Dear reader,

what a surprise tae learn that th' nearly unspellable fund is cried efter a ben. That’s a moutain tae ye fowk wha bide below hadrian's dyke.

I’ll stop writing in Scot’s English but I do remember reading Trainspotting in Scots English and I’d thoroughly recommend doing so - apparently they translated for the American audience who struggled to understand although if you speak it aloud then it’s surprising how easy it is to understand. Ye ken?

The ticker MNTN named after Schiehallion mountain therefore makes sense. This is another Trust from the Baillie Giffs.

Schiehallion (MNTN) reports these as its top 10 holdings:

Its private equity holdings are majority 54% US with 23% Europe and 10% China and 7% elsewhere. With 6% cash.

Its fund manager Robert Nazler recently argued public markets have fundamentally changed, with most large companies now staying private rather than listing on stock exchanges. 87% of US companies with turnover >$100 million operate privately.

The Schiehallion Fund specifically targets promising private businesses across several high-growth sectors including social media, artificial intelligence, data management, manufacturing services, and Chinese consumer brands. These companies often offer better investment value because they’re seeking private funding while waiting for the right moment to enter public markets.

Companies in the Schiehallion portfolio are growing significantly faster than typical technology stocks, with stronger profit potential. About 80% aren’t yet profitable, most have sufficient cash reserves to operate for at least four years, providing financial stability.

The risk profile sits between safer public investments and riskier early-stage venture funding. A typical Schiehallion investment is a company generating $200m in annual revenue and growing at 70% per annum. Rocketing you might say. Past success stories including payment platform Wise (75X revenue growth since investment), Affirm (24 times), and TikTok owner ByteDance (23 times).

#1 SPACEX

Valued at $350bn (based on a recent funding round) with revenues of $15.5bn (Musk recently revealed) so this is valued at 22X revenue and estimated profits are less than a billion. Assuming $0.35bn then SpaceX is valued at 1000X earnings (P/E 1000). 2024 revenue was an estimated $11.8bn so around 33% growth.

SpaceX is kind of like a Vodafone. Sorry to burst the bubble. It charges a monthly subscription for its Starlink service and that overtook its space transportation division in 2025. Space.com reports 7,578 Starlink satellites in orbit and the plan is for 42,000. The internet connectivity market is worth $1tn. At an assumed 30% market share and an assumed 35% profit margin that’s $100bn per year so a future P/E of 3.5X. But Viasat, Echostar, Amazon, Inmarsat and Eutelsat are all looking to do the same thing.

“After years of vertical integration, SpaceX is now entering its horizontal integration phase—leveraging its industrial scale and launch dominance to move rapidly into adjacent markets,” said Lucas Pleney, Senior Consultant at Novaspace and lead author of the SpaceX Business Outlook. “This shift, from space transportation builder to multi-market operator, is unlocking new revenue streams and reshaping the competitive dynamics in the entire space industry.”

Starlink’s rise has been consistent rather than explosive, built on incremental expansion across markets such as consumer broadband, government services, maritime, and aviation. Its financial growth has been accelerated by a distribution model that pairs direct sales with strategic partnerships, and a constellation deployment cadence enabled by low-cost access to orbit.

At the same time, SpaceX’s transportation business—anchored by Falcon 9—has shifted into a fleet management model. In 2024, only 6% of Falcon 9 flights used new boosters, with some individual rockets flying as many as 24 times in a single year. These reusability gains have helped lower Starlink’s marginal cost of capacity, reinforcing the commercial viability of the satellite business.

This realignment from a capital-intensive infrastructure company to an operator with scalable recurring revenue streams represents a natural next step in SpaceX’s trajectory. The company is still investing heavily, particularly in Starship and Starlink’s D2D architecture, but is now doing so from a position of financial strength.

Ron Baron is a large shareholder in SpaceX and his latest newsletter makes interesting reading:

Future Profits in the 2030s according to Goldman estimates will be circa $1.25tn. Today’s $350bn valuation and “yesteryear’s” P/E of 1000X fades to irrelevance if they are right.

#2 Ben Ding Spoons

Chances are you’ve used Ben’s software. If it’s Remini hey I’m not judging you. You Catfish.

Ben is a buy and build business.

Ben is Italian (Benito) based in Milano so acquires Silicon Valley businesses sacks off the San Francisco developers and uses cheaper Italian developers instead. It acquires businesses, improves performance and features but puts the prices up too. Yes it loses some customers and slows growth but turns the platform profitable. Ben Ding aims to build cash cows.

