Dear reader,

“Let’s consider the news we have all been waiting for”. So said Oliver Friesen today, CEO of Guardian Metals. Guardian has a project in Nevada called Pilot Mountain which contains Tungsten.

Twitter is alive with the same single news source (Nikkei Asia) which is running this story:

This appears to be incredibly positive for Tungsten miners, and particularly those in friendly jurisdictions. But let’s put this bubbling excitement in perspective.

Tungsten was discovered in 1783 by Spanish chemists and mineralogists Juan Jose and Fausto Elhuyar. Austrian engineer Robert Oxland in 1857 patented a process for making tungsten steel. This led to tungsten’s use in industrialisation and machinery. The breakthrough came in the early 1920s when German company Osram developed tungsten carbide by heating tungsten (also called “wolfram”), carbon, and hydrogen at 1,400-1,600 degrees Celsius. The result was the second-hardest material on earth behind diamonds.

GMET’s excitement

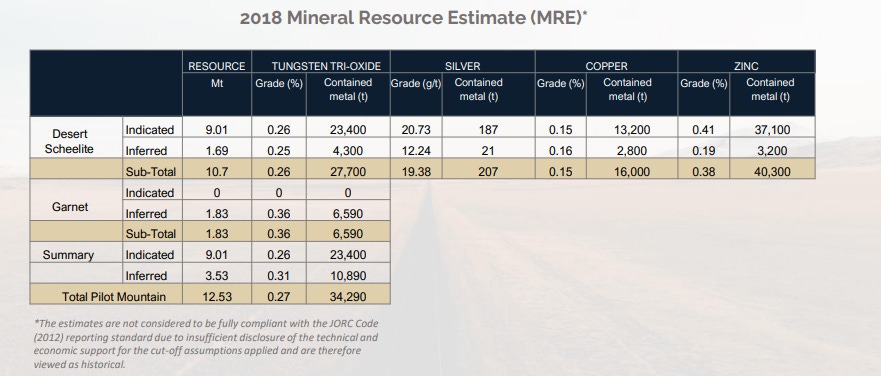

GMET currently has an estimated 27.7Kt MRE (resource estimate) of Tungsten. This estimate isn’t JORC code compliant and of course GMET are seeking to define such an estimate. The estimate could of course increase with increased sampling and drilling to define the resource. Tungsten grades tend to improve at greater depth.

Global Supply

2023 production estimates according to the US Geological Survey are that China produced 80.9% of Tungsten and Russia 2.6%, leaving 16.5% of world production or 12.9Kt tons in either friendly or non-aligned countries (Vietnam and Bolivia).

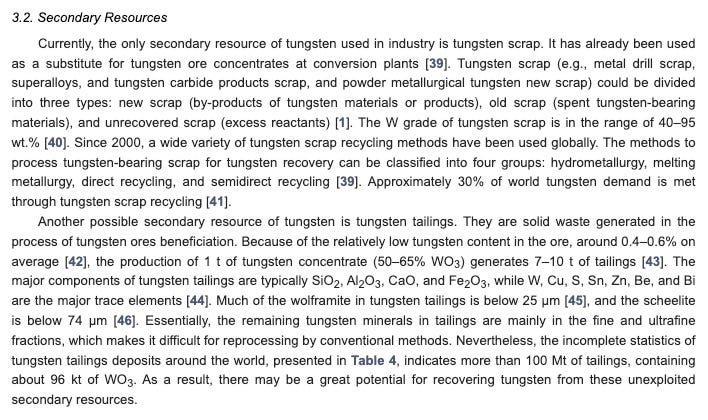

Recycling is a further major source of re-supply - over 20kt per annum.

Tungsten Demand:

Historical (2021) demand of 100Kt (estimated at 125Kt in 2024) looked like this:

But historical numbers hide current growth in sectors:

DEFENCE 10% (10Kt++)

As military tensions continue to rise, the demand for advanced defence technologies is increasing.

