1 to 100 - KDNC - OB idea #9

A gamechanger RNS turns a trading flip day at Cadence Minerals into an opportunity

Dear reader

I’m deeply conflicted on this idea.

It is too good not to share but what do they say about too good to be true?

Yesterday Cadence (ticker KDNC) announced what I suspected what they would announce - a massively upgraded Pre Feasibility Study.

After hitting a 2.9p day high, traders quickly sold into the rise pocketing a 10%-20% gain. If that’s you, good for you.

But if that’s not you and you hold KDNC still or are sat at the sidelines and watched or perhaps have never heard of KDNC then let’s cover why it’s one of the OB ideas for 2025.

Cadence holds a number of projects but it has steadily sold them and whittled them down placing the eggs to a big egg called Amapa.

EMH - European Metal Holdings

EMH has a theoretical 36.7% IRR and a 51% partner in CEZ the Czech state power utility and backing from the European Bank of Reconstruction and Development. The DFS and the FID are due in 2025 after some replanning occurred for the mine site. As readers probably know lithium juniors are well down, but this Lithium and Tin mine project is proximate to European car makers so is “strategic” and the medium-long term growth of lithium demand remains undimmed.

Given today’s news from China restricting metals in response to Trump’s threats perhaps the need for European lithium is now here.

Moreover EMH’s NPV is at conservative commodity price estimates. For example EMH's PFS put Lithium Hydroxide at US$10,000/tonne and Carbonate at $12,000/tonne. Even with today’s low prices, they are not THAT low!

Also of note is EMH’s simplified flowsheet. Zeus say "At the full 20% reduction, this increases our NPV10 for the project as envisaged currently by EMH to $1,217m using our new long-term lithium carbonate price of $15,000/t, and by $300m to $3,655m for our expanded case (whereby EMH doubles production from year 6)." That would imply KDNC’s 2.96% holding of EMH @ £974m NPV and a 49% share of the mine is worth £14.1m/6.5p per KDNC share.

EG1 - Evergreen

Australian Lithium Miner EG1 similarly is prospecting for lithium and there are upsides not reflected in the current £200,000 valuation for the 8.74%, both in that milestones deliver further shares to KDNC in EG1 but also that the NPV is much higher than the market price of 0.09p suggests. There is a lock in until March 2025 in any case.

EG1’s project is contiguous to Core Lithium Ltd. They have temporary suspended operations at their mine in January 2024 due to the lithium price but it is notable that Core went from A$0.04 to A$1.67 in 2023 when lithium prices were high.

This Australian web site “Stockhead” tells us that the geochemical samples are contiguous:

Sonora

A third holding called Sonora is held at zero. There is a dispute to the title of the holding with the Mexican government. There is an administrative review ongoing and there is a £3.9m balance owed by REM Mexico (in connection with Sonora) which may or may not be recoverable. The actual NPV over 20 years is £23m (10.1p per KDNC share) but the areas might not be mined until the late 2030s so potentially some sort of deal might be done with the primary miner, Ganfeng.

Amapa

Amapa is a brownfield Iron Ore mine, railway and port. It is being written about positively in Brazil and has both State and Federal government support. Steel making is a big business in Brazil with over 33.7mt produced each year, placing it the world’s 9th largest producer.

Green steel is a form of steel produced through renewable energy and requires high grade iron ore. Metallurgical coal is otherwise required for the lower quality stuff. For this reason Green Steel attracts a premium price both because it’s cheaper to make but also because it can sell for higher prices to eco-conscious and ESG-criteria buyers.

Making Green Steel requires both green iron and green energy. Brazil has extensive renewable energy is one of the best placed to offer Green Steel (using Hydrogen) as well as Amapa’s high grade Iron Ore. Green Iron Ore attracts a $20 premium per tonne.

The Amapa project requires permitting (called “LO”), which is forecast to be granted in the next few weeks and the Definitive Feasibility Study (DFS) needs to be finalised and then the Final Investment Decision made. There is a memorandum of understanding with Sinoma Tianjin Cement Industry Design & Research Institute Co., Ltd. a wholly owned subsidiary of Sinoma International Engineering Co., Ltd. ("TCIDR") to provide a final proposal to complete the Definitive Feasibility Study ("DFS"), and on completion of a successful DFS, to submit a fixed price Engineering Procurement and Construction ("EPC") contract for the Amapá Project. The DFS, EPC contract and any other services provided by TCIDR are subject to both the services being provided on a competitive basis and KDNC’s commercial evaluation and approval.

