Dear reader,

I recently had an interesting discussion recently with a reader about the Service Businesses held by Apax Private Equity. Service is one of three key markets targeted by Apax, and there is additionally a legacy Healthcare and legacy Derived Equity aspect.

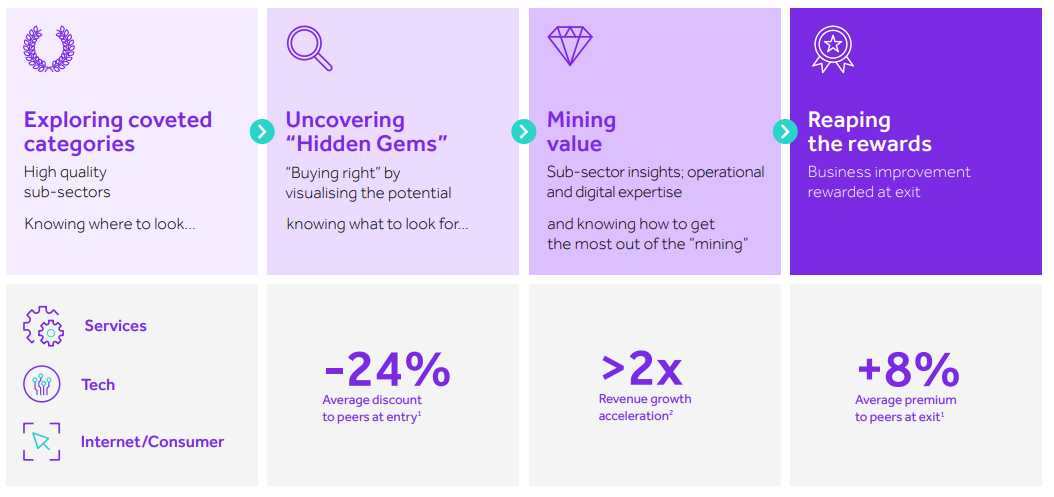

It is a claim by APAX that they can buy -24% cheaper and sell for +8% more than others plus grow holdings twice as fast. If that’s true what’s to lose, eh?

If that’s true.

As the reader put it: “it all boils down to how realistic it is to exit their investments at an average valuation of 18x EBITDA”

How realistic indeed. More on that later.

They continued: “ I have serious doubts that’s achievable unless we go back to a 0% interest rate environment.”

Little chance of 0% rates I say to myself, should I have serious doubts too?

They continued “I know the Services side well, I worked in Private Equity and there are some assets where the carrying valuation is unrealistic (eg Toi Toi and Safetykleen).”

After some deep diving into SafetyKleen where the Apax holding was acquired for €11m in 2017 and at 31/12/24 was valued at €30.6m. 178% more. Is that justified?

EBITDA profits had grown only 36% (from £76.4m to £104.2m in the last accounts in 2023) so, no, it was hard to justify and the reader was clearly knowledgeable on this. Perhaps profitability is much higher in the 2024 and 2025 accounts - we’ll find out in 2026 and 2027!

What other insights could they share?

Adco, renamed Toi Toi, was acquired for €7.3m and is valued today at €34.5m. Quite a jump right? Overvalued according to the reader.

Headquartered in Germany, Toi Toi & Dixi is a leading provider of portable sanitation solutions, offering a range of products and services including portable toilets, sanitary containers, and mobile showers. The company has a significant presence in the European market and is known for its high-quality and reliable services. If you enjoy attending Festivals, Events or the like then you’ve likely relieved yourself in a Toi Toi. Hopefully just a number 1. Having to do a number 2 would be a life-changing incident.

In 2019, the British private equity firm Apax Partners acquired a majority stake in Toi Toi & Dixi, aiming to expand its market reach and enhance operational efficiencies. In 2022 Toi Toi acquired 3 competitors Sebach, YLDA, Liekens. The same year Apax tried to sell it unsuccessfully. Since 2022 Apax has reduced its valuation from a €46.7m valuation in 2022 to €34.5m in 2024.

When Apax attempted to exit in 2022 according to MAInsights.io Apax valued the company between €1.5bn to €2bn based on 2022 revenues of €628m and EBITDA of €148m. The sale did not materialise. However, recent developments suggest that Apax may soon revisit its exit - claim MaInsights.io.

According to Toi Toi’s sustainability report turnover for TOI TOI SANITARIS MÒBILS, S.A. grew from €628m to €736m in 2023 (and from €428m in 2020). If EBITDA has grown pro rata (I do say if) then EBITDA of €173m would value the equity value at 8.7X-11.5X EBITDA earnings plus an unknown amount of Debt. That ignores any growth in 2024 and 2025 too.

So who knows…. if MaInsights are right…. then we’ll all know soon.

PS: Toi Toi do some very natty mobile toilets finished in Wood with proper sinks and luxury finishes. Demand better mobile toilets when next at an excruciatingly expensive event! They do exist! How much nicer would that event be?

Savatree

A third holding that the reader said has a doubtful valuation was Savatree.

APAX bought this from another PE Fund called CI Capital after CI tripled its revenues in 4 years we are told.

APAX claim since its initial investment it has transformed Savatree and has helped to deliver robust performance, even in a challenging environment:

• Organic growth acceleration and digitalisation by leveraging Apax’s Operational Excellence Practice’s digital playbook, with a focus on digital marketing and search engine optimisation, to fuel growth and capture market share.

