Dear reader,

CHRY released their report to 30th September 2024. Well done to readers who followed this idea to a near double bag from just over a year ago. Back then only 1/3rd of readers polled felt CHRY had the potential to do so, and there was a lot of bearish-ness, and probably still is.

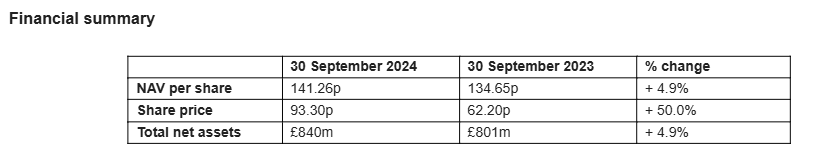

Meanwhile CHRY released their performance to 30/09 and NAV is up but so too is the share price.

This was a telling fact. “ALL” portfolio companies saw profits rise or losses narrow. £132m of profitability (this must be prorata since Starling alone achieved over £300m), on a portfolio of £840m is really impressive!

I first wrote about CHRY in “don’t CHRY for me Argentina”, which was just after the world cup quarters. Seems a world ago now doesn’t it? Milei is now El Presidente, Starmer is El Primo Ministerio. Argentina has gone from basket case to the poster child for Musk/Trump. Will Trump also adorn his wall with a Starmer pic? I’ll leave you to ponder that one.

Don't CHRY for me Argentina!

A well done to the England Rugby team. While pondering a good CHRY strapline I couldn’t help but choose don’t CHRY for me Argentina.

So what about CHRY for 2025? Buy, hold or fold?

I believe there’s more to come from CHRY in 2025.

For those who track all the data points, Klarna is the stand out performance in 3Q24, while wefox has disappointed and offset Klarna’s gain. But more on that later.

Featurespace was held at £81.4m as at 30/09/24 but sold post period for £89m

WeFox

WeFox has been “streamlined” in 2024, cutting costs and disposing of non-core assets i.e. its loss-making presence in Germany. What remains are regions where it either has profitable operations of a critical size or is on track to achieving this within the year. That means the Netherlands, Austria and Switzerland. €25m was injected to support the plan including €20 million from CHRY.

CHRY’s valuation was written down materially over the period, due to a more cautious assessment of the company's valuation, and the treatment of certain CLA instruments as debt.

It’s reasonable to feel the £36.2m valuation should be at its low point and new CEO Joachim Muller has a successful track record in busines transformation at Allianz Commercial.

Starling

In 2024 Starling unveiled astonishing numbers and 31.5% ROTE - return on tangible equity makes it stand head and shoulders above nearly all UK banks (beaten only by Bank of Georgia)

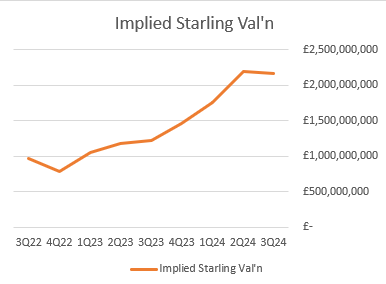

Starling as at 30/09/24 has a book value of £254.4m and this implies a £2.16bn valuation, up over 100% from a sub £1bn valuation 18 months ago.

Consider its banking first and compare to Monzo’s £4.1bn valuation in 2024:

Starling has much lower impairments (£160m), lower personnel cost, and a 2.5% higher Net Interest Margin. Monzo has grown its fee and commissions by 50% y-o-y and interest income by 340%, while Starling’s growth was only 6% and 70% comparably. Monzo wins the comparison in 2024. Monzo’s Profits moved by a £125m delta vs just £78m at Starling. And that’s why Monzo has a higher £4.1bn valuation vs £2.16bn. Yet if we compare those deltas and pro rata them we arrive at an implied £2.6bn valuation for Starling. Pro rata to Revolut £2.6bn valuation comparing profits to customers. Finally if you apply a P/E of 12 to Starling you also get a £2.6bn valuation. That’s 9p a share for CHRY’s NAV.

But then consider Starling’s “Engine” software. Consider its 1st customer Salt Bank who on boarded 200k customers in 1H24 and now has 300k customers at year end. Consider its 2nd AMP who go live this quarter in 1Q25.

CHRY value the potential Engine business at a future £10bn but I made a more prosaic £2225 per seat plus £8 per customer annual charge and based on Salt and AMP’s projected growth discounting by 10% on a P/E of 15 I arrived at a £1bn valuation - on top of the £2.6bn valuation for the banking business.

So £3.6bn compared to £2.16bn today is 66% higher and worth 30p extra to the NAV per CHRY share.

Brandtech

The Brandtech Group is a marketing technology group that helps brands do their marketing better, faster and cheaper using the latest technology. But it is also a marketing VC group that has invested in 24 startup businesses who are building tech-enabled ways for global brands to do their marketing better, faster and cheaper.

