Copper! Copper!.... Part Two!

Readers add new investment ideas to the fray!

Dear reader,

My review of Tier one, two and three Copper producers and explorers yielded a flurry of further reader ideas. Even one where I had “forgotten” to include their idea. Apparently. Well, based on my careless forgetfulness I thought I should extend my copper analysis.

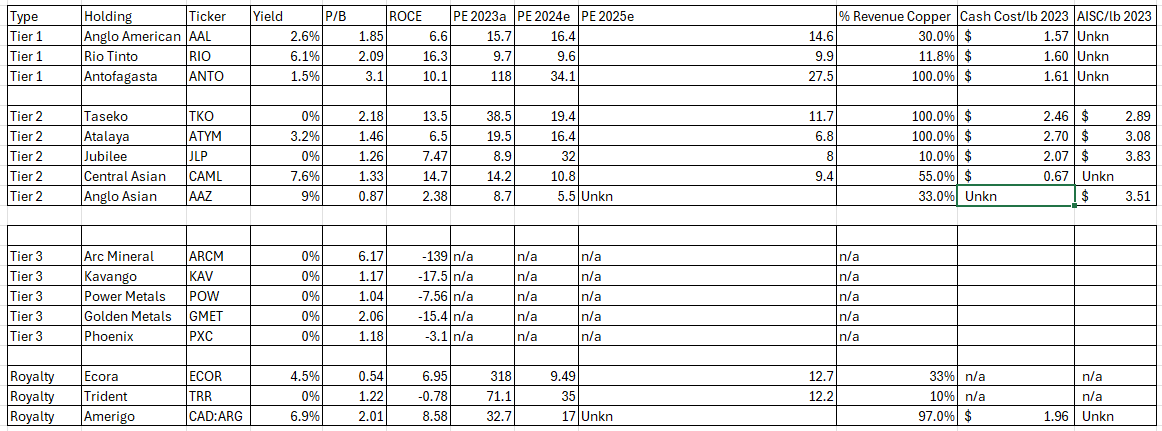

How do these four compare to the twelve companies the Oak Bloke reviewed in the recent article Copper! ?

Readers Ideas are:

Amerigo - CAD:ARG 6.8% yield;

Central Asian Metals LON: CAML - Central Asian 7.74%

Phoenix Copper - LON: PXC 0% yield

Anglo Asian - LON: AAZ 9.1% yield

Noting that in my last article Atalaya’s presentation slide stated that CAML is only 60% copper, and that AAZ is 0% copper…. so let’s look to the truth or falsehood of that. I’m generally not keen on non-UK companies (due to the costs and FX risk) but let’s give ARG the benefit of the doubt and keep an open mind. Finally I suspect PXC joins my prospector juniors - but let’s see.

AMERIGO

Amerigo Resources Ltd. is a Canada-based copper producer. The Company owns a 100% interest in Minera Valle Central S.A. (MVC), a producer of copper concentrates. MVC, located in Chile, has a long-term contract with the El Teniente Division (DET) of Corporacion Nacional del Cobre de Chile (Codelco) to process fresh and historic tailings from El Teniente.

The Company solely operates in the production of copper concentrates under a tolling agreement with DET, with Molybdenum Credits which equate to a $0.20-$0.40 per copper Lb credit.

I was torn whether to classify this as a Tier 2 or as a Royalty. I decided Royalty even though technically it isn’t. The reason for this is its Royalty-like income stream tied to the price of Copper. They explain they require no growth capital and earn a living symbiotically processing waste tailings (like Jubilee). There is sustaining capital of course. On a Price to Book basis 2.75 times isn’t cheap but as this is a waste processor the value isn’t in the ground - or least not in ground owned by Amerigo.

The share yields $0.03 per quarter which on a market price of c$1.88 (US$1.36) is a 6.9% yield. Had you bought in even 3 months ago you’d have locked in nearly a 10.5% yield. Nice!

Q1 earnings versus dividends (which cost around US$15m a year) are around 1.2X covered by net cash generated from operations. This is crucial as is this chart which provides a very useful guide to proxy profitability. At around US$4.2/Lb (or $9,000/tonne) the current dividends are affordable. But at $4.8/lb which is $10,600 or $400 above today’s price the FCFE suggests a dividend of 14% could be affordable. High leverage indeed! Of course below $9k/tonne and the dividend is in trouble and around $7.8k/tonne is breakeven. This calculation is rough and depends on the price of molybdenum but also other factors. I note flooding occured in 2023 but drought is a feature too, so this isn’t without risks. Also Chile is a lower risk jurisdiction but not without issues.

