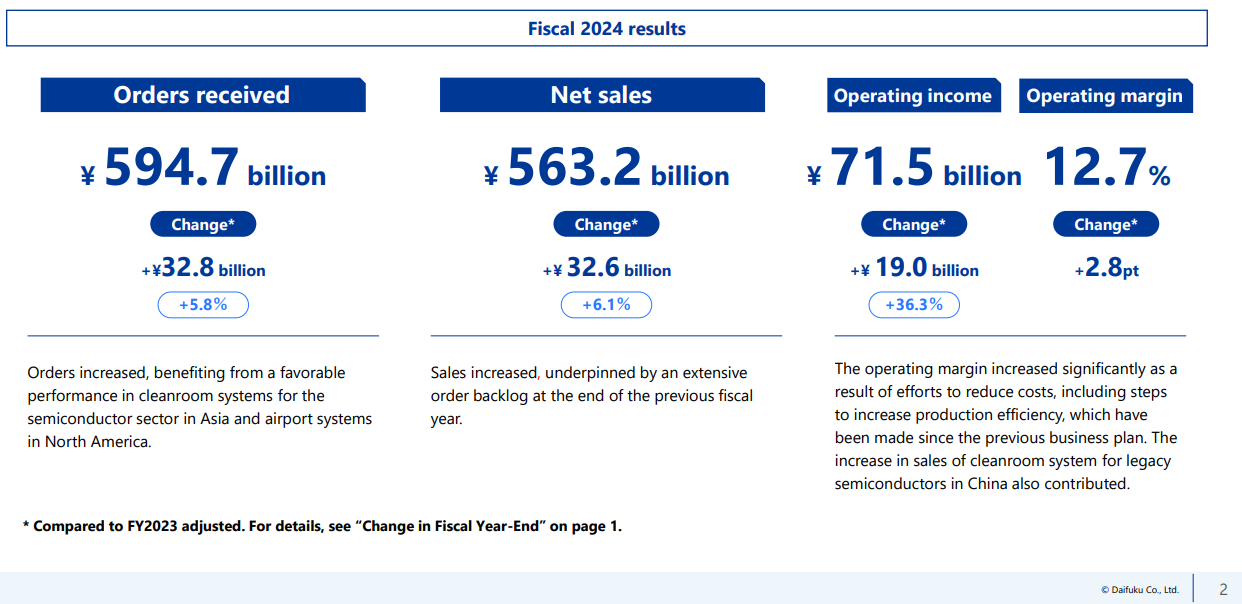

#7 Daifuku

… did amazing! Automation that inspires says the strapline, and the FY24 result did too.

Order book up 5.8%, sales up 6.1%, net profit up 36.3% and margin up 2.8% to 12.7%. Cleanroom system sales were the stand out and I guess it’s fair to say deglobalisation is causing a duplication of production in Europe, separately in the US and separately in China.

Automation for Airports was another standout performance where orders since 2021 have tripled.

#8 Dynatrace

Since I last look at this (1Q25) the 3Q25 results show $0.11bn growth in recurring revenue with no deterioration in retention rate, margin, ARR growth and subscription growth.

Gross margins of 86%-88% are pretty spectacular. The P/E of 30 is actually fairly good value given its growth and margin. The share rose 20% following the above results last month and then fell by 25% following the recent US sell off.

Another holding to feel pretty positive about.

#9 Yaskawa

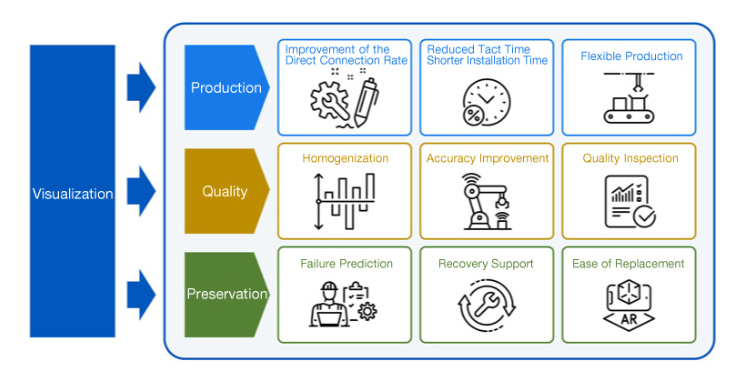

Yaskawa is another Japanese Robot maker. Specifically it is a large player in Robot arms in factories, including servo motors, and AC drives. Also systems for water and sewerage (a smelly problem for many countries including the UK , so a growth area)

Its systems are built on a principle of sensors called i3-mechatronics to drive improved production, quality and continuity.