So this is a little bit like SFOR. CHRY tell us Brandtech spent 2024 integrating its businesses and streamlined cost, and to re-accelerate growth in 2025.

Brandtech has been embracing AI since 2018 before it was on trend to do so. Its advert prediction and generative AI perception builder (track how Gen AI views your business), its ecommerce engine, digital media agency along with partnerships with Google, Adobe and others along with

This 20 second video illustrates a small part of the “exciting technology” at BrandTech

Smart Pension

Smart’s valuation is up 40% in 2024. First class service plays a role, the 1 star reviews are harrumphers unhappy with the world while the near universal 5 stars show a professional business - FAR AHEAD of Nest and People’s Pension at 4.0 stars.

It has 70,000 businesses using its service with 1.4m savers. £22/month per employee + 0.3% fund charge + £1.75 per member translates to a £55m turnover business.

£6bn AUM (and £0.1bn organic growth per month) means £10bn AUM by 2028 and meanwhile Smart expect to reach break even in 2025.

As someone whose employer uses a pension provider with a legacy platform and how shockingly bad (and expensive!) it is compared to my SIPP provider - I get why Smart will grow - I’m sure you do too! Smart has Integration with nearly all UK payroll software, and in this interview Retirement saving is really a technology problem.

Today Smart Pension is valued at $1bn so £800m.

Based on AUM £10bn, 110k businesses and 2.5m savers that’s £110m revenue so perhaps a net profit of £40m-£50m a year, with growth prospects could be valued at £1bn so 25% above today.

Klarna

Klarna became profitable in 1H2024.

CHRY’s holding Klarna was re-valued as at 30/9/24 at £120.56m. Is that now fully valued?

Klarna’s revenue was up 16% year on year. Gross profit up 22%. Operating expense was static (excluding technology and product development it’s down by 10% actually*) so adjusted operating income moves from a £33.9 loss in 1H23 to a £50m profit in 1H24 - an £84m improvement!

*a 10% drop suggests the much vaunted investment in AI is translating into savings in “the real world”. Further evidenced that revenue per employee grew an ASTONISHING 73% in y-o-y to 1H24.

In fact at net profit level, a loss of -£24.7m in 1H24 from -£155.4m in 1H23 illustrates the strong trajectory and improvement year on year.

Klarna’s CEO commented:

Klarna’s massive global network of consumers and merchants is expanding rapidly, with continued success in the US as revenue grows 38% YoY in H124. Over 68k new merchant partnerships were established, supporting further engagement from our consumers, and driving strong revenue growth of 27% in H124. This led to SEK 1tn in payment volume through our network in the last 12 months

The Oak Bloke had a little shopping experience at Klarna and was gobsmacked to find a “Google-esque” experience. This is referred to in Klarna’s Interim Report.

Rather than think of Klarna as purely a buy now pay later experience it’s actually much more. It’s a way to find what you want as a shopper. I would encourage you to watch this video to understand the powerful dual online and bricks and mortar shopping experiences Klarna has managed to create.

Klarna speak to “becoming ubiquitous”. It speaks to a developing ecosystem. That means working with what were once competitors - Payment Service Providers (PSPs) for example. Strategic agreements with Adobe and WorldPay are examples where they’ve “lost” the gateway role but embraced thousands of merchants who use those PSPs - so overall gained far more than what they’ve conceded. All the major PSPs appear to be available for a merchant to “plug and play”.

The ubiquity for customers: The evidence is that once people start to Klarna they keep going and return for more. This is (Klarna say) due to a combination of saving time, money and assurance. Assurance means fraud protection, hassle-free returns, and delivery tracking….. all in one place.

The ubiquity for merchants: The evidence is also that once a merchant list on Klarna that the benefits mean increasing revenue retention, and growth. Klarna now has over 575k merchants, and that number continues to grow. In the past 12 months, it added over 68k new merchants and expanded strategic partnerships with iconic everyday-use partners such as Voi, Google, and Uber. The deal with Uber is to power its payments portal, with a buy now & pay at the end of the month (when you get paid) for customers….. smart.

But Uber aren’t the only ones - Klarna also struck a deal with travel giant Expedia/Hotels.com too.

This 5 year view is fascinating too. Income has increased by ~2.5X, and loans accounts for a portion of that income and these are ~3X over 5 years. What I find fascinating is the 5X growth in “deposits from the public”. These exceed “loans to the public” in FY24! Also the average duration of Klarna's credit portfolio is ~40 days. This means the company can recycle its capital 9 times per year (365 days / 40 days = 9.125). Assuming a 1.5% net transaction margin and 30% pre-tax margin, each $100 would generate $100 x 1.5% x 30% margin x 9 loans per year = $4.

