Copper!

Options for investing for the copper shortfall

Dear reader

If you’d bought Antofagasta 6 months ago you’d have doubled your money today. But buying ANTO today you’d pay for a PE of 118, yield of 1.46% and Price to Book of 3.1 times. Is that good value? Or a trap? If you simply read “copper’s going up” and “ANTO is a huge copper producer” you might conclude that’s the way to invest - but is that good value? Will you see any upside?

As optimistic as the Oak Bloke is and if (when?) Copper tracks higher than its current $10,000 tonne mark then perhaps ANTO will squeeze a bit higher but there’s a lot of expectation already built in. Any pessimist will tell you that ANTO could lead to a copper arrest - declining grades, water shortages (dealt with via expensive water desalination, challenges and risk with the jurisdiction of Chile).

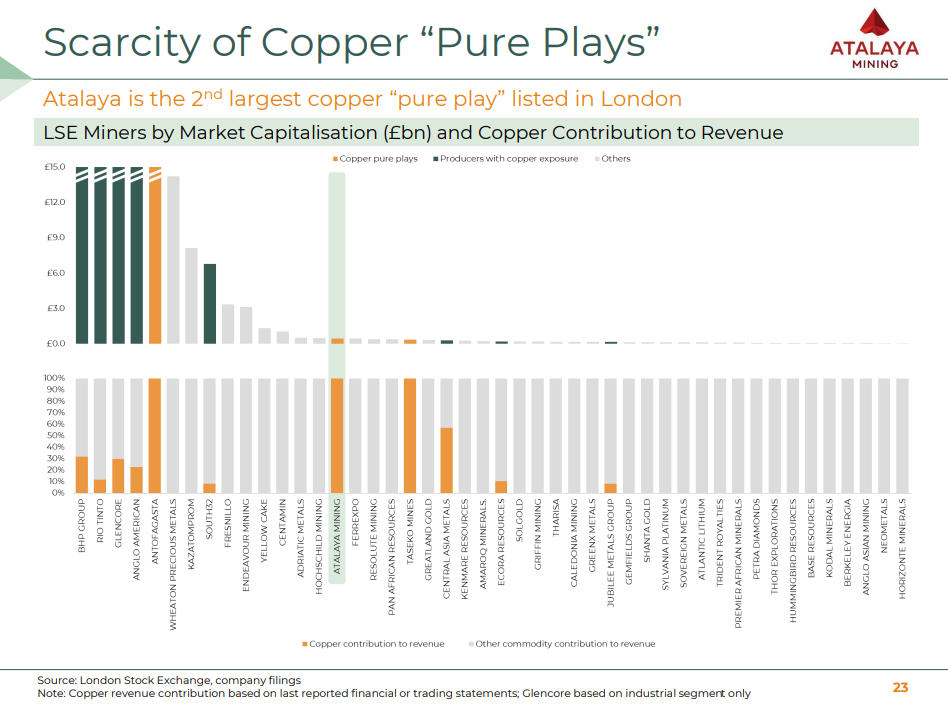

Meanwhile as I began researching other ways to play copper I found ATYM’s investor presentation very helpful. Atalaya is up 50% over the same time period but is a 100% producer of copper too.

I then pieced together a range of options ranging from FTSE100 options called biggies, medium copper producers, minnows and prospectors and finally royalty options.

It quickly became apparent that comparing prospectors would be tricky and require some other metrics - more on that later - but Price to Book is somewhat useful to understand the value of the assets relative to their share price.

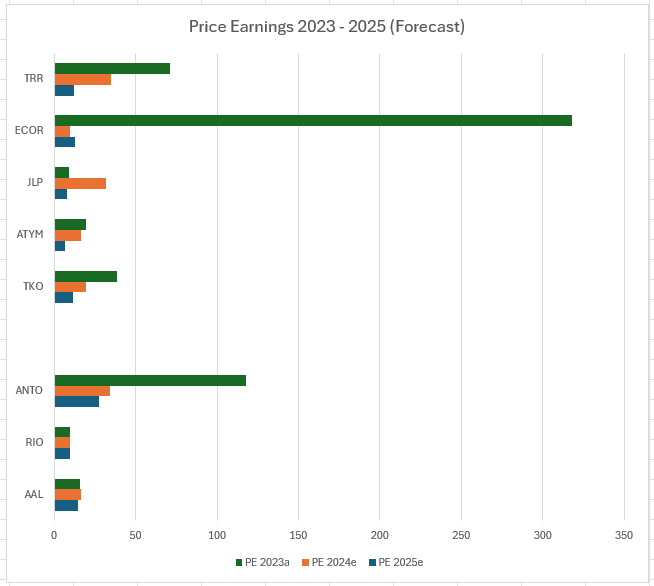

I’ve used refinitiv data for the Price Earning estimates and not sought to apply either analysts numbers nor my own. I will comment on comparable numbers as I discuss each holding.