The share is down 30% over 12 months so adding may be an opportunity to capture value. The stock is on a 23X P/E and has a £5.5bn market cap and a £0.24bn profit.

2025 is the year where their 2025 vision culminates. Yaskawa enthuse that they “venture in new technologies/ domains/targets to bring ”WakuWaku”*¹ excitement to people.” 1. Onomatopoeia used in Japanese language to express someone's feeling of enthusiasm

The strategy is to develop mechatronics, pursue a #1 status and to apply mechatronics into growing markets which serve key environmental goals too.

#10 JBT Marel

John Bean doesn’t sound Japanese and it isn’t. Let me introduce John Bean the founder of the Bean Spray Pump Company, and one time owner of an almond orchard in the 1880s. John invented a “magic” pump that could reach the treetops. Here it is and you can visit it here. US company JBT is a major player in Food Factory Automation and a $6.4bn market cap, with a P/E of 75. Shares trade for slightly over $120 each.

P/E of 75?! Well adjust out the extraordinary costs and you can arrive from $84.6m net income to $164.3m and a P/E of 39.

JBT has just completed a merger with Iceland’s Marel - a major seafood processing equipment company. Imagine, perfectly filleting 25 fish a minute? Not up for that challenge? How about 25 an hour? I bet you and I would struggle even for 1 hour and that’s where Marel comes in…. 24 hours a day. No wonder the sales rep is giddy with excitement, it uses IoT sensors to perfectly directly the cutting action and debone, remove the guts and perfectly fillet fish with no human involvement. Hope that machine doesn’t mistake his hands for wriggling salmon or he won’t be smiling.

JBT is essentially the “turf” to the Marel “surf”, imagine all the machinery in slaughterhouses but also in food cooking and preparation…. this videos explains more. JBT is Factory Automation for food.

I think what’s interesting is this is 50/50 merger - both companies are a similar size but combined the FY25 outlook is that revenue grows to $3.58bn-$3.65bn at a 15.75%-16.5% adj.EBITDA margin. That suggests profits will grow from the FY2024 $295m as synergies are achieved, in terms of rationalising the technology stack but also rationalising back office costs.

Both parts of the business bring strong and growing order books.

Considering Industrial Robots

The first Industrial Robots originate in the 1950s. Today, with the availability of sophisticated AI algorithms, more powerful chips, improved sensors and actuators, and a deeper understanding of electro-mechanical systems, the capabilities of industrial robots have advanced significantly.

This has also spurred their adoption and use. In 2023, global manufacturers installed nearly 4.3 million industrial robots, marking 10% year-over-year (YoY) growth, say Global X. Demand is particularly strong in markets like North America, supported by catalysts such as reshoring of manufacturing. For example, manufacturers in the United States installed 44,303 industrial robots in 2023, reflecting a 12% YoY increase. Canada saw even stronger growth, with 4,616 units installed—a 43% YoY jump—primarily driven by the automotive sector.

Amidst reshoring, manufacturers also favor robotics as the solution to tackle the dual pressures of rising labor costs and maintaining production cost parity. In the United States, manufacturing wages increased nearly 4% in 2023, making it challenging for companies to produce locally while sustain unit economic advantages associated with globally outsourced production according to American Machinist.

By 2030, U.S. manufacturing wages according to FRED data are expected to grow even higher, by roughly 35% compared to 2023 levels. Trump’s focus on reshoring precision-heavy industries such as electronics goods, semiconductors, and automotive further necessitates the adoption of advanced robotic systems to ensure quality and price parity. These sectors demand exacting production standards that only state-of-the-art robots can reliably meet.