It targets distressed businesses that are underperforming or stagnating companies which have the potential for a turnaround. It looks for steady cash flows from subscriptions, and recurring revenue. It looks for a loyal user base: Products with dedicated users who rely on the service are less likely to churn despite price increases.

It looks for untapped potential: Businesses where operational efficiencies can be implemented, costs can be reduced, and revenues can be increased through price hikes and product improvements. It models out cash flows and intrinsic value to determine what it can pay since they buy and hold companies instead of flipping them.

CEO Luca Ferrari plans an IPO in the next few years.

#3 ByteDance

The OB has resisted moving to the TikTok platform despite an overwhelming number of requests. Anyway the other Tiktok saga of 2025 is the Trump plan to force ByteDance to dispose of its US operation due to connections with the Chinese government. TACO - Trump always chickens out - is a recently invented acronym and Trump has delayed the ticking (and tocking) deadline for this to happen three times. The jury is out. The outcome could determine the planned IPO and its recent $300bn valuation in a recent buyback of shares.

Alongside MNTN are various PE firms like KKR (see the XLPE OB25 for 25 idea), Softbank and other investors in Bytedance.

Bytedance actually has 12 platforms spanning various applications. Douyin is a video creation app, and there are social, chat and collaboration platforms as well as a big bet of generative AI.

TikTok, CapCut, TikTok Shop, Lark, Pico and Mobile Legends: Bang Bang, as well as products and services specific to the China market, including Toutiao, Douyin, Fanqie, Xigua, Feishu and Douyin E-commerce

#4 Affirm

Financial Services BNPL provider offers payment services via its app, via merchant checkout and via its card.

It is used by 8% of the US and growing, and argues it is different to a credit card and taps into a younger audience afraid of credit cards. Smart, perhaps have grown up listening to their parents complain of the credit trap. It is 3X larger than the next largest BNPL provider with 22m active customers making 5-6 purchases per year.

#5 Wise

Wise’s vision is to build money without borders. It moved £145.2 billion across borders for 15.6 million people and businesses, a 23% increase compared to last year. This growth has been generated by the investments it’s made in underlying infrastructure, delivering lower fees and faster speeds reducing the take rate by 14bps over the year, to 53bps in Q4 FY2025.

More customers also benefited from instant payments, with approximately 65% of transactions being completed in under 20 seconds.

Its well on its way to handle trillions, not just billions, and become 'the' global network for the world's money.

£282m net profit on £1.21bn revenue with a focus on growth this is an interesting company.

#6 Stripe

After Spacex possibly the 2nd most “wish it would IPO” company. Remaining private allows it to continue to grow and reinvest in its scaling.

#7 Tempus AI

Based on recent advancements, including generative AI, the time is now. AI is finally ready to transform healthcare. Tempus believes the change will occur in diagnostics first.

This US-listed firm has 40m patient records and 0.3m DNA+RNA profiles summing to a model of 300 petabytes of multimodal healthcare data. It offers data services (analytical tools), diagnostic tests and matching of patients to clinical trials or healthcare initiatives.

It is growing rapidly and will likely hit EBITDA profitability in 2025.

#8 Tekever

A European Unicorn with a £400m funding round in 2025 this Portuguese and British UAV (drone) manufacturer has a five-year program called “Overmatch”.

Think of this like a modern-day “Nimrod” that blinds, jams and deceives enemy radar.

Or go further back and “Window” were strips of aluminium foil released from a single bomber that fooled the Nazis to think an incoming fleet of bombers were coming in.

