In “is it a Baker Steel?” I set out the case for BSRT and why it should be part of the OB top 20.

Baker Steel Resources Trust Limited (the "Company") announced its unaudited net asset value per share at 29 Feb 2023.

Net asset value per share remained stready at 75.3 pence/share - from December 2023 to Feb 24. Due to some movements in the portfolio.

At a market price of 47p buy that leaves BSRT on a 40% discount to NAV, despite an over 45% share price rise from recent 33p lows, and a 12% YTD return in the OB20.

Let’s explore the question “is there more to come?”

PUBLIC:

MTL

Metal Exploration is now at 3.9% of the portfolio announced bumper Q4 results. 85.1Koz compared to 78-81Koz guidance, at $1126 AISC. Its FCF means it will be debt free in the next few months, and it is exploring in the Abra area, while its RunRuno mine will run run out in 2027 so it has 3-4 years of free cash flow (which cumulatively should amount to over 100% of its current market cap) and is busy working on exploration for its next mine.

CMCL

Caledonia reduced to 4.5% of the portfolio mainly due to cost increases, but the underground exploration drilling at Bilboes-Motopa offers substantial further upside and economies of scale (an attractive AISC of $1,035).

BSRT stands to gain double here since there’s a NSR of 1% over Bilboes. BSRT gets a ~£0.5m dividend from Caledonia.

Silver X

Silver X continues to be in the wars and dropped 35% in the period as it undergoes its strategic reset - but it plans to turnaround and reach 2Moz silver in 2024 and there are grounds for optimism on this:

Post period the share price has regained over half its losses (Silver is as I write over $24.50 an ounce, while its latest brownfield exploration reports an initial inferred resource at Plata of 448,812 tonnes, at grades of 220.81 g/t Ag, 2.55% Pb, and 4.58% Zn.

The turnarond combined with silver’s price moves up could be very positive for Silver X.

First Tin

Tid bits of news continue even on BSRT’s holdings which have declined due to junior mining blues.

But interesting to note that Tin is now north of $27k/tonne and that 1st Tin reported “significant improvements to recovery rates”. Ahead of the DFS, even this £1.6m holding (2% of NAV) which you can “buy” for less than £1m may prove to surprise to the upside.

My eye remains drawn to its IRR calculation of 58% (which presumably will be revised upwards on “significant improvements to recovery rates”).

Tungsten West

Even at bombed out Tungsten there might (just) be a glimmer of hope. The draft permit has been granted last month. Meanwhile there’s undisputedly the need for tungsten as a strategic mineral (i.e. it is used in ammunition and can you think of a need to produce more ammunition right now?) and if it can raise finance then it could be in production in 2025. Tungsten at $340-$360/tonne would be profitable and the Hemerdon mine has 100Mt of proved and probable tungsten with tin credits, and needs just £23m-£33m CapEx (and more luck than it enjoyed in the past) to get to an NPV of £297m, or £232m according to H&P’s last analysis based on annual production of 3.5Kt of Tungsten at $340/tonne and 0.5Kt of Tin at an assumed $30k/tonnne.

But can it get there? The parallels to Futura, which was in a similar bombed out state, until suddenly it wasn’t, aren’t lost on me.

TUN’s last accounts shows £38m of assets, £16m of liabilities so £22m net assets vs a market cap of £2.5m.

PRIVATE

Prognoz

While BSRT have written down the Silver Net Smelter Royalty of 0.5%-2.5% to zero the reality is that a deal could done. Eagle-eyed readers will know this and that Polymetal (the ex-Jersey listed miner and FTSE100 constituent) recently sold off its Russian assets for $3.69bn which deconsolidated the Russian business from the Kazakh assets (yek shemesh!)

The Prognoz mine began operations Q3 2023 so due to the “tangled” NSR this will be forcing the Russian accoutants to place its earnings as accrued income but not recognisable. This is why I believe BSRT will be offered some money to unlock this accrued income, and for the Russian government to collect tax on its operation.

The value of the royalties are worth £1.5m-£2.5m per annum over 20 years, so a NPV of £28m. Even if just £7m is offered and accepted that represents 7p a share to the bottom line not even in the NAV right now.

Futura

I’ve saved the best for last:

Futura Resources achieved the milestone of first production of steel making (or coking) coal (10Kt) from its Wilton Mine in Queensland Australia, on plan and budget with a 1 month slippage due to heavy rains.

The coal has been trucked to the nearby Gregory Crinum Coal Handling and Preparation Plant (CHPP) and will shortly be batch processed into the final product. It will then be loaded and railed to the port of Gladstone on the Queensland coast before being shipped to customers. Futura anticipates receiving first sale proceeds from this shipment during March 2024.

Futura is in advanced negotiations to secure a A$35m pre-payment debt offtake and marketing facility with a major coal trading company to fund its second shovel ready open pit mine, Fairhill, contiguous to Wilton, which will allow mining at the 2nd mine to commence in September 2024.

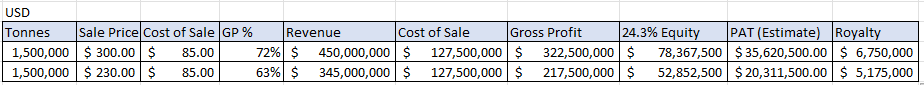

Once ramped up to planned production levels will extract between 3 and 4 million tonnes per annum of run of mine coal which after processing recoveries at the Gregory CHPP will result in sales of between 1.5 to 2 million tonnes of final products to the international markets with industry competitive operating costs of around US$85 per tonne.

Steel making coal remains vital to steel production in conventional blast furnaces which are likely to be the mainstay for primary steel production for many years to come, particularly in the developing world, with for example India forecasted to require significantly increased imports of seaborne steel making coal by 2030.

Prices for the benchmark Platts Australian Hard Coking coal have been stable at above US$300 per tonne over the past few months, somewhat above the industry consensus of around US$230 per tonne longer term, but well below the peaks of the mid US$400s per tonne seen in 2022.

The Company will own 24.3% of the equity of Futura assuming full conversion of the convertible loan together with a 1.5% Gross Revenue Royalty over all coal production from the Wilton and Fairhill licenses.

Let’s work that out mathematically:

PAT for BSRT’s 24.3% share is based on 25% straight line depreciation of US$11m (A$16m of A$65m), assumed US$8m (A$12m overheads), and 40% Tax (assumed).

This equates to a $25.5m-42.5m PAT to BSRT, or £20m-£33.5m per annum. (Or higher if 2Mt can be achived). Astonishing numbers.

£20m - £33.5m annual return from an asset which (35.8% of BSRT’s NAV of £80.16m) is book value of £28.7m and due to a 40% discount to NAV you can “buy” for £17.2m (via BSRT’s holding)

Now to get to 1.5Mt - 2Mt will take time and initial estimates of royalties are much lower. A 10Kt run rate if that equates to a month’s production then that’s just a 0.12Mt annual run rate, or 0.25Mt once Fairhill is opened.

I previously spoke to a much lower £3.5m royalty and £5m dividend income, for 2025, based on an interview with BSRT’s investment manager.

Even a £8.5m annual return on a £17.2m investment offers compelling value.

Conclusion

While there’s still some BSRT holdings which are struggling, and even may fall to zero the progress at Futura’s Coal, and Cemos’ Cement is very encouraging and the 40% discount to NAV remains very attractive.

When pretty much all of junior mining (at least in the UK) is in a quagmire of depressed prices, a lack of available finance it seems there are a cornucopia of bargains out there. After a few years in the wilderness, BSRT remains an exciting and I believe overlooked investment trust for 2024.

This is not advice

Oak