Lastly, the cost of deploying industrial robots is also rapidly coming down, with a nearly 25% decline in the last decade due to advances in sensors, software, and hardware (FRED data). Declining prices could make this technology even more accessible.

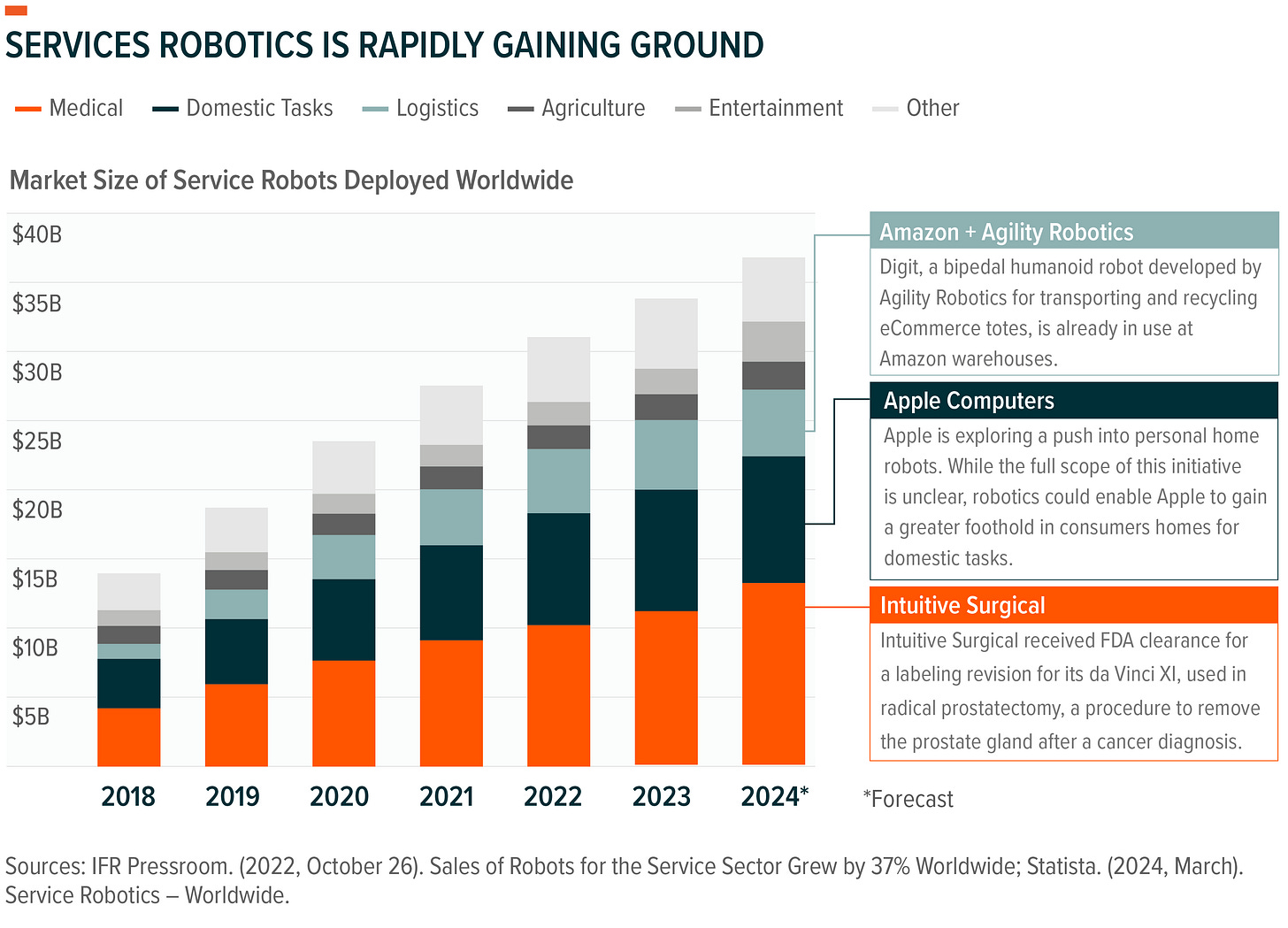

Considering Service Robots

Today, industrial robots are almost…. “expected”. But what if the larger opportunity unfolding is Service Robots? The world’s richest man thinks so. Optimus is a service robot.

