Dear reader

TOPIC 1: The Rebuttal

Did you read the copy of Rusty’s letter sent to the Honorable Frank J Pallone today?

What a great letter!

We learn that 12 plugging teams and 15 rigs has increased in 2023 to 16 plugging teams operating 17 rigs. That’s a capacity of plugging at least 350 wells/year (which is also the actual in 1H23 - see below).

We learn that the Environment Defense Fund hold DEC up as an example of good stewardship of gas well assets. The EDF highlight its concern that sale of O&G wells to private firms is a concern since these do not have to have sustainability goals as firm like DEC has.

We learn that 99.92% of Appalachian wells in 2023 had 2 or more leak inspections. Physical inspection is being backed up by SCADA - supervisory control and data acquisition. Automated remote monitoring.

DEC employ LIDAR capable of detecting 1 part per million of methane - substantially (or well?!) below the statutory minimum of 500 parts. Using best-of-breed technology from Bridger Photonics.

Bridger’s technology is backed by extensive - and recent - scientific studies.

In 2023, DEC conducted over 246,000 handheld leak surveys for approximately 68,000 sites. On a site basis, DEC attained a zero emission rate of 97.75%

DEC’s robust and transparent disclosures were specifically highlighted by the United Kingdom’s Financial Review Council in an October 2021 white paper on provision IAS37, noting Diversified’s expansive disclosure as a laudable example of how to provide fulsome and transparent estimates related to the Asset Retirement Obligation.

(The report is linked below reader for your viewing pleasure)

I see the letter is well received in the US, despite a strange reaction in the UK earlier today.

TOPIC 2: How does DEC compare on ARO?:

I thought it would be interesting to look at a range of companies Oil assets (Production, Plant & Equipment) and then to look at their Depreciation, Depletion and Amortisation to calculate an approximate “number of years worth of production”. My methodology is to use the DD&A (not just the depletion) since not all firms report that separately (DEC does).

ARO Top Trumps

What prompted me to do this was someone holding i3 Energy up as an example where they set aside a “much more realistic” level of asset retirement obligation (than DEC). Did i3 embarrass DEC?

Dec him!

What I found was that DEC has approximately double the level of “years of production” taking the rate of DD&A as the decline as a ratio to its PP&E. DEC stewards gas wells whereas i3 energy drills wells and carries out workovers when gas prices are high and goes acquiring when prices are low. i3 had double the proportion of ARO to PP&E but my thinking here is that if you have half the years of production then you must accumulate an ARO twice as fast.

Besides, DEC is able to decommission wells at 10% less per well than i3 energy - or at least that’s what their 2022 annual reports tell me.

i3e 70 wells / £1.369m = £19,557 ~ $25k per well in 2022.

DEC 214 wells / $4.889m = $22.8k* (this is lower still in 1H23***)

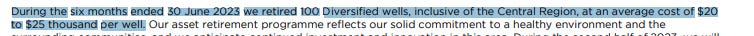

(***To explain the above “this is lower still” comment for 1H23 - I stand by this comment. Why? 100 DEC wells were retired in 1H…. plus 74 3rd party wells in 1H23 which is a 348 per year well retirement capacity (Or higher ….. we do not know whether the additional crews and rigs began Jan 1st 2023 or more likely, began during 2023)

The report clearly shows “At an average of between $20 to $25 thousand….” I’m sure it was easier in the letter to Honourable Pallone to just say $25k per well rather than get drawn into the semantics of whether it’s $25k or a little less…. as some readers appear to have done. I don’t see an inconsistency.

Remember, reader, even if it’s $25k it really doesn’t matter. 68,000 wells x $25,000 is $1.7bn of which $0.45bn is already set aside, so out of the NPV10 future earnings of around $8bn and debt of $1.2bn can DEC afford the ARO? The answer is yes, unless the retirement per well is $81k (in present day value) or greater.

(($8bn-$1.2bn)-($1.7bn-$0.45bn))/68,000 = $81k/well.

But we can also see the Plugging costs for 100 wells in 1H23 is $2,077,000 which is an average $20,770 per well. You deduct the cost of the plugged wells from your ARO, reader, because that accrued cost has been expensed/recognised - but I’m sure you already know that.

Anyway, back to comparisons….

The next example held up was Pine Cliff Energy (PNE). Again DEC is described as “pitiful”. But is it?

Danger! Falling Cliffs

Far from being a (Pine) Cliff Hanger the result is clear……… 5.7 years of PP&E compared to its DD&A - no wonder its ARO is so high! And to be fair to PNE their ARO is very high…. 79.8% of PP&E. Impressive! What’s noticeable too is that PNE do not once mention workovers, or returning wells to production. Perhaps the wells truly are exhausted, or perhaps they’re missing a trick.

Either way, by comparison DEC pursues a SMART ASSET MANAGEMENT policy so a CEO comparing the number of wells decommissioned sort of misses the point. You need to consider the fact that you only decommission wells that do not have a future life, and when comparing retirement activity levels you should also include DEC’s RESURRECTED WELLS in DEC’s count too.

Next up is the Enq Well

Enquest (ENQ) I believe operates deep water wells so you would expect their ARO to be much higher, and it is higher…. but much higher? I didn’t think so. DEC compares favourably here too.

SPLAT

Moving to SEPLAT and EQT I was really surprised. DEC compares favourably to both of these and particularly against EQT where the ARO of DEC’s is more than triple that of EQT’s.

Here’s the comparisons reader:

So this fake argument about DEC’s Asset Retirement Obligation being “pitiful” and below the norm simply doesn’t stand up to scrutiny. DEC accumulate their ARO in accordance with the IAS37 accounting standard so the liability is being treated exactly as it should.

Conclusion

None of the peers have the 71 year production profile which DEC has to operate, shut in, resurrect and work over with no drilling. They all focus on a drill and operate model over much shorter time horizons. So, just as I calculated in DEC-tecting fact and fiction DEC’s ARO does stand up to scrutiny. Remember ARO is a set aside on a balance sheet not some sort of piggy bank, except in the sense that the assets of the business offset the liabilities of the business - ARO being a liability. But DEC are calculating their liability according to IAS37 so their approach is unremarkable and in keeping with its peers.

This is not advice

Oak

I broadly agree with this. I just wish they'd addressed the inconsistency you pointed to in the CATF report, as it seemed to me just a simple typo that changed 0.21% to 0.71%. It would have been so simple and obvious to point out that now I'm in some doubt.

By the way I don't understand your extrapolation of well retirement capacity/costs. Half of the 174 wells Next LVL Energy retired in H1 were DEC wells, so looks to me you're double-counting them when you add the 100 DEC wells retired. From the interims: "During the first half of 2023, Next LVL Energy safely retired 174 wells in the Appalachian region, of which 87 were operated by Diversified and 87 were owned or operated by third-party companies or state plugging programmes."