A well done to the England Rugby team. While pondering a good CHRY strapline I couldn’t help but choose don’t CHRY for me Argentina.

Let me ask a simple question. When is Private Equity meant to actually crash? Chrysalis announced its Q3 update today - a 1.6% drop - yet trades on a 60% discount. At this rate it will take nearly 10 years of such quarterly drops for the NAV to actually reach the current share price. The growth is bad mantra, and the higher interest rates mean fast growing companies are bad mantra is pervasive. Do people not realise that Private Equity existed very happily under 5% interest rates in the past?!

In GROWing pains a month or so back I argued the (then) 258p share price was ridiculous. Today it’s now 221p - down 14.4%

In my article will TMT be explosive the same argument at $2.80. Today $2.58.

I’ve written various articles on TEK while at 12-14p; languishing at 9p today.

CHRY is another. 60% discount to today’s (lower) revised NAV.

What bad news does the market think it actually knows about these Investment Trusts?

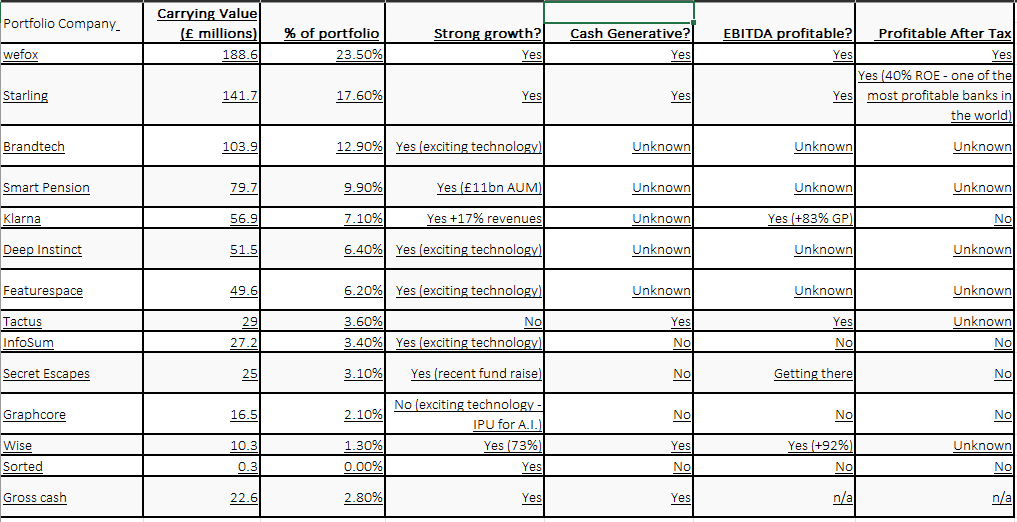

When I work through what I know about the Chrysalis portfolio I struggle to find 62.8% of the portfolio which are worth zero. Or 100% which are worth 62.8% less than than their book value.

In fact CHRY holds an exciting portfolio of disruptive (and mostly) privately listed firms. Growing and prospering as this chart sets out.

WeFox

In my article “Is VSL a risky bet” I speak about WeFox. To complete a funding round in the parched 2023 markets at a 50% upround suggests WeFox is something special. When you learn that JP Morgan and Barclays participated in that upround and this is backed by Insurance Giant Munich RE. WeFox is expanding to Asia and NA in 2024.

Starling

Starling is another exciting story. One of the most profitable banks in the world.

Between the pair, on the basis the share price is 100% backed by the current NAVs of Starling and WeFox alone, I’ve already exceeded the share price of Chrysalis!

But let’s carry on:

Brandtech

This is 20 second video which will illustrate why I write “Exciting technology” about BrandTech (this is just a little part of what they do).

Smart Pension

Retirement saving is really a technology problem says Sam as he shows the Keystone platform. As someone whose employer uses a pension provider with a legacy platform and how shockingly bad it is compared to my SIPP provider - I get it - I’m sure you do too! If you don’t watch this video and you’ll understand why they already have £11bn AUM and are profitable.

Klarna

Klarna has gone through some challenges as Buy Now Pay Later BNPL was demonised by the media after some Gen Z’s got themselves in bother when they “didn’t realise” they’d have to pay later with buy now pay later. The industry has tightened up and matured. Klarna is very close to being net profit profitable. It’s now breaking even on an adjusted basis in the H1 2023 Accounts

A recent interesting City AM article values Klarna at £12bn: https://www.cityam.com/klarna-pushes-for-12bn-float-with-new-british-firm/

whereas its last downround implied a reduced $6.7bn valuation.

Assuming this occurs this alone is worth 2.25x NAV of £56.9m so £127.5m and assuming that a £50m balance is kept as cash and the rest is used for buy backs assuming buy backs at the current 67p share would buy back about 1/4 of all shares in Chry and boost NAV per share to £1.79 from £1.34.

The Dead Ones

Arguably Sorted is anything but sorted but it’s been written down to nearly zero - the remaining £0.3m isn’t material.

Some people believe Graphcore is doomed - although in GROWing pains I speak to Graphcore could find a number of niches, and why I don’t believe the doomed thesis is correct. And even if it’s not going to thrive I don’t accept that 144 patents are worth zero.

Conclusion

CHRY offers some excellent holdings and the current 54.6p ask price is very cheap indeed. Based on total portfolio weighting companies that are either profitable or funded to profitability increased in March 2023 from 42% to 74%. That figure has since rose to 84%

So are profitable and cash generative companies are worth zero, Mr Market, because they have a “high growth” label? That makes as much sense as a firefighter bathing in petroleum before going to work.

Is CHRY better than AUGM, TEK, IPO, INOV, GROW or TMT? It’s the favourite child syndrome. Considering the discount, 60% is less than the 85% of GROW, yet you’re getting a more concentrated and later stage holding here maybe.

Similar to INOV, CHRY suffers from its history where shareholders were arguably taken for a ride by the Investment Manager. But that’s in the past.

As with all my writing you’re welcome to enjoy it but it is not advice and you make your own decisions.

Enjoy your evening.

Oak

PS if you are enjoying my work please consider making a donation to the Royal British Legion.

https://www.britishlegion.org.uk/get-involved/ways-to-give/donate

It’s that time of year again and fewer and fewer wear poppies. Halloween spending meanwhile has rocketed. We owe a debt of gratitude to all the service people who sacrifice, and often end up in a bad way on Civvy Street. Thank you in advance.

I had a small holding in CHRY for a while. I sold out in disgust at the antics of the manager. They still have not addressed the performance fee issue that saw the manager walk away with millions while investors lost big time. Touch with a bargepole I would not.

I’m with phl on this one - can’t trust da management and reflected badly on Jupiter. Tainted for me. Your TENT article was a revelation though ...