Dear reader

I have goose bumps.

I wrote recently about Avacta in Avacta, Avacta Cash Flow Factor

I spoke about Cash. And Burn. And at the time angry Avacta shareholders, angry at a fund raise that was fairly obvious to an investor studying cash flows. But also I spoke that while, yes, there’s risk of more burn in FY26, there’s also a very real prospective upside - especially if there is increasing demonstrable evidence. Buying shares in Avacta gets you a 21 month lottery ticket run at a Pharma Major feeling compelled by the compelling evidence. Have we seen compelling evidence today?

We’ve seen some hints of compelling evidence today. Evidence that PreCision can target tumours. That it can minimise the effect of Chemo. The proof being that the Chemotherapy drug is between 10X and 1000X more concentrated in the tumour. This graph gives me goose bumps.

We’ve seen tumours shrinking in over half of admittedly a small sub-sample. Each bar in the diagram below is a human being with cancer. “FAP high” means they are 15 of 72 with a high FAP. Asterisks means they are still receiving chemo - further improvements could still come. And a few where the bars are above 0 whose cancer progresses - one poor soul who appears to get no benefit whatsoever at 22% increase. But do you see Mr Red bar on the last but one on the right?

This is Mr Red Bar. A 60 year old male, who went through radiotherapy and surgery which failed and 18 months later finally was LUCKY ENOUGH to participate in Avacta’s Phase 1a study. A year later and his cancer is nearly gone. The orange circles are 4 pictures of before and after of different parts of Mr Red Bar’s lungs.

I would stress Mr Red Bar is just one out of 15 of the 72 who has lucky enough to have a high FAP (you either come under a high or medium FAP) therefore it’s not (yet) true that Avacta is a proven cancer buster. Can certain criteria create an army of Red Bars? I hope so.

FAP varies by:

Tumor Type:

Different types of cancers exhibit varying levels of FAP expression.

For example, breast cancer may have different FAP levels compared to lung cancer or pancreatic cancer.

Tumor Heterogeneity:

Within a single tumor, there can be heterogeneity—meaning different regions of the tumor express varying amounts of FAP.

Some areas may have high FAP levels, while others have lower expression.

Individual Variation:

Genetic and environmental factors play a role in determining FAP expression.

Some individuals may naturally have higher or lower FAP levels due to their genetic makeup.

Environmental factors (such as exposure to certain substances) can also influence FAP expression.

Also it’s fair to point out that it takes two to Tango and it’s only Tangoed with Doxorubicin till now. Doxo is a steady eddie in the Chemo world but not the only dance partner for AVA6000

It takes two to Tango and AVA6000 has only Tangoed with Doxorubicin till now

This diagram is also interesting. This is human cells implanted into mice. A mouse with low FAP is toast. Toast if you do nothing. Toast if you give it Doxorubicin. Toast if you use Avacta + Doxorubicin. Toast.

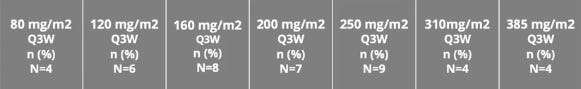

A mouse with high FAP - another story. Without Chemo, toast. With Chemo yeah lasts a bit longer, but as you introduce Avacta + Chemo its survivability improves dramatically. Quite how the units of measure compare i.e. 12MG per KG vs the HUMAN doses of 80-385mg/M2 is not made clear to us investors.

It is compelling?

Senior medical professionals like Christina Coughlin found Avacta compelling. Christina ex-Wyeth, Pfizer and Novartis joined Avacta. Christina who previously held several senior leadership roles in biotech companies including Immunocore, Tmunity and Rubius as Chief Medical Officer, leading clinical development, translational medicine and regulatory efforts across the pipelines of those companies. Dr. Coughlin earned her M.D. and Ph.D. from the University of Pennsylvania and trained in haematology and oncology at the Children's Hospital of Philadelphia.

Christina who presented brilliantly today. I was putty as she presented.

As a non-medical person and an investor who has family with cancer I find it compelling. It’s hard not to get emotional about today’s read out.

This is a link to Christina presenting the Phase 1a read out

This is today's investor presentation:

How does the Science work?

FAP (Fibroblast Activation Protein):

FAP is an enzyme found in the tumor microenvironment.

The worse a cancer is the higher the FAP levels become

It’s mainly expressed by cancer-associated fibroblasts (CAFs).

High FAP levels currently means a poor prognosis in many cancers.

AVA6000:

AVA6000 is a precision medicine designed by Avacta.

It’s based on a technology called preCISION™.

AVA6000 contains a dipeptide (a small protein piece) linked to doxorubicin (a chemotherapy drug).

How Does FAP “Cleave” AVA6000?:

Imagine AVA6000 as a tiny package.

FAP recognises and cuts open (cleaves) this package specifically within the tumor area.

When FAP cleaves AVA6000, it releases free doxorubicin right where it’s needed—inside the tumor cells.

Why Is This Cleavage Important?:

By targeting FAP, AVA6000 ensures that doxorubicin is activated only in the tumor.

This precision minimises side effects on healthy tissues.

AVA6000 selectively delivers doxorubicin to fight cancer cells while sparing normal cells.

In Summary:

FAP acts like a pair of scissors, specifically cutting AVA6000 where it matters.

This targeted cleavage helps AVA6000 deliver its chemotherapy payload precisely to the tumour site.

What next?

It is tempting to rush out and top up based on this news. It’s a new tax year. The news appears compelling.

But as someone who is also attempting to give a reflective opinion, as much as I’d like to fan the winds of yes, go and top up reader, and as much as I think to top up myself, is immediately after the news breaks the day to do it? I’d like you to take a breath and offer this view.

Please please please take a breath - and reflect. Think hard about going big on AVCT. There are other ways to invest in this area. For example, I see PDS Biotech at record lows, yet has a similar potential to Avacta.

PDS:

developing a novel immunotherapy platform called Versamune®.

Versamune® is designed to enhance the immune response against cancer cells.

It works by delivering tumor-specific antigens to immune cells, activating a robust immune reaction.

PDS aims to improve cancer treatment by boosting the body’s natural defence mechanisms.

PDS’s approach involves stimulating the immune system broadly, while Avacta’s AVA6000 is more targeted.

PDS works with Merck’s Keytruda rather than Doxorubicin).

Yet it is on a $3.27 per share low today, despite being at Phase 2 stage (not 1a) with similar compelling evidence. You can invest in PDS either via the Nasdaq or via UK-listed Netscientific (NSCI) which owns 3.5% of PDS.

And putting my “safety first” hat on, I’m not a medical expert so while I can speak of Mr Red Bar, and evidence in mice much of the science is complicated and much of what I read in terms of investor’s rationale and giddiness leads me to think leave the expertise to the experts.

In that sense, I find RTW Biotech Investment Trust a compelling proposition as this is full of medical PHDs who know what a FAP and a Peptide actually is. RTW which trades at a substantial discount to NAV, with buy backs ongoing. While your fellow AVCT-ers are diving in the shark fest tomorrow, did you read my buy-o-tech article on RTW and get a holding in the likes of Immunocore (where Avacta’s Christina Coughlin used to work incidentally) and who have a T Cell Receptor read out in H2 2024.

I guess, reader, while I share your excitement on today’s news and feel the pull of a “fear of missing out”…. the FOMO. Yet, I feel compelled to provide a view on AVCT’s presentation but as well as an alternative view on how you as an investor should behave after watching AVCT’s presentation.

The best thing an investor can do is take a deep breath and pause.

Regards,

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".