Hello reader

A reader asked me about ARO. No, they weren’t a Twilight fan. I have nothing to say about Volturi Vampires (apart from Michael Sheen is one of the most incredible talents in the world).

The ARO I’d like to explore today is DEC’s ARO - its Asset Retirement Obligations.

I tried to approach this with an open mind. After all, I am a climate activist. When King Charles speaks of his worry I hear him. So I tried to see if the other side had a point. I had the fun experience of reading the legal complaints and read the case against DEC.

For example:

https://www.ehn.org/amp/abandoned-oil-and-gas-wells-2659296731

https://climatecasechart.com/wp-content/uploads/case-documents/2023/20230616_docket-522-cv-00171_complaint.pdf

The gist of these allegations is that wells are not being retired quickly enough, that the ARO is too low and that production is “running out” and constant asset purchases must be made to replenish production. The ideas the final well will be exhausted in 2095 is “totally” unrealistic they say. Moreover, they allege asset retirement costs are not accounted for and there’s a future black hole where hapless land owners will carry the can. More specifically, they allege EQT deliberately connived with DEC to sell DEC gas wells that both parties knew couldn’t be dealt with in the future. (As an aside reader, I know via my site statistics many of you haven’t read my gassing on about gassing on about DEC part 1 - I’d encourage you to do so where I describe the great comparative value of DEC vs EQT. It makes good reading in a week where we have DEC is now at 65p. Astonishing, when you compare prices to its peers. EQT hasn’t budged. I am looking forward to that US listing reader and have averaged down on DEC this week.)

Back to ARO. Well, we’ve spoken before about production running out haven’t we reader? In Captain on Dec we looked at and rubbished, the case for depletion. Depletion, Depreciation and Amortisation is accounted for and in H1 2023 “cost” $115m. Depletion is growing slightly year on year. There are rules for how Depletion is calculated which you can read (here). This gets audited - in DEC’s case by PWC. The 7 banks who offer a lower rate of interest (sustainability-linked debt) also audit. There are environmental audits by MSCI, GMP who both use independent auditors. There’s a lot of auditors being hoodwinked it seems - or there’s no case to answer.

As for the year 2095 timeline this is the timeline given by independent engineers based on PDP proved developed producing assets. These are subject to audit (and appear in the 2022 audit)

I also read the DEC ESG report cover to cover. I met the author of this report at the Excel earlier this year. If you are one of my readers then welcome.

Reading the legal complaint and in the various conspiracy articles and web sites which complain about DEC, there is plenty of prose but no numbers to substantiate what they are saying. Show me the numbers! The opposing case seems to rely on a vague “usual industry capping costs” are far higher than $25,000 a well. DEC have proven approach and are capping at $21,000 a well. This is an excerpt from a presentation on ARO which illustrates how DEC approach the problem more smartly (the graphic links to the report)

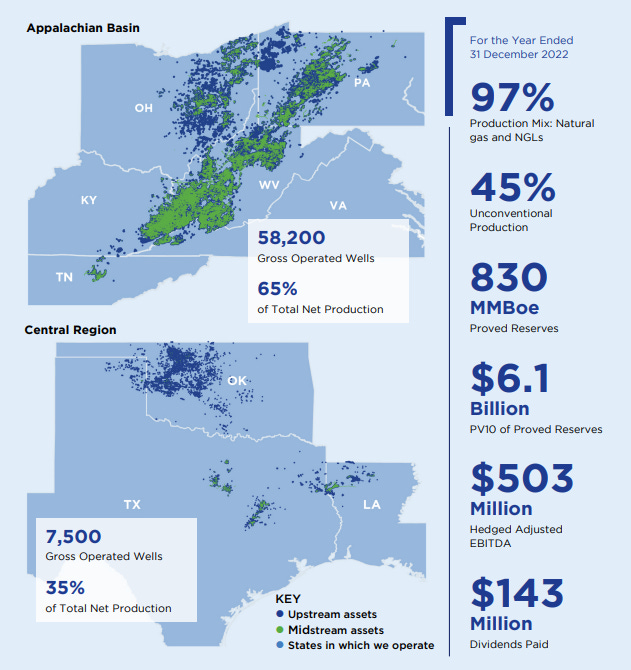

DEC bought and operate an explicit well retirement business called Next LVL. It operates as a standalone business and competes to win work - and has won work from 3 US State Plugging Operations in 2023. Next LVL has expanded capacity from 40 wells/year to at least 348/wells in the past 2 years. To plug all 70,000 wells in the next 75 years suggests they will have to increase capacity by 2-3X but having proven they can increase by 10X in the past 2 years is this actually an issue? Also later on, I explore some of the reasons you WOULDN’T want to merrily plug lots of wells - at least not yet. We will explore reasons like workovers, shut ins and Carbon Capture.