After permitting (“LO”) a 12 month refurbishment build means production could potentially begin in early 2026.

Amapa is on the books at $14.3m or £11.5m which is purely book value of expenditure. Based on an NPV discounted at 10% this 34.6% share is valued at £547.23m (based on a $1.97bn NPV10 for 100%).

Reader, this is why this is a 1 in 100. Because of your 2.5p purchase, 0.3p is the listed value of EMH and EG1.

The 2.3p translates to 238p as a $1.97bn NPV10.

A 1 into 103 if you’re being picky.

That further assumes:

a/ Assumes EMH and EG1 account for 0.3p a share (£0.65m)

b/ Assumes Sonora is worthless

c/ Assumes EMH can’t rise in price from record lows despite the planned DFS and backing from the Czech state energy company, and the European Bank of Reconstruction and Development for a strategic Lithium project.

d/ Assumes EG1 can’t rise in price from record lows despite an ongoing drilling program which has been reporting successful strikes of Lithium.

But Wait

The inevitable “too good to be true” kicks in.

We don’t yet know the financing terms.

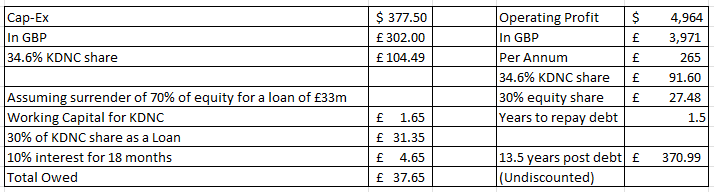

KDNC’s portion 34.6% of $377.5m would be circa £104.5m

It is highly unlikely that KDNC could raise that in the markets itself, so the solution would be offer a portion of the equity as part of a loan package.

Let’s imagine the Indo Sino Pty Ltd dudes can pay their 65.4% proportion.

But KDNC scrabbles around to find the £104.49m it needs. Let’s imagine we’re on Dragon’s Den and the Dragon says I’ll give you 100% of the money but I want 70% of your business. Ouch. But let’s go with that. It’s pretty extreme but we need to think worst case.

I mean look at it from the point of view of the Dragon. I’m lending you £105m for a project where I’m going to get 24.2% of a project worth nearly $500m profit (24.2% of $1977m). But let’s make it even harsher.

Let’s say the Dragon then says, I’ll lend MYSELF the 70% of the equity I own (that you’re giving me for free), and I’ll lend you 30% for the equity you then own. So effectively that Dragon is taking your ENTIRE equity and selling 30% back to you! Cheers Dragon. What? Oh and there’s interest too? 10%? Oh and the project is going to take 18 months not 12 so you’ll owe for 1.5 years. Ok.

Then and even then which is the most screwy, unfair, nasty ‘orrible terms and conditions I can dream up. Even then the £27.5m you get from your 30% of 34.6% of the £265 operating profit each year pays off that orrible Dragon and leaves you with £370m less whatever discount you think you want to apply.

The point is I’m struggling to see how shareholders can get diddled through the finance stage.

This is green iron - but not a green field

The reinstatement of the mine, the railroad and port has a revised cost of $377.5m based on the new 2024 PFS. Eagle eyed readers will know this mine was owned by Anglo American.

What if the outcome here is that the redevelopment is not financed at all? What if the LO is obtained and the DFS produced and in steps an acquirer? What better acquirer could there be than Anglo American?

Let me explain why:

Anglo decided to sell in 2013 after 6 died during a freak wave, and to concentrate on its Minas-Rio asset. Anglo American sold its 70% stake for $300m 11 years ago.

Who plans to grow their Green Iron business by 2030? Anglo American. Here is their Investor’s presentation deck.

Despite its mines having a production outlook with NO GROWTH (until after 2026 at least). AA speak to doubling Minas-Rio but that’s 25Mt additional or 40% overall growth. Acquisition is the only way to achieve the 2030 portfolio which is 46% iron ore.