Overall, I didn’t expect to like Amerigo but actually if you believe Copper is going to rise to and beyond its price today this is a low risk and high yield way to play that trend which could provide a substantial and higher yield from today. If (when) copper prices collapse this would suffer - but so too would other copper producers. What if copper only goes higher from here? The cost of production isn’t dwindling. Compliments to reader Avi for highlighting this one.

#2 CAML - Central Asian Metals.

I’ve previously held CAML and it did occur to include it in Copper Part 1, but my recollection (which I didn’t check) was that it was majority Zinc and Lead Base Metals. That’s 45% true but 55% not true - because 55% of revenue is copper. So Antalaya were approximately correct. In fact one mine in Macedonia is the Base Metal mine and a 2nd mine in Kazakhstan is the copper mine.

CAML throws off an impressive 7.6% yield and has an astonishing Cash Cost for Copper of $0.76/Lb. There is no AISC disclosed but judging by the EBITDA to Net Income ratio of approx 50% even a $1.10/Lb AISC is impressive. Again comparisons due to FX and the Zinc, Lead and Silver byproduct credits make comparisons hard.

But what is clear is CAML has an impressive track record. Their Q1 24 presentation frustratingly compares H1 2023 to H1 2022 which casts the business in a much more negative light as a result (i.e. when Copper Prices were much lower and the FY23 results have since been released). It is also the case that Copper carries the business’ profitability contributing 7X more profit in 2023 despite being 1/6 of the Net Assets. There are $20m of unallocated costs which actually move Macedonia to a net loss if those central costs are distributed 50/50. Should they dispose of their mine in Macedonia? There are oddities at the Sasa Macedonia mine too, like all Silver is sold for $6/ounce - nearly 80% less than market price! (Losing about $8m a year). Ouch.

Clearly expanding Kazakhstan copper would make most sense. At current production there are 7 years of reserves left so CAML have begun prospecting and have started CAML exploration in a 80%/20% JV with some Kazakhstani Geologists. 2024 is a year for copper expansion for CAML.

ARC in its Q1 2024 analysis believes the dividend could rise to 20p a share putting the yield on 9% at today’s prices.

#3 Phoenix - PXC

Moving to a junior, Phoenix has the Empire Copper Mine in Idaho with Gold & Silver credits. 109.5m/lb copper ($550m); 104koz gold ($245m) and 4.65moz of silver ($133m). So $928m of proved and probable metals versus a market cap of $36m. EBITDA $300m+ according to its presentation deck. With Cobalt potential and exploration upside. Indicated and Inferred adds a further $1bn or more of metal at current prices.

But this is at PFS stage and that PFS is expected shortly. Meanwhile Phoenix have been buying pre-owned milling equipment. I also see today a bond of $80m has been successfully raised. Lots of positives then.

Prices have doubled at PXC in excitement for the PFS and potentially this could show some compelling results. It’s not a bombed out holding so it comes down to whether you want to follow others into PXC where boredom and disappointment could mean taking a loss in the short to medium term with a risk on the long term - but such is the nature of juniors! The conventional advice here would be wait for the PFS and then decide. But I can see how people could be tempted to buy in ahead of that!

#4 Anglo Asian - AAZ

Finally AAZ is in Azerbaijan. In a recent presentation they were closely questioned about wars and they replied “which one?”, which I thought amusing - if a little dark. The obvious war is with Armenia. AAZ say their mine sits behind some very tall mountains separating themselves from Armenia and I say “war” but currently a peace has lasted 6 months, maintained by 2,000 friendly (?) Russians. Negotiations are ongoing. There has been conflict for decades around a breakaway region called Nagorno Karabakh. Just to complicate things further there’s a part of Azerbaijan called Naxcivan which is also cut off from Azerbaijan. So the solution is to maintain magento coloured roads to connect them up.

So you kind of expect a risk discount to AAZ. And you do get one. A 9% yield and assets at a 13% discount to NAV, with a FY2024 PE of 5.5. One third of revenue is copper, so you also have to be happy with two thirds gold. With prices at $2,364 an ounce I’m sure that’s a tough one.