DEC put $14m investment into Next LVL in 2022. No wonder then that new capabilities and capacities lead to economies of scale and economies of experience:

What I also found fascinating was the idea of turning exhausted wells into a profit engine. Have you gone mad Oak? What value is an exhausted well? The answer is Carbon Capture. If you can reverse flow CO2 into a well and sequester it then you can claim carbon credits. It’s genius. A Ryanair business model. Sell them a coffee for 3 Euro, then charge a Euro for using the Loo. Charge them on the way in and charge them on the way out. Don’t worry reader I was on a Ryanair flight last night they’ve not yet introduced the Toilet Charge. In fact I was fortunate enough to get a 4 Euros drinks voucher from Ryanair due to a 6 hour flight delay. It afforded a medium Americano. Geeeee thanks Michael. I’ll be getting a further 250 Euros compensation from them for that delay too, don’t you worry.

It’s not just DEC that has ARO. US States have them too. When John Q the Indie Gas well operator disappears into the sunset the State picks up the tab. It’s a bit like fly tipping. The council clear up the mess and try to find the culprit if they can. So imagine DEC is like a more efficient clean up crew. Earning money from the State Govt. By retiring nearby DEC wells in concert with retiring State wells you clearly get economies of scale as the above illustration showed.

It’s also the case that ARO is accounted for. Does that mean the money is locked away in a secure fund? No, I mean it’s a liability in the accounts. A liability is offset against your assets (cash, gas wells, debtors, plant etc) to give you a NET ASSET VALUE. Generally if you account for something it gets dealt with. DEC’s argument is that it’s only accounting for 25% of its ARO in much the same way as you’d only account for 25% of the depreciation on your car if it’s only a quarter of a way through its life. The ARO is linked to the estimates of remaining gas reserves - and future cash flow.

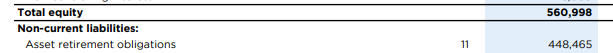

So let’s look at the numbers. In 2022 $27.5m was added to ARO. The balance sheet shows a $448.5m liability. That’s for what was 65,700 wells at the end of 2022. That’s $6,825 per well. Not enough! So let’s do some more maths. The average life of wells are 50 years. The long term ARO is $1.7bn according to DEC (and if you divide $1.7bn by 65,700 that’s $25,875 per well). The shortfall is $1.7bn-$0.448bn = $1.251bn. If you divide that by 50 (years) what do you get? $25.3m a year. Look at the P&L below. DEC *ARE* fully accounting for its ARO. By 10% ($2.5m) more than they need to. Their full life ARO allowance at $25,875 per well is 23% higher than the average $21,000 well retirement cost they are achieving in 2023. Basically accountancy is that you account for the cost in the time period it’s due to occur.

What’s very interesting reader is if the carbon capture can happen then the ARO of $1.7bn is too high. 41% too high. The offset cost is $1.2bn as seen below.

If everything I’ve said about ARO is wrong. And let’s say true well plugging is $50k not $25k. What does that mean reader? It means of the future $8bn FCF, nearly $5bn is swallowed up with debt repayment and plugging. Assuming realised prices at $4.66/MMBtu, 4.5% decline, your 21.75% (using current yield) dividend for the next 5 years is secure* (at a cost of $160m a year assuming zero buy backs), and following this 40% of FCF is assumed (or $2bn over a further 45 years) which averages $44m so around 6% yield. The assumption DEC make is a total “base dividends” of $2.8bn. So there’s $200m left in the kitty. If well plugging is much more then the dividend is toast.

But if gas prices are as forecast and plugging is just $1.2bn, 50 year dividends are more like an 11% yield. Remember, too, that is before any kind of compounding. £1000 of DEC shares paying 11% p.a. paid quarterly, and reinvested, compounds to £227,000 over 50 years assuming no trading costs and that the share price remains at 65p for 50 years of course :)

