Market Cap £190.9m, NAV £262m, discount to NAV 27.1%. Ask/bid 68p/70.8p

Proposals to amend the Company’s investment policy to facilitate a managed wind-down of the Company were approved by Shareholders at the General Meeting on 12 June 2023.

They have been paying 2p a share every quarter for the past 20 quarters. They plan to continue to pay this for the next year or so.

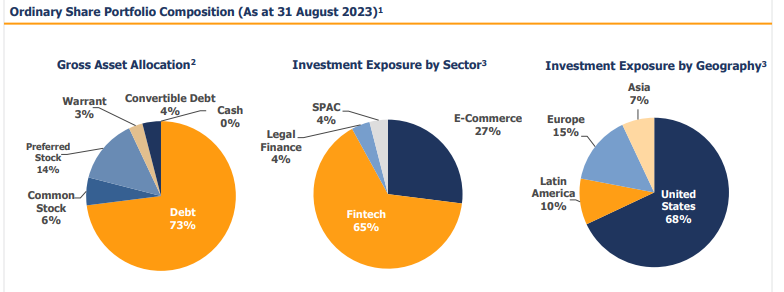

Their assets are mainly asset backed lending with near term cash flows (of both capital and interest), although there are some growth (oh no!) equity investments.

But let’s examine some of those.

First “FinanceApp” - sounds ominous - no, not really. This is WeFox Insurtech. And WeFox raised funds 4 months ago maintaining its valuation at $4.5bn - no downround to see here! I know WeFox from another of my holdings Chrysalis.

Heyday meanwhile is an ecommerce aggregator which according to an ex-employee has carried out major cost cuts (including him), so there is a 7.2% potential exposure to VSL although the 3.95% debt will have layers of protection. Heydey’s competitor Thrasio meanwhile has gone into Chapter 11 bankrupty. Thrasio has done so with $1bn of assets and $1bn of liabilities and continues to trade (under chapter 11 protection) with 90% protection for debt holders so the jury is out whether/if there will be any Heyday exposure. The RNS 07/02/24 shows a negative -5.46% capital return suggesting VSL has pre-emptively written some or all of this 7.2% down to zero based on what’s happened at Thrasio.

Combined the 2 equity holdings account for 10% of assets. There’s then another 10% of equity all with downside protection (as they are Preferred Stock), then 3% Warrants and 4% Convertibles. The rest is asset backed debt where repayments of capital are occuring each month.

Assuming ZERO upside from the convertibles and warrants, and using the data from the June 2023 accounts and August 23 update I’ve constructed an estimate of capital and dividend returns over the next 4 years.

By my estimate there’s a £1.29 return (of capital and dividends) assuming a pessimistic view:

As you can see I’m assuming haircuts and no hair growth (the convertibles don’t convert the warrants get chucked in the bin), despite the fact this trust only shrank about by -20% (hit to NAV) since 2021. Which is not a terrible result considering today’s bleak market, and prior to this it grew 50% over 18 months. The -20% is an unrealised loss mainly Fair Value adjustment to Equity with some minor levels of loan write off.

I’m assuming further haircuts of 15% on investments, and 50% on loans remaining post Q2 2027 (i.e. they sell off the remainder at a discount).

The problem with these kinds of investments is getting under their skin a bit and understanding the risks and downside.

The fact that over the next 2 years (Q4 2025) this “should” repay 70p (today’s share price), means the upside is everything which happens further out. My estimate is a further 59p post 2025 but there are grounds for optimism - for example an IPO for WeFox who are valued at $4.5bn and are backed by JP Morgan, Samsung, Barclays, and importantly insurance giant Munich RE gives me grounds for optimism.

So this is my opinion. This is not advice. But I hope it helps explain why I believe VSL is a nice little opportunity in the market with limited downside and possibility of upside. I wish you well in making your own investment decisions.

Oak

14/02/24 - I've had a question from Brent: "Do you have any more thoughts on this as the share price continues to fade away which seems crazy !"

Well, VSL's NAV has fallen by 5.1% in December and 1.1% in November while the share price has fallen by 18.3% so the fall is disproportionate. Largely, I think because people get "bored" with these sorts of shares. There's no particular reason for the 6% NAV fall either, the wider macro doesn't point to any kind of wider decline - quite the opposite actually.

But this is now one of the highest dividend yields and that yield is good for 2024 and most or all of 2025 which will be about a third of the current price, or we may see capital returns instead - that's the whole point of the current Tax Query - to find the most tax efficient way to return funds to shareholders.... legally

It will be interesting to see VSL's January report, which is out soon. The basic premise of this article remains valid - and WeFox newsflow remains positive... in fact is there a WeFox IPO in the offing? A new CTO and group CFO, at WeFox are they lining up and ticking the boxes that precede that? See: https://media.wefox.com/archive/press_releases/

Also refer to https://theoakbloke.substack.com/p/vsl-och-its-a-wee-fox where I discuss WeFox

This is worth a read too:

https://www.innovatefinance.com/capital/fintech-investment-landscape-2023/

"The majority of investors surveyed for this report remain bullish on payments, as well as regtech, insurtech and AI - particularly wherever these sub-verticals offer solutions to, in Volution VC’s words, “streamline process[es], mitigate risks, and reduce costs."

Hope that helps provide some perspective.

Oak

I'm a fan of VSL type stocks, and whilst I agree there is money back minimum, with potential for upside here, I think your 50% haircut on the debt element is excessive. Yes there will become an inflection point in wind down, where admin/mgmt costs will rise proportionally, having lost economy of scale, but even so, I'd suggest a 25% haircut to be more likely. Which for the patient, means even more pay back than you suggest.