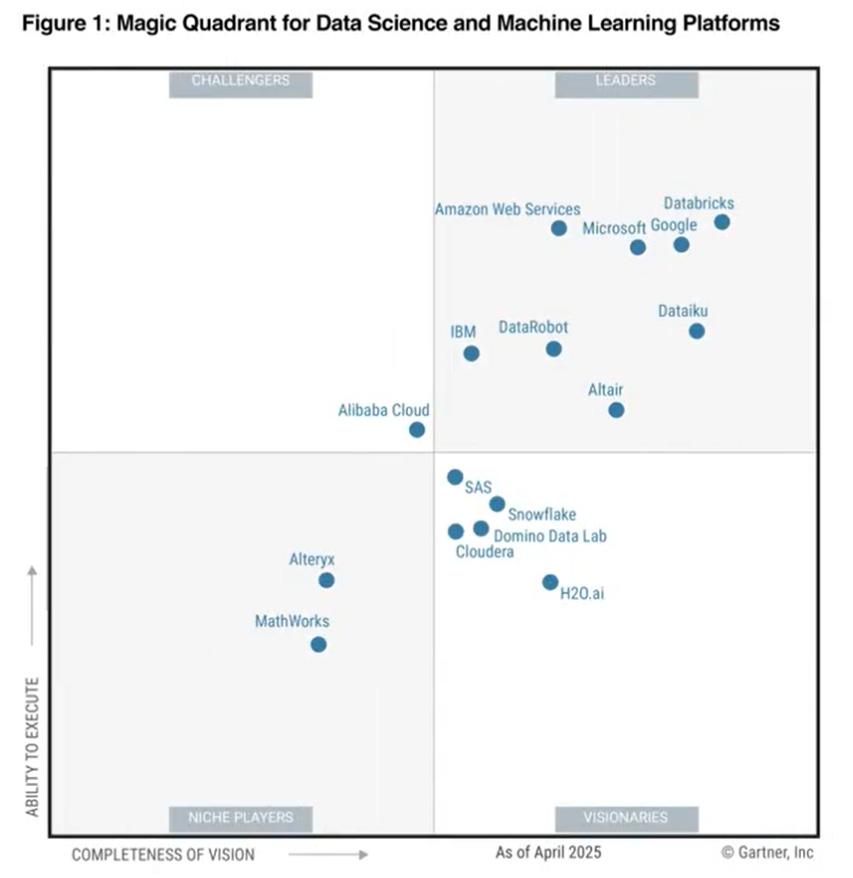

#9 Databricks

A $10bn Series J round values Databricks at $62bn.

Databricks is AI meets data warehouse. It is the market leader ahead of Mag 7 wannabes. When it comes to Machine Learning platforms you could get fired for buying IBM - instead of Databricks.

Databricks is experiencing accelerated growth (over 60% year-over-year) in recent quarters largely due to the unprecedented interest in artificial intelligence. To satisfy customer demand, Databricks intends to invest this $10bn capital towards new AI products, acquisitions, and significant expansion of its international go-to-market operations. In addition to fueling its growth, this capital is expected to be used towards providing liquidity for current and former employees, as well as pay related taxes.

Finally, this quarter marks the first time the company is expected to achieve positive free cash flow and $3bn annualised revenue. It has 500+ customers paying over $1m a year for its services and boasts 60% of the Fortune 500 among its clients.

#10 Wayve

Autonomous driving specialist Wayve has $1.3bn funding from Baillie Giff alongside Uber, Ocado, NVidia, Softbank, Microsoft and others.

Its platform is vying with Tesla and Google (Waymo) for the Robotaxi market and beyond that for other types of autonomous vehicle.

The platform is present in the UK (Jaguar), Germany, Canada, US and Japan (Nissan). Nissan are launcing a Wayve platform to a production vehicle in FY2027.

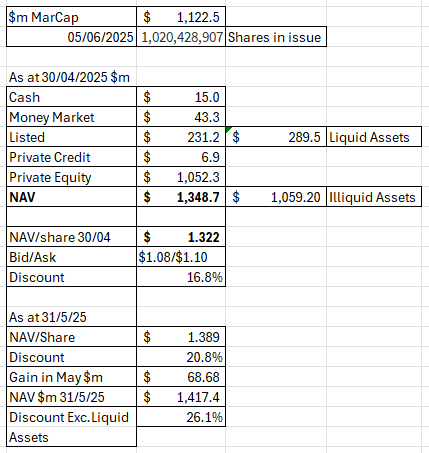

Valuation

On a 20.8% discount to NAV where at least the top 10 are leaders in their fields, and if you strip out liquidity then a 26.1% discount is even more tasty.

But then your heart sinks as you realise that you could have picked this up at a nearly 60% discount (plus more excluding liquid assets, probably) earlier this year.

MNTN shares fell to a $0.78 low point yet the P&L gains of around $0.10 per share per year (based on the past 2 years) put this on a P/E of about 8X.

Where more than -$100m per year of losses are offset by much higher gains.

Where there are some chunky charges, which are a consideration too.

Conclusion

If you believe the world is poised for disruption where AI, Software, Connectivity, Space, Financial Services and Military are all big macros with further to run then MNTN gives you a seat at the big boys table.

The top 10 are leading global companies and an IPO in one or more is not impossible in the future. There are other routes to acquire similar assets like buying Softbank but buying Japanese equities is expensive compared to a UK trust like MNTN. These assets are quite different to the much more famous Scottish Mortgage.

I find it remarkable that the latest results are that NAV has grown $68m in the month of May 2025. If that pace can continue for another 11 months that’s a P/E of 1.36X on a $1,122m market cap. I did say if.

Regards

The Oak Bloke

Disclaimers:

This is not advice - make your own investment decisions.

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"