These are the prospective price earnings for each of the above.

What is clear to see is that if you want FTSE100 “quality” then you’ll pay a price. A PE of 9.7 if you want 11.8% copper exposure via RIO or a PE of 15.7 falling to 14.6 in FY2025e for AAL. Or a Tesla-esque PE of 118 falling to 27.5 (you hope) for ANTO.

None of those float my boat, but I’m sure plenty of readers will disagree on this point and are holders of these. The OB holds part of his portfolio in a FTSE100 tracker so I indirectly hold these too.

Smaller copper specialists appear to offer a much more reasonable route. Taseko are a 210p ask and have a target of 275p (according to CG) so offers a 30% upside along with a palatable PE2025e of 11.7.

ATYM is cheaper still - but just had a difficult and disappointing Q1. It is developing a new deposit called San Dionisio. Its target price is 530p versus 450p so a 18% upside.

JLP is up 35% since I last wrote about Jubilee Metals. I’ve extended the chart to compare copper costs both cash and AISC (all in). None of the majors will tell you their AISC but TKO and ATYM provide theirs. Jubilee I calculated using the business segment reporting to arrive at a painful $3.83/LB AISC for copper (for y/e 30th June 2023). This is partly due to low volumes of copper and high relative fixed costs.

The AISC calculation is on the basis that JLP are on track for 5,850 tonnes of copper in FY24 (y/e 30/06/24) then the calculation of $3.4m (which is Zambia overheads, Zambia depreciation, Zambia amortisation and 40% of “central” costs - I chose 40% based on a 40%/60% value of assets between South Africa and Zambia) spreads over 5,850 units (i.e. 13m Lbs) to arrive at a $0.26/Lb cost which makes the AISC/lb of just $2.33 (assuming static cash costs from FY23).

Since Jubilee don’t mine but instead they extract copper from tailings then logically you would expect a lower AISC wouldn’t you? This places JLP ahead of its medium peers on cost but also on its expansion scale.

The question is whether JLP’s “bad luck” or disruption and delays are now behind it. It has a much better track record in South Africa and expanding its chrome so extrapolating the performance means JLP are expanding copper and precisely the right time (as they did with Chrome too).

Plugging in a $9k/tonne sell price drops another £3m net profit to the bottom line for FY2024. PGMs are also recovering but let’s focus on copper for this article.

Revenue being just 10% copper in FY23 becomes revenue is 25% from copper in FY24 based on 5,850 tonnes. If JLP can achieve 14,500 tonnes in FY25 and assuming JLP’s PGM basket at $1,400/oz and Chrome at $86/tonne (and copper at $9000/tonne) then copper grows to 40% in FY25. The stated medium term ambition is to grow to 25kt of copper so that means 50% copper with 30% chrome and 20% PGMs and Cobalt.

Juniors

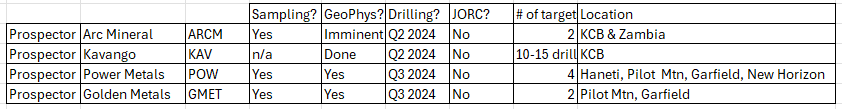

Likelihood and timeline of JORC appears to be the best measure:

Arcm

In Zambia Arc have a 30/70 agreement with mining major Anglo American in return for US$88.5m comprising $14.5m cash and $74m exploration expenditure. Arc get 30% in their 67% owned subsidiary (i.e. they get 20% overall of what AAL and they find). AAL used to own this land and not only bring resources and expertise but also knowledge and data too.

A work programme is underway including LiDAR Survey to help determine surface outcrop positions; detailed geological mapping, spectral and pXRF analysis of samples collected; Core Diamond drilling in areas that are deemed prospective to host copper and nickel mineralisation; and further ground-based geophysics to understand the underlying basin and sub-basin geometry.

In Botswana’s Kalahari Copper Belt meanwhile ARCM own 75% of 2 licences called “Virgo” which are adjacent to the Khoemacau copper mine which sold for $1.9bn last month. A 35 line-km induced polarisation survey is underway and a 2,000m drill programme planned for Q2 2024.

KAV

Kavango have an active gold prospecting and mining operations programme which I will leave aside other than to say it is cash generative (albeit in a minor way for now) plus KAV has raised funds from a cornerstone investor Puregold.

A 5,000m drill programme (10-15 holes) begins in May and will last until September. Targets have been identified from AEM and IP surveys. Three domal features similar to those discovered by KCB miner Sandfire (an Ozzy £2.2bn market cap) are among the targets.

POW/GMET

I group Power Metals (POW) and Golden Metals (GMET) together because POW owns 57.07% of GMET.

Let’s talk about POW’s non GMET holdings first.

