Dear reader

Speculation surrounding Golden Metal’s Pilot Mountain has some investors bubbling with excitement and the shares have tripled in price in the past year.

GMET was IPO’d from Power Metals last year and it’s the 2nd spin out (the other being FCM - First Class Metals). GMET’s holdings cover Garfield, Kibby, Golconda and Pilot Mountain. Before we get to Pilot I’d like to cover the others.

Garfield

GMET identified “high grade gold-silver-copper” in bedrock and re-examined geological mapping and sampling to identify a “Magnetic Bullseye anomaly”, of

significant porphyry and epithermal style mineralisation principally located within the project's Power Line Zone and High-Grade Zones.

Have you heard that lightning never strikes twice? What about geological events? Do they strike twice? That’d be golden (metals).

GMET postulates “that epithermal mineralisation overprints earlier porphyry mineralising event, increasing the overall prospectivity and most importantly the gold-silver potential” over 4 square kilometres.

Notably, Golden Metal confirmed multiple 'Magnetic Bullseye' geophysics anomalies (often associated with intrusive porphyry centres) identified beneath the project's High-Grade and Power Line Zones. Inversion results confirmed the very encouraging size and scale of these buried anomalies.

The results were considered by the Company's technical team to be significant and a decision was taken to rapidly plan and undertake next exploration steps to drive the project forward. This campaign is now underway and represents the largest ever geophysical exploration programme undertaken by Golden Metal.

Next Steps

1. High-resolution induced polarisation ("IP") geophysics surveys over the High-Grade and Power-Line Zones, in support of three-dimensional inversion modelling.

2. A ground magnetics geophysics survey over the newly staked eastern extension zone.

Results should be available before the end of June and after this GMET will be in a position to delineate drill targets.

Other Projects

This presentation deck describes these. Pilot appears the most attractive of these.

Pilot Mountain

A 2,000m drill programme, a garnet study and high resolution ground magetics study is also underway at Pilot. A PFS is also underway (simultaneously) at Pilot.

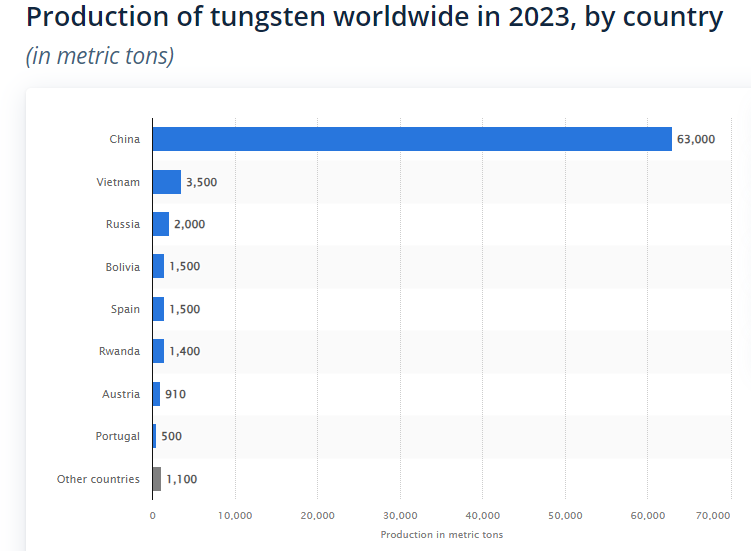

Pilot has indicated and inferred 12.53Mt at 0.27% W03 (Tungsten) with significant Cu -Ag -Zn Credits, or 34.29kt of metal. At $36,550 USD/tonne WO3 that’s $1.23bn of tungsten less the AISC (net of “significant” credits). The Chinese have introduced a 25% tariff to any exported Tungsten.

Tungsten is a focus metal for the West given its critical use within the defense industries (e.g. armour piercing ammunitions) as well as its usage within nuclear fusion technology. The U.S. DOD has banned tungsten imports from China for DOD procurement as of Jan 1, 2026 – domestic sources of mined tungsten are needed to fill supply gap.

The US government recently contributed a $2.26bn loan to develop a strategic lithium mine to reduce (over)reliance on Chinese lithium. Tungsten far more strategic - and thanks for Australian and South American sources Lithium is far less concentrated in China. Not so for Tungsten, needed for military weaponry. It is known that GMET are in talks with the US government but are unable to disclose any detail.

The historical studies also report that the dominant form of industrial garnet at Pilot Mountain is the mineral species Andradite with a lesser proportion reported as being the Grossular garnet species; A tonne of garnet imported into the USA in 2023 traded at an average price of USD $190 with domestic garnet trading at a premium price of $220 per tonne. The Garnet could be worth $952m - and a study is underway.

GMET have support from strategic IIs also Purebond for example who bought £506,250 of shars in a raise yesterday at a premium valuation of 22.5p per share with no warrants attached.

Significance for POW

Power metals has also been shooting up in price. In its last accounts (30th September 2023) it held £14.48m of net assets (including a holding in GMET and FCM). These net assets equated to 6.54p a share.