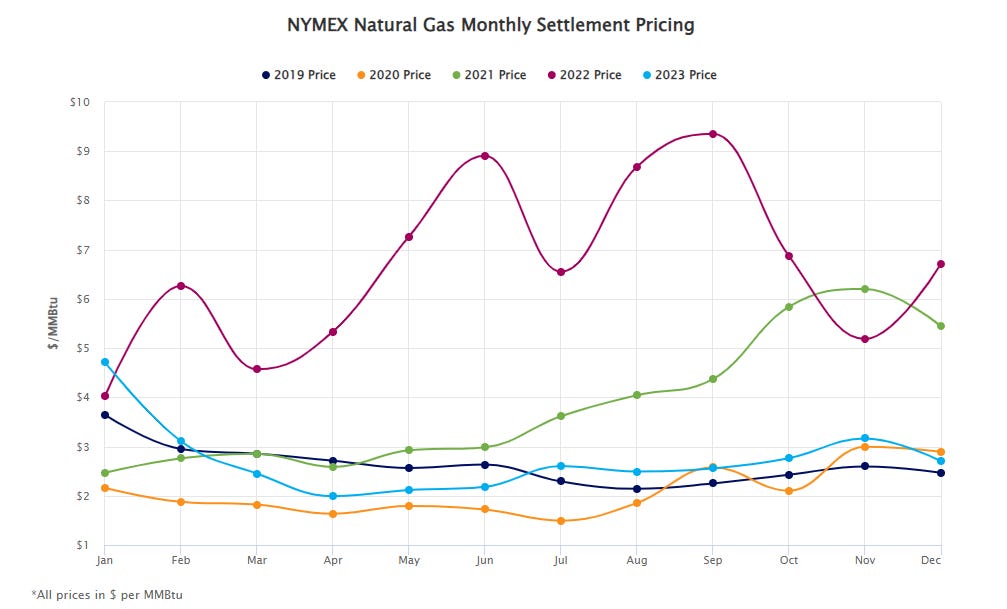

*IF gas prices are $4.66 average. A reader picked up on this. This is the Nymex over the past 5 years. The average is around 10% below $4.66 and average realised price by DEC around 15% below using in 2022/2023. So that’s a valid consideration.

$25k well vs a $100k well decommission

Let’s look at one of these wells reader. You have to plan, plug, sometimes remove tubing, set a bottom-hole plug (with cement presumably), then seal it (more cement) and remove the equipment.

Let’s use some common sense. Ask yourself if the stuff above were in your back garden would $25k (£20k) cover it or would the builder scratch his chin and say yeah, gov’nor, looks expensive, I’ll need $100k (£80k) to sort it out. Reader, I think you’ve just concluded the same as me. No case to answer.

Couple of final things to mention.

Shut ins

There was some criticism made of some DEC wells being “non producing”. Doesn’t mean they should be capped. Wells naturally build pressure back up over time. During high prices it can be economic to pump them, and during low gas prices economic to not pump them. Shut them in to rebuild pressure. $2m uplift.

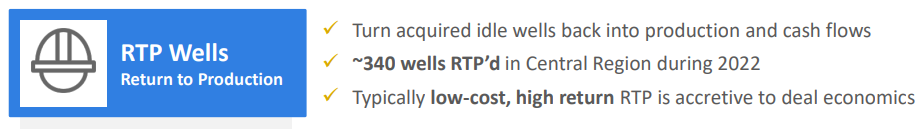

RTP return to production

Sometimes wells can be resurrected too.

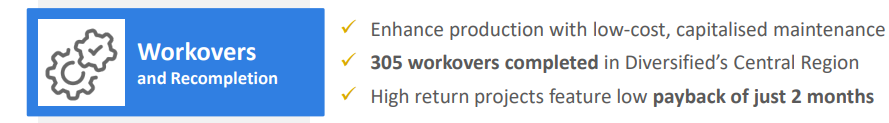

Work overs

A major reason why people get confused about depletion is they are not considering workovers. It costs $45k to workover a well and that cost is repaid in less than 2 months.

A workover can include a capillary string well treatment which as seen below increases the amount and consistency of production.

Leaks!

An obvious point, but minimising leaks also maximises production. DEC have put a lot of effort into leak detection and prevention. That’s another reason why depletion is lower than it otherwise might be - they sell the gas not leak the gas!

Conclusion:

While ARO is not a “piggy bank” the key piece to look at (in my opinion) is that Net Assets exceeds ARO. And it does - this is the position at 30/06/23. Exceeds by $112m. So if DEC closed its doors tomorrow it would have $112m book assets more than its liabilities.

I hope you find this useful in understand ARO and provides some solid facts why the so called “cover up” and “cliff edge” lacks evidence in fact. This article is not advice, if you need advice go and find advice.

OAK

Hi. Thanks for your posts about DEC.

You wrote:

"Your 21.75% (using current yield) dividend for the next 50 years is secure. That will cost $2.8bn."

I don't think this is correct. As far as I can see, the 50-year-scenario chart doesn't clearly define what it means by "Base Dividends" of $2.8bn, but that figure can't be the total cost of paying the current dividend over 50 years, as that would be very roughly 50 years x 17c x 1bn shares = $8.5bn. (I'm assuming that the numbers in the chart are not discounted to give a NPV, since there's no mention of a discount rate.)

I've never thought that the current dividend was intended to be paid for the full 50 years. That didn't stop me investing.

I would also point out that the chart's figures assume a gas price of $4.66 over the first 10 years (a price which is not currently being achieved), followed by a price of $4.91 thereafter. (And I don't think we can avoid this issue by appealing to general inflation to increase gas prices. If we did that, we should also correspondingly inflate future capping costs, and discount future dividends.)

All in all I don't think the situation is quite as rosy as you suggest.

The total Future Value (FV) of the $1.6B plugging costs is $8.33B using a 3.24% discount rate and 50 year period.

The total FV of the current ARO ($448.5M) plus 50 yearly accretions of $27.5M is $5.55B using the same discount rate.

Which appears to leave a $2.78B discrepancy between the two (not enough to cover liabilities).

To get the two to close would require DEC adding $23M more per annum in accretions to ARO.