60Mt of Iron ore produced each year - so aims to grow to ~120Mt by 2030. Only possible by acquiring producing assets. A green field would take too long.

Today, who is 100% focused on making Green Iron Ore? Anglo American.

Who has 4.3Bt of resources and might jump at 0.5 Bt more? Anglo American.

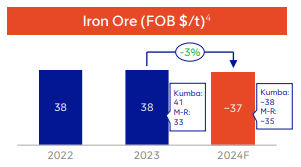

Who produces Green Iron Ore at $38/t and hopes to reduce their unit costs to $37/t, and who would see a mine with a $33.75 as very attractive?

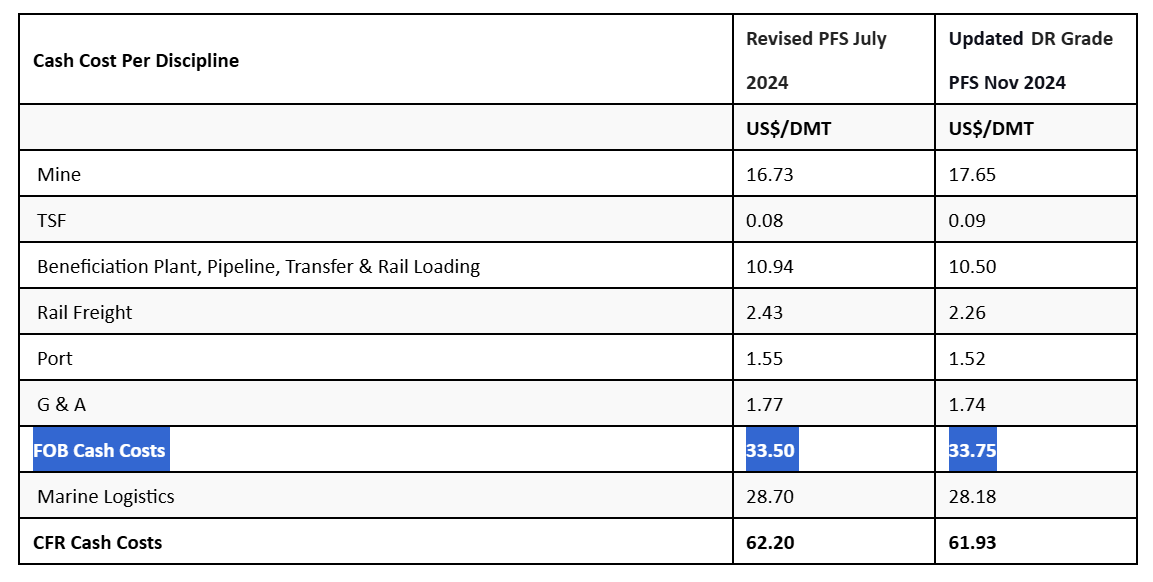

Amapa Revised Prefeasibility Results:

Costs $33.75 per Tonne or $61.93 including transportation.

This is the basis for the NPV10 $4,696m

The KDNC Directors in the last fundraise invested £125k into KDNC. £125k doesn’t sound like huge numbers but just to put this in context we are talking Strang and Suckling putting in 8 months of net pay and Morzaria 4 months of net pay equivalent (based on FY23 pay and assuming net is 50% of gross pay)

Valuation Thoughts

This is a 1 in 100 and today’s new economics throw a whole new light on the project. The revised economics are beyond expectations.

It’s a high risk idea in the sense that this is a nanocap with little cash and holds 34.6% of a Tier 1 mine. But otherwise where is the risk?

Risk of dilution for sure - but even considering the greediest Dragon and the most onerous terms even then this is surely worth more than the 2.5p to buy?

Being optimistic and with a fair wind behind it this idea could sail in even before 2025 begins, and possibly could make 2025 the best investment return year you ever had.

And that’s just based on Amapa and before considering upside from EMH, EG1 and Sonora too.

Regards,

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

https://www.lse.co.uk/rns/KDNC/loi-to-acquire-projects-1631m-fundraise-updates-tr1djw6d7oih075.html

oops

Today on a 40% discount 😝