Calculating the trajectory of invinity

IES has achieved funding at 0% discount

Dear reader

Invinity Energy Systems (LON:IES) manufactures and sells Vanadium Redox Flow Batteries (VRFBs) for utility-scale grid storage.

In the recent past huge sums have poured into GRID, GSF, HEIT and other “BESS” (Battery Energy Storage System) listed companies. These have typically been lithium 1 hour or 2 hour facilities. But lithium is not ideal. It has short duration of 1-2 hours, typically 5,000 charge cycles, fire risk, duration and end of life challenges. I will be writing about BESS and the opportunity (or otherwise) in UK Renewable Trusts in a future article, but clearly investors in many of those have lost money in what was supposed to be as safe as…. power demand.

VRFBs cost more up front but on a levellised cost of energy cost less, have 20,000 cycles, are fully recyclable (and the vanadium can be re-electrolysed for another 20,000) are longer cycle 4-12 hours, plus are much safer.

A year ago I read about the UK’s need for longer duration storage. I rode the IES wave and it became apparent that funding was going to be needed so I exited. I waited for the funding news, noting a successful Mistral prototype in February this year.

Two weeks ago on the 2nd May the funding arrived.

IES raised £56.0 million through a placement at 23p per share. (This was at zero discount). An additional Open Offer to raise up to £6.6 million has been offered to existing shareholders on the same terms. The influx of equity capital will transform the investor base, thanks to strategic investments from the UK Infrastructure Bank (UKIB) and Korea Investment Partners, along with continued support from existing institutional investors.

IES’ next-generation Mistral VFB technology, jointly developed with Gamesa Electric (previously was Siemens Gamesa) is set to launch in 2H24. Mistral aims to provide grid-scale, longer-duration energy storage (LDES) as renewable energy generation increases globally.

Mistral boasts 81 granted or pending patents and over 6 GWh of commercial interest. Building upon an existing base of 75 MWh deployed or contracted across 82 projects in 15 countries, Mistral is positioned for success. IES has a strengthened balance sheet, backing from UK, German and Korean strategic investors, an existing order book and this funding round will accelerate Mistral’s commercialisation.

Mistral is a game changer where storage costs reduce from $111/Mwh to $60/Mwh as efficiency rises from 67% in its Gen3 vs Mistral at 78%. Eagle-eyed readers will immediately connect the dots between my recent article HGEN (bemoaning Spanish wholesale electricity prices) and this. If renewables can sometimes produce power at “worthless” prices of $0.02/Kwh and store it for $0.06/Kwh that’s $0.08/Kwh. A gas peaker plant is $151-$198/MWH so $0.15-$20 per KWH over twice the price! In fact both Solar and Wind combined with Mistral are competitive across a LCOE + LCOS basis to baseload gas.

Die-hard anti renewable folks will shuffle their feet because the economics of renewables + storage can beat fossil fuels. Not always, because as they enjoy pointing out renewables are variable, and storage doesn’t exist in sufficient volume (yet).

This study from Lazard illustrates that IES doesn’t need special subsidies to be competitive, although it gets them via the US IRA (30% investment tax credit) and REPowerEU’s EUR80bn programme and investment from the UK Infrastructure Bank.

It is also notable that the UK government are conducting a “Review of Electricity Marketing Arrangements” (REMA) for UK electricical power. New arrangements the government are considering include a cap and floor mechanism to encourage new long duration storage and a LDES subsidy - particularly to address the high upfront investment of storage.

Growth

IES’ international growth strategy outside the UK/US, involves a capital-light model, such as with their partnership with Taiwanese industrial company Everdura. Everdura has already placed a 14.4 MWh order with IES and will manufacture Mistral VFBs under license. They will purchase cell stacks directly from IES, assemble the battery systems, and pay royalties on end sales. This licensing and royalty model supports the Group’s expansion beyond the UK and U.S.

Valuation

IES is a 22.5p bid/23.5p ask today.

Longspur’s valuation is 86p while VSA’s is 110p. The latter is based on a DCF valuation of £511 million.

It’s not entirely clear how either arrive at their valuation numbers, hopefully I can be more plain with mine.

IES is minority and passive project owner in a 7.2MWh project which VSA estimate to be worth £1.4m a year per MWh. Operating on an assumed 20% gross margin as project operator, with a 42% share that appears to equates to £0.9m EBITDA per annum.

Licences to Asia (Everdura and Hyosung). These will manufacture under licence. I assume a 10% royalty equating to £40k per MWh. I assume 50MWh in 2026 and 150MWh in 2027 noting that Taiwan have a 255MWh pipeline in 2024.