New Horizon Metals is 20% owned by POW and this is currently being listed on the ASX. Its Wilan Project in Australia borders BHP’s “Olympic Dam” deposit and NHM believe they might have another Olympic Dam. Wilan is in a prolific copper area. Its 2nd project Bortal Project neighbours a 62.5Mt @ 1.8% Cu.

Haneti is 35% owned by POW and the 65% owner Katoro gave this update on 17/04/24:

A series of technical meetings and review have been undertaken in respect of the Haneti Project and the Company is preparing to move to the next stage of exploration work.

As previously announced, previous exploration, including the diamond drill programme conducted in 2021/22, provided an extensive dataset that has greatly increased the Company's understanding of the Project's geology and, from this, determined the optimal next steps for exploration.

A further technical review of the Haneti Project is now underway and will include a detailed review of historical exploration, including a possible new approach targeting the potential for nickel ("Ni") and copper ("Cu") mineralisation within the gabbroic lithologies within the project licence boundaries.

A further update in respect of exploration strategies and findings from the work undertaken will be provided to the market in due course.

Pilot Mountain potentially contains a porphyry system which could make it a blockbuster prize. It contains other minerals than copper but let’s focus on the copper today. There is a clear magnetic anomoly. Sampling at the surface above that anomoly has shown “quite a bit” of copper mineralisation.

Yesterday (the 11th May) drilling began into this anomoly.

Nearby GMET also owns Garfield where the magnetic inversion results are due shortly.

The reason I hold POW and not GMET is that when I strip out cash and the value of POW’s holdings in GMET and FCM I arrive at an 81.5% discount.

GMET itself is on a 31% surplus to its own NAV. I believe there’s great upside at GMET but I’m happy to get 57% of that not 100% of it in return for all the other holdings at POW too.

If GMET and FCM were both to hit their target prices then POW’s current market price minus those and minus cash would be a 126% discount to NAV.

Royalties

Ecora and Trident both offer copper exposure, albeit Ecora’s perecentage exposure is higher. Trident’s percentage will grow to above 20% in 2025/2026 but Ecora is the larger bet.

As copper prices increase the “cut” the royalty co gets also increases so this could be the lowest risk way to get exposure to copper - so long as you are happy with the quality of the assets. Ecora typically has mining majors as its counter party while Trident has medium miners instead.

Conclusion

Large miners appear to be a pedestrian way to play copper. There is limited potential upside and they are valued, but clearly the cash cost of production is incredibly low and they offer lower risk - arguably.

But AAL is quite pricey (probably because of the recent takeover bid), ANTO even more so, while RIO appears the most attractive but only generates 11.8% of revenue from copper.

In the medium segment, TKO and ATYM (I hold neither) offer some attraction and limited upside (according to analyst target prices) but are expensive on a PE 2023 but improve on their forecast PE 2025. Both are in safe jurisdictions.

JLP is a higher risk but higher reward. It’s cheaper on all metrics but the question is whether they can successfully scale their copper business in Zambia. If they can then they will easily exceed its peers due to a lower cost base and its polymetal production. While the “official” PE for FY2025 is 8, my own calculation is 4. This is based on some fairly achievable outcomes and $10k copper, a $1400 PGM basket and $50k cobalt.

Royalty Cos also feel a smart way to play copper. You don’t need to worry about drill results or AISCs - that’s the miner’s problem. Rising copper prices and rising production (both feature in 2024) are beneficial.

Finally the juniors I hold all three of ARCM, KAV and POW - and while I don’t hold GMET I hold it via POW.

Reviewing the collective “copper newsflow” for these has been extremely useful and a hit on any one of these drill programmes will multi bag that holding. These are the market caps: POW £14m, KAV £17m, GMET £14m, ARCM £26m.

It’s my view that the risk/reward based on the geophys, sampling and data models along with the funding each of these now have via Anglo, via PureGold, via the Saudis and via HNW investors and the US Gov’t prospectively for GMET (we haven’t spoken about Tungsten at Pilot Mountain but there’s a bigger picture for GMET)

Despite all the improvement of risk/reward I wouldn’t bet the farm on a junior. As part of a portfolio of investments and in order to best play the copper story carefully think about the merits and demerits of large, medium and small - and royalty.

I hope you find this UK listed co’s copper guide useful - your feedback is welcome too.

Regards

The Oak Bloke

Disclaimers:

This is not advice

Micro cap and Nano cap holdings might have a higher risk and higher volatility than companies that are traditionally defined as "blue chip".

At $9950/tonne there’s good margin for producers. I think there’s a distinction to be drawn between speculative copper explorers, some of which have been bid up, versus producers some of whom their share price is nearly the same as when copper was $8,000.

Amerigo Resources in Canada? Priced like an explorer but with biz model closer to royaltyco and ~ 100% pure play copper.