You may have heard the term shooting lead, and that’s because most munitions were lead tipped (with brass casings). Lead gave them their weight and hardness to pierce stuff. Tungsten is the evolution from lead-based munitions to Tungsten-based. Or for real high-end stuff you may have heard of depleted uranium munitions which are more expensive again with environmental impact - and were used in the Iraq wars for example.

➢ Tungsten is the key component in all modern armour, including in the M1 Abrams tank, armor-piercing bullets and (standard) 155mm caliber shells (as used in the HiMars). But also in body armour, and other military vehicles, also in other modern tanks.

➢ Tungsten armor is less regulated than depleted uranium and considered “exportable” by the US. Thus, the US will sell tungsten armoured tanks to allies - but not those armoured with depleted uranium. The US of A keeps those for personal use.

➢ There is a race for future technologies such as hypersonic projectiles, that use exceptional heat-resistant tungsten alloys

➢ There is extensive use of Tungsten as an advanced material in aerospace including military aircraft as a coating and also for mechanisms such as rotors.

➢ Poland ordered 116 x M1A1 Abrams tanks with tungsten armour (deliverable by this month) and a further 250 Abrams tanks (deliverable 2025/2026)

➢ Romania and other countries also expressed their interest in the Abrams too.

➢ France increased their military budget by 40% for this decade; Australia announced the biggest military budget in decades and Japan has recently unveiled an ambitious military build-up, renowned as the most significant since World War II, commonly referred to as "rearmament"

➢ China increased its military budget by 7% and is working to become the leader in hypersonic projectiles.

➢ In 2024, Germany will allocate over 2% of its GDP to defence spending for the first time since 1990, marking a significant milestone post-Cold War

Why did the Nazis lose?

History is an interesting teacher for those who bother to study it. The Chinese are famous for studying history, the Russians too. World War II was the first war which led with tanks. Arguably tanks were the major reason for the downfall of France, and later of Nazi Germany. It is easy to argue that Hitler’s insanity and decision making plus the combined sheer military might of the US and Soviet Union were the reasons for losing the war, but could something as simple as a lack of Tungsten be the core reason too? This link takes you to a fascinating glimpse how Hitler’s Wonder Weapons did not perform as expected through a lack of Tungsten, both in the weapons but also the factories which made the weapons. Have those who oppose the USA read the lessons of history?

World War I

It wasn’t the first time Tungsten was a challenge during War. During World War One demand for Tungsten drove prices up 700%.

“As submarine warfare took its toll on Allied shipping in 1915, tungsten rose an astonishing 700% above prewar prices, dropping back later in the year after ore imports eased domestic shortages …”

In a time when it did not have the applications it has today.

The USA

Considering countries now, US Tungsten demand (back in 2021) was 11,400 tonnes and was rapidly growing POW tell us. These demand numbers almost certainly excludes military demand. 100Kg per M1 Abrams tank doesn’t seem an unreasonable number and production is about 1,000 tanks a year. That’s 100 Tonnes per year just for Abrams tanks. Add ammunition and 20Kt-30Kt annual US tungsten demand doesn’t appear unreasonable.

On the basis that GMET claim:

If I’m right on US demand this suggests it can achieve 4Kt-6Kt production by early 2028. Logic tells you that you’d want at least a 10 year mine supply for that to make sense. So up to 60Kt or more.

The EU

EU tungsten demand is estimated at a further 10,000 tonnes per year. Again, those demand numbers are pre-Ukraine war and exclude countries like the UK. We know Leopard Tanks and Challenger Tanks have gone into rapid production since the Ukraine war. So doubling European demand to 20Kt-25Kt per year again doesn’t seem unreasonable, especially once you factor in the non-EU like the UK into that equation.

Rest of the Western World

South Korea, Canada, Australia, Japan could all be seen as further sources of demand. Estimates are 25Kt-30Kt.