Lots to like. But some frustrations here too. The investor presentation on their web site is 1 year old - and quotes FY2022 numbers. AAZ wants to be a mid-tier producer, and plans to double. Well part of that is providing info to investors and its reporting appears worse than junior, frankly. It is mid May 2024 yet there are no 2023 accounts. Also when you are a major copper producer (and aim to grow this) to not show a cash cost per lb and ideally a AISC is extremely poor. We are given by AAZ an AISC in terms of gold of $1,357 per ounce, but they don’t say whether that’s a gold equivalent ounce or just a gold ounce. Or gold net of credits.

In fact if we take the latest financial results and consider $30.8m revenue and $2.2m op profit. Taking two thirds (i.e. the gold) $20.5m and the AISC at $1,357 x 10,506 ounces is $14.2m = $6.3m operating profit for gold. This implies the operating loss on copper is $4.1m, so the Copper AISC is $30.8-$2.2m = $28.6 AISC less $14.2 = $14.4m copper AISC. Divide by 1860 tonnes and 2204 to get Lbs is $3.51 AISC for copper. That’s pretty high, if that’s accurate - would you wish to expand copper if your costs were that high per Lb?

AAZ produce 44,576 ounces of Silver which equates to $1.3m of revenue at today’s prices but is that a credit against gold and its AISC? We just know AAZ say “it’s immaterial”. Considering that $1.3m is over 50% of operating profit for the half year I find that comment surprising.

There are two producing mines (with further prospectivity) and four exploration mines with two “awaiting access” - these are in Nagorno Karabakh. Xarxar and Garadag are scheduled to begin production in 2026 and 2027 respectively.

While I state 33% coppper that’s true today. But by 2028 at today’s prices, revenue will be nearly 90% copper and 10% gold. That’s mainly because of copper production growth of 8X from today’s 5kt and forecast production is as illustrated below.

A key question however is will that scary looking (so scary AAZ won’t actually tell you what it is) $3.51/Lb AISC for copper reduce to something less?

I want to like AAZ but I’m quite put off by their poor presentation of the facts. There is a detailed Hardman Report dating back 12 months, and they put a target price on AAZ of £2.16 - based on a completely outdated $8000/tonne copper and $1900 gold!!! Other than this it has poor coverage so requires quite a bit of forensic analysis I feel.

The final scores on the doors from Copper Part I and II

Here are the Price Earnings across all the non-junior holdings.

Conclusion:

Both ARG and CAML offer steady but leveraged rewards based on the copper price. Their risk isn’t zero but Kazakhstan and Chile are well established mining jurisdictions. Kazakhstan would be a rich target for Russia (more so than Ukraine) while South America can - and does - erupt into riots and political instability. Chile is more stable than others. CAML appears to need to dump its base metals business and focus in to Kazakhstan.

PXC offers a more advanced junior since it has a JORC resource, but now is going on a PFS → DFS → Permitting → Final Investment Decision journey. There will be fundraises, dilution, but the resource looks good and it’s in the US which is a big plus. The prospect of Cobalt (not part of the Jorc) adds an intriguing extra element.

For me POW wins out over PXC, just this morning a 2nd porphyry has been announced at Garfield to accompany the other one at Pilot. Drilling it going on at Pilot and I am positioned accordingly.

AAZ has irritated and annoyed me. I’ve pointed out numerous deficiencies in their reporting. Is it cheap because it is badly described? Or because it is in Azerbaijan?……. Yet, AAL has intrigued me beyond the other three and probably beyond Atalaya and Taseko, although I feel I need to spend time getting in depth and also getting more familiar with the political situation (and risk) too.

I have a suspicion that AAZ might be the ace in the pack, at least in terms of hidden value. Perhaps a follow up article is needed.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip"

Thoughtful articles as always. PXC is my main holding. No further dilution anticipated. From NIU Invest (LinkedIn) a P/E ratio of 1 can be calculated, for the open pit alone.

Fantastic pieces on Copper. Thanks for the review of PXC. FWIW I own CAML, PXC & AAZ.

A comment I received earlier on PXC (ref the funding announced at 4.30 today): "we had 100% of a dream, now we have 75% of a mine funded to production".