Happy Saturday readers.

Now I think we all know the UK market is a bit cheap right now. So I said Oak Kay, let’s see if that applies to dear old DEC - Diversified Energy.

DEC yields 20.4% and I’ve covered why DEC is misunderstood in DEC the halls and whether it is “running out of cash” and “unable to pay its debts” in Captain on DEC

Looking at the stats from my growing subscribers (and thank you for your support) people are reading both of these articles very closely - more than other value plays. I don’t hold many FTSE350s and have always sought out overlooked value and there’s plenty (more) of that in the AIM market. Plenty, too, in Investment Trusts and I plan to write about one or two of those soon. Plenty of value in the UK generally too.

As we know, Rusty is planning a 2nd listing in the US and for that to become the primary listing - in time. He plans to keep the UK listing, he tells us, and there’s no reason to think this wouldn’t be the case. However they’ve pulled out due to the horrendous market sentiment. Tin Hat time!

Tin hat isn’t about survival - it’s about thriving in the future.

So I thought it would be interesting to compare a US listed equivalent to DEC. And then as serendipity would have it as I watched CNBC the perfect candidate appeared. EQT Corp. Mr Rice.

“Surely” its valuation is higher…… keep reading reader….. the analysis is astonishing! Slam dunk anyone??!! (But watch the CNBC interview first reader - it makes my analysis relevant)

First off, while we know DEC’s production volumes in Q3 and “nothing untoward” we don’t yet know the Q3 results for DEC. We do however know EQT’s results. And do you see a (very) positive read across from their Q3 results?

Second do you see a very obvious takeover target on companies like DEC from larger predators like EQT? Tony Rice speaks to consolidation, speaks to ESG compliance, speaks to the leveraging the differentiation of scale and the opportunity in LNG. Scale begets more scale. At $819m market cap, DEC would be a tasty morsel for EQT.

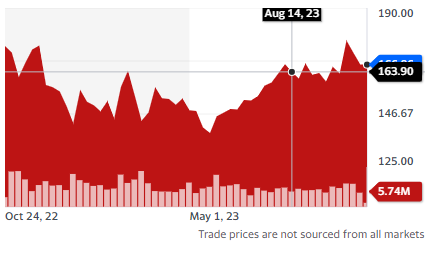

Next thing is to examine the 1 year share price. What do these 3 charts tell you about DEC?

EQT

Cheniere

DEC

By the way I added in LNG (Cheniere) late into this to just check whether EQT was a “one off”. LNG turns out to be an errm LNG transporter (funny that?) so doesn’t own wells (that I can see) instead owns pipes, LNG facilities (compress the gas into liquids) and possibly LNG ships - not sure. So perhaps the comparison is less strong to DEC.

So I started by comparing the Market Cap and the average target price. I’ve used Stifel’s price target of 170p for DEC. I know, I know, Jefferies say only 80p. But on the basis of what? Where is their analysis? What proof do they offer? I’ve read Stifel and can’t see anything wrong with their analysis. Remember Jefferies (let’s call them Jeff because I am going to mention Jeff a lot) thought the target price was 170p too, only a year ago. Bit of a flip flop there Jeff.

Right so the consensus target price suggests there’s little upside at EQT but huge upside at DEC (or only 15% if you are Jeff).

So let’s dig in to the data and find our own target price. Who needs Jeff and Stifel? So EQT, like DEC, does a lot of hedging. It has the same “misunderstood” profits and losses…. so it’s great to be able to compare “Adjusted EBITDA” and cashflow net of settled hedges…. it’s very revealing. More in part 2.

It’s also been great looking at EQT because I found these on their Q3 presentation. Do these 2 charts not excite you reader? The future of US Gas is bright…. Quadrupling LNG Capacity by 2030. That’s just 7 years Jeff. I think the capacity build out is far higher and faster than Jeff realised, and this is an enormous tailwind for DEC.

Jeff, does your 80p evaluation consider the future growth patterns of US gas?

North America is the dark blue on the left hand chart below. The lion share of LNG growth. Even between 2024 and 2025 LNG supply increases by 1/3 in the US. (more LNG supply means more converted - ergo more US Gas Demand)

I’m going to do a PART 2 reader… ARTICLE LENGTH LIMITS are flashing.

In Part 2, I deep dive into the EQT vs DEC top trumps. Keep reading reader!