Let’s also not forget that if countries now realise that they need to build a strategic supply then that’s a brought forward source of demand too.

Worldwide Deficit Estimate:

So that’s 65Kt-85Kt of demand vs about 12.9Kt of Western and non-aligned supply plus 20Kt-30Kt of recycling (that’s generously assuming that 100% of recycled tungsten occurs within the western world). So a 32Kt-52Kt per annum shortfall if China/Russia shut off 100% of supply.

EVs ALSO NEED TUNGSTEN

Despite various negative comments made against them, the growth of EVs and particularly of Solid State Batteries is continuing at a rapid pace.

➢ Tungsten is an increasingly important component in the production of EV batteries due to its ability to enhance their high energy density

➢ Development in the battery field is ongoing as performance, safety and cost-effectiveness are current key drivers

➢ Increased focus on niobium tungsten oxide in batteries to reduce charge time and increase power density could result in a growing demand

TUNGSTEN’S INDUSTRIAL USES IN SEMICONDUCTORS AND ROBOTICS

Robotics is evolving rapidly too. I’ve recently written about the rapid build out of robots and cobots. Consider then that:

➢ Tungsten Hexafluoride (WF6 ) gas used in the production of all semiconductors; a market with an expected growth of more than 12% p.a.

➢ Essential material to produce robotic arms and other heavy machinery; a market with an expected growth of more than 10% p.a.

➢ High melting point and good conductivity make it an ideal material for EDM processes, which require high levels of precision and control. EDM in this context stands for Electrical Discharge Machining. It's a manufacturing process that uses electrical discharges (sparks) to remove material from a workpiece. This process is often used for materials that are difficult to machine with traditional methods, such as hardened steels or exotic alloys. Materials with high melting points and good conductivity are well-suited for EDM because they can withstand the intense heat generated by the electrical discharges and efficiently conduct the electrical current needed for the process. This combination of properties allows for precise and controlled machining, even on complex shapes and hard materials.

Tungsten Requirement in Fusion - a potential future

➢ Approximately 100 metric tons would be needed per fusion reactor, with some designs requiring up to 200 metric tons

➢ Special Steel Composition around that reactor needs a further 1100 metric tons of special steel used in reactor structure, containing 2% tungsten. 22 more tons.

➢ If a scenario of deploying 250 thermonuclear Fusion reactors annually materialises to cover a third of global energy demand, it could lead to a yearly need for 30,000 to 50,000 tons of tungsten, with additional requirements for maintenance and component replacement over the first decade.

Fusion is just 5 years away - and always will be?

Not necessarily. China has activated its first Fusion reactor yesterday, successfully. Work continues. Objectively you can’t see a 5 year timeline today but will we see change under a Trump Presidency with Musk advocating Fusion? (Albeit Musk also advocates the Fusion reactor we already have in the Sky… the Sun. Musk has big skin in that game you see. Tesla bought Solar City in 2016 and Tesla deployed 348MW of solar cells in 2023.

How to invest in Tungsten?