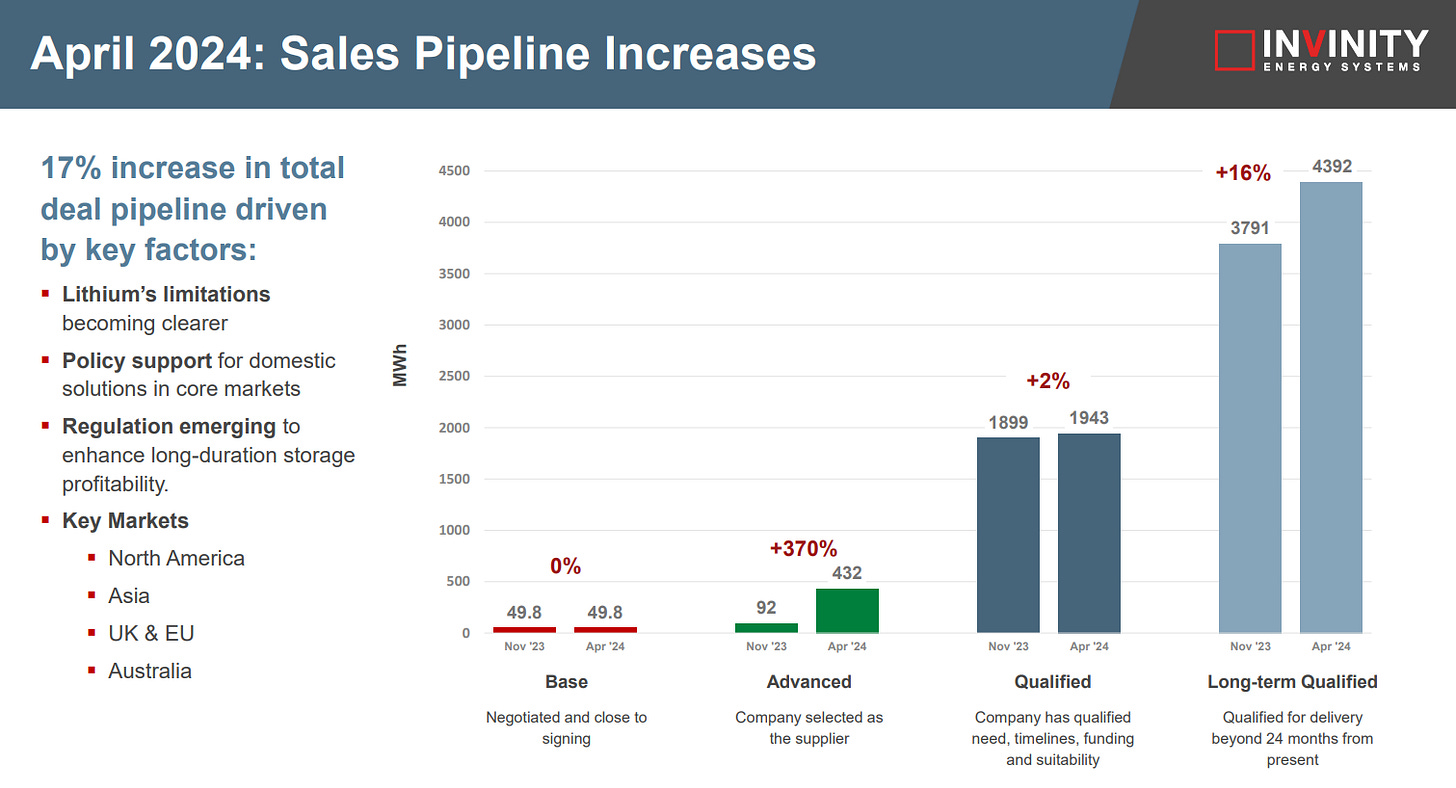

I then apply a £400k per MWh revenue to IES own sales and assume what I think is fairly conservative assumptions on sales growth. While a small loss is made this year and next, as the sales pipeline develops I believe we will see this rerate in the coming 12 months. The growth in pipeline since last November is the equivalent to an extra 2,400MWh a year. Hundreds of MWh have progressed from qualified to advanced (where advanced basically is signed up but need to implement)

From a cash flow perspective the £56m-£62.6m is actually more than enough to cover the losses in 2024 and 2025, since the sales and production for IES is already in place. Its factory in Canada currently has a 200MWh per annum capacity but can be expanded although it is likely a US plant will be added to take advantage of the IRA.

A warchest of some £40m is available to expedite whatever needs to be done, which I suspect may involve rapidly trying to meet demand.

My sales estimates are 100% of base, 100% of advanced, >50% of qualified and 0% of long-term qualified. Around 1000MWh of pipeline has been added in 5 months - equates to 2400MWh new demand per year.

Conclusion

Invinity’s Mistral product arrives at a time when energy security is paramount to the world. European energy security is an enormous investment theme, as is energy transition and Net Zero. These aims can be conflicting but with Invinity’s energy storage both are achieved simultaneously.

Two warm winters might make investors complacent since the consequential falling prices make the threat of energy disruption appear to be an event in the past. It’s not - higher future prices remains very real. LNG will arrive in greater volume from the US and Qatar in the future, but even that is not sufficient, and comes at a cost.

Heightened concerns also exist in South Korea, Taiwan and Japan. Meanwhile the US’ IRA provides enormous tailwinds for renewables and consequently drives the need for storage. There is no “national grid” in the USA as we have in the UK.

VRFBs can play a key role, as will Hydrogen, and the reduction in cost for VRFBs will drive their adoption and use.

On a forecast P/E 2026 of 2 and P/E 2027 of 1, IES is well-positioned, now well-capitalised and if it can execute its plan will reward investors handsomely.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

UK based battery storage trusts had a bad year. Just wanted to know if you think this is just a short term blip https://www.investorschronicle.co.uk/news/2024/02/05/battery-storage-trust-dividends-wilt-away/