Unlike industrial robotics, where robot usage can be confined to a fixed range, robotics applications in the services industry must be far more versatile. Robots operating in environments such as retail services or entertainment venues need to be both adaptive and safe to function effectively around humans. This puts a high barrier for acceptance, requiring near-perfect engineering of robotic technology.

However, recent technological advancements and development of robotics across growing use cases promise progress. In healthcare, robots are seen playing a growing role as assistants to surgeons, adding precision and reliability to surgical procedures. Intuitive Surgical, a pioneer in surgical robotics systems, most recently disclosed nearly 2.2 million surgeries conducted on its da Vinci surgical systems in 2023, which grew 22% year over year (YoY) and highlighting growing use of such technologies.

In logistics and transportation, the use of robots in well-defined indoor and outdoor geographic spaces enables e-commerce companies to operate more efficiently. Again not remarkable.

But consider that Amazon operates nearly 750,000 robots across its operations worldwide – there’s roughly one robot for every two employees. The robots help the company stay productive amidst turnover rates as high as 150% annually in its warehouses. Walmart’s warehouses, for their part, have been getting a boost from robotic fork-lifts.

Similarly, the restaurant sector, can benefit from robotics in counter work, order serving, food preparation, and even security. As of 2022, research by Aaron Allen showed only one service robot is engaged per 1,500 restaurants globally, suggesting vast growth potential.

Factors such as safety and ability to work alongside humans prolong the adoption curve for services robots, but we see steady expansion of the technology playing out this decade, benefiting the broader automation theme.

Considering Humanoid Robots

Our physical environment of course is designed primarily for humans (except for Cat Flaps). Naturally, robots taking humanoid form could find it much easier to function effectively around us. Human-like shape is also anticipated to enhance social acceptance of robots, making it easier to integrate robotics into domestic lives. For these reasons, the arrival of humanoids could mark a key inflection point for robotics.

What a great film Chappie was back in 2015, and 10 years later science fiction is close to science fact.

Advancements are being achieved in AI, particularly in making AI interact with humans through technologies like large-language models, bring us closer to this reality. Will we interact with AI only through software? Through keyboards and perhaps a microphone? Or will AI interact with us physically?

Technological progress has also attracted capital support. For example, there has also been a noticeable uptick in private funding targeted towards humanoid development in 2023 and 2024 according to Crunchbase. The market for humanoids could easily surpass fixed robots as industrial and domestic use cases emerge. Humanoid robots would have application into both industrial and service rendering “arms” and co-bots obsolete and handling more complex tasks—ranging from heavy lifting to adapting to varied work environments, delivering unmatched flexibility and driving significant productivity gains. At home, humanoids could revolutionise daily life by assisting with tasks such as cleaning, cooking, and caregiving.

The era of the demographic timebomb could be disarmed perhaps? An ageing population cared for by robots, a shrinking workforce becomes an unlimited workforce, limited only by energy and production, rather than by births and deaths.

Such a world could be utopia but would bring other challenges. Just like in the film Chappie. Regardless of whether that utopia is possible, the rewards for investors into one of the largest macro forces of today’s world - robotics - is less loved than AI stocks but just as profound. Just as a human is a mind, body and soul, robotics is the body to the AI mind.

Regards

The Oak Bloke.

Disclaimers:

This is not advice, you make your own investment decisions.

Micro cap and Nano cap holdings including those held in an ETF might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

So you looked at RBTX, ARCI and BOTG. What made ARC1 drop off a cliff?

Seems odd that RBTX and BOTG performance similar even with different holdings.

I've seen it argued that AMZN is essentially a robotics play. Glad to see your excellent article mention Amazon.

Odd that NVDIA was reduced if it is so fundamental to robotics. Would like to know the thinking behind that.

Like the industrial uses more I think. Seems less risky.