You imagine loans to be a huge cost to Klarna (or Klarna’s merchant). But no. Actually deposits and the Net Interest Margin, make loans profitable, actually! And capital light with CET1 ratio of 14.9%, that’s as strong as a major bank.

Klarna VALUATION

CHRY owns 1.11% of Klarna so if a $20bn/£16bn price is achieved, the result for CHRY is a substantial £54.24m uplift and a £174.80m valuation - adding 10p per share to CHRY’s NAV.

CHRY’s £120.56m valuation (as at 30/09/24) implies a £10.8bn valuation. Klarna’s 1H24 revenue is £1bn so £2bn annualised. A £10.8bn valuation is ~5X sales. Affirm has a similar multiple of 5X sales (but was at a much higher multiple previously).

Assuming 5X is a fair multiple (which seems quite conservative) and furthermore assuming Klarna continues to grow at 27% then in FY2025 based on revenue growth to £2.5bn and expectations of 27% growth to £3.2bn then we neatly arrive to a £16bn valuation.

But isn’t the Klarna story a little bit like Ebay (and Paypal)? They got divorced in 2015. Until that point weren’t they “an ecosystem” and weren’t they “ubiquitous”? Back in 2009 they achieved $8.7bn revenue adjusted for inflation which is approximately £3.2bn today. Which is also my FY26 expectation of Klarna. Back then a $30.5bn valuation adjusted for inflation is £34bn today or 300% of CHRY’s valuation! So post IPO if CHRY holds Klarna as a listed holding will we see further upside maybe?

Of course you could point to the $2.39bn net profit Ebay also achieved in 2009, which is £2.7bn adjusted for inflation today and tell me I’m over egging the pudding. But with another two years could Klarna achieve that? It would require a “flywheel” effect in growth and a lower number feels “nailed on” given the £84m improvement to the bottom line in the past 12 months. Furthermore compared to Affirm which is losing between $0.5bn - $1bn a year and forecast to do so in both 2024 and 2025, the 5X multiple is a little harsh.

So while I will settle for concluding the forward prospects for Klarna feel to be “at least” a £16bn IPO, I also believe the 1H24 results demonstrate how the “ubiquity” of Klarna’s platform and services tap into a “Bricks vs Clicks” world in a way I have never seen Ebay do. I’m probably the last person you’d call an “avid shopper”, but I can see how Klarna addresses the world in a uniquely clever and nuanced way while creating an ecosystem where retailers and brands thrive, consumers are compelled to return and that ubiquity is worth something.

Deep Instinct

Many of us use Defender, perhaps, so it was interesting to see how this compares or supplements Microsoft.

It sounds like this one needs continued support when CHRY say “Continued innovation should ultimately widen the company's addressable market and lead to a growing sales pipeline, with sales conversion ultimately driving ARR progression and the strategic value of the asset.”

Infosum

This holding is ideal in a post-cookies world by using its patented technology to connect multiple data source records with any data transfer, for web stat analysis and customer insights. With zero GDPR fuss. Zero middleware fuss.

Partnerships struck in 2024 included with Experian, Netflix and WPP and you could imagine this being a high flyer in 2025 or beyond, although that belief isn’t showing in the valuation - yet..

Secret Escapes

I think Holiday companies and others, must grit their teeth around Social Media Review sites. Secret Escapes scores a 4.4, which exceeds OnTheBeach and equals Jet2. Some people use review sites to resolve a customer service issue and there appears to be a number of those. The score excluding those would be nearer 5.

EBITDA profits grew in 2023 to £11.4m from £4m in 2022.

Sky News tells us a sale is in the offing:

Conclusion

I can see how CHRY could get above £2 on its NAV valuation. So including closing the discount that implies a fair value of at least £2.00 a share - so 2X today’s price.

CHRY have delivered succesful outcomes for a number of its holdings and 2025 the year of the Klarna IPO should deliver more with IPO for Starling possible too.

Its stable is beginning to look a little bare so it would be good to see some new holdings - there’s plenty of bombed out great ideas to pick from!

The continuing buy backs and what appears to be still half price should boost the NAV also. 33m shares bought back is around 5% of shares in issue. A further £70m at £1 each would boost the share price by 15p per share also.

Regards,

The Oak Bloke.

Disclaimers:

This is not advice, make your own investment decisions.

Micro cap and Nano cap holdings even those held in VC stocks might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

It's hard to go badly wrong here when 15% is safely in the hands of AVI and the company wants to buy back another 10-15% of itself. (and that's before any proceeds from Klarna) It's just a question of patience and hoping that nothing blows up. (with wefox written down that bomb has already been mostly disarmed)

For Starling Bank, how do you get to the 2.16bn (implied) valuation? I neither found a multiple they use for valuing Starling nor their share of ownership.