Since then GMET has undertaken strategic raises and warrants have been exercised. So POW’s holding reduced from 62% to 47.92%. (52.2m shares of 109m)

But GMET’s market cap is now £28.8m, while POW have GMET held as £5.1m. So POW have a £8.7m unrealised gain on its holding based on today’s GMET share price. The target price for GMET suggests that there is a further £6.6m upside too. Of course if you value POW’s holding based on 47.92% of GMET’s net assets the valuation is far lower (£3.8m).

POW also holds 1.7m unexpired warrants which if they exercised would mean a £150k gain since their exercise price is 17.5p.

FCM is suspended from trading due to an issue with their accounts but POW’s 23.16% holding was worth £0.5m, so a £1.4m loss compared to the last POW accounts.

POW’s NAV was £14.5m but since then the gain at GMET, the gain assuming the JV with Ucam for its Uranium assets goes ahead of £2.2m (as I covered in my article Uranium POWer) and the loss at FCM, and POW own fundraise net to £24m NAV. This puts the POW share price at a 5% discount to NAV.

This is a crucial point reader. 5% sounds like very little. But the analogy I’d draw here is this. Accounting rules states you list the book value at the lower of cost or realisable value. These assets were bought during the “drought” when mining assets were unloved and unwanted. You cannot buy those same assets for the same sorts of prices today. The assets also are the value of the land or the rights to what’s beneath the land (in the USA at least). Mining like buying muddy cutlery and a job lot of pictures at a car boot sale. When you clean it all perhaps you have solid silver or perhaps you have worthless stainless steel. Perhaps you have a child’s scrawl or perhaps you have a lost Monet. You are paying 5% discount to the car boot price - not the price of a Monet - and POW are the antique experts in this scenario - so you have a better than average chance of striking err gold.

But if you strip out last reported cash, and the current share price holdings of FCM and GMET POW is actually on a 46.6% discount.

If GMET and FCM reach their target prices and if you strip those and cash out at those prices then POW despite a doubling of share price is actually on an 88.45% discount to forecast/target NAV.

There will be a drilling programme at the numerous sites within the Athabasca region, via the Ucam deal, searching for Uranium, and a £4m payment once a signifcant value event is reached.

There are other drill programmes ongoing at Molopo and Tati, as well as JV programmes ongoing at Wilan (with AAJ), New Ballarat Gold (with RRR***), and a Net Smelter with Kavango’s drill programme in the KCB, Botswana.

STOP PRESS - RRR update 12/06/24

*** - the deal POW has struck is to get their book value back in 2 months time (£250k) plus:

A CLN of £250k convertible to shares in the next 6 months at their placement price - or paid in cash in 6 months time.

Shares equal to 3.87% of Red Rock Resources (RRR) which is 166.67m shares at 0.05p so worth £80k today. (3.87% is 166,666,667 on top of 4,138,978,811 existing shares.)

Warrants (expiring in 2027) at 5 times today’s market price of RRR mean if a bonanza is found and RRR shoots up, then POW can increase their holding to 7.75% at a fixed 0.25p/share cost (i.e. £0.4m cost).

£250k nine months after Completion

£250k on a 20Koz gold JORC (in cash or shares)

£250k on a 200Koz gold JORC (in cash or shares)

So the downside scenario is £830k (£750k cash and £80k shares) and the upside is £1330k + Warrants.

£1,330k is less than the £1.5m spoken about in the March 2024 RNS but that’s because RRR shares are now 0.045p not 0.15p agreed in March.

The upside could be worth much more. Nearby to New Ballarat, Chalice Gold literally struck gold in fact 32Moz of it and 15 bagged as a result. So the deal gives zero downside to POW-wowers, and **if** RRR is the next Chalice, then POW’s 7.75% holding would be worth £11.2m (£11.6m is 7.75% of A$308m less £0.4m paid for the warrants).

What’s more: POW will retain the royalty interests namely a 0.75% GPR (which is gross proceeds and uses the higher contained ounces, and is without deduction of costs) over the licence. If we were talking 32Moz then that’s worth US$552m to POW too.

What’s more if RRR stiff POW they can charge 2% interest a month and if it all goes horribly wrong can also take back their 49.9% holding for A$1 (e.g. if RRR go bust).

-

STOP PRESS - FCM update 13/06/24

Even the “bad news” of FCM’s fall in price could rapidly reverse. Shortly before suspending trading it announced it is in talks regarding the potential disposal of a number of FCM's core and non-core assets with Seventy Ninth Resources Limited.

Today it announced £270k for the sale of its Enable and McKellar claims. These are less than 10% of the area under investigation and have no discernable balance sheet value so the £270k sale price is effective “profit” and this plus a £230k loan equate to 8 months operating costs.

Other holdings are also under review. Also an acquisition of an earn in opportunity at a producing gold mine.

End of Stop Press

Meanwhile there are also 3 further IPOs POW have planned for New Horizon Metals, First Development Resources and Ion.

Finally POW also own 75% of GSAe as I covered in my article POW-dered opps

So this is why I decided to position in POW rather than GMET. To retain an upside if Pilot Mountain (and Garfield) are as exciting as they might be, but to also cover the upside in the cornucopia of opportunities within Power Metals.

Regards,

The Oak Bloke.

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".