• Margin improvement through unlocking cross-sell opportunities and optimising route density and pricing strategy.

• Expanding the internal M&A team, positioning SavATree as a platform for sector consolidation.

If LandScapeManagement.net and LeadIQ.com are to be believed, APAX appear to have roughly repeated the performance of CI Partners… they’ve tripled revenue until today.

When APAX acquired Savatree they had tripled by growing from 12 to 27 states. Today they cover 40 states suggesting the evidence about growing turnover could be true.

So whether Savatree deserves to be lopped or chopped is less clear. The strategy of expansion and creating a national brand made up of Arborists (tree experts) who are typically “Mom & Pop” operations who just love climbing trees kind of makes sense. I can see why that could grow value. I met a tree climber yesterday and that person told me once you climb trees it becomes an addiction. People get hooked to it you might say.

The WIDER picture

It got me thinking. I’d written positively about two exits in 2025 above the carrying value.

The same reader advised me not to “extrapolate from a couple of exits at or above carrying value to the entire portfolio” as “PE funds sell their better asset first in this environment”.

Makes sense to me, obvious even. So let’s widen the net. Let’s consider 6 years of performance at Apax. The long run removes selectivity and that will be more than “a couple of exits”. Since 2019 APAX have achieved 42 exits so let’s consider all of those.

APAX don’t always report granular gains on exit compared to the last NAV known as the “unaffected valuation” consistently although they always have reported an overall average gain on NAV at exit per year. As can be seen below the worst annual performance was in 2024 but generally these have otherwise ALWAYS (for 5 years) above the NAV. In and amongst those exits yes there were exits below NAV but the gains outweighed those - until 2024. If you agree Vyaire was a one off exception - as Apax argue - then even then the average exit was 0.4% ABOVE the carrying value. (Apax don’t disclose what the calculation would be in 2024 excluding Vyaire)

During all of those years we were not in a zero interest rate environment. Quite the opposite actually. Perhaps the reader should take courage rather than wait for said zero rate environment to see any improved portfolio performance.

I have had to record the MOIC and IRR for some of the detailed gains/losses and I **DO** understand they are not the same thing, but in 2020 and 2023 we do get granular disclosure and see lots of gains above the carrying (NAV) value in the detailed exits (known as the unaffected valuation). So while I cannot explain the reason for the carrying value of Safety Kleen and why that is so high while EBITDA profits growth (at last disclosure) do not appear to justify its 33.2m valuation the picture is less clear cut for Toi Toi and Savatree. They might be more flush and having branched out over years they might be ready for harvest. Both are non-UK so disclosures are far more limited compared to the UK.

Even if we take the reader’s experience at face value and assume a 50% haircut on the €103.2m valuation of the three (as at 31/12/24) then a -€51.6m reduction would be -5.2% of the €978.8m Private Equity valuation and would likely get lost against the historical average unaffected valuation uplift of 24% since 2020.

Now of course these gains are “gross” so don’t consider the costs of running the fund and of course Private Equity is about 85% of the fund but not the whole Fund. Nor do these returns consider the cost of capital returns to shareholders i.e. dividends and buybacks.

We also need to consider Unrealised gains/losses. Gains or losses on exits are meaninglesss if there are vast write downs on UNREALISED LOSSES after all.

Is there?

No, there have been reductions but (as we’ve seen with the above 3 service companies) these are largely reversing the strong unrealised gains added in 2020 and 2021…. the froth has been blowing off those valuations you might say.

There’s not really evidence of APAX kitchen sinking valuations and then declaring an above NAV realisation at exit. Besides KPMG audit the fair value assumptions and the Board of Directors oversee the valuation process too, so there are quite a number of eyes on the valuations to ensure they are FAIR even if shareholder disclosures are somewhat limited - for commercial confidentiality etc etc

Weirdly or more likely deliberately, capital returns to shareholders actually equal the net realised and unrealised gains. €343.7m of realised and unreaslised gains combined and -€343.7m of withdrawals has a certain Merchant of Venice justice from Portia feel to it. Not a drop more.

Fund Costs aren’t included in these numbers so overall the seed corn is getting nibbled at but the sustainability of the dividend was something I was keen to understand and from what I can see that is being largely managed.

Conclusion

At a 42.5% discount to NAV, where there is evidence that backs up the Apax “8% premium at exit” boast, and actually at 24% premium, also where you are acquiring assets at an (I think) attractive FX rate of €1.19:£1.

With buy backs reducing the number of shares too.

In a nutshell, if you believe the discount can close and that the exit upside can continue to occur then a target valuation upside of 116% above today’s share price would be fair. That generates an income of 11p per share (so 9.6p per £1 on a 115p share)

While it was good to get into the nitty gritty of holdings, I now feel more comfortable that there’s not (to use Shakespeare again) “something rotten in the State of Denmark”

Regards,

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

In general, Micro cap and Nano cap holdings including those held in an Investment Trust might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

Ah well, another one bites the dust. Recommended cash offer of €1.90.

https://www.londonstockexchange.com/news-article/market-news/recommended-acquisition/17144492

This has seemingly re-rated quickly to £1.40 and I'm back to where i started 3 or so years back!