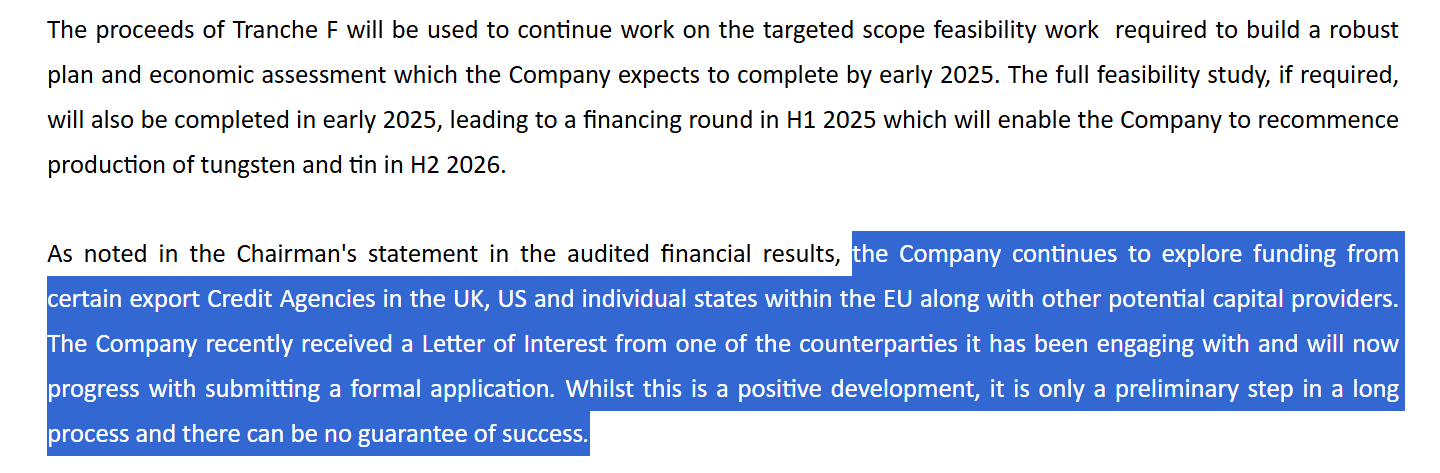

While I greatly admire Oliver Friesen’s enthusiasm which contrasts with the near silence coming out of Tungsten West, both could offer opportunity. Arguably all of the above Western Tungsten mines are going to be needed based on the perceived likely demand. But Tungsten West wins out (either directly ticker TUN or via Baker Steel Resource Trust ticker BSRT) because it appears to be the fastest way to play the theme, especially for UK investors. The DFS is imminent (as in the next few weeks) and FID is 2025 (will the FID take minutes to decide upon?!). 2,900 tonnes a year would be possible from 2H26 - far sooner than GMET perhaps.

Longer term, the higher (0.26% vs 0.18%) tungsten concentration, the polymetal by-credits (and garnet) could make GMET a more profitable approach, (analysed here in my article POW-lot mtn) while Tungsten West is Tungsten with Tin credits only. But it’s quite early to be able to say that today. It is also noticeable that other Tungsten producers like Almonty show years of mediocrity. $1 invested in 2010 would be worth $0.82 today (less inflation). Tungsten in recent history has been a pauper’s trade starved of capital and profit.

Almonty’s Sangdong mine:

It’s also easy to say that the US government will give preference to domestic production and that could be true especially under a Trump administration. But there’s also plenty of evidence that the US government are placing several bets with friendly jurisdictions so equal preference appears to be the approach. Yes, that might change under Trump. Until now the evidence that the US government are actively involved at Sangdong, South Korea, and while Tungsten West is very much more circumspect as to their backers, they do speak to “overseas agencies” involvement too.

Tungsten West’s MRE:

Conclusion

Almost regardless of the supply of Chinese Tungsten, Wo3 appears to have strong demand drivers. War, robotics, Fusion, Weaonry, Industrialisation, EVs, Battery Technology, Hydrogen Technology all make it a must have metal.

Those drivers “should” translate into strong economic forward prospects for Tungsten miners. The level of antipathy towards this critical metal, meanwhile, (with the notable exception of Oliver Friesen) across the Western world appears to be ignoring history, ignoring the reality of today.

But add in a China export restriction, tariffs and disruption then will World War One’s 700% leap seem small to what could happen here?

After all if I’m right about 100Kg of Tungsten per Abrams Tank and the unit price today is $43 per Kg then we are talking $4,300 of tungsten cost today per tank. Of a tank which sells for about $11m each. If Tungsten 10X’d in price that Abrams could cost $11.04m instead. Who would care?

The world would simply pay the price as there is no economic alternative to Tungsten (depleted uranium is far more expensive). That’s an interesting market to be supplying.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

The more you write, the more I like the little gems hidden within my / our